Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $2.89 to be very precise. The Stock rose vividly during the last session to $3.31 after opening rate of $3.28 while the lowest price it went was recorded $3.07 before closing at $3.09.

Recently in News on April 9, 2021, Uranium Energy Corp Completes Financing and Reports Over $110 Million in Cash, Equity and Inventory Holdings as of April 9, 2021. Uranium Energy Corp (NYSE: UEC) (the “Company” or “UEC”) is pleased to announce the closing of its previously announced offering of an aggregate of 3,636,364 shares of common stock of the Company (each, a “Share”) at a purchase price of $3.30 per Share and for gross proceeds of $12,000,000 in a registered direct offering (the “Offering”). You can read further details here

A Backdoor Way To Profit From Today’s Crypto Bull Market

Even […]

Tag: uranium

Uranium explorer 92 Energy eyes ASX listing for mid-April

Uranium explorer 92 Energy (ASX:92E) is among several companies lined up to list on the ASX this or next week after bioenergy company Delorean joined the bourse yesterday . There are four IPOs timed for this week, including Delorean (ASX: DEL) . The others are Island Pharmaceuticals (ASX:ILA), 92 Energy and Iceni Gold (ASX:ICL). 92 Energy raising $5m

Formed last year, 92 Energy acquired eight mineral claims for uranium in Canada’s Athabasca Basin from Toronto-listed Iso Energy to which it added four of its own tenements.

The tenements are arranged into three projects, Clover, Gemini and Tower, in the Canadian province of Saskatchewan and home to several high profile uranium projects.

ASX stockspert Bhavdip Sanghavi ( @Bhavdip143 on Twitter) told Stockhead he believes the current valuation of 92 Energy is “cheap”.“92 Energy is a uranium explorer in Canada and its Tower project is only 10km from the world’s largest low-cost, highest […]

Purepoint Uranium Outlines 2021 Exploration Plans

TORONTO, April 12, 2021 /CNW/ – Purepoint Uranium Group Inc. (TSXV: PTU ) (" Purepoint " or the " Company ") today released its exploration schedule for the remainder of the year, focusing on its large portfolio of 100% owned uranium projects strategically located across Canada’s Athabasca Basin; host to the world’s highest grade uranium resources.

"There has been significant investment flowing into uranium companies over the past six months, signaling a potential near-term revival of uranium prices" said Chris Frostad, Purepoint’s President and CEO. "The timing is right for us to return to the exploration projects we initiated over a decade ago. We believe that the investments we make in advancing these projects now will unlock significant value and opportunities over the coming year".

Highlights: Scheduling reflects the anticipated timing of permit applications, the availability of contracted service providers and seasonal weather conditions

Permits are in place for […]

