Summary

If volatility rises markets could sell off, making gold collateral damage in the near term.

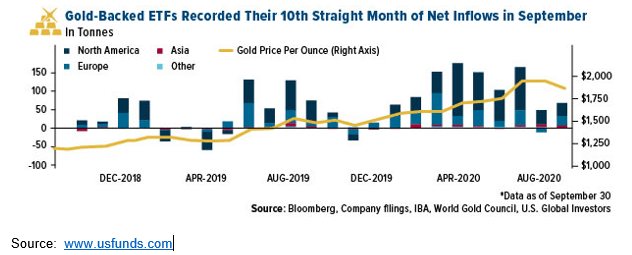

The global addiction to easy money supports much higher gold prices.

Election promises abound, but gold is the one you can count on.There’s no shortage of prognostications or conjecture about the U.S. election.Of course, everyone has an opinion.Some like red, some like blue, some like neither.Last week’s volatility in stocks, bonds, currencies and commodities is a clear signal that markets are uneasy. They hate uncertainty.If the election’s outcome is less than clear, then volatility will be around for a while, and probably even intensify.A lot of the forecasting is about what will happen to gold. One thing I know for sure is, no matter who takes election victory, gold will come out of it the biggest winner.In the meantime, we’re likely to hear a lot of noise.I suggest you ignore most of it, and focus on […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments