Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – After a very hectic start to the week, the gold price bounced off the consolidation low of $1850.62 per ounce after falling 5.46% during yesterday’s session. This morning the precious metal trades 1.23% higher after the Pfizer/BioNTech vaccine news provided the catalyst for the dramatic move lower.

Overnight equities continued to move higher in Asia with the Nikkei 225 pushing 0.26% in the black. The ASX (0.66%) also gained but the Chinese bourses didn’t manage to capitalise on the bullishness seen elsewhere. European futures are also painting a mixed picture with Dax futures up 0.63% and FTSE 100 (-0.11%) futures lagging behind. Stay at home stocks are still suffering with the likes of […]

PRECIOUS-Gold prices gain some ground on stimulus hopes

Nov 10 (Reuters) – Gold prices edged higher in early Asian trade on Tuesday after falling as much as 5.2% in the previous session, as hopes of more U.S. stimulus measures to weather the impact of rising COVID-19 cases nudged investors towards the precious metal as an inflation hedge. FUNDAMENTALS * Spot gold rose 0.5% to $1,871.81 per ounce by 0136 GMT * It fell to $1,849.93, its lowest level since Sept. 28, on Monday after U.S. drugmaker Pfizer Inc said its experimental COVID-19 vaccine was more than 90% effective, based on initial trial results. * "I still think we’ve got more stimulus coming and the Fed will keep rates low, while a vaccine is going to provide that reflationary impulse… That’s why the markets are still holding onto gold," said Stephen Innes, chief global market strategist at financial services firm Axi. * U.S. gold futures were up 0.8% […]

Equinox Gold Corp. (EQX) Q3 2020 Earnings Call Transcript

Image source: The Motley Fool. Equinox Gold Corp. ( NYSEMKT:EQX )

Q3 2020 Earnings Call

Nov 09, 2020, 11:00 a.m. ET Contents:Prepared Remarks

Questions and Answers Call Participants Prepared Remarks: Operator Thank you for standing by. This is the conference operator. Welcome to the Equinox Gold third-quarter 2020 results conference call and webcast. [Operator instructions] I would now like to turn the conference over to Rhylin Bailie, vice president, investor relations for Equinox Gold.Please go ahead. Rhylin Bailie — Vice President, Investor Relations Thank you very much. And thank you very much, everybody for joining us on the call this morning. We will of course be making a number of forward-looking statements today. So please do take the time to visit our continuous disclosure documents on our website, on SEDAR and on EDGAR.I will now turn the call over to our CEO, Christian Milau, for opening remarks. 10 […]

There’s more to this story But it’s a member-only story. Subscribe today to unlock it and more…

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend Delivery […]

Click here to view original web page at www.goldcoastbulletin.com.au

Teranga Gold Acknowledges Discussions

TORONTO, Nov. 10, 2020 (GLOBE NEWSWIRE) — Teranga Gold Corporation ("Teranga" or the "Company") (TSX: TGZ) (OTCQX: TGCDF) acknowledges that it is in discussions with Endeavour Mining Corporation regarding a potential merger of equals structured transaction (the “Proposal”).

There can be no assurance that the Proposal will ultimately result in a completed transaction. Teranga intends to provide updates if and when necessary in accordance with applicable securities laws.

Teranga remains focused on the development of its strong growth pipeline of assets, as the Company strengthens its position as a low-cost, mid-tier gold producer in West Africa. Teranga’s strategy is to maximize shareholder value by increasing sustainable long-term free cash flow through diversification and growth while remaining fiscally conservative.

Forward-Looking Statements This press release contains certain statements that constitute forward-looking information within the meaning of applicable securities laws ("forward-looking statements"), which reflects management’s expectations regarding Teranga’s future growth opportunities, results of operations, […]

A Golden Election Promise

Summary

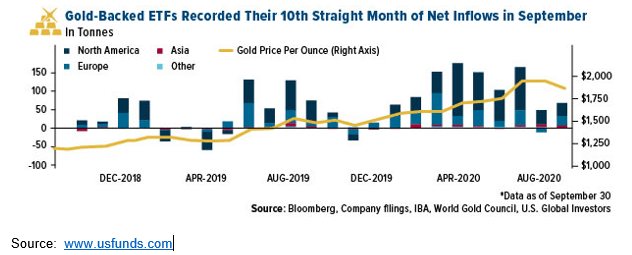

If volatility rises markets could sell off, making gold collateral damage in the near term.

The global addiction to easy money supports much higher gold prices.

Election promises abound, but gold is the one you can count on.There’s no shortage of prognostications or conjecture about the U.S. election.Of course, everyone has an opinion.Some like red, some like blue, some like neither.Last week’s volatility in stocks, bonds, currencies and commodities is a clear signal that markets are uneasy. They hate uncertainty.If the election’s outcome is less than clear, then volatility will be around for a while, and probably even intensify.A lot of the forecasting is about what will happen to gold. One thing I know for sure is, no matter who takes election victory, gold will come out of it the biggest winner.In the meantime, we’re likely to hear a lot of noise.I suggest you ignore most of it, and focus on […]

Police stumble on bizarre shotgun selfie session

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend Delivery […]

Click here to view original web page at www.goldcoastbulletin.com.au

Gold prices gain some ground on stimulus hopes

A gold bar is wrapped in a financial newspaper.

GSO Images | Getty Images

Gold prices edged higher in early Asian trade on Tuesday after falling as much as 5.2% in the previous session, as hopes of more U.S. stimulus measures to weather the impact of rising Covid-19 cases nudged investors towards the precious metal as an inflation hedge. Fundamentals

Spot gold rose 0.5% to $1,871.81 per ounce by 0136 GMTIt fell to $1,849.93, its lowest level since Sept. 28, on Monday after U.S. drugmaker Pfizer Inc said its experimental Covid-19 vaccine was more than 90% effective, based on initial trial results.“I still think we’ve got more stimulus coming and the Fed will keep rates low, while a vaccine is going to provide that reflationary impulse … That’s why the markets are still holding onto gold,” said Stephen Innes, chief global market strategist at financial services firm Axi.U.S. gold futures were […]

Gold plunges 4% on COVID-19 vaccine euphoria: Where next for prices? [VIDEO]

Gold slumped more than 4% on Monday as news of the first successful late-stage COVID-19 vaccine trials prompted investors to dump safe-haven bullion and flock to riskier assets instead.

Spot prices retreated sharply from a two-month peak of $1,965 hit earlier in the session amid a weaker dollar and hopes for more stimulus following Joe Biden’s victory in the U.S. elections.

Equities surged after Pfizer Inc said its experimental COVID-19 vaccine was more than 90% effective.

Bullion, a hedge against currency debasement and inflation, has climbed 24% this year, mainly driven by unprecedented global pandemic-led stimulus.Other precious metals also sold off, with platinum falling 3.2%. Where are prices heading next? Watch The Commodity Report now, for my latest price forecasts and predictions: Trading has large potential rewards, but also large potential risk and may not be suitable for all investors. The value of your investments and income may go down as […]

Gold Miners Update – Updated GDX Price Target

Our cycles supported a turning point in precious metals around November 6th (+/- a few trading days). I assumed it would time a low. Today’s market action suggests that instead of a low – gold inverted and probably formed a high overnight. Below is our updated price target(s) for GDX.

GDX DAILY : Prices reversed at the gap, and I am glad we waited for confirmation before committing to new positions. If gold continues to collapse below $1850 (likely), I think GDX will reach $34.00 to $35.00 near-term, and perhaps $31.00 – $33.00 in December. Reaching the December target would represent an incredible buying opportunity, in my opinion.

Click here to view our article- Gold Price Forecast: Gold Price Target’s $1750

AG Thorson is a registered CMT and expert in technical analysis. He believes we are in the final stages of a global debt super-cycle. For more information, please visit […]

Can gold price go lower? Vaccine 90% effective; metals, work from home stocks get crushed

Gold price dropped $100, or 4.5% on Monday as Pfizer announced that its COVID-19 vaccine is 90% effective. The S&P 500 climbed 2.9%, the Dow is up 3.8%, and the NASDAQ is up only 1%, dragged down by companies that benefit from the work from home culture, like Zoom (-12%) and Netflix (-4%).

