Oh god, a retired Morris Dancer. Picture: Getty Images share

Thomson Resources’ NSW silver projects acquisition continues to excite investors

Technology Metals Australia gains after revealing off-take deal with Sinosteel Australia

Minotaur Exploration benefits from joint venture partner Andromeda Metals’ test work ASX silver, iron-vanadium and rare earths stocks are leading the small cap resources winners in morning trade Friday, November 13. ASX investors continued to warm to Thomson Resources’ (ASX:TMZ) plan to acquire two silver deposits in NSW from Silver Mines (ASX:SVL). The stock put on up to 40 per cent in Friday’s morning session, after gaining 30 per cent on Thursday. Thomson Resources chairman, David Williams, called the acquisition “game-changing” for the company.Acquiring the Conrad and Webbs silver projects in NSW’s New England Fold Belt will diversify the company’s assets.The company plans to bring its new silver projects into production quickly, said Williams.Silver Mines is taking a […]

Gold holds steady as virus wave offsets vaccine hopes

An employee arranges gold bars for a photograph at the YLG Bullion International headquarters in Bangkok, Thailand.

Dario Pignatelli | Bloomberg | Getty Images

Gold prices were little changed on Friday, as fears of an economic impact due to a surge in global cases of Covid-19 countered optimism from the developments in a potential vaccine. Fundamentals

Spot gold was steady at $1,876.92 per ounce by 0044 GMT. It was headed for its worst weekly performance since late-September, declining 3.8% so far.U.S. gold futures were up 0.1% at $1,874.50.The dollar index held steady but was on track for a 0.7% weekly gain.The heads of the Federal Reserve and the European Central Bank welcomed the encouraging results in trials of a vaccine candidate for Covid-19 but stressed that the economic outlook will remain uncertain.The number of Americans filing new claims for unemployment benefits fell to a seven-month low last week, but the pace […]

Gold price buoyed by virus woes, but heads for worst week

US gold futures gained 0.2 per cent to USD 1,876.50.(REUTERS) Gold prices inched higher on Friday, as fears over the economic fallout from mounting cases of Covid-19 overshadowed hopes of a vaccine, although the metal was on track for its worst weekly performance since late-September.

Spot gold rose 0.1% to $1,877.14 per ounce by 0325 GMT. For the week so far, it is down 3.8%.

US gold futures gained 0.2% to $1,876.50.

“There has been a bit of shift in market psychology,” ED&F Man Capital Markets analyst Edward Meir said, adding that people are realising a significant roll-out of a vaccine will take time while the need for relief is immediate.A Reuters tally showed novel coronavirus cases soared by more than 100% in 13 US states in the past two weeks, while the global tally crossed 52.45 million, underpinning the need for more stimulus.“The fact that there isn’t a stimulus coming seems […]

Click here to view original web page at www.hindustantimes.com

Pure Gold Reports Third Quarter Financial Results

Remains on Track for First Ore to Mill by Year-End

VANCOUVER, British Columbia, Nov. 12, 2020 (GLOBE NEWSWIRE) — Pure Gold Mining Inc. (TSX-V: PGM, LSE: PUR) (“Pure Gold” or the “Company”) is pleased to announce that its unaudited condensed interim consolidated financial statements (“Financial Statements”) for its third quarter ended September 30, 2020 and the accompanying Management’s Discussion and Analysis are available for download on the Company’s website at www.puregoldmining.ca and under the Company’s SEDAR profile at www.sedar.com .

Financial and Operating Highlights for the quarter and to date :

During the three months ended September 30, 2020 and up to the date of this MD&A, the Company advanced construction and underground development activities at its 100%-owned PureGold Mine Project (“ Mine Project ” or the “ Project ”)). A summary of the highlights for the three months ended September 30, 2020 and subsequent period to date are […]

Click here to view original web page at www.globenewswire.com

Outlook for gold – “gold’s story is not yet over”

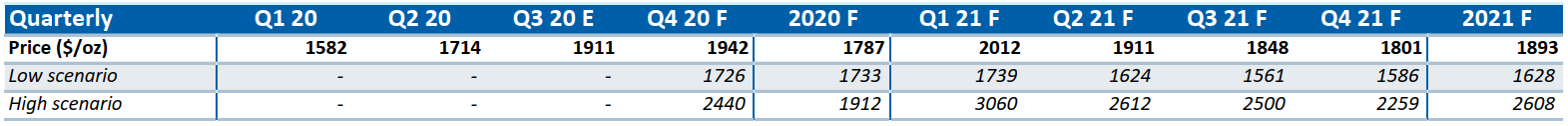

A client note via RBC on the metal, the bank sees factors still prevalent to support the price ahead:

While we may have seen a reset of sorts in gold’s valuation, its path is not predetermined as we barrel towards 2021 While the market seems to have priced in a new normal for now, prices remain elevated beyond where many macro drivers would imply on their own, as uncertainty still pervades.

even putting the risk of a viral resurgence aside, an effective vaccine will take time to distribute, the economy will take time to recover, and prolonged political uncertainty remains a worry.

While investor flows as measured by ETF flows have levelled out for the most part, we believe that there is still a clear appreciation for gold amid all the uncertainty that still persists. Thus, while the "light at the end of the tunnel" may […]

Gold Price Analysis: XAU/USD buyers eye $1,900 amid risk-off mood

Gold pares early-week losses despite latest pullback from $1,883.93.

Covid recalls activity restrictions in US states, Fed Chair Powell warns about vaccine hopes.

Trade, political tensions also join the line to weigh the risks.

Aussie PM’s likely hint for vaccine, reopening can entertain Asian traders amid a light calendar. Gold extends the previous day’s corrective recovery while picking up the bids near $1,877 during the early Friday’s Asian session. In doing so, the yellow metal consolidates the biggest losses in three months, marked on Monday, amid fresh risks emanating from the coronavirus (COVID-19), trade and political frontiers. Vaccine hopes aren’t enough to restore economics… Although Pfizer, Moderna and Chinese pharmaceuticals are trying their best to find the cure to the deadly virus, Federal Reserve Chairman Jerome Powell’s hint to not be too optimistic about the cure’s economic impact cooled down the earlier positive market sentiment […]

How will higher gold price, COVID-19 impact Diwali’s gold demand?

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) It’s almost time to celebrate Diwali, known as the Festival of Light, during which it is a tradition to purchase gold. But how will the coronavirus pandemic and high prices dent demand this year?

Diwali always grabs markets’ attention and this year’s celebrations begin on Friday with Dhanteras — the most auspicious day to buy gold jewelry for Hindus, which is dedicated to Lakshmi, the Hindu goddess of wealth and prosperity.

"The ‘Festival of Lights’ goes back thousands of years and marks the start of the Hindu New Year; it is a Lunar Festival and falls either in October or November," said Rhona O’Connell, head of market analysis for EMEA and Asia regions at StoneX. "The first day of […]

Exclusive: Gold market authority threatens to blacklist UAE and other centres

LONDON (Reuters) – The world’s most influential gold market authority is threatening to stop bullion from countries including the United Arab Emirates entering the mainstream market if they fail to meet regulatory standards, a letter seen by Reuters showed.

In the letter dated Nov. 6 addressed to countries with large gold markets, the London Bullion Market Association (LBMA) laid out standards they must meet on issues such as money laundering and where they source their gold – or be blacklisted.

The move by the LBMA is the first time a market or state authority trying to tackle the illegal or unethical production and trading of gold has raised the prospect of cutting off the bullion industry in a major financial centre.

“Our goal is to work jointly with these key markets to advance global standards, not to disengage from them. However, we are also committed to act if there is not meaningful […]

So You’ve Decided to Collect Classic Head Half Eagle Gold Coins…

By Doug Winter – RareGoldCoins.com ……

As a companion piece to the Sunnyvale Collection of Classic Head half eagles that they offered for sale in mid-October 2020, Douglas Winter Numismatics (DWN) creating a guide for assembling a set of these interesting coins.

* * *

Classic Head half eagles were struck from 1834 through 1838. They form a bridge between the early gold issues (those struck from 1795 through 1834) and the ubiquitous Liberty Head issues, struck from 1839 through 1908.A basic set of Classic Head half eagles contains eight coins: six issues from Philadelphia (the 1834 is found with a Plain 4 and a Crosslet 4 ), and one each from Charlotte and Dahlonega . None of these is rare from the standpoint of overall availability, but the two branch mint coins are very scarce in higher grades as is the 1834 Crosslet 4. As a rule, the Philadelphia coins […]

PRECIOUS-Gold holds steady as virus wave offsets vaccine hopes

Nov 13 (Reuters) – Gold prices were little changed on Friday, as fears of an economic impact due to a surge in global cases of COVID-19 countered optimism from the developments in a potential vaccine. FUNDAMENTALS * Spot gold was steady at $1,876.92 per ounce by 0044 GMT. It was headed for its worst weekly performance since late-September, declining 3.8% so far. * U.S. gold futures were up 0.1% at $1,874.50. * The dollar index held steady but was on track for a 0.7% weekly gain. * The heads of the Federal Reserve and the European Central Bank welcomed the encouraging results in trials of a vaccine candidate for COVID-19 but stressed that the economic outlook will remain uncertain. * The number of Americans filing new claims for unemployment benefits fell to a seven-month low last week, but the pace of decline has slowed and further improvement could be […]

Gran Colombia Gold Corp. (TPRFF) CEO Lombardo Paredes on Q3 2020 Results – Earnings Call Transcript

Gran Colombia Gold Corp. ( OTCPK:TPRFF ) Q3 2020 Earnings Conference Call November 12, 2020 10:00 AM ET

Company Participants

Mike Davies – CFO

Lombardo Paredes – CEO Conference Call Participants Sid Rajeev – Fundamental Research Operator Welcome to the Gran Colombia Gold Q3 2020 Results Webcast. My name is Venessa, and I’ll be your operator for today. At this time, all participants are in a listen-only mode. Later, we will conduct a question-and-answer session [Operator Instructions]. Please note that this conference is being recorded.I will now turn the call over to Mr. Mike Davies, Chief Financial Officer. Mike Davies Great. Thank you, Venessa. Good morning, and thank you for joining us today for the Gran Colombia Gold third quarter and first nine months 2020 results webcast. With me on the webcast this morning is our CEO, Lombardo Paredes. And as is customary, I’ll first go through our prepared remarks […]

Gold Gate Launches Luxury Real Estate Investment Platform

World’s First Global Real Estate Exchange Platform Capable of Converting Ultra-Luxury Residential Properties Into Digital Investments

AUSTIN, Texas, Nov. 12, 2020 (GLOBE NEWSWIRE) — Gold Gate today announced the launch of its high-end platform where high-net-worth individuals, professional athletes, family offices, and foreign investors can acquire fractional ownership in ultra-luxury real estate properties throughout the world.

“Our platform offers users more time, wealth, flexibility in where they live, and control over their lives,” states Dalton Skach, CEO and founder of Gold Gate. “Gold Gate is going to change the way that people live, invest, and travel forever. You don’t have to be confined to one property, in one location. Gold Gate offers the opportunity to become a citizen of the world.”

The online platform provides high-net-worth individuals around the world with the opportunity to acquire luxury real estate properties at a fractional level (1 to 12 months), for the purpose of […]

Russia’s gold & foreign currency reserves surge by over $3 BILLION in one week

The holdings rose by $3.6 billion, or 0.62 percent, from October 30 to November 6. The growth was supported by “positive exchange rate revaluation and higher gold prices,” according to the regulator.

The country’s international reserves are highly liquid foreign assets comprising stocks of monetary gold, foreign currencies, and Special Drawing Right (SDR) assets, which are at the disposal of the Central Bank of Russia and the government. The holdings have surpassed the target level of $500 billion set by the regulator in June 2019 and remained above the threshold ever since.

Despite the impact of the coronavirus pandemic on the country’s economy, forcing the government to increase spending to support businesses and households, Russia has continued to boost its gold and foreign currency reserves this year.

The assets have increased by $31.6 billion over the past ten months, though the pace of growth has slowed since 2019. According to the bank’s […]

Central banks will continue to buy gold to diversify their holdings – Invesco survey

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – In the third quarter, for the first time in nearly a decade, central banks became net sellers of gold . However, according to a report from Invesco, central banks are expected to maintain a firm grip on their gold reserves.

The international investment firm conducted a central bank survey between August and September as gold prices pushed to an all-time high above $2,000 an ounce.

According to the results survey, participants expect to see that central bank gold reserves will continue to increase during the next 12 months.

At the same time, the survey noted that the COVID-19 pandemic had not impacted central banks’ views on gold . Around 25% of respondents said they view gold as a more […]

Gold Price Analysis: XAU/USD awaits fresh clues to break the monotony below $1,900

Gold prices trade mixed near the September lows, probed on Monday.

Risk catalysts remain mostly sluggish as virus woes combat vaccine hopes.

Expectations of further monetary easing, absence of a push towards negative rates and rising US treasury yields keep buyers hopeful.

Economic calendar welcomes the return of the US data, challenges to trading sentiment will be the key. Gold prices extend corrective bounce off $1,856 while taking rounds to $1,865 amid the initial Asian session on Thursday. Following a heavy drop on Monday, to September month low, the yellow metal consolidated gains to $1,890, before marking the latest move around $1,856.34. The reason for the mixed trading could be traced from a lack of clear market direction amid mixed signals concerning the coronavirus (COVID-19) and the US election results, not to forget about the global monetary policy moves. Virus, vaccine regains market attention… With […]

Gold prices rise Thursday ahead of inflation report, but sit on sharp weekly loss

The U.S. reported more than 144,000 new cases for Wednesday, up about 4,000 from the day before, according to data compiled by Johns Hopkins University. The total number of confirmed cases nationwide topped 10.4 million.

