ASX uranium shares are in a sea of red on Tuesday. At the time of writing, leading ASX uranium producers and explorers such as Paladin Energy Ltd (ASX: PDN) , Boss Energy Ltd (ASX: BOE) and Deep Yellow Limited (ASX: DYL) are plunging by 13.91%, 8.11% and 7.78% respectively. What’s driving the selloff for ASX uranium shares?

ASX uranium shares are on the slide following reports the US Government is assessing a leak at a Chinese nuclear power plant.

The plant is a joint venture between state-run China General Nuclear Power Group, which owns 70%, and French power giant Electricite de France (EDF) which owns the remaining 30%.

According to the Wall Street Journal , EDF requested an extraordinary board meeting with Chinese managers to gather more information about the buildup of gases inside one of the plant’s reactors. The French company warned of an “imminent radiological threat”.The BBC reported […]

Why Uranium Energy, Cameco Corporation, and NexGen Energy Stocks All Crashed Today

What happened

Shares of uranium miners Energy Fuels (NYSEMKT: UUUU) , Cameco (NYSE: CCJ) , and NexGen Energy (NYSEMKT: NXE) stocks all dropped in afternoon trading Monday, falling 7.5%, 8.7%, and 9.2%, respectively, through 12:30 p.m. EDT.

That’s curious, considering how the price of uranium has been behaving lately. Image source: Getty Images. So what

Since its most recent bottom in late April, the spot price on uranium has run up 12.5% to $30.26 per pound today — and you’d think that investors in miners Energy Fuels, Cameco, and NexGen would take that as good news, but here’s the thing: Today’s uranium price is roughly equal to what the atomic power raw material cost 11 months ago, in July 2020. It’s not so much a spike in price we’re seeing, therefore, as a climb back toward normal.It also may not be enough to turn these companies profitable . Now what […]

Appia Announces Start of Summer Exploration Program on Rare Earth Elements and Uranium Projects

Article content

Toronto, Ontario–(Newsfile Corp. – June 14, 2021) – Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the “Company” or “Appia”) is pleased to provide details regarding the Company’s planned aggressive exploration activities on the high-grade critical rare earth elements* (“ REE “) Alces Lake project, and the North Wollaston and Loranger uranium projects, Athabasca Basin area, northern Saskatchewan.

ALCES LAKE HIGH-GRADE REE PROJECT

With a planned comprehensive aerial survey and core drilling program to establish the project’s resource potential, the exploration team has been deployed to the project area. Planned activities have commenced and include the following:– 6,000+ metres of helicopter-supported diamond drilling with two diamond drill rigs focused on discovering new high-grade zones and delineating the extent of known high-grade REE mineralization; Article content – flying a high-resolution airphoto survey as well as a digital elevation model over the entire property […]

Recent Change of -7.19% in the Uranium Energy Corp. (UEC) market price might lead to pleasant surprises

Uranium Energy Corp. (UEC) is priced at $2.97 after the most recent trading session. At the very opening of the session, the stock price was $3.19 and reached a high price of $3.31, prior to closing the session it reached the value of $3.20. The stock touched a low price of $3.18.

Recently in News on June 9, 2021, Uranium Energy Corp Files Fiscal 2021 Q3 Quarterly Report. NYSE American: UEC. You can read further details here

Investing in stocks under $10 could significantly increase the returns on your portfolio, especially if you pick the right stocks! Within this report you will find 5 top stocks that offer investors huge upside potential and the best bang for their buck.

Add them to your watchlist before they take off! Get the Top 5 Stocks Now! SponsoredUranium Energy Corp. had a pretty favorable run when it comes to the market performance. The […]

Why Did Uranium Energy Corp. (AMEX: UEC) Drop So Much?

Uranium Energy Corp. (AMEX:UEC) traded at $2.97 at last check on Monday, June 14, made a downward move of -7.09% on its previous day’s price.

Looking at the stock we see that its previous close was $3.20 with the day’s price range being $3.18 – $3.31. In terms of its 52-week price range, UEC has a high of $3.67 and a low of $0.82. The company’s stock has gained about 15.52% over that past 30 days.

