Vancouver, BC, May 19, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) ( SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that it has entered into an Option Agreement with Rio Tinto Exploration Canada Inc. (“RTEC”), a wholly owned subsidiary of Rio Tinto Limited (“Rio Tinto”), to acquire up to 100% of the Russell Lake Uranium Project (the “Property” or “Project”), which comprises 26 claims covering 73,294 hectares of prospective exploration ground strategically situated between the Company’s Moore Uranium project (to the east) and Denison Mines’ Wheeler River project (to the west) in the eastern portion of the Athabasca Basin.

Russell Lake Project Location Map:

http://www.skyharbourltd.com/_resources/images/SKY-RussellLake-20220325-Inset.jpgThe Project is a premier, advanced-stage exploration property given its large size, proximity to critical regional infrastructure, and the significant amount of historical exploration carried out on the property, which has identified numerous prospective target areas and […]

Uranium stocks jump, banks fall, Atlas soars on IFM deal: ASX up 0.8% at noon

The Australian sharemarket has recouped some of Tuesday’s decline as industrials and miners are leading a broad-based rally. The major banks are the exception, extending their fall after the Reserve Bank’s outsized interest rate hike yesterday.

At noon, the S&P/ASX 200 is 0.8 per cent or 57 points higher at 7,153. The SPI futures are pointing to a rise of 57 points.

Industrials are up 2.8 per cent, lifted by Atlas Arteria (ASX:ALX) surging over 16 per cent to $8.24 after IFM Global Infrastructure Fund obtained a 15 per cent stake in the toll road group. Utilities have added 2.7 per cent, materials and energy have both added 2.2 per cent, and information technology has advanced 1.8 per cent. Financials are down 1.5 per cent.

Morgan Stanley wrote that an aggressive rate hiking cycle by the RBA “increases tail risks” for banks. Westpac (ASX:WBC) is down 4.5 per cent to $22.35, National […]

Click here to view original web page at www.finnewsnetwork.com.au

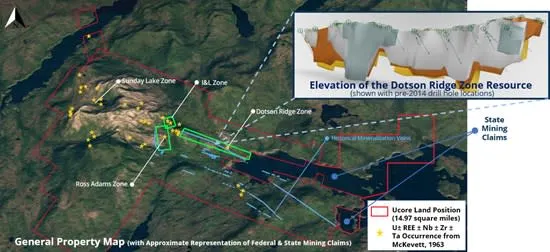

Ucore Comments on Uranium and Recent External Interest in Ucore’s Ross-Adams Uranium Mine Property

June 8, 2022 ( Source ) — Ucore Rare Metals Inc. (TSXV: UCU ) (OTCQX: UURAF ) (“Ucore” or the “Company”) is pleased to comment on the recent increasing interest in uranium as an energy source and also current interest in Ucore’s not-often-mentioned Ross-Adams mine property (the “Mine” ), a former producing uranium mine located on the Ross-Adams portion of Ucore’s Alaskan mineral property (the “ Property “). The Property is located on Prince of Wales Island, approximately 38 miles southwest of Ketchikan, Alaska, USA, near the west arm of Kendrick Bay (within the Bokan Mountain Complex). At its closest point, the edge of the former Mine is located more than 500 m from Ucore’s Bokan-Dotson Ridge Zone, which is Ucore’s rare earth elements (“ REEs “) advanced property mineral resource as described in the Company’s technical report (a preliminary economic assessment [i] (“ PEA “)) that was filed […]

Resources Top 5: US wants to spend $US4.4bn on local enriched uranium, all the ASX stocks fly

Pic: EduardoarToledo, iStock / Getty Images Plus share

US is reportingly seeking US$4.4bn to buy enriched uranium directly from domestic producers

On the ASX it is a sea of green for the uranium cohort, led by GTI, 92 Energy and Peninsula

American West Metals receives “best assays to date” — a 105m-long interval of high-grade zinc and copper Here are the top small cap resources movers in early trade, Wednesday June 8. ALL THE URANIUM STOCKS The US is reportedly seeking $US4.4bn to buy enriched uranium directly from domestic producers in efforts to wean itself from Russian supply.“Still, it won’t be easy for the US to jump-start the domestic uranium industry,” writes Bloomberg’s Ari Natter .“The country has only one remaining commercial enrichment facility — a New Mexico plant owned by Urenco Ltd, a British-German-Dutch consortium.”It didn’t stop the Global X Uranium ETF jumping as much […]