Still, the precious metal is off 4.6% so far this week, according to FactSet data, after its worst daily drop in seven years was prompted by news from Pfizer PFE, -0.46% and BioNTech BNTX, -2.93% of an effective coronavirus vaccine.

“Gold has not yet managed to recover after the $100 collapse which followed Pfizer’s vaccine announcement as investors moved to riskier assets,” wrote Carlo Alberto De Casa, chief analyst at ActivTrades in a daily note.

“The bullion price is stagnating at $1,870 without being able to achieve significant and stable recoveries,” the commodity strategist wrote. “The main scenario remains risk on, even if it seems likely that some traders will take home some profits over the next […]

Gold price holding steady following weak consumer inflation data

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold prices are holding some gains as consumer inflation pressures were weaker than expected last month

Thursday, the U.S. Labor Department said its U.S. Consumer Price Index was unchanged in October, after a 0.2% rise in September. The data were weaker than consensus forecasts, calling for a rise of 0.1%

The report said that annual inflation data rose 1.2%, missing expectations calling for a 1.3% rise.Stripping out volatile food and energy prices, core inflation also did not rise last month, following September’s rise of 0.2%. Economists were expecting to see a 0.2% rise.For the year, inflation is up 1.6%; economists were expecting to see a 1.7% rise.December gold futures are seeing little reaction to […]

Gold price ignores significant drop in U.S. weekly jobless claims

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold prices are holding firm as the U.S. labor market continues to see significant improvement as fewer American worker applied for weekly unemployment benefits. Although gold is holding firm support, prices remain well below the critical psychologically important level of $1,900 an ounce.

Thursday the U.S. Labor Department said that weekly jobless claims fell by 48,000 to 709,000. The data were better than expected; market consensus called for initial claims to be round 730,000.

The four-week moving average for new claims – often viewed as a more reliable measure of the labor market since it flattens week-to-week volatility – fell to 755,250, down by 33,250 claims from the previous week.Continuing jobless claims, which represent […]

Don’t Believe the Hype When It Comes to Oil and Gold, Commodities Expert Larry Williams Says

Veteran commodities trader Larry Williams offers advice for investing in oil and gold. Commodities traders have been bombarded by a constant flow of market-moving news this year, from the U.S.-China trade deal to the pandemic and the U.S. presidential elections. But veteran trader Larry Williams has some sound advice: don’t get sucked in by the news of the day, and focus on the fundamentals.

The commodities market is “influenced largely by supply and demand,” says Williams, author of several books on trading, including Long-Term Secrets to Short-Term Trading . He’s also the developer of the Williams %R , a momentum indicator, which can determine if a market is overbought or oversold, and he runs the website IReallyTrade.com, which offers stock-trading and investing courses.

Williams says you really “need to study fundamentals in these markets to get a longer-term view of them.” In other words, tune out the noise and you’ll get […]

Gold, sees good gains as risk aversion returns

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – Gold futures prices are solidly up in midday U.S. trading Thursday. Safe-haven demand is featured late this week as the early-week stock market rallies are now becoming suspect amid the spike in Covid-19 cases in the U.S. and Europe. The precious metals are also seeing some support from a weaker U.S. dollar index on this day. December gold futures were last up $19.60 at $1,881.30 and December Comex silver was last up $0.173 at $24.44 an ounce.

Global stock markets were mixed overnight, while U.S. stock indexes are mixed to lower at midday. The U.S. has seen over 240,000 deaths and more than 10.3 million confirmed Covid-19 infections, with new cases soaring to […]

Gold Price Prediction – Prices Edge Higher on Flat CPI

Gold prices edged higher and are consolidating just above support levels. The 10-year US treasury yield reversed course as riskier assets such as stocks moved lower. The dollar moved higher but failed to put downward pressure on gold. US CPI was flat and was the tamest it’s been in 2020. US jobless claims continued to move lower.

Trade gold with FXTM Technical analysis

Gold prices edged higher near support levels which coincides with the September lows at 1,848. Resistance is seen near the 10-day moving average at 1,896 and then the 50-day moving average at 1,908. Short-term momentum is negative as the fast stochastic generated a crossover sell signal. The fast stochastic has stopped accelerating lower and is currently printing a reading of 19, below the oversold trigger level of 20 which could foreshadow a correction. Medium-term momentum has turned negative as the MACD (moving average convergence divergence) index generated […]

Gold Price Futures (GC) Technical Analysis – Consolidating Inside Retracement Zone at $1889.70 to $1842.60

Gold futures are trading higher late in the session on Thursday on concern over the logistics of a potential COVID-19 vaccine roll-out as U.S. case continued to surge, while hopes of more fiscal and monetary stimulus offered support to the precious metal.

