Boss has appointed key personnel to ensure wellfield development and construction activities can start as soon as a final investment decision is made. Aspiring producer Boss Energy (ASX: BOE) has confirmed it will expand preliminary project execution strategies for the re-start of its Honeymoon uranium venture in South Australia.

On the back of an enhanced feasibility study released last month , the company will advance planned activities in production schedule optimisation, equipment selection and contract and procurement negotiation.

Preferred vendors are completing equipment design for long lead items, as priority work steams ahead of a final investment decision. New appointments

Boss’ process plant management team has been strengthened in recent weeks to focus on key packages along the four critical paths of engineering and procurement, water treatment plant design, wellfield planning and development, and concrete and structural steel works.New appointees Ben Jeuken (general manager wellfield and resources) and Jason Cherry (geology […]

Why standing apart stands out

Value investing and contrarian investing are intrinsically related. Value investing seeks to identify good quality companies that are trading cheaply. To achieve that goal, contrarian investors tend to look in places that others have not. In doing so, they hope to uncover opportunities that are cheap relative to their intrinsic worth.

Both sets of investors must first establish what they believe a business is worth before betting against the market. There are few things as rewarding for either a value investor or a contrarian investor (many of which are one and the same person) than identifying a dislocation and mispricing in the market, supported by a consensus view, and investing with success despite the wider community’s concerns. It is worth noting that there is a subset of contrarian investors who do not undertake fundamental analysis of a business before they buy. This investor is keen to speculate (often successfully) that […]

Click here to view original web page at www.livewiremarkets.com

Energy Fuels Announces Strategic Alliance with RadTran, LLC for the Recovery of Isotopes Needed for Emerging Cancer Therapeutics

Alliance has the potential to develop commercial technologies and sources of isotopes needed for a new domestic medical supply chain

LAKEWOOD, Colo., July 29, 2021 /PRNewswire/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) ( "Energy Fuels" or the "Company" ) is pleased to announce the execution of a Strategic Alliance Agreement ( "Alliance" ) with RadTran, LLC ( "RadTran" ) to evaluate the recovery of thorium, and potentially radium, from the Company’s existing rare earth carbonate (" RE Carbonate ") and uranium process streams for use in the production of medical isotopes for emerging targeted alpha therapy (" TAT ") cancer therapeutics. This initiative will complement the Company’s existing uranium and RE Carbonate businesses, as it will investigate the recovery of isotopes in existing process streams at Energy Fuels’ White Mesa Mill in Utah (the "Mill" ) for medical purposes. RadTran is a Denver, Colorado-based technology development […]

Top Stories This Week: Gold Reacts to Fed, Rick Rule’s Uranium Stock Advice

All eyes were on the US Federal Open Market Committee this week, which shed some light on policy after its two day meeting, held from Tuesday (July 27) to Wednesday (July 28). “Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses. The path of the economy continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain” — US Federal Reserve Gold Outlook 2021! Are You Investing In Gold Yet?

What Happened To Gold In Q1? Which Gold Stocks To Watch In 2021?

Exclusive Information You Need To Make An Informed Decision.

The Fed indicated that it will leave interest rates unchanged, and will also continue its bond-buying program, although the […]

Overview

This Elevate Uranium profile is part of a paid investor education campaign. *

As decarbonization and electrification continue to develop around the world, carbon-free nuclear power is required to achieve both changes. Why is this the case? It’s simple—nuclear power produces zero carbon emissions, prevents air pollution, spans a smaller land footprint and produces minimal waste. Nuclear power is central to the clean energy movement. As a result, the uranium market presents an exciting opportunity for investors seeking to capitalize on the clean energy movement.

Elevate Uranium Limited (ASX:EL8) is an Australian mineral exploration and development company specializing in identifying, exploring and acquiring highly prospective uranium projects in Australia and Namibia. The company is the largest tenement holder for uranium in Namibia, which is the fourth-highest uranium-producing country in the world as of 2019. The company is backed by a management team with over 60 years of experience in the […]

Uranium Energy Corp. (UEC): Analysts Provide Important Insight

Uranium Energy Corp. (AMEX:UEC) at last check was buoying at $2.26 on Friday, July 30 with a fall of -4.85% from its closing price on previous day.

Taking a look at stock we notice that its last check on previous day was $2.37 and 5Y monthly beta was reading 2.44 with its price kept floating in the range of $2.27 and $2.43 on the day. Considering stock’s 52-week price range provides that UEC hit a high price of $3.67 and saw its price falling to a low level of $0.82 during that period. Over a period of past 1-month, stock came subtracting -5.58% in its value.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap […]

azValor Asset Management Buys Sprott Physical Uranium Trust, Acerinox SA, Melia Hotels International SA, Sells Euskaltel SA, Cementos Molins SA, Zegona Communications PLC

Investment company azValor Asset Management ( Current Portfolio ) buys Sprott Physical Uranium Trust, Acerinox SA, Melia Hotels International SA, Zardoya Otis SA, Altri SGPS SA, sells Euskaltel SA, Cementos Molins SA, Zegona Communications PLC, Codere SA, Applus Services SA during the 3-months ended 2021Q2, according to the most recent filings of the investment company, azValor Asset Management. As of 2021Q2, azValor Asset Management owns 23 stocks with a total value of $46 million. These are the details of the buys and sells.

For the details of azValor Iberia FI’s stock buys and sells, go to https://www.gurufocus.com/guru/azvalor+iberia+fi/current-portfolio/portfolio

These are the top 5 holdings of azValor Iberia FI

> Tubacex SA ( TUB ) – 3,393,674 shares, 11.04% of the total portfolio. Shares reduced by 0.01% Tecnicas Reunidas SA ( TRE ) – 388,097 shares, 9.07% of the total portfolio. Shares reduced by 0.01% Galp Energia SGPS SA ( GALP […]

Energy Fuels Announces Strategic Alliance with RadTran, LLC for the Recovery of Isotopes Needed for Emerging Cancer Therapeutics

Energy Fuels Logo (CNW Group/Energy Fuels Inc.) Alliance has the potential to develop commercial technologies and sources of isotopes needed for a new domestic medical supply chain

LAKEWOOD, Colo., July 29, 2021 /CNW/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) ( "Energy Fuels" or the "Company" ) is pleased to announce the execution of a Strategic Alliance Agreement ( "Alliance" ) with RadTran, LLC ( "RadTran" ) to evaluate the recovery of thorium, and potentially radium, from the Company’s existing rare earth carbonate (" RE Carbonate ") and uranium process streams for use in the production of medical isotopes for emerging targeted alpha therapy (" TAT ") cancer therapeutics. This initiative will complement the Company’s existing uranium and RE Carbonate businesses, as it will investigate the recovery of isotopes in existing process streams at Energy Fuels’ White Mesa Mill in Utah (the "Mill" ) for medical purposes. […]

Energy Fuels (UUUU) falls 0.18% in Light Trading on July 29

Energy Fuels Inc (NYSE: UUUU) shares fell 0.18%, or $0.01 per share, to close Thursday at $5.45. After opening the day at $5.58, shares of Energy Fuels fluctuated between $5.60 and $5.32. 1,885,620 shares traded hands a decrease from their 30 day average of 2,706,953. Thursday’s activity brought Energy Fuels’s market cap to $732,109,144.

Energy Fuels is headquartered in Lakewood, Colorado.. About Energy Fuels Inc

Energy Fuels is a leading U.S.-based uranium mining company, supplying U3O8 to major nuclear utilities. Energy Fuels also produces vanadium from certain of its projects, as market conditions warrant, and expects to commence commercial production of REE carbonate in 2021. Its corporate offices are in Lakewood, Colorado, near Denver, and all of its assets and employees are in the United States. Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch in-situ recovery (‘ISR’) Project in […]

Boss Energy on-track to become Australia’s next uranium miner

Boss Energy managing director Duncan Craib said the June quarter had been a “transformational” period for the company. Boss Energy (ASX: BOE) is on track with its strategy of becoming Australia’s next uranium miner from its Honeymoon project in South Australia, with an enhanced feasibility study recently returning financially robust results.

Boss managing director Duncan Craib said the June quarter had been “transformational” for the company.

During the period, Boss unveiled its much-anticipated enhanced feasibility study for restarting Honeymoon.

The company says the study shows the proposed uranium operation will be financially and technically robust.Under the enhanced study, Honeymoon’s pre-tax net present value rose 35% on last year’s study to U$309 million.Nameplate production capacity was increase by 22.5% to 2.45 million pounds of uranium per annum based on the Honeymoon restart area resource of 36Mlb. Outside of this area is a further 35.6Mlb of JORC resources which could underpin production beyond the […]

VIDEO — Rick Rule: Gold Malaise Not a Bad Thing, Key Uranium Catalyst

The gold price remains well off last summer’s all-time high, but for veteran investor and speculator Rick Rule, the current malaise in the space is an opportunity, not a cause for dismay.

He previously thought gold and gold equities had gotten ahead of themselves, and he views the current levels as a sale — but not necessarily a sale that will last for very long.

“I think now that a recovery in the gold price occurs sooner rather than later,” he told the Investing News Network (INN). “I’m always fond of saying that I like things that are inevitable, but might not be imminent — I’m beginning to think that an upward move in the gold price is imminent too as a consequence of the expansion of the negative margin on the US 10 year Treasury.” Gold Outlook 2021! Are You Investing In Gold Yet?

What Happened To Gold In […]

Deep Yellow adds quality and grade at Namibian uranium project

Drilling at Deep Yellow’s Tamas 3 uranium prospect in Namibia has been incorporated into the new mineral resource upgrade. Deep Yellow has exceeded expectations at its Tumas 3 uranium project in Namibia converting an impressive 117 percent of the existing inferred mineral resource to the more reliable indicated mineral resource status on the back of recent drilling that also identified an additional 5.7 million pounds of indicated resources from peripheral zones. Overall grade also jumped from 299ppm to 320 ppm eU3O8.

Deep Yellow recently announced it has set the wheels in motion on a definitive feasibility study, or “DFS” on its Tumas project after delivering a solid set of pre-feasibility figures earlier this year. Infill drilling of the known prospects has been a big component of the DFS. Since February, the company has put down a total of 911 holes for 17,679m covering the Tumas 3 prospect.

Drilling also turned up […]

Hedge Fund and Insider Trading News: Tiger Global Management, Archegos Capital, Blue Foundry Bancorp (BLFY), Uranium Energy Corp. (UEC), and More

‘You Chose War’: Hedge-Fund Rift Emerges From Cum-Ex Probe (Bloomberg)

A London hedge fund dispute exposed a bitter rift between two former business partners who were targeted for their alleged roles in the sprawling Cum-Ex tax scandal a year ago. Duet Group’s CEO Henry Gabay was ordered by a judge in London to pay Alain Schibl $2.5 million to cover debt outstanding from an arbitration settlement this week. The pair, who founded the London-based hedge fund together in 2002, traded insults and allegations of improper conduct at the hearing that pushed their spat into the public domain.Blue Owl Collects $2bn for Debt-and-Equity Opportunistic Fund (Opalesque)

The alternative asset manager Blue Owl Capital Inc. has raised $2 billion for an opportunistic fund targeting both equity and debt investments. The fund, Owl Rock Opportunistic Fund, will have $2.5 billion in investable capital, including anticipated leverage, and will target investments including […]

Click here to view original web page at www.insidermonkey.com

Energy Fuels Announces Strategic Alliance with RadTran, LLC for the Recovery of Isotopes Needed for Emerging Cancer Therapeutics

Energy Fuels Logo (CNW Group/Energy Fuels Inc.) Alliance has the potential to develop commercial technologies and sources of isotopes needed for a new domestic medical supply chain

LAKEWOOD, Colo., July 29, 2021 /CNW/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) ( "Energy Fuels" or the "Company" ) is pleased to announce the execution of a Strategic Alliance Agreement ( "Alliance" ) with RadTran, LLC ( "RadTran" ) to evaluate the recovery of thorium, and potentially radium, from the Company’s existing rare earth carbonate (" RE Carbonate ") and uranium process streams for use in the production of medical isotopes for emerging targeted alpha therapy (" TAT ") cancer therapeutics. This initiative will complement the Company’s existing uranium and RE Carbonate businesses, as it will investigate the recovery of isotopes in existing process streams at Energy Fuels’ White Mesa Mill in Utah (the "Mill" ) for medical purposes. […]

Growth Drivers of Uranium Hexafluoride Market 2020-2026 based on Key Players (Arkema , Asahi Glass , Saint-Gobain , Gujarat Fluorochemicals,,, etc.), Types and Applications | Affluence

The report on Uranium Hexafluoride Market added by Affluence provides a complete briefing on strategic recommendations, trends, segmentation, use case analysis, competitive intelligence, global and regional forecast to 2026. The objective of this research is to provide a 360 holistic view of the Uranium Hexafluoride market and bringing insights that can help stakeholders identify the opportunities as well as challenges. The report provides the market size in terms of value and volume of the Global Uranium Hexafluoride Market.

The analyst studied various companies like Arkema , Asahi Glass , Saint-Gobain , Gujarat Fluorochemicals,, , etc. to understand the products and/services relevant to the Uranium Hexafluoride market . The report includes information such as gross revenue, production and consumption, average product price, and market shares of key players. Other factors such as competitive analysis and trends, mergers & acquisitions, and expansion strategies have been included in the report. This will enable […]

Click here to view original web page at domestic-violence.org.uk

Uranium demand rising while supply remains uncertain: Cameco

Demand for uranium is growing at the same time supply is becoming less certain, said Cameco President and CEO Tim Gitzel July 28.

Receive daily email alerts, subscriber notes & personalize your experience.

Register Now

"Since 2011, about 1.6 billion pounds of uranium have been consumed in reactors, and only about half of that or 800 million pounds have been placed under long-term [utility] contracts," Gitzel said in a second-quarter earnings call."This has led to a growing wedge of uncovered uranium requirements," he said."We’re also seeing increased demand for uranium from financial funds and junior uranium companies," Gitzel said."Through the end of June this year, more than US$550 million has flowed into the uranium market via junior uranium companies and financial funds. This money has been used to purchase approximately 16 million pounds of uranium with more expected."At the same time, however, "uranium supply is becoming less certain due to […]

Uranium Energy Corp. [UEC] Stock trading around $2.33 per share: What’s Next?

Uranium Energy Corp. [AMEX: UEC] stock went on an upward path that rose over 6.88% on Wednesday, amounting to a one-week price increase of more than 2.19%. The company report on June 25, 2021 that Uranium Energy Corp. (NYSE American: UEC) Creating Interest, Building Portfolio.

NetworkNewsAudio – Uranium Energy Corp. (NYSE American: UEC) announces the availability of a broadcast titled, “Time to Capitalize on the Net Zero Emission Initiative.”.

To hear the AudioPressRelease, please visit: The NetworkNewsAudio News Podcast.

Over the last 12 months, UEC stock rose by 126.21%. The average equity rating for UEC stock is currently 1.70, trading closer to a bullish pattern in the stock market.The market cap for the stock reached $545.90 million, with 233.25 million shares outstanding and 228.54 million shares in the current float. Compared to the average trading volume of 5.37M shares, UEC stock reached a trading volume of 4838445 in the most recent trading […]

Uranium Energy Corp. (UEC) can’t be written off after posting last 3-months Average volume of 5.37M

Uranium Energy Corp. (UEC) is priced at $2.27 after the most recent trading session. At the very opening of the session, the stock price was $2.31 and reached a high price of $2.32, prior to closing the session it reached the value of $2.18. The stock touched a low price of $2.13.Recently in News on June 25, 2021, Uranium Energy Corp. (NYSE American: UEC) Creating Interest, Building Portfolio. NetworkNewsAudio – Uranium Energy Corp. (NYSE American: UEC) announces the availability of a broadcast titled, “Time to Capitalize on the Net Zero Emission Initiative.”. You can read further details here

Uranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $3.67 on 03/16/21, with the lowest value was $1.51 for the same time period, recorded on 01/21/21.

3 Tiny Stocks Primed to Explode The world’s greatest […]

CanAlaska Uranium Appoints Two New Board Members and Advisor

Karen Lloyd and Geoff Gay Appointed to Board of Directors

Shane Shircliff Appointed to Advisory Board

Vancouver, British Columbia–(Newsfile Corp. – July 28, 2021) – CanAlaska Uranium Ltd. (TSXV: CVV) ( OTCQB: CVVUF) ( FSE: DH7N ) ("CanAlaska" or the "Company") is pleased to announce the appointment of Ms. Karen Lloyd and Mr. Geoff Gay to the Board of Directors of the Company, effective immediately. In addition, the Company is pleased to announce Mr. Shane Shircliff’s appointment to the Advisory Board of the Company.

Ms. Lloyd (B. Comm., M.B.A.) comes from a strong and significant strategy and marketing background across five different industries including mining, telecommunications, online payments, executive training and banking. This depth of experience comes from her employment with Telus Communications, Hongkong Bank of Canada and Cameco Corporation. Between 2009 and 2020, Ms. Lloyd managed a team of contract and inventory specialists to seamlessly fulfill global […]

Click here to view original web page at www.juniorminingnetwork.com

Are Investors Keen On Selling Holdings In Uranium Energy Corp. (AMEX: UEC)?

Uranium Energy Corp. (AMEX:UEC) traded at $2.18 at last check on Tuesday, July 27 made a downward move of -5.41% on its previous day’s price.

Looking at the stock we see that its previous close was $2.31 and the beta (5Y monthly) reads 2.43 with the day’s price range being $2.19 – $2.33. In terms of its 52-week price range, UEC has a high of $3.67 and a low of $0.82. The company’s stock has lost about -20.62% over that past 30 days.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the […]

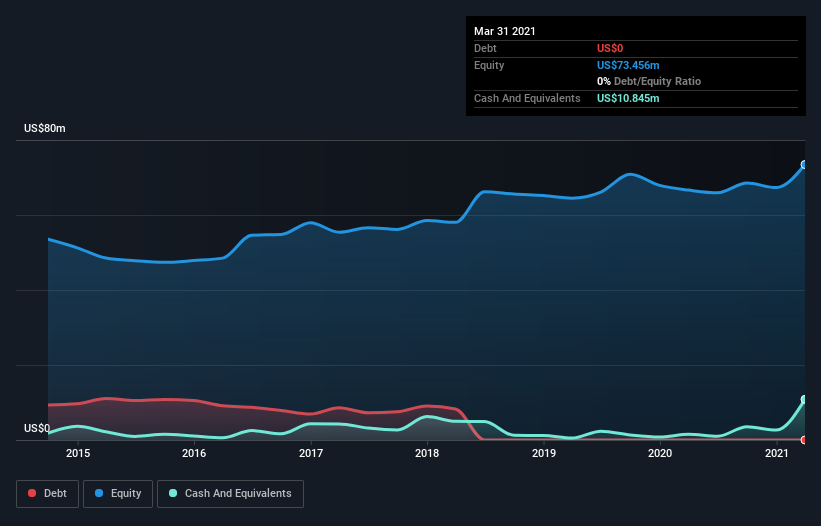

GoviEx Uranium (CVE:GXU) Is In A Good Position To Deliver On Growth Plans

There’s no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we’d take a look at whether GoviEx Uranium ( CVE:GXU ) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its ‘cash runway’. Does GoviEx Uranium Have A Long Cash Runway?

You can calculate a company’s cash runway by dividing the amount of cash […]

Why Uranium Stocks Were Heading for the Sky Today

What happened

Shares of junior uranium miners shot through the roof today. As of the market’s close on Wednesday, Uranium Energy (NYSEMKT: UEC) , Energy Fuels (NYSEMKT: UUUU) , and Ur-Energy (NYSEMKT: URG) were up 6.1%, 9.5%, and 8.2%, respectively.

As if the emergence of the world’s first exchange-traded fund (ETF) that invests in physical uranium wasn’t enough to stir up frenzied buying in uranium stocks, big nuclear energy news from Japan this morning added fuel to the enthusiasm. So what

Miners’ profitability depends a great deal on uranium prices. After a lull that lasted years, uranium spot prices crossed $30 per pound in 2020, only to give up some gains as 2021 kicked off. Prices have bounced back by double digits since, though, triggering hopes of better days ahead for uranium miners.The enthusiasm hit a whole new level when the Sprott Physical Uranium Trust Fund started trading on the […]

Uranium Energy Corp. (AMEX:UEC) trade information

Uranium Energy Corp. (AMEX:UEC) has a beta value of 2.42 and has seen 3.23 million shares traded in the last trading session. The company, currently valued at $541.21M, closed the last trade at $2.31 per share which meant it gained $0.12 on the day or 5.48% during that session. The UEC stock price is -58.87% off its 52-week high price of $3.67 and 64.5% above the 52-week low of $0.82. If we look at the company’s 10-day average daily trading volume, we find that it stood at 5.11 million shares traded. The 3-month trading volume is 5.37 million shares.

The consensus among analysts is that Uranium Energy Corp. (UEC) is a Buy stock at the moment, with a recommendation rating of 1.70. 0 analysts rate the stock as a Sell, while 0 rate it as Overweight. 0 out of 2 have rated it as a Hold, with 2 advising it […]

Click here to view original web page at marketingsentinel.com

Energy Fuels (UUUU) to Report Q2 Earnings: What’s in Store?

Energy Fuels Inc. UUUU is expected to report second-quarter 2021 results soon. Q2 Estimates

The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $5.5 million, indicating growth of 1,270% from the prior-year quarter. The consensus mark for bottom line is pegged at a loss of 4 cents, compared with a loss of 8 cents in the year-ago quarter. The estimates have remained stable over the past 30 days. Q1 Results

In the last reported quarter, Energy Fuels reported revenues of $0.38 million, which declined 46% year over year and missed the Zacks Consensus Estimate of $0.55 million. The company reported first-quarter 2021 loss per share of 8 cents, wider than the Zacks Consensus Estimate of a loss per share of 5 cents. The uranium mining company had reported a loss of 5 cents in the prior-year quarter.

The company has a trailing four-quarter negative earnings surprise of 40%, […]

More Pain Ahead For Workhorse Group Inc. (WKHS) and Uranium Energy Corp. (UEC)?

KOHMANN BOSSHARD FINANCIAL SERVI bought a fresh place in Workhorse Group Inc. (NASDAQ:WKHS). The institutional investor bought 17.0 thousand shares of the stock in a transaction took place on 6/30/2021. In another most recent transaction, which held on 6/30/2021, CREDIT SUISSE ASSET MANAGEMENT ( bought approximately 4.7 thousand shares of Workhorse Group Inc. In a separate transaction which took place on 6/30/2021, the institutional investor, CARROLL FINANCIAL ASSOCIATES, IN bought 4.3 thousand shares of the company’s stock. The total Institutional investors and hedge funds own 44.20% of the company’s stock.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to […]