Ucore Comments on Uranium and Recent External Interest in Ucore’s Ross-Adams Uranium Mine Property

Halifax, Nova Scotia–(Newsfile Corp. – June 8, 2022) – Ucore Rare Metals Inc. (TSXV: UCU ) (OTCQX: UURAF ) ("Ucore" or the "Company") is pleased to comment on the recent increasing interest in uranium as an energy source and also current interest in Ucore’s not-often-mentioned Ross-Adams mine property (the "Mine" ), a former producing uranium mine located on the Ross-Adams portion of Ucore’s Alaskan mineral property (the " Property "). The Property is located on Prince of Wales Island, approximately 38 miles southwest of Ketchikan, Alaska, USA, near the west arm of Kendrick Bay (within the Bokan Mountain Complex). At its closest point, the edge of the former Mine is located more than 500 m from Ucore’s Bokan-Dotson Ridge Zone, which is Ucore’s rare earth elements (" REEs ") advanced property mineral resource as described in the Company’s technical report (a preliminary economic assessment [i] (" PEA ")) that […]

Australian Dollar Post-RBA Boost May Continue as Uranium Prices Surge

Australian Dollar, AUD/USD, Uranium, Bond Yields, Recession – Talking Points

Wednesday’s Asia-Pacific Outlook

The Australian Dollar paced higher against the US Dollar through the New York trading session overnight, benefiting from Tuesday’s Reserve Bank of Australia (RBA) rate decision. A rosy session on Wall Street helped support the risk-sensitive currency as the Dollar fell against most of its peers. The Japanese Yen , however, continued to deteriorate, with USD/JPY hitting a fresh multi-decade high.

Australian bond yields rose following the RBA’s surprise decision as traders ditched bond holdings in preparation for further rate hikes this year. Analysts moved quickly to price in more aggressive rate hike bets for the July RBA meeting. The higher trajectory has some economists concerned that it may trigger a recession as households grapple with high debt levels.Spot uranium prices rose on news that the United States may see a government-led initiative to bolster the country’s […]

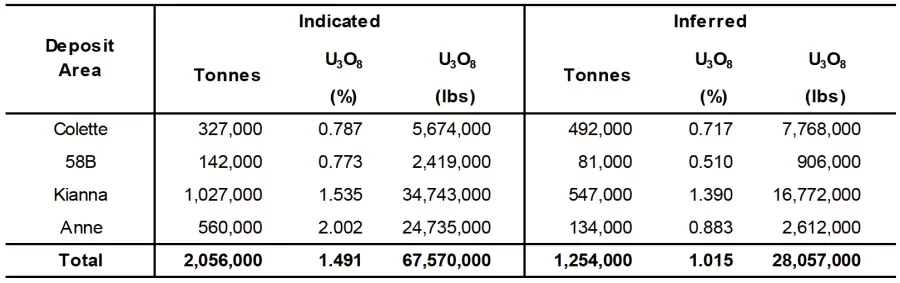

UEX Files Updated Shea Creek Technical Report

Saskatoon, Saskatchewan – TheNewswire – June 6, 2022 – UEX Corporation (TSX:UEX) (OTC:UEXCF)(“UEX” or the “Company”) is pleased to announce that is has filed an updated technical report for the Company’s 49.0975% owned Shea Creek Project that includes an updated mineral resource estimate for the property. The remaining 50.9025% interest in the Shea Creek Project is owned by Orano Canada Inc.

The updated technical report and mineral resource estimate was completed by Mr. James Gray, P.Geo. of Advantage Geoservices Limited, Mr. David Rhys, P.Geo. of Panterra Geoservices Inc., and Mr. Chris Hamel, P.Geo., UEX’s Vice President of Exploration. Mr. Gray, Mr. Rhys, and Mr. Hamel are Qualified Persons as defined by National Instrument 43-101. Mr. Gray is considered independent of the Company. Mr. Hamel is an employee of UEX, and Mr. Rhys is a technical advisor to the Company. Mr. Hamel and Mr. Rhys are not considered to be independent […]

Click here to view original web page at www.juniorminingnetwork.com

Western Uranium & Vanadium Completes Final Delivery on 2015 Supply Agreement

IMPORTANT MESSAGE: Benzinga prides itself as a media platform that is "For the People, By the People." We understand the markets are scary right now. For that reason, we are here to help. For today only get access to our #1 Options Newsletter for only $1.

FOR IMMEDIATE RELEASE

Toronto, Ontario and Nucla, Colorado, May 31, 2022 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp.

WSTRF ("Western" or "Company") is pleased to announce that it satisfied the obligations of its Uranium Concentrates Supply Agreement. The agreement was signed in 2015 with a major U.S. utility which provided for five delivery years from 2018 to 2022. For Delivery Year 2022 the final delivery was made in April 2022 and payment was received in May 2022. Western sold 125,000 pounds of uranium yellowcake (U 3 O 8 ) at a price of $57.04 per pound generating gross revenues of $7.13 million. […]

Forget What the Analysts Say and Check out Trade Data for Uranium Energy Corp. (UEC)

Uranium Energy Corp. (UEC) is priced at $3.94 after the most recent trading session. At the very opening of the session, the stock price was $4.05 and reached a high price of $4.10, prior to closing the session it reached the value of $4.19. The stock touched a low price of $3.90.Recently in News on April 20, 2022, Uranium Energy Corp Expands U.S. Warehoused Physical Uranium Program to 5 Million Pounds U3O8. NYSE American Symbol – UEC. You can read further details here

Uranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $6.60 on 04/13/22, with the lowest value was $2.34 for the same time period, recorded on 01/28/22.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the […]

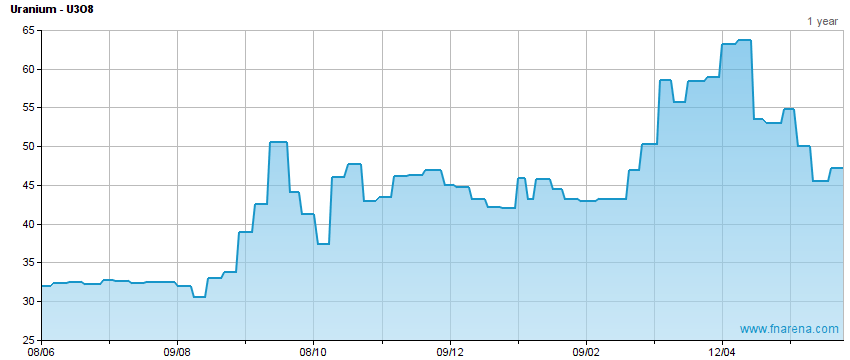

Uranium Week: Mid-Term Price Pullback

The uranium spot price continued to bounce last week as the mid-term price fell back and cost pressures are rising.

-U3O8 spot market anticipating SPUT purchases

-Mid-term price adjustment reflects other buyer demands

-Cost of uranium production still steadily risingThe bounce in the spot uranium price following general financial market lows continued last week, with industry consultant TradeTech’s weekly spot price indicator rising another US$2.60 to US$47.75/lb.May ended mid-week, at which point the indicator was at US$48.50/lb, down -US$4.50 from end-April.The two-week bounce began the week before when global equity and other markets staged a solid comeback rally off the most recent lows, and also on news the Sprott Physical Uranium Trust had successfully issued new capital, and was thus cash-positive.Given SPUT’s sole purpose in life is to purchase uranium as a financial investment, the market is assuming the trust will soon be in buying more material. As […]

UEX Files Updated Shea Creek Technical Report

(TheNewswire) Saskatoon, Saskatchewan TheNewswire – June 6, 2022, UEX Corporation (TSX:UEX) (OTC:UEXCF) ("UEX" or the "Company") is pleased to announce that is has filed an updated technical report for the Company’s 49.0975% owned Shea Creek Project that includes an updated mineral resource estimate for the property. The remaining 50.9025% interest in the Shea Creek Project is owned by Orano Canada Inc.

The updated technical report and mineral resource estimate was completed by Mr. James Gray, P.Geo. of Advantage Geoservices Limited, Mr. David Rhys, P.Geo. of Panterra Geoservices Inc., and Mr. Chris Hamel, P.Geo., UEX’s Vice President of Exploration. Mr. Gray, Mr. Rhys, and Mr. Hamel are Qualified Persons as defined by National Instrument 43-101. Mr. Gray is considered independent of the Company. Mr. Hamel is an employee of UEX, and Mr. Rhys is a technical advisor to the Company. Mr. Hamel and Mr. Rhys are not considered to be […]

Investment firm Geiger Counter deemed best-performing trust in 2021 with a return of 81.9%

GCL has a global mandate but predominantly invests in North American and Australian listed companies With the impact of climate change becoming more prominent than ever as well as greater interest in alternative and renewable energy solutions in response to the ongoing Russo-Ukrainian conflict, all eyes are currently on investment trusts in the commodities & natural resources and renewable energy infrastructure sectors.

