NYSE American Symbol – UEC

Highlights and Balance Sheet Update as of March 15, 2021: $65.8 million in cash and equity holdings;

Establishing a physical uranium inventory to take advantage of spot purchases below most industry production costs, adding additional asset value to the balance sheet;

Uranium inventory will provide greater marketing flexibility for utilities, while freeing up UEC’s domestic mine production for the U.S. Uranium Reserve, and other U.S. origin specific opportunities; Entered into agreements totaling $10.9 million to purchase 400,000 pounds of uranium concentrates at ConverDyn in Metropolis, Illinois at a volume weighted average price of $27.29 per lb. U3O8; Market value of a 19.5% equity stake in Uranium Royalty Corp. (URC: TSX-V) increased to $34.3 million following URC’s announced acquisition of royalties on the world-class MacArthur River and Cigar Lake uranium mines; Realized gross proceeds of $30 million from the […]

Category: Uranium

Why Uranium Energy Corp Stock Shot Higher by as Much as 35% Today

What happened

Shares of Uranium Energy Corp ( NYSEMKT:UEC ) rose a dramatic 35% in the first ninety minutes or so of trading. That massive price gain didn’t last, however, with the stock quickly giving up more than half of the advance over the next ninety minutes or so before turning higher again. At 1 p.m. EDT the shares of the U.S. uranium miner had rebounded back to a roughly 20% gain — not as big as the early price jump but still quite impressive. The likely reason for the price gyrations was a company update. So what

Uranium Energy released a news report explaining that it had filed an earnings report with the Securities and Exchange Commission (SEC) for the fiscal quarter ended Jan. 31. But the bigger news was the update of its balance sheet and the business plans that it discussed in the update. As of […]

NexGen Announces Exercise of $22.5 Million Over-Allotment Option in Connection with Recently Completed Bought Deal Financing

VANCOUVER, BC, March 16, 2021 /PRNewswire/ – NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE: NXE ) is pleased to announce that the Underwriters (as defined below) have exercised their over-allotment option (the "Over-Allotment Option"), in full, to purchase an additional 5,010,000 common shares in the capital of the Company (the "Common Shares") at a price of $4.50 per Common Share, in connection with the Company’s recently completed underwritten public offering of 33,400,000 Common Shares, which closed on March 11, 2021 (the "Offering"). Upon closing of the Over-Allotment Option, the Company received additional gross proceeds of $22,545,000, resulting in total gross proceeds from the Offering of approximately $172.8 million.

The Offering was completed through a syndicate of underwriters led by BMO Nesbitt Burns Inc. and Canaccord Genuity Corp., and including Eight Capital, Raymond James Ltd., TD Securities Inc., Cormark Securities Inc., Haywood Securities Inc., Sprott Capital Partners LP, […]

Uranium Energy Corp Establishes Physical Uranium Initiative and Provides Balance Sheet Update

The MarketWatch News Department was not involved in the creation of this content.

CORPUS CHRISTI, Texas, March 16, 2021 /PRNewswire via COMTEX/ — NYSE American Symbol – UEC Highlights and Balance Sheet Update as of March 15, 2021: $65.8 million in cash and equity holdings;

Establishing a physical uranium inventory to take advantage of spot purchases below most industry production costs, adding additional asset value to the balance sheet;

Uranium inventory will provide greater marketing flexibility for utilities, while freeing up UEC’s domestic mine production for the U.S. Uranium Reserve, and other U.S. origin specific opportunities; Entered into agreements totaling $10.9 million to purchase 400,000 pounds of uranium concentrates at ConverDyn in Metropolis, Illinois at a volume weighted average price of $27.29 per lb. U3O8; Market value of a 19.5% equity stake in Uranium Royalty Corp. (URC: TSX-V) increased to $34.3 million following URC’s announced […]

CanAlaska Uranium Increases Private Placement Financing to $3,000,000

Vancouver, British Columbia–(Newsfile Corp. – March 15, 2021) – CanAlaska Uranium Ltd. (TSXV: CVV ) (FSE: DH7N ) ("CanAlaska" or the "Company") announces that further to its news releases of February 26, 2021 and March 12, 2021, due to increased demand, it is increasing the total gross amount to be raised under its non-brokered private placement to $3,000,000 (the " Offering ").