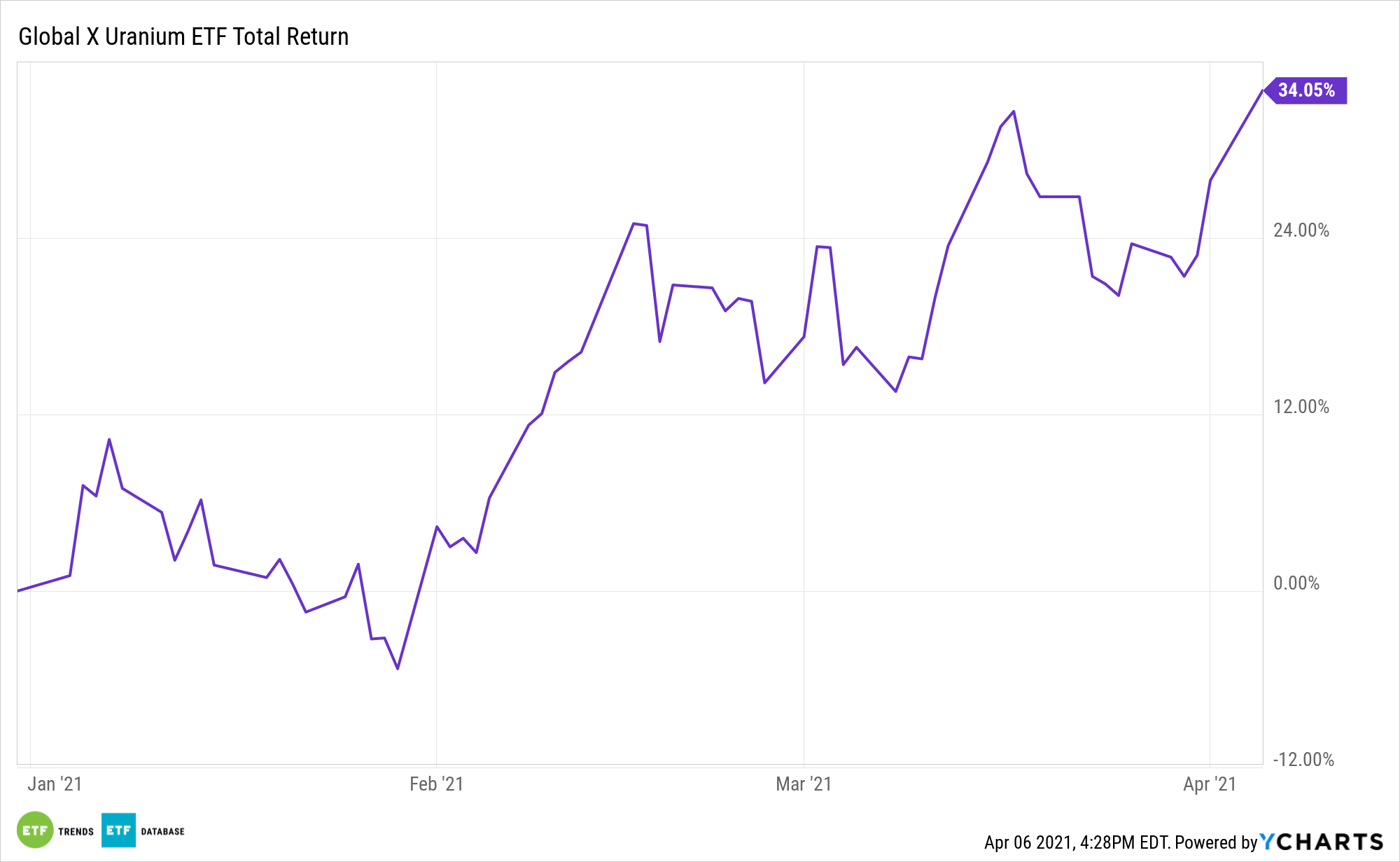

What are the top-performing Uranium ETFs in April?

The uranium investment theme topped our leaderboard on 4 April, as it was reported uranium prices are on the rise. According to The Motley Fool, the price of U308 (triuranium octoxide, also known as “yellowcake”) "last week surged past $30 per pound for the first time this year, approaching its highs of last year". Morgan Stanley analysts predict it could hit $50 per pound by 2024.

As an investment theme, uranium has gained circa 6.65% in the past month and circa 107% over the past year (as of 9 April’s close). A resurgence in nuclear energy production, which had fallen after the 2011 Fukushima disaster, has powered this demand as more countries use the power source in their energy mix.

Emerging markets have been the biggest growth sector for nuclear, led by China, which aims to be carbon neutral by 2060 — an ambition that could double global uranium […]

Purepoint Uranium Outlines 2021 Exploration Plans

TORONTO, April 12, 2021 /PRNewswire/ – Purepoint Uranium Group Inc. (TSXV: PTU) (" Purepoint " or the " Company ") today released its exploration schedule for the remainder of the year, focusing on its large portfolio of 100% owned uranium projects strategically located across Canada’s Athabasca Basin; host to the world’s highest grade uranium resources.

"There has been significant investment flowing into uranium companies over the past six months, signaling a potential near-term revival of uranium prices" said Chris Frostad, Purepoint’s President and CEO. "The timing is right for us to return to the exploration projects we initiated over a decade ago. We believe that the investments we make in advancing these projects now will unlock significant value and opportunities over the coming year".

Highlights: Scheduling reflects the anticipated timing of permit applications, the availability of contracted service providers and seasonal weather conditions

Permits are in place for work […]

5 Top Weekly TSX Stocks: Fission Uranium Up on Drill Results

The S&P/TSX Composite Index (INDEXTSI: OSPTX ) ended last week higher at 19,227.21, rising for the fifth consecutive week. Gains have been spurred by optimism around a faster economic recovery.

On Friday (April 9), prices for gold and silver slipped as the US dollar strengthened , while copper was trading above US$9,000 per tonne again.

Last week’s five TSX-listed mining stocks that saw the biggest gains are as follows: Uranium Price Forecasts and Top Uranium Stocks to Watch Did You Know That Uranium Was A Top Commodity In 2020?

Don’t Miss Out This Year With Our Exclusive FREE 2021 Uranium Outlook Report! Xanadu Mines (TSX: XAM ) SolGold (TSX: SOLG ) Orosur Mining (TSX: OMI ) Fission Uranium (TSX:FCU) Black Iron (TSX: BKI ) Here’s a look at those companies and the factors that moved their share prices last week. 1. Xanadu Mines ASX- and TSX-listed Xanadu Mines is […]

America’s Most Iconic Natural Wonder Has a Uranium Mine Next Door

Scott Buffon/Arizona Daily Sun via AP ust 10 miles south of the entrance to the South Rim of the Grand Canyon is a giant hole in the ground where miners are hoping to strike it big with one of Earth’s rarest but deadliest elements—uranium. Despite it only being about 17 acres in size, the Canyon Mine extends over 1,400 feet down into the Earth’s surface and critics worry it could scar the Grand Canyon itself and pollute a nearby tribe’s water.

Mining has been prevalent in the region surrounding the Grand Canyon since the early 1900s. During the atomic era of the 1950s, it was a little bit like the Wild West—interest in uranium mining soared and it evolved into a highly unregulated industry, where people were walking around with Geiger counters and shovels, hoping to sell it to the government for profit.

As the price of uranium plummeted, so did […]

Click here to view original web page at www.thedailybeast.com

Uranium Energy Corp Completes Financing and Reports Over $110 Million in Cash, Equity and Inventory Holdings as of April 9, 2021

CORPUS CHRISTI, Texas, April 9, 2021 /CNW/ – Uranium Energy Corp (NYSE: UEC) (the "Company" or "UEC") is pleased to announce the closing of its previously announced offering of an aggregate of 3,636,364 shares of common stock of the Company (each, a "Share") at a purchase price of $3.30 per Share and for gross proceeds of $12,000,000 in a registered direct offering (the "Offering").

The Company offered and sold the Shares pursuant to a Securities Purchase Agreement, dated April 5, 2021, with certain institutional investors.

UEC anticipates that the net proceeds of the Offering will be used for additional uranium purchases and for general corporate and working capital purposes.

Following the closing of this offering, the Company has over $110 million in cash, equity and inventory holdings.UEC’s physical uranium initiative is fully funded with cash on hand and now includes 2.105 million pounds of U.S. warehoused uranium at a volume weighted average […]

Click here to view original web page at www.juniorminingnetwork.com

Plateau Energy Metals Announces Break-through in Process Testing of Macusani Uranium Deposits Process significantly reduces mass while doubling head grades

Article content

TORONTO, March 30, 2021 (GLOBE NEWSWIRE) — Plateau Energy Metals Inc . (“Plateau” or the “Company”) (TSX-V:PLU | OTCQB:PLUUF) is pleased to announce positive preliminary pre-concentration test results from the Colibri II-III and Corachapi uranium deposits at the Company’s Macusani Uranium Project (“Macusani”) in Peru. This process testing was completed by TECMMINE E.I.R.L. (“TECMMINE”), a metallurgical consulting company based in Lima, Peru, and also involved DRA Global in South Africa. These results build from, and improve on, previous work completed by the Cameco Corporation in 2013 when they were involved with the Tantamaco uranium deposit discovery. These results should substantially improve on the encouraging potential economics for Macusani reported in the previous 2016 Preliminary Economic Assessment (“PEA”) 1 and will help form the basis for an updated PEA, currently being contemplated.

Highlights: Colibri II-III Deposit – 81.6% of U retained in 35.3% of original mass passing 300 […]

Uranium Energy Corp Completes Financing and Reports Over $110 Million in Cash, Equity and Inventory Holdings as of April 9, 2021

CORPUS CHRISTI, April 9, 2021 – Uranium Energy Corp. (NYSE: UEC) (the "Company" or "UEC") is pleased to announce the closing of its previously announced offering of an aggregate of 3,636,364 shares of common stock of the Company (each, a "Share") at a purchase price of $3.30 per Share and for gross proceeds of $12,000,000 in a registered direct offering (the "Offering").

The Company offered and sold the Shares pursuant to a Securities Purchase Agreement, dated April 5, 2021, with certain institutional investors.

UEC anticipates that the net proceeds of the Offering will be used for additional uranium purchases and for general corporate and working capital purposes.

Following the closing of this offering, the Company has over $110 million in cash, equity and inventory holdings.UEC’s physical uranium initiative is fully funded with cash on hand and now includes 2.105 million pounds of U.S. warehoused uranium at a volume weighted average price of […]

Uranium Energy Corp Completes Financing and Reports Over $110 Million in Cash, Equity and Inventory Holdings as of April 9, 2021

CORPUS CHRISTI, Texas, April 9, 2021 /PRNewswire/ – Uranium Energy Corp (NYSE: UEC ) (the "Company" or "UEC") is pleased to announce the closing of its previously announced offering of an aggregate of 3,636,364 shares of common stock of the Company (each, a "Share") at a purchase price of $3.30 per Share and for gross proceeds of $12,000,000 in a registered direct offering (the "Offering").

The Company offered and sold the Shares pursuant to a Securities Purchase Agreement, dated April 5, 2021, with certain institutional investors.

UEC anticipates that the net proceeds of the Offering will be used for additional uranium purchases and for general corporate and working capital purposes.

Following the closing of this offering, the Company has over $110 million in cash, equity and inventory holdings.UEC’s physical uranium initiative is fully funded with cash on hand and now includes 2.105 million pounds of U.S. warehoused uranium at a volume weighted […]

Top 3 Uranium Stocks to Buy in 2021

Uranium and nuclear energy have a bad rep. But is that justified? As we move further into renewable energy, tables are turning. More nuclear projects are coming online and it’s a perfect setup for the best uranium stocks.

The companies below focus on mining and processing uranium. So, as demand climbs, these stocks should do well… Cameco (NYSE: CCJ)

Uranium Energy Corp. (NYSE: UEC