Commodities & natural resources trusts had a rollercoaster ride in 2021 as metals and energy prices responded to the stuttering recovery from COVID. Most made progress, barring a couple of minnows and Golden Prospect Precious Metals, which is focused on gold miners.

However, the standout leader within the sector, and the wider investment companies market, was Geiger Counter (Ticker: GCL). It was the best-performing of all investment companies in 2021, delivering a net asset value return of 81.9%, and the second-best performer in share price terms, with a return […]

Standard Uranium enters letter agreement with Red Cloud Securities for a fully marketed, private placement for gross proceeds of up to C$3.5M

The placement will see the sale of any combination of units of the company at a price of C$0.11 per unit and flow-through units (FT unit) at a price of C$0.13 per FT unit Standard Uranium Ltd (TSX-V:STND, OTCQB:STTDF) said it has entered into a letter agreement with Red Cloud Securities Inc to act as lead agent on behalf of a syndicate of agents that includes Canaccord Genuity (TSX:CF, LSE:CF) Corp, in connection with a fully marketed, private placement for gross proceeds of up to C$3.5 million.

The net proceeds raised from the offering will be used for the exploration of the company’s Davidson River Project and for working capital purposes.

The placement will see the sale of any combination of units of the company at a price of C$0.11 per unit and flow-through units (FT unit) at a price of C$0.13 per FT unit.

Each unit will consist of one common […]

Click here to view original web page at ca.proactiveinvestors.com

Uranium Energy Corp. [UEC] is 17.61% higher this YTD. Is it still time to buy?

Uranium Energy Corp. [AMEX: UEC] loss -5.97% or -0.25 points to close at $3.94 with a heavy trading volume of 16131007 shares. The company report on April 20, 2022 that Uranium Energy Corp Expands U.S. Warehoused Physical Uranium Program to 5 Million Pounds U3O8.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for big returns.

Click here for full details and to join for free .SponsoredNYSE American Symbol – UEC.Uranium Energy Corp (NYSE: UEC) (the “Company” or “UEC”) is pleased to report that it has now […]

Ur-Energy Reports Results of Annual General and Special Meeting of Shareholders and Appointment of Chairman of the Board

Ur-Energy Inc. (NYSE American:URG)(TSX:URE) (the "Company" or "Ur-Energy") announces the results of the Company’s Annual General and Special Meeting of Shareholders ("Shareholders Meeting") held June 2, 2022, including the election of Directors

Each of the nominee Directors listed in the Company’s management proxy circular dated April 21, 2022 was elected as a Director. The Company received proxies with regard to voting on the seven Directors nominated for election, as follows: Nominee Votes For % Votes Withheld % Non-Votes W. William Boberg 50,021,685 68.20 23,326,255 31.80 44,631,927 John W. Cash 71,947,377 98.09 1,400,564 1.91 44,631,926 Rob Chang 62,313,454 84.96 11,034,486 15.04 44,631,927 James M. Franklin 61,074,768 83.27 12,273,173 16.73 44,631,926 Gary C. Huber 53,206,557 72.54 20,141,383 27.46 44,631,927 Thomas H. Parker 70,333,076 95.89 3,014,865 4.11 44,631,926 Kathy E. Walker 71,594,668 97.61 1,753,272 2.39 44,631,927 The Company’s independent auditors PricewaterhouseCoopers LLP were reappointed by the Shareholders, and the Directors of the Company […]

Best Penny Stocks To Buy Now? 4 To Watch Before Next Week

Get instant alerts when news breaks on your stocks. Claim your 1-week free trial to StreetInsider Premium here .

Penny stocks are a great way to make a quick buck if you know what you’re doing. While some new traders might treat these cheap stocks like lottery tickets, there are ways to consistently profit as long as you have a strategy. Knowing how to set proper entry and exit targets, learning how to use catalysts to your advantage, and taking emotion out of your trades can help.