The Offering is comprised of a combination of: (i) non-flow-through units (the " NFT Units ") being sold at a price of $0.50 per NFT Unit; (ii) flow-through units (the " FT Units ") being sold at a price of $0.64 per FT Unit; and (iii) flow-through charity units (the " Charity Units ") being sold at a price of $0.69 per Charity Unit. Each NFT Unit is comprised of one non-flow-through common share and one-half (0.5) of one warrant. Each FT Unit and Charity Unit is comprised […]

Click here to view original web page at www.juniorminingnetwork.com

CanAlaska Increases Private Placement Financing to $3,000,000

CanAlaska Uranium Ltd. announces that further to its news releases of February 26, 2021 and March 12, 2021, due to increased demand, it is increasing the total gross amount to be raised under its non-brokered private placement to $3,000,000 .The Offering is comprised of a combination of: non-flow-through units being sold at a price of $0.50 per NFT Unit; flow-through units being sold at a price of $0.64 per FT Unit; …

CanAlaska Uranium Ltd. ( TSXV: CVV ) (FSE: DH7N) (“CanAlaska” or the “Company”) announces that further to its news releases of February 26, 2021 and March 12, 2021, due to increased demand, it is increasing the total gross amount to be raised under its non-brokered private placement to $3,000,000 (the “Offering”).

The Offering is comprised of a combination of: (i) non-flow-through units (the “ NFT Units “) being sold at a price of $0.50 per NFT Unit; (ii) […]

Denison Announces Funding of Project Finance Initiative Involving Strategic Acquisition of Physical Uranium

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES/

TORONTO, March 15, 2021 /CNW/ – Denison Mines Corp. ("Denison" or the "Company") (TSX: DML ) (NYSE American: DNN) is pleased to announce that it has entered into an agreement with Cantor Fitzgerald Canada Corporation ("CFCC"), as lead underwriter and sole book-runner, on behalf of themselves and a syndicate of underwriters (collectively with CFCC, the "Underwriters"), under which the Underwriters have agreed to purchase, on a bought deal basis, 68,200,000 units of the Company (the "Units") at the price of USD$1.10 per Unit (the "Issue Price") for aggregate gross proceeds of approximately USD$75 million (the "Unit Offering"). View PDF Version . View PDF Denison Announces Funding of Project Finance Initiative Involving Strategic Acquisition of Physical Uranium (CNW Group/Denison Mines Corp.) Net […]

U.S. Uranium Market Trends by 2021-2026

Global Uranium Market Overview:

Global Uranium Market presents insights on the current and future industry trends, enabling the readers to identify the products and services, hence driving the revenue growth and profitability. The research report provides a detailed analysis of all the major factors impacting the market on a global and regional scale, including drivers, constraints, threats, challenges, opportunities, and industry-specific trends. Further, the report cites global certainties and endorsements along with downstream and upstream analysis of leading players. The research report comes up with the base year 2020 and the forecast between 2021 and 2026.

This report covers all the recent development and changes recorded during the COVID-19 outbreak.

This Uranium market report aims to provide all the participants and the vendors will all the details about growth factors, shortcomings, threats, and the profitable opportunities that the market will present in the near future. The report also features […]

What Type Of Shareholders Make Up Uranium Participation Corporation’s (TSE:U) Share Registry?

A look at the shareholders of Uranium Participation Corporation ( TSE:U ) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. Companies that used to be publicly owned tend to have lower insider ownership.

With a market capitalization of CA$685m, Uranium Participation is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. Let’s delve deeper into each type of owner, to discover more about Uranium Participation. TSX:U Ownership Breakdown March 12th 2021 What Does The Institutional Ownership Tell Us About Uranium Participation?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about […]

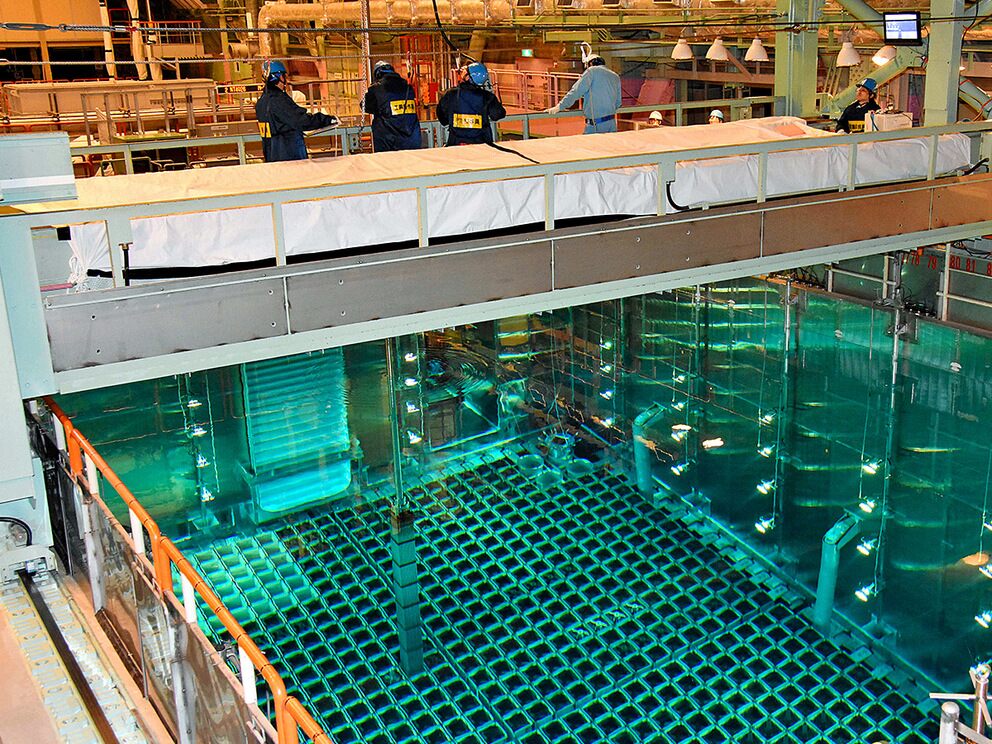

Nuclear power proves its resilience a decade after Japan’s Fukushima disaster

In 2011, the Fukushima Daiichi power plant was the site of the worst nuclear disaster in a quarter century. TEPCO/AFP via Getty Images It has been a decade since the Japan nuclear disaster caused the energy industry to rethink the safety of the power source, but the event hasn’t led to the destruction of the market or uranium demand.

Instead, it may have highlighted the importance of nuclear-power generation in the world’s efforts to provide clean energy.

“It would be far from accurate to say that Fukushima was the death knell for the nuclear industry,” says Jonathan Hinze, president at nuclear-fuel consultancy UxC, LLC.

On March 11, 2011, Japan suffered from a 9.0-magnitude earthquake , the largest ever recorded in the country. The massive tsunamis created by the quake flooded the Fukushima Daiichi power plant and led to the worst nuclear disaster in a quarter century. “Fukushima obviously was a huge event […]

GoviEx Letter to Stakeholders and Market Update

GoviEx Uranium Inc. today provides a Letter to Stakeholders and Market Update from the Executive Chairman, Govind Friedland and the Chief Executive Officer, Daniel Major.To Our Fellow Stakeholders, When we reflect on 2020, it will likely be remembered as the year strongly dominated by the COVID pandemic. Yet despite 2020 being a year like no other, GoviEx was able to adapt to this challenging environment and made …

GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) (“GoviEx” or “Company”) today provides a Letter to Stakeholders and Market Update from the Executive Chairman, Govind Friedland and the Chief Executive Officer, Daniel Major.

To Our Fellow Stakeholders,

When we reflect on 2020, it will likely be remembered as the year strongly dominated by the COVID pandemic. Yet despite 2020 being a year like no other, GoviEx was able to adapt to this challenging environment and made progress by improving our financial position, advancing […]

CanAlaska Announces First Tranche Closing of Private Placement Financing

Vancouver, British Columbia–(Newsfile Corp. – March 12, 2021) – CanAlaska Uranium Ltd. (TSXV: CVV) ( FSE: DH7N ) ("CanAlaska" or the "Company") announces that it has closed the first tranche (the " First Tranche ") of its non-brokered private placement (the " Offering ") previously announced on February 26, 2021. Under the First Tranche, the Company has issued 1,820,000 non flow-through units for gross proceeds of $910,000 and 156,250 flow-through units for gross proceeds of $100,000, for total gross proceeds of $1,010,000.