Uranium Energy Corp. has a market cap of $730.11 million. Estimates by analysts give the company expected earnings per share (EPS) of $0, with the EPS growth for the year raised at -$0.06 for 2021 and $0.01 for next year. These figures represent 25.00% and 116.70% growth in EPS for the two years respectively.

There have been no upward and no downward revisions for the stock’s EPS in last 7 days, something that reflects the nature […]

Uranium Energy Corp. (AMEX:UEC) trade information

Uranium Energy Corp. (AMEX:UEC) has a beta value of 2.45 and has seen 4.44 million shares traded in the last trading session. The company, currently valued at $730.11M, closed the last trade at $3.20 per share which meant it gained $0.07 on the day or 2.24% during that session. The UEC stock price is -14.69% off its 52-week high price of $3.67 and 74.38% above the 52-week low of $0.82. If we look at the company’s 10-day average daily trading volume, we find that it stood at 4.74 million shares traded. The 3-month trading volume is 6.79 million shares.

The consensus among analysts is that Uranium Energy Corp. (UEC) is a Buy stock at the moment, with a recommendation rating of 1.70. 0 analysts rate the stock as a Sell, while 0 rate it as Overweight. 0 out of 4 have rated it as a Hold, with 4 advising it […]

Click here to view original web page at marketingsentinel.com

Appia Energy Announces Start of Summer Exploration Program on Rare Earth Elements and Uranium Projects

ALCES LAKE HIGH-GRADE REE PROJECT

With a planned comprehensive aerial survey and core drilling program to establish the project’s resource potential, the exploration team has been deployed to the project area. Planned activities have commenced and include the following: 6,000+ metres of helicopter-supported diamond drilling with two diamond drill rigs focused on discovering new high-grade zones and delineating the extent of known high-grade REE mineralization;

flying a high-resolution airphoto survey as well as a digital elevation model over the entire property to aid in aerial geophysical survey calibration as well as providing accurate data for future resource evaluations;

a project-wide, high-resolution radiometric and magnetic survey designed with 50 m flight-line spacing and flying within 10 to 20 metres of the surface to commence June 15, 2021; a 2,500 by 2,500 metre ground magnetic and VLF-EM survey designed to identify structures and geological trends associated with mineralization; local and regional […]

Click here to view original web page at www.juniorminingnetwork.com

Biden’s clean energy plan fuelling great expectations for uranium price

HAVE YOU READ OUR LATEST PRINT EDITION? Uranium stands as the coiled spring of the commodities space. At some point, the price of the nuclear fuel is going to take off. That’s the broad expectation out there. Ask around about the commodity to watch in the next 12 months and the answer increasingly comes back as uranium.

AUTHOR: Barry FitzGerald ( Resources: Rising Stars )

Maybe so, but the reality is that at $US32/lb (spot), the uranium price remains well below the $US60/lb price considered necessary to incentivise the investment in new supply required to fill the ever-widening gap between supply and long-term demand.

That’s been the uranium thematic for years. But thanks to Joe Biden, uranium’s coiled spring status is now drawing in more devotees by the day. And that’s because tucked away in his $US6 trillion budget request, there was a strong confirmation that nuclear power is […]

Click here to view original web page at www.miningreview.com

Uranium Market 2021 Strategic Analysis, Growth Drivers, Industry Trends, Demand and Future Opportunities till 2026 |Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, etc

“ Global Uranium Market is growing at a High CAGR during the forecast period 2021-2026. The increasing interest of the individuals in this industry is that the major reason for the expansion of this market and This has brought along several changes in This report also covers the impact of COVID-19 on the global market. Overview Of Uranium Industry 2021-2026:

The latest research report, titled “ Uranium Market ” Added by Market Info Reports , provides the reader with a comprehensive overview of the Uranium Industry and familiarizes them with the latest market trends, industry information, and market share. The report content includes technology, industry drivers, geographic trends, market statistics, market forecasts, producers, and raw material/equipment suppliers. Global Uranium market size was xx million US$ and it is expected to reach xx million US$ by the end of 2026, with a CAGR of XX between 2021 and 2026. […]

International Consolidated Uranium Provides Update on Laguna Salada Option Agreement

VANCOUVER, British Columbia, June 11, 2021 (GLOBE NEWSWIRE) — International Consolidated Uranium Inc. (“ CUR ” or the “ Company ”) (TSXV: CUR) is pleased to provide the following updates on the option agreement (the “ Option Agreement ”) with U3O8 Corp. (“ U308 ”) (TSXV: UWE.H) that was previously announced on December 14, 2020, providing CUR with the option to acquire a 100% undivided interest in the Laguna Salada project (“ Laguna Salada ” or the “ Property ”) located in Chubut Province, Argentina.

Following receipt of conditional approval of the TSXV Venture Exchange (“ TSXV ”), the Option Agreement has become effective as of June 11, 2021. As a result of the Option Agreement having been made effective, CUR will deliver consideration to U308 comprised of (i) $125,000 to be satisfied by the issuance of 56,306 common shares in the capital of the Company (the “ Common Shares […]

Click here to view original web page at www.digitaljournal.com

Peter Brown: The hot stocks and metal for the climate change fight

Peter Brown: The hot stocks and metal for the climate change fight

File picture of the Ranger Uranium Mine in Australia’s Northern Territory. Stockmarkets are focusing on the huge imbalances between supply and demand as the global economy roars back from the Covid crisis, hence the price of shipping containers has trebled, many raw materials are in short supply, and inflation is now dominating market thinking.

Inflation is bad for stock prices, if it leads to a rise in interest rates.

If rates were to rise, company earnings would be less attractive and therefore lead to lower valuations, and any correction to valuations could be severe.The authorities in the US say recent price rises are transitory, a message the market has bought into. For the past decade passive investing has been extraordinarily successful.Just buying the index has made substantial returns.However, given the over-extended valuations of the US stocks, where may […]

Click here to view original web page at www.irishexaminer.com

Mega Uranium Announces Further Investments in Toro Energy Ltd. and International Consolidated Uranium Inc.

TORONTO, June 04, 2021 (GLOBE NEWSWIRE) — Mega Uranium Ltd. (MGA: TSX) is pleased to announce that it has participated in the recently closed equity financings of Toro Energy Limited (ASX: TOE; “Toro Energy”) and International Consolidated Uranium Inc. (TSXV: CUR; “Consolidated Uranium”), two publicly-listed issuers engaged in uranium exploration and development activities.

Mega’s AUD$1.5M investment in Toro Energy formed part of Toro Energy’s AUD$15M aggregate equity financing, that, together with and subject to completion of its proposed AUD$6.7M debt conversion transaction (which requires shareholder approval), would position Toro Energy as debt-free and well-funded for its ongoing development and exploration programs. Mega has been a long-time shareholder and supporter of Toro Energy dating back to 2013 and now holds a 12.76% equity interest in the company.

Mega also invested an additional CAD$482,000 in Consolidated Uranium’s recently completed CAD$9M equity financing. The financing brought Consolidated Uranium’s balance sheet to approximately CAD$23M in […]

Click here to view original web page at www.juniorminingnetwork.com

Biden’s clean energy plan fuelling great expectations for uranium price

Boss Energy set to feed investor appetite for near-term uranium producers with release of pivotal feasibility study. Plus, the runaway share prices of Coda and Sovereign show we were on the mark with our mentions months ago. And Black Canyon prepares to drill after more promising results from its Pilbara manganese prospects.

Uranium stands as the coiled spring of the commodities space. At some point, the price of the nuclear fuel is going to take off.

That’s the broad expectation out there. Ask around about the commodity to watch in the next 12 months and the answer increasingly comes back as uranium.

Maybe so, but the reality is that at $US32/lb (spot), the uranium price remains well below the $US60/lb price considered necessary to incentivise the investment in new supply required to fill the ever-widening gap between supply and long-term demand.That’s been the uranium thematic for years. But thanks to Joe […]

Click here to view original web page at www.livewiremarkets.com

U3O8 Corp. Sells the Laguna Salada Project to Focus on the Berlin Uranium and Battery Commodities Deposit

Article content

Toronto, Ontario–(Newsfile Corp. – June 11, 2021) – U3O8 Corp. ( TSXV: UWE.H ) (“ U3O8 ” or the “ Company “) announces that International Consolidated Uranium Inc. (“CUR”) has chosen to exercise its option to purchase the Laguna Salada Project in Argentina from U3O8 Corp. The terms of the option agreement (“ Option Agreement “) were outlined in U3O8 Corp.’s press release dated December 14, 2020.

The cash component of the purchase will be used to advance U3O8 Corp.’s Berlin Deposit that contains uranium, a suite of battery commodities and rare earth elements. The component of the purchase price to be paid in CUR shares will be held in U3O8 Corp.’s treasury to provide its shareholders with exposure to a broadening portfolio of uranium deposits that CUR has acquired in Australia and Canada.

Consideration for the Laguna Salada Project A summary of the status and related terms […]

International Consolidated Uranium Provides Update on Laguna Salada Option Agreement

VANCOUVER, British Columbia, June 11, 2021 (GLOBE NEWSWIRE) — International Consolidated Uranium Inc. (“ CUR ” or the “ Company ”) (TSXV: CUR) is pleased to provide the following updates on the option agreement (the “ Option Agreement ”) with U3O8 Corp. (“ U308 ”) (TSXV: UWE.H) that was previously announced on December 14, 2020, providing CUR with the option to acquire a 100% undivided interest in the Laguna Salada project (“ Laguna Salada ” or the “ Property ”) located in Chubut Province, Argentina.

Following receipt of conditional approval of the TSXV Venture Exchange (“ TSXV ”), the Option Agreement has become effective as of June 11, 2021. As a result of the Option Agreement having been made effective, CUR will deliver consideration to U308 comprised of (i) $125,000 to be satisfied by the issuance of 56,306 common shares in the capital of the Company (the “ Common Shares […]

Click here to view original web page at www.digitaljournal.com

Hedge Fund Behind Amazon-MGM Deal Amasses Big Bet on Uranium

Venturing into the uranium market, which is much smaller than oil or gold markets, is unusual for a firm that typically invests in corporate debt. It is another example of money managers straying into esoteric markets in search of returns after a yearslong run-up in stocks and slide in a bond yields.

Anchorage was recently in the spotlight after scoring about $2 billion in paper profits from Amazon’s deal to buy MGM in May. The hedge fund became MGM’s biggest shareholder after the Hollywood studio emerged from bankruptcy in 2010.

Anchorage’s physical uranium holdings are also a rarity because Wall Street firms don’t typically own physical uranium. Most investors bet on uranium prices by buying shares of mining firms , or through companies like Yellow Cake PLC., which acts as an exchange-traded fund.

In the 2000s, investors piled into uranium trades, helping to power a run-up in prices that peaked in […]

Australian uranium hopefuls bolstered by global uranium production predictions

Experts are predicting uranium production to increase by more than 3% in 2021, despite the closure of the Ranger mine in Northern Territory in January. Global production is expected to grow at a compound annual growth rate of 6.2% over the 2021-2025 period. Global uranium production is tipped to increase by 3.1% in 2021, bolstering the hopes of a handful of Australian uranium hopefuls.

Experts at data analyst consultancy GlobalData have predicted 51,200 tonnes of uranium will be produced this year, largely thanks to the return of production at Cigar Lake in Canada and increased output growth from leading uranium producers Kazakhstan and Russia.

The production increase comes despite a predicted 21.2% drop in Australian uranium production due to the renowned Ranger mine in the Northern Territory closing down after 40 years of service. Market on road to recovery

Associate project manager at Global Data Vinneth Bajaj said uranium would begin […]

Click here to view original web page at www.proactiveinvestors.co.uk

International Consolidated Uranium Engages Mars Investor Relations

VANCOUVER, British Columbia, June 10, 2021 (GLOBE NEWSWIRE) — International Consolidated Uranium Inc. (“ CUR ” or the “ Company ”) (TSXV: CUR) is pleased to announce that it has engaged Mars Investors Relations Inc. (“ Mars ”), a full services investor relations and consulting services company focused on the junior metals and mining sector. Mars will provide a full suite of investor relations services to the Company including strategic messaging, investor targeting and outreach as well as corporate communications services including digital marketing, social media and branding.

Philip Williams, President and CEO commented “As we grow CUR, the investor relations and corporate communications function has become a key area we intend to focus on as it relates to communicating with existing shareholders and engaging with potential new investors. We are excited to work with the dynamic team at Mars who has deep expertise in the metals and mining sector […]

Click here to view original web page at www.wallstreet-online.de

Baselode Starts Groundwork Exploration on the Catharsis Uranium Project

Baselode Energy Corp. is pleased to announce that a field crew has started groundwork exploration on the Catharsis high-grade uranium exploration project . The Company received its exploration permits from Saskatchewan’s Ministry of Environment and remains engaged in good faith discussions with local Indigenous communities and northern stakeholders. “This is an exciting time for the Company kicking-off our first …

Baselode Energy Corp. ( TSXV: FIND ) (OTCQB: BSENF) (” Baselode ” or the ” Company “) is pleased to announce that a field crew has started groundwork exploration on the Catharsis high-grade uranium exploration project (” Catharsis ” or the ” Project “). The Company received its exploration permits from Saskatchewan’s Ministry of Environment (see News Release dated May 25, 2021 ) and remains engaged in good faith discussions with local Indigenous communities and northern stakeholders.

“This is an exciting time for the Company kicking-off our first ground-based exploration […]

Baselode Energy Starts Groundwork Exploration on the Catharsis Uranium Project

Ministry of Environment (see News Release dated May 25, 2021) and remains engaged in good faith discussions with local Indigenous communities and northern stakeholders.

"This is an exciting time for the Company kicking-off our first ground-based exploration program. The groundwork exploration is critical to advance the Project in preparation for our planned diamond drill campaign. We’re also very happy to report that the majority of our logistical support and economic benefits have been sourced to Indigenous and northern Saskatchewan businesses. We’ve been proactively engaged towards mutually-beneficial working relationships with the local Indigenous communities and stakeholders for the past few months, communicating our manner of planning and operations with respect to the possible impacts on their traditional Rights, lands, and resources, while also identifying areas for economic benefits," said James Sykes, CEO and President of Baselode.

"We’re excited to have this opportunity to explore Catharsis for the first time […]

Click here to view original web page at www.juniorminingnetwork.com

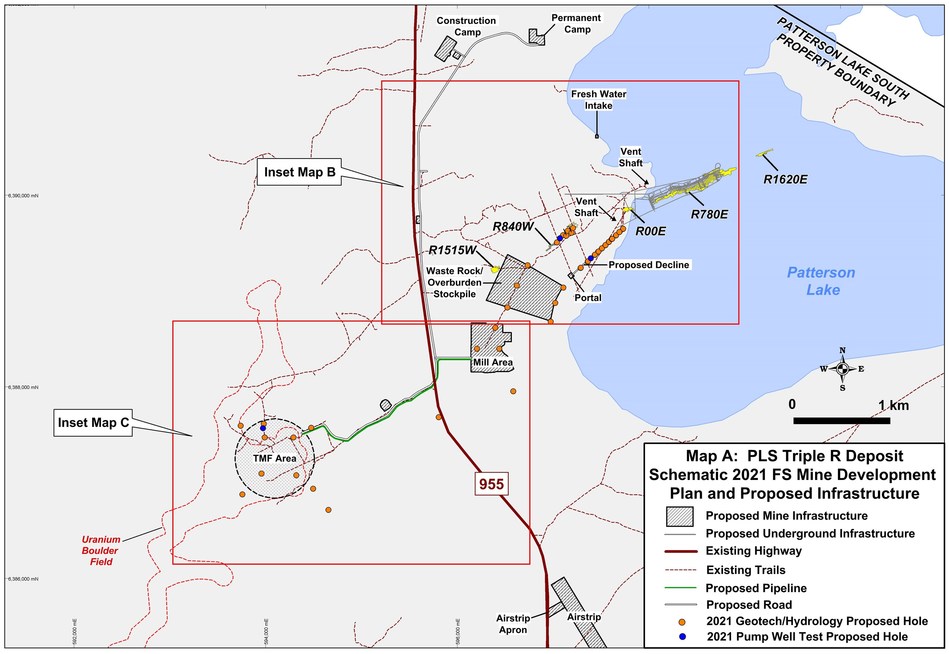

Fission Commences Feasibility Study for PLS Uranium Project in Saskatchewan, Canada

SYMBOL: FCU

OTCQX SYMBOL: FCUUF

FRANKFURT SYMBOL: 2FUFeasibility Report to be Supported by Resource Growth Drilling at High-Grade, Near Surface Deposit at PLS