Gold was generally supported by a plunge in U.S. Treasury yields that drove the U.S. Dollar lower. The drop in the greenback made dollar-denominated gold a more attractive investment.

Daily December Comex Gold Daily Swing Chart Technical Analysis

The main trend is down according to the daily swing chart. A trade through $1848.00 will signal a resumption of the downtrend. The main trend will change to up on a move through $1966.10.The main range is $1690.10 to $2089.20. The market is in a position to close inside its retracement zone at $1889.70 to $1842.60 for the fourth straight session. This tells us that this zone is controlling the near-term […]

Endeavour Silver Continues to Intersect High-Grade Gold-Silver Mineralization at Guanacevi, Durango, Mexico

VANCOUVER, British Columbia, Nov. 12, 2020 (GLOBE NEWSWIRE) — Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR) announces that exploration drilling continues to intersect high-grade gold-silver mineralization in the Santa Cruz vein on the El Curso property at the Guanacevi mine in Durango, Mexico. Drilling was suspended for four months, April through July, due to the COVID-19 pandemic. A total of 11 holes were drilled since the end of July, 8 of which hit high grades over mineable widths (view longitudinal section here ).

Drilling highlights of the 11 core holes include the following intersections: 2,307 gpt silver and 3. 1 5 grams per tonne ( gpt ) gold over 3.2 met re s (m) true width in hole UCM-29 (2,559 gpt or 74.6 oz per ton (opT) silver equivalents (AgEq) over 10.5 feet (ft) using an 80:1 silver:gold ratio)

1,409 gpt silver and 3.13 gpt gold over 3 .1 m […]

Click here to view original web page at www.globenewswire.com

Dhanteras shopping kicks off; high prices of gold, silver may dent sales

Pre-Diwali Dhanteras sales of gold and silver kicked off on Thursday but overall business is likely to be a muted affair in view of sharp rise in prices and subdued demand due to the COVID-19 induced economic hardship, according to jewellers and industry experts. Although the buying sentiment has improved after the COVID-19 curbs were relaxed, consumers are still wary of investing in precious metal at current high rates, they said.

Jewellers also said they are recycling old jewellery stock to meet the festive and wedding season demand. Besides, a caution still prevails among people while coming out of their homes for shopping amid rising COVID-19 cases in key consuming markets across the country, and consumers in view of the pandemic have made advanced booking through online jewellery platforms, they added.

Dhanteras, considered the most auspicious day in Hindu calendar for buying items, ranging from precious metals like gold and silver […]

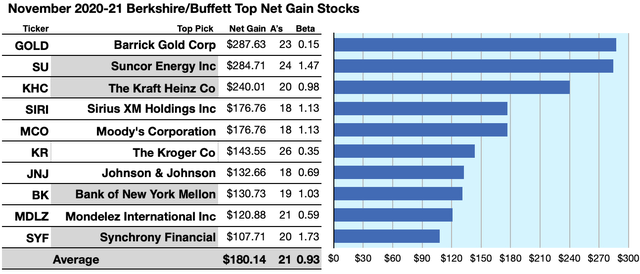

Gold & Energy Top Warren Buffett’s Hoard In November

Summary

This Buffett holdings list from Kiplinger first appeared 8/17/20 on line. YCharts and Dogs of The Dow also tracks this Buffett/Berkshire Batch. Here is your update as of 11/10/20.

28 of 44 Berkshire-Hathaway-owned-stocks pay dividends. As of 11/10/20 the top-ten ranged 2.97%-5.25% by annual yield and ranged 21.07%-118.69% per broker-estimated price-target-upsides.

Top ten of 28 Buffett-held dividend stocks ranged 10.77% to 28.76% in net gains calculated from broker targets, plus dividends, less broker fees.$5k invested in the lowest-priced five top-yield Buffett/Berkshire-held November dividend dogs showed 68.48% more net-gain than from $5k invested in all ten. Little low-priced Buffett-collected dogs dominated his November portfolio. Looking for a portfolio of ideas like this one? Members of The Dividend Dog Catcher get exclusive access to our model portfolio. Get started today » Foreword James Brumley says in Kiplinger Investing :"Rich people often get perpetually richer for a reason, so it could be worthwhile […]