In connection with the First Tranche, the Company paid a total of $20,400 and issued a total of 38,175 warrants as finder’s fees. Each finder’s warrant is exercisable for one common share at a price of $0.75 for two years.

All securities issued under this private placement are subject to a hold period expiring July 13, 2021, in accordance with applicable securities laws and the policies of the TSX […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Market Share, Overview 2021_2027 | Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum

The Global Uranium Market 2021-2027 report includes the reliable data collected and studied by our team of experts. We have implement in Uranium market report by area-specific professional analysts who make sure you get the reliable data on the Global Uranium Market. This data collected by our team of experts will help you understand the Uranium market inside-out.

The report provides a basic summary of the Uranium business as well as definitions, classifications, applications and business chain structure, Uranium market development policies and plans square measure mentioned also as producing processes and value structures. Uranium Market analysis report includes historic information from 2016 to 2020 and forecasts from 2021 to 2027 that makes the reports a useful resource for Uranium industry business executives, marketing, sales and products managers, consultants, analysts, and others searching for key business information in promptly accessible documents with clearly conferred tables and graphs.

Obtain Sample Copy […]

Cameco Did Alright In 2020, Set To Do Much Better In Coming Years

Summary

Because uranium is a non-cyclical commodity, Cameco and other uranium miners did alright last year despite all the upheaval.

Between utilities drawing down their nuclear fuel stockpiles and new reactors being built around the world, global mined uranium demand is set to increase significantly in coming years.

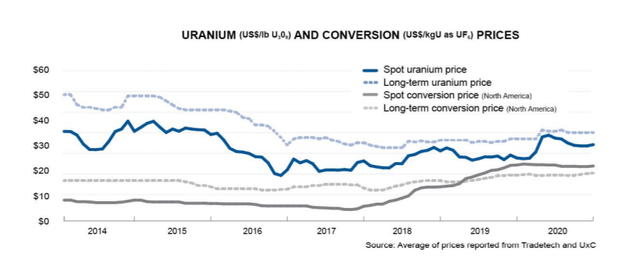

In anticipation of higher demand going forward, the spot uranium price did bottom half a decade ago. Uranium prices need to go much higher in order to stimulate more production. Cameco is set to benefit from higher prices, given its ample economic reserves, an ability to produce uranium profitably, as well as its capacity to increase mined production in response to higher prices. When I first mentioned that uranium prices may have bottomed half a decade ago, there were many people who doubted that it could happen. I did buy some Cameco (NYSE: CCJ ) stock soon after I called what […]

Drilling into North Shore’s Global Uranium Mining ETF

The North Shore Global Uranium Mining ETF [URNM] could have plenty of fuel for growth in 2021 as countries go nuclear. The fund was up 24.6% year-to-date at $53.45 on 5. Furthermore, it hit an intraday high of $61.67 on 17 February.

The North Shore Global Uranium Mining ETF has kept up the positive momentum from 2020 when it soared 68.4%. Despite the number of nuclear reactor operating globally falling to a 30-year low in July last year, the fund had a strong performance.

According to the World Nuclear Industry Status Report, total operating nuclear capacity fell 2.2% year-over-year to 362 gigawatts by mid-2020. The slide was mainly because there were fewer nuclear reactors in operation, but COVID-19 production disruptions at uranium mines have also played a part.

The drop in supply has led to higher uranium prices and the spot price of the commodity climbed 20.5% in 2020, according to data […]

Uranium Energy Corp. (UEC) market price of $2.41 offers the impression of an exciting value play

At the end of the latest market close, Uranium Energy Corp. (UEC) was valued at $2.21. In that particular session, Stock kicked-off at the price of $2.27 while reaching the peak value of $2.41 and lowest value recorded on the day was $2.22. The stock current value is $2.41.