KELOWNA, BC, June 10, 2021 /CNW/ – FISSION URANIUM CORP. (" Fission " or " the Company ") is pleased to announce that it will commence its Feasibility Study ("FS" or the "Study") for its’ 100% owned PLS high-grade uranium project, in the Athabasca Basin region of Saskatchewan, Canada. The feasibility work will kick-off with Phase 1, comprised of extensive data collection using drilling and other fieldwork. The FS follows the results of the Company’s Pre-Feasibility Study detailing an underground-only mining scenario, which has outlined the potential for PLS to be one of the lowest operating cost uranium mines in the world. Phase 1 will commence during June 2021 with completion expected by Q2, 2022. Concurrent with Phase 1 field work, a 25-hole […]

Power Up: Uranium is picking up speed

Uranium is picking up the pace as optimism rises. Pic: Getty Images share

Uranium optimism is growing with governments around the world including nuclear energy in their plans to slash carbon emissions and the US saying outright that achieving its climate goals would not be possible without nuclear plants.

Nuclear energy currently accounts for 20 per cent of US electrical generation so it is no surprise that it is currently evaluating the potential to extend the operating life of its existing plants to 100 years.

China has flagged that it will have 70 gigawatts of installed nuclear power capacity by 2025, up from the current 55GW, with further growth likely.Uranium spot prices have edged upwards in regard to the increased optimism.With the expected demand growth, GlobalData has forecast that uranium production could increase by 3.1 per cent to reach 51,200t this year as significant mines come back online.The market intelligence firm […]

URANIUM ENERGY : Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q)

The following management’s discussion and analysis of the Company’s financial condition and results of operations (the "MD&A") contain forward-looking statements that involve risks, uncertainties and assumptions including, among others, statements regarding our capital needs, business plans and expectations. In evaluating these statements you should consider various factors, including the risks, uncertainties and assumptions set forth in reports and other documents we have filed with or furnished to the SEC and, including, without limitation, this Form 10-Q Quarterly Report for the nine months ended April 30, 2021, and our Form 10-K Annual Report for the fiscal year ended July 31, 2020, including the consolidated financial statements and related notes contained therein. These factors, or any one of them, may cause our actual results or actions in the future to differ materially from any forward-looking statement made in this Quarterly Report. Refer to "Cautionary Note Regarding Forward-looking Statements" as disclosed in […]

Click here to view original web page at www.marketscreener.com

Australian uranium hopefuls bolstered by global uranium production predictions

Experts are predicting uranium production to increase by more than 3% in 2021, despite the closure of the Ranger mine in Northern Territory in January. Global production is expected to grow at a compound annual growth rate of 6.2% over the 2021-2025 period. Global uranium production is tipped to increase by 3.1% in 2021, bolstering the hopes of a handful of Australian uranium hopefuls.

Experts at data analyst consultancy GlobalData have predicted 51,200 tonnes of uranium will be produced this year, largely thanks to the return of production at Cigar Lake in Canada and increased output growth from leading uranium producers Kazakhstan and Russia.

The production increase comes despite a predicted 21.2% drop in Australian uranium production due to the renowned Ranger mine in the Northern Territory closing down after 40 years of service. Market on road to recovery

Associate project manager at Global Data Vinneth Bajaj said uranium would begin […]

Click here to view original web page at www.proactiveinvestors.com.au

Why Denison Mines Stock Rallied 14% in May

What happened

Shares of Denison Mines ( NYSEMKT:DNN ) advanced roughly 14% in May according to data from S&P Global Market Intelligence . That, however, wasn’t out of line with the performance of its peers, which were up about the same amount. But Denison isn’t exactly comparable to most of its uranium mining peers because its biggest asset isn’t an operating mine but a mine development called the Wheeler Project. So what

Uranium prices have been relatively strong since January 2020, and they increased in May. So there was a clear tailwind for uranium companies last month that likely played a big role in Denison’s price increase. However, the sector has been receiving increasing interest of late because nuclear power plants don’t emit carbon, making them a source of clean energy (despite the negative image of nuclear power). Uranium miners have actually been building stockpiles of the fuel as […]