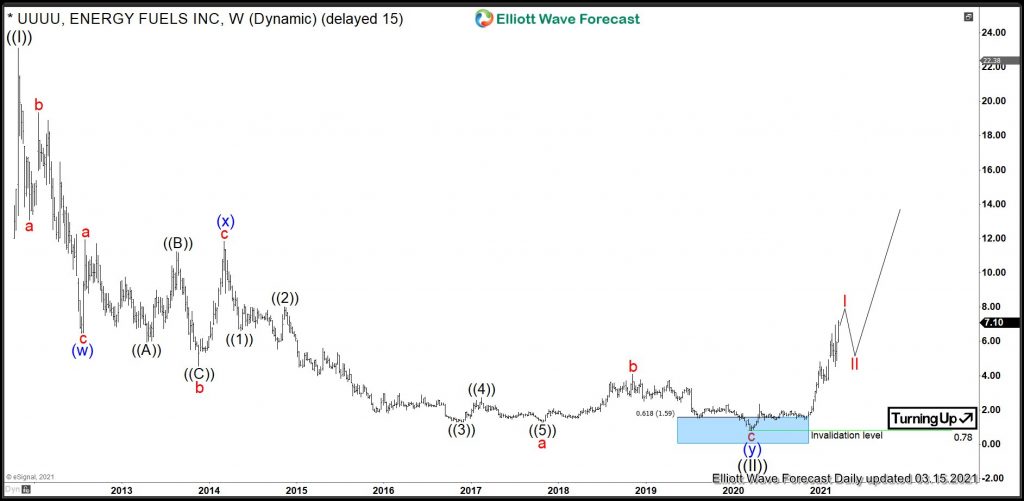

(NYSE: UEC), (the "Company" or "UEC") is pleased to announce the closing of its previously announced offering of an aggregate of 10,000,000 shares of common stock of the Company (each, a "Share") at a purchase price of $3.05 per Share and for gross proceeds of $30,500,000 in a registered direct offering (the "Offering")

The Company offered and sold the Shares pursuant to a Securities Purchase Agreement, dated March 17, 2021, with certain institutional investors.

UEC anticipates that the net proceeds of the Offering will be used for additional uranium purchases and for general corporate and working capital purposes.

Following the closing of this offering the Company has approximately $95 million in cash and equity holdings, which includes $61M in cash.UEC’s physical uranium initiative is fully funded with cash on hand and now includes 1.4 million pounds of U.S. warehoused uranium with 1,000,000 pounds delivered by May 2021 and another 400,000 pounds delivered […]

Click here to view original web page at www.marketscreener.com