Recently in News on March 5, 2021, Media Advisory – Interactive Map Recognizes Canadian Women. The Honourable Seamus O’Regan Jr., Canada’s Minister of Natural Resources, will hold a virtual event on International Women’s Day to unveil the Geographical Names Board of Canada’s new interactive map entitled Recognizing Women with Canadian Place Names. You can read further details here

A Backdoor Way To Profit From Today’s Crypto Bull Market

Even if you’re not actively in crypto, you deserve to know what’s actually going on…Because while leading assets such as Bitcoin (BTC) and Ethereum (ETH) are climbing in value, a select group […]

GoviEx buoyed by prospects of a uranium uptrend, nuclear energy expansion

TSX-V-listed GoviEx Uranium reports that, with nuclear energy having shown resilience in 2020, the spot uranium price has been in a “gentle uptrend” for the last four years after having reached its cyclical low of $18/lb of U 3 O 8 in December 2016.

The company notes that despite 2020 having been strongly dominated by the Covid-19 pandemic, the company nonetheless adapted to this challenging environment and made progress by improving its financial position, advancing its pipeline of uranium mine development plans, specifically in Niger, and beginning the assessment of “compelling” gold prospects in Mali. In addition, GoviEx says the positive momentum of its activities in 2020 has continued into this year.

During 2020, the spot uranium price rose from $25/lb at the start of the year to $30/lb at the end – a 20% increase. GoviEx states that the increase in prices is being supported by progressively stronger demand for […]

Click here to view original web page at www.miningweekly.com

Drilling into North Shore’s Global Uranium Mining ETF

The North Shore Global Uranium Mining ETF [URNM] could have plenty of fuel for growth in 2021 as countries go nuclear. The fund was up 24.6% year-to-date at $53.45 on 5. Furthermore, it hit an intraday high of $61.67 on 17 February.

The North Shore Global Uranium Mining ETF has kept up the positive momentum from 2020 when it soared 68.4%. Despite the number of nuclear reactor operating globally falling to a 30-year low in July last year, the fund had a strong performance.

According to the World Nuclear Industry Status Report, total operating nuclear capacity fell 2.2% year-over-year to 362 gigawatts by mid-2020. The slide was mainly because there were fewer nuclear reactors in operation, but COVID-19 production disruptions at uranium mines have also played a part.

The drop in supply has led to higher uranium prices and the spot price of the commodity climbed 20.5% in 2020, according to data […]

Why ASX uranium shares could run even hotter in 2021

There’s no arguing with the numbers.

The past year (and then some) has seen the leading ASX uranium shares truly light up.

The Paladin Energy Ltd (ASX: PDN) share price, for example, is up 415% over the past 12 months. ASX uranium miner Deep Yellow Ltd (ASX: DYL) ’s share price is up 246% over that same time.

Things have continued apace in 2021, with Deep Yellow shares up 24% in the calendar year and Paladin shares up 54%.That more than handily outpaces the one-year 7% gains posted by the broader All Ordinaries Index (ASX: XAO), not to mention the 0.4% loss on the All Ords so far in 2021.But the run higher for ASX uranium shares like these could only just be getting started. Why ASX uranium shares may have a bright future Australia may not opt to use uranium for its own power sources. Though Australia – both fortuitously and […]

Western Uranium & Vanadium : Closes Final Tranche of Non-Brokered Private Placement

Western Uranium & Vanadium Corp. Closes Final Tranche of Non-Brokered Private Placement

FOR IMMEDIATE RELEASE

Toronto, Ontario and Nucla, Colorado – Western Uranium & Vanadium Corp. (CSE: WUC) (OTCQX: WSTRF) ("Western" or the "Company") is pleased to announce the closing of a second and final tranche of its non-brokered private placement (the "Private Placement") (please refer to the news release issued by Western on February 16, 2021 for details on the first tranche of the Private Placement). At this closing, the Company raised gross proceeds CAD$2,500,000 through the issuance of 3,125,000 units (the "Units") at a price of CAD$0.80 per Unit. The total raised in the two tranches of this Private Placement of 6,375,000 Units aggregates to CAD$5,100,000. Western used 100% of the overallotment option to issue the maximum quantity of authorized Units to satisfy investors’ oversubscription demand.

Each Unit consists of one common share of Western (a "Share") plus one common […]

Click here to view original web page at m.marketscreener.com

Uranium Mining Market Share, Growth, Size 2021 by Top Manufacturers, Regional Market, Type and Application, Forecast 2025

The MarketWatch News Department was not involved in the creation of this content.