Peter Hug, global trading director of Kitco Metals, said that these moves factor in expectations that are a bit ‘premature’.

“I think what the metals markets specifically are thinking, I think is premature, is that now with the vaccine coming out, the economy is going to re-open and there’s going to be a resurgence and another stimulus package is not necessary, and on that point I totally disagree,” Hug said.

Hug noted that he is looking for bearish momentum to test gold’s support level of $1,850 an ounce.“This kind of momentum could feed on itself as stop losses are […]

Gold Price Prediction – Prices Tumble as Yields Soar Following Vaccine Announcment

Gold prices reversed course on Monday, tumbling lower and testing support, as the dollar rose and US yields surged. The 10-year US treasury yield surged higher on Monday rising to 95-basis points, a robust 14-basis point climb. US yields rose following news that Pzifer announced that it had great success with its COVID-19 vaccine. The 90% success rate help buoy the equity markets putting upward pressure on US yields. This helped buoy the dollar paving the way for lower gold prices.

Trade gold with FXTM Technical analysis

Gold prices reversed its upward climb and tumbled on Monday. Prices sliced through support near the 50-day moving average at 1,900, which is now seen as short-term resistance. Prices appear to have bounced just ahead of support near the September lows at 1,848. Short-term momentum is negative as the fast stochastic generated a crossover sell signal. Medium-term momentum has turned neutral and is […]

Gold & Silver Penny Stocks to Watch During The Latest Correction

5 Precious Metals Penny Stocks To Watch Right Now

On Monday, November 9th, many gold and silver penny stocks saw a big market correction. After gold and silver hit lows of $1,450 and $11.74 per ounce respectively back in March, prices have since rallied. From March to August, gold prices shot up dramatically, hitting a record high of $2,089.20 by the middle of August. Similarly, silver prices hit a high of $29.91 in August, up by 155% from its March lows. While Monday, November 9th may be disheartening for gold and silver stock investors, it could also signal a potential.

In the past few years, we have seen a trend of precious metals stocks dropping in value prior to the end of the year. With this in full swing, we could see the potential for precious metals penny stocks as we move into 2021. In addition, geopolitical tensions usually tend […]

Gold fuels big banks’ bumper profits as oil bonanza fades

LONDON (Reuters) – Lower income from oil reduced commodity-related revenues at the world’s ten biggest investment banks in the third quarter, but booming profits from precious metals means they are still set for a bumper year, consultants McKinsey CIB Insights said on Monday. FILE PHOTO: Gold bars are displayed during a photo opportunity at the Ginza Tanaka store in Tokyo September 7, 2009. REUTERS/Yuriko Nakao/File Photo Big banks have almost doubled their earnings this year from trading, selling derivatives and other activities in the commodities sector thanks to price volatility, supply disruption and a boom in trading since the coronavirus outbreak.

Massive swings in the price of oil LCOc1 CLc1 , the biggest market, drove profits earlier in the year, but gold XAU= has taken over as the biggest earner as crude prices stabilised.

A rush of interest in gold from investors and a fracturing of the market after the virus […]

Lundin Gold Reports Q3 2020 Results

Lundin Gold Logo (CNW Group/Lundin Gold Inc.) VANCOUVER, BC, Nov. 9, 2020 /CNW/ – Lundin Gold Inc. ("Lundin Gold" or the "Company") (TSX: LUG) (Nasdaq Stockholm: LUG) is pleased to announce its results for the three and nine months ended September 30, 2020. All amounts are in U.S. dollars unless otherwise indicated. View PDF version

The Company had a very strong re-start of operations at its Fruta del Norte gold mine ("Fruta del Norte") following the temporary suspension in the second quarter due to the COVID-19 pandemic. Fruta del Norte produced 94,250 ounces ("oz") and sold 62,160 oz of gold, at a low cash operating cost of $632 per oz 1 sold during the quarter. This resulted in net revenues of $119 million, income from mining operations of $62.8 million and cash flow from operations of $23.4 million.