In many cases, low-priced stocks have given novice and experienced traders and investors ways to leverage volatility in their favor. Companies in start-up phases and others falling on hard times have become prime candidates. Today, we look at a handful of names that are gaining momentum in the stock market on Thursday. Will they be on your list of penny stocks to watch […]

Click here to view original web page at www.streetinsider.com

Skyharbour’s Partner Company Basin Uranium Corp. Announces Completion of Phase One Drilling at Mann Lake Uranium Project

Vancouver, BC, May 31, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. ’s ( TSX-V: SYH ) ( OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company, Basin Uranium Corp. (“Basin Uranium”) is pleased to announce it has completed its phase one 2022 drill program at its Mann Lake project located 25 km southwest of the McArthur River Mine and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit. The phase one program consisted of five holes totalling 3,503 metres with the unconformity being intersected between 608 metres to 651 metres in all holes. This was the first significant drill program undertaken on the property since 2007.

The second phase of drilling is planned for the fall of this year and will consist of approximately 3,500 metres. Results from both the phase one drill program and upcoming geophysical surveys at Mann Lake will be used for […]

Click here to view original web page at www.globenewswire.com

The reopening of an uranium mine in Arizona has Indigenous people worried

A MARTINEZ, HOST:

There’s a new push to mine more uranium in the U.S. It’s rooted in a growing demand for more nuclear power plants to curb climate change. And that’s become an incentive for reopening an old uranium mine near Grand Canyon National Park, but Native people in the area are wary of the industry’s deadly past. From member station KJZZ, Michel Marizco reports.

MICHEL MARIZCO, BYLINE: About a year ago, investment groups started getting more interested in acquiring uranium companies to address climate change. Then, in February, Russia invaded Ukraine. Talk about the U.S. sanctioning Russian uranium pushed prices higher, says Scott Melbye, president of the Uranium Producers of America.

SCOTT MELBYE: The faster we move away from those supplies, the better, for many reasons, both humanitarian and business-wise.MARIZCO: Russia and former Soviet republics supply nearly half of all U.S. nuclear fuel now. But Curtis Moore, vice president of marketing […]

Strathmore Acquires Former Producing Uranium Mine in Wyoming

News and research before you hear about it on CNBC and others. Claim your 1-week free trial to StreetInsider Premium here .

Kelowna, British Columbia–(Newsfile Corp. – June 1, 2022) – Strathmore Plus Energy Corporation (TSXV: SUU.H) (OTC: SUUFF) (" Strathmore Plus " or " the Company ") is pleased to announce that it has acquired by staking the Night Owl claims in the Shirley Basin uranium district of Wyoming. Night Owl was formerly mined by Night Owl Properties & Battle Axe Mining Co. producing 93 tons at a grade of 0.24% U 3 O 8 ,which was mined at or near surface in the late 1950s to early 1960s. Production at Night Owl ceased due to low uranium prices ($7), not for lack of resource. Wyoming Uranium LLC, to be acquired by the Company, has strategically staked the core of the Night Owl production and the surrounding areas. […]

Click here to view original web page at www.streetinsider.com

Production to recommence at Honeymoon uranium mine in South Australia’s outback

The Honeymoon uranium mine in north-east South Australia was bought by Boss Energy in 2015. Uranium production will resume by the end of next year at the Honeymoon uranium mine in north-east South Australia, the owner says.

Boss Energy announced this morning that it had signed off on a $113 million upgrade of the mine near Broken Hill, after previous plans to revive the mine were shelved in 2013 because of low uranium prices and high production costs.

Production is expected to begin by December next year, with the outback mine forecast to produce 2.5 million pounds of uranium per year by 2026.

In a statement to the ASX, Boss Energy said it had raised capital for the project through $125 million in share sales in March.The company’s managing director, Duncan Craib, and director Bryn Jones briefed South Australian Mining Minister Tom Koutsantonis on the project on Friday.Uranium prices have almost doubled […]

Why the uranium sector is just getting warmed up

At last year’s COP 26 conference, which was itself entirely powered by electricity from nuclear power, governments pledged their commitment to nuclear as a key tool for hitting far-off decarbonisation targets.

But with energy prices now soaring, talk has turned to action quicker than these governments may have planned, with a conga-line of nations giving tangible support to their nuclear power sectors to help shore up energy security. With this and other factors at play, uranium stocks have had a big few years, even after taking recent markets into account.