Mar 11, 2021 (The Expresswire) — Global Uranium Mining Market (2021 -2025) status and position of worldwide and key regions, with perspectives of manufacturers, regions, product types and end industries. This report also Uranium Mining Market Size, states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins, Uranium Mining Market Share Analysis. this report analyses the topmost companies in worldwide and main regions, and splits the Uranium Mining market by product type and applications/end industries. This Report provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector for Uranium Mining Market Growth.

Uranium Mining Market 2021 Research report contains a qualified and in-depth examination of Uranium Mining Industry. At first, the report provides the current business situation along with a valid assessment of the Uranium Mining Market Analysis. This […]

NexGen Announces Closing of $150 Million Bought Deal Financing

NexGen Energy Ltd. is pleased to announce that it has closed its previously announced bought deal financing . Pursuant to the Offering, the Company issued 33,400,000 common shares of the Company at a price of $4.50 per Common Share for gross proceeds of approximately $150 million . NexGen has granted the Underwriters a 30-day option to purchase up to an additional 5,010,000 Common Shares. The Offering was completed …

NexGen Energy Ltd. (“NexGen” or the “Company”) (TSX: NXE) (NYSE: NXE) is pleased to announce that it has closed its previously announced bought deal financing (the “Offering”). Pursuant to the Offering, the Company issued 33,400,000 common shares of the Company (the “Common Shares”) at a price of $4.50 per Common Share for gross proceeds of approximately $150 million . NexGen has granted the Underwriters (as defined below) a 30-day option to purchase up to an additional 5,010,000 Common Shares. NexGen Energy […]

Energy Fuels (UUUU) to Report Q4 Earnings: What’s in Store?

Energy Fuels Inc. UUUU is expected to report fourth-quarter 2020 results on Mar 15. Q4 Estimates

The Zacks Consensus Estimate for fourth-quarter revenues is currently pegged at $0.55 million, indicating a decline of 21.4% from the prior-year quarter. The company is expected to report a loss per share of 3 cents compared with a loss of 10 cents per share in the year-ago quarter. The estimates have been remained stable over the past 30 days. Q3 Results

In the last reported quarter, Energy Fuels reported revenues of $0.5 million, which improved 15% year over year but fell short of the Zacks Consensus Estimate of $2 million. The company reported a loss per share of 8 cents, wider than the year-ago quarter’s loss of 7 cents per share and the Zacks Consensus Estimate of a loss of 5 cents.

The company has a trailing four-quarter negative earnings surprise of 73.3%, on […]

Appia Energy Proposes Corporate Name Change to Highlight Its Rare Earth Element and Uranium Focus

Toronto, Ontario–(Newsfile Corp. – March 3, 2021) – Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the "Company" or "Appia") today announced that it will seek shareholder approval to change its name to "APPIA RARE EARTHS & URANIUM CORP." in order to better identify the Company’s focus on the Alces Lake Project and the Athabasca Basin uranium prospects. The Property hosts some of the highest-grade total and critical rare earth elements (" CREE ") and gallium mineralization in the world. CREE is defined here as those rare earth elements that are in short-supply and high-demand for use in permanent magnets and modern electronic applications such as electric vehicles and wind turbines, (i.e: neodymium (Nd), praseodymium (Pr) dysprosium (Dy), and terbium (Tb)).

In the oxide form, the Shanghai Metals Market quoted February 28 prices per kg in US$ are: Nd $105, up over 100% year over […]

Click here to view original web page at www.juniorminingnetwork.com

Drilling into North Shore’s Global Uranium Mining ETF

The North Shore Global Uranium Mining ETF [URNM] could have plenty of fuel for growth in 2021 as countries go nuclear. The fund was up 24.6% year-to-date at $53.45 on 5. Furthermore, it hit an intraday high of $61.67 on 17 February.

The North Shore Global Uranium Mining ETF has kept up the positive momentum from 2020 when it soared 68.4%. Despite the number of nuclear reactor operating globally falling to a 30-year low in July last year, the fund had a strong performance.

According to the World Nuclear Industry Status Report, total operating nuclear capacity fell 2.2% year-over-year to 362 gigawatts by mid-2020. The slide was mainly because there were fewer nuclear reactors in operation, but COVID-19 production disruptions at uranium mines have also played a part.

The drop in supply has led to higher uranium prices and the spot price of the commodity climbed 20.5% in 2020, according to data […]