"Fruta del Norte has proven it is a low-cost producer. Our low […]

Gold December contract may continue to trade higher with resistance at Rs 53,500 per 10 gram

Commodity prices regained momentum on US presidential election jitters as most of the non-agro commodities witnessed strong buying during the week passed by. Silver prices rallied the most reporting gains of more than 8 percent for the week followed by Zinc, gold and crude oil. Natural gas prices on the contrary plunged by more than 13 percent during the week. The weaker dollar against major currencies boosted buying in commodities. The greenback fell to 92.23 shedding nearly 2 percent for the week against the major currencies.

Bullion prices rallied on the uncertainty of US presidential elections which has led to public protest in some parts of the US. COMEX spot gold prices gained by nearly 4 percent to $1,951 an ounce crossing a key hurdle at $1940 for the week, reporting the highest weekly run since July 2020. Spot silver prices at COMEX remained highly volatile rallied by more than […]

Click here to view original web page at www.moneycontrol.com

Gold Price Forecast: XAU Slammed to Support on Covid Vaccine News

Gold Price Forecast:

When good news goes wrong, at least for Gold bulls. Gold has put in a massive bearish move of -5% on positive news of a Covid vaccine.

Gold prices had broken out from the falling wedge formation late last week, giving the appearance that bullish continuation might be in the cards. That has reversed aggressively.

This covid news is still relatively new and the situation remains fluid: Be prepared for continued volatility in Gold and other macro markets. The analysis contained in article relies on price action and chart formations . To learn more about price action or chart patterns, check out our DailyFX Education section. The resounding driver across global markets today is one driven by hope: If you’re reading this you probably already know that Pfizer has announced some pretty positive results for their Covid vaccine . This entails apparently a […]

Gold Falls, Yields Rise On Pfizer Vaccine

Gold Getting Whacked As US Yields Rise On Vaccine News

The dollar isn’t faring too badly and is actually a little up on the day despite having widely been adopted as a safe haven asset. This is very much not a risk-averse day but it seems it’s the yen that’s taking the brunt of the hit, while risk currencies are doing very well.

Interestingly, gold is getting whacked in the wake of the vaccine news. US rates are rising on the back of the announcement and that’s bad news for the yellow metal which has fallen as low as USD1,900, having traded above USD1,950 ahead of the release. Investors now clearly betting on a stronger economic recovery and everything that comes with it.

Perhaps we’re now seeing a bit of a reset moment for gold, where its correlation with risk assets starts to fade and it returns to its traditional […]

Silver price falls 7% on vaccine news, but here’s key difference between gold and silver

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) Silver tumbled more than 7% on Monday as precious metals sold off in response to positive coronavirus vaccine news, which investors interpreted as good for the economy.

"The initial reaction was that stimulus may not be necessary," RJO Futures senior commodities broker Daniel Pavilonis told Kitco News. "With a vaccine, we have a way to change the dynamic of the way everybody is living post-COVID. Maybe everyone can go back to work, or maybe there is less economic risk. Maybe pent-up purchasing picks up."

Monday’s price action has seen an unwind of the pandemic-era trades, said TD Securities commodity strategist Daniel Ghali.

"Vaccine is seen as opening the door to other assets that haven’t performed as well during the pandemic. […]

Gold Price Analysis: XAU/USD nurse biggest losses in three months around $1,850

Gold stays depressed near the lowest in six weeks.

US dollar recovery, Wall Street gains shifted funds off the bullion.

Vaccine hopes from Pfizer/BioNTech magnified early Monday’s market optimism, led by US election results.