So, to take stock and to hear how things could play out from here, we spoke to the CEO of one of the ASX’s top-performing uranium stocks and heard why the sector could just be getting warmed up. From a microcap to a midcap

The fundamentals for the sector had long been bullish, but that didn’t stop the sector from heading […]

Click here to view original web page at www.livewiremarkets.com

Western Uranium & Vanadium Completes Final Delivery on 2015 Supply Agreement

Western Uranium & Vanadium Corp. FOR IMMEDIATE RELEASE

Toronto, Ontario and Nucla, Colorado, May 31, 2022 (GLOBE NEWSWIRE) — Western Uranium & Vanadium Corp. (CSE:WUC) (OTCQX:WSTRF) (“Western” or ”Company”) is pleased to announce that it satisfied the obligations of its Uranium Concentrates Supply Agreement. The agreement was signed in 2015 with a major U.S. utility which provided for five delivery years from 2018 to 2022. For Delivery Year 2022 the final delivery was made in April 2022 and payment was received in May 2022. Western sold 125,000 pounds of uranium yellowcake (U 3 O 8 ) at a price of $57.04 per pound generating gross revenues of $7.13 million. The U 3 O 8 sold was sourced from the uranium inventory that Western announced acquiring in its Strategic Acquisition of Physical Uranium news release in June 2021. This U 3 O 8 was acquired at a price of $32.16 […]

The reopening of an uranium mine in Arizona has Indigenous people worried

A MARTINEZ, HOST:

There’s a new push to mine more uranium in the U.S. It’s rooted in a growing demand for more nuclear power plants to curb climate change. And that’s become an incentive for reopening an old uranium mine near Grand Canyon National Park, but Native people in the area are wary of the industry’s deadly past. From member station KJZZ, Michel Marizco reports.

MICHEL MARIZCO, BYLINE: About a year ago, investment groups started getting more interested in acquiring uranium companies to address climate change. Then, in February, Russia invaded Ukraine. Talk about the U.S. sanctioning Russian uranium pushed prices higher, says Scott Melbye, president of the Uranium Producers of America.

SCOTT MELBYE: The faster we move away from those supplies, the better, for many reasons, both humanitarian and business-wise.MARIZCO: Russia and former Soviet republics supply nearly half of all U.S. nuclear fuel now. But Curtis Moore, vice president of marketing […]

Traction Uranium Announces Appointment of New Chairman and Management Change

VANCOUVER, British Columbia, May 27, 2022 (GLOBE NEWSWIRE) — Traction Uranium Corp. (the “Company” or “Traction”) ( CSE: TRAC ) ( OTC: TRCTF ) ( FRA: Z1K ), a mineral exploration issuer focusing on the development of discovery prospects in Canada, including its two flagship uranium projects in the world-renowned Athabasca Region, is pleased to announce effective June 1st, 2022 the appointments of Mr. Blair Way, current director of Traction Uranium Corp (see Press Release dated November 5th, 2021) to Chairman of the Board of Directors and the appointment of Tasheel Jeerh as Chief Financial Officer of the Company.

Mr. Way is an experienced international executive with over 35 years experience in the resources and construction industries. Mr. Way’s experience spans the complete mineral development cycle from early-stage exploration to project definition and studies culminating in implementation, commissioning and operations. He spent his early career with large scale resource companies […]

Click here to view original web page at www.globenewswire.com

Why Uranium Stocks Are Red Hot on Thursday

Uranium prices are making a U-turn. So are uranium stocks.

What happened

Uranium mining stocks are glowing a bright, clear green in Thursday morning trading — up 10% and more across the board. As of 11:15 p.m. ET, shares of Energy Fuels ( UUUU 10.44%) have risen 11.3%, while tiny Ur-Energy ( URG 13.68%) is tacking on 13%. Meanwhile, Uranium Energy ( UEC 17.61%) is leading the pack higher with a startling 16.8% gain.

There’s one good reason for it: Uranium prices have turned north again. Image source: Getty Images. So what Uranium is a volatile commodity . As investor hopes for a revival of nuclear power plant building have waxed and waned, uranium prices have experienced some serious ups and downs over the past couple of years. Per pound, prices of uranium rose more than 40% between mid-March and late May 2020, for example, then rose more than 60% […]