Gold prices lick their wounds around $1,956, near the lowest since September 28, during the early Asian session on Tuesday. The yellow metal posted the heaviest declines since August 11, while refreshing the multi-day low, after the news concerning the coronavirus (COVID-19) propelled market sentiment and extended the US dollar strength. Vaccine hopes bolster market optimism… With a 90% effective rate, the covid vaccine from Pfizer-BioNTech offers the biggest success in finding the cure for the deadly virus. Global markets cheer the welcome development while magnifying the initial optimism backed by Joe Biden’s victory in the US elections.The mood enthused DJI30 and S&P 500 Futures to refresh the record highs whereas the […]

P2 Gold Upsizes Financing

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION

OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.VANCOUVER, British Columbia, Nov. 09, 2020 (GLOBE NEWSWIRE) — P2 Gold Inc. (“P2” or the “Company”) ( TSX-V:PGLD ) reports that it intends to increase the size of its previously announced non-brokered private placement of units from 2,500,000 units to 3,307,500 units (the “Private Placement”).

The Private Placement will now consist of 3,307,500 units (the “Units”) at a price of $0.40 per Unit for gross proceeds of $1.323 million. Each Unit will consist of one common share in the capital of the Company and one common share purchase warrant (a “Warrant”). Each Warrant will entitle the holder to purchase one additional common share in the capital of the Company at an exercise price of $0.65 per common share for a period […]

There’s more to this story But it’s a member-only story. Subscribe today to unlock it and more…

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend Delivery […]

Click here to view original web page at www.goldcoastbulletin.com.au

Daily Gold News: Gold Lower Following Covid-19 Vaccine News

The gold futures contract gained 0.25% on Friday, as it extended its short-term advance following a rebound from local low of around $1,850. The markets continued to react on U.S. Presidential Election uncertainty but today we can see euphoria rally after Covid-19 vaccine news release. Gold got back to around $1,950 price level last week, as we can see on the daily chart ( the chart includes today’s intraday data ):

Gold is 2.4% lower this morning, as it is retracing its last week’s advance following the mentioned news about coronavirus vaccine. What about the other precious metals? Silver gained 1.87% on Friday and today it is 2.7% lower. Platinum lost 0.06% and today it is 2.1% lower. Palladium gained 4.88% on Friday and today it’s 1.8% lower. So precious metals are retracing their last week’s advance this morning .

Friday’s Nonfarm Payrolls number release has been slightly better than expected […]

Gold price plummets on news of successful Covid vaccine

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold and silver futures prices are sharply down in early U.S. trading Monday, on the just announced news from Pfizer that it has developed a very promising Covid-19 vaccine. Stock markets soared on the news, including U.S. indexes hitting record highs, as risk appetite has up-ticked markedly the past hour. Gold prices had hit a nearly seven-week high of $1,966.10 in overnight trading. December gold futures were last down $39.90 at $1,911.70 and December Comex silver was last down $0.792 at $24.855 an ounce.

Pfizer within the past hour announced a Covid-19 vaccine trial of around 44,000 subjects that is 90% effective gave the stock markets a solid boost from earlier overnight gains. […]

Demand For Gold During Pandemic Drives Strong Growth In Gold Mining Industry

PALM BEACH, Fla., Nov. 9, 2020 /PRNewswire/ — During periods of crisis, gold has proven to be a time-honored safe-haven asset. Scarcity and built-in utility have made the yellow metal a sought after commodity throughout recorded human history. Whether in physical or paper form, gold bullion is the world’s go to financial hedge against uncertainty. The global gold market is likely to be affected by the fluctuating supply of mined gold as the global gold production is a mix of scrap recovery, central bank supply, and mined gold. More than half of the global gold supply comes from mined gold. In 2019 the U.S. produced 200 tons (6.4 million troy ounces) of gold (down from 210 tons in 2018), worth about US$8.9 billion, and 6.1% of world production, making the U.S. the fourth-largest gold-producing nation, behind China, Australia and Russia. Most gold produced today in the US comes from […]

![Gold plunges 4% on COVID-19 vaccine euphoria: Where next for prices? [VIDEO]](https://stockmarket.ezistreet.com/wp-content/uploads/2020/11/hand-full-of-gold-nuggets-53773200_Large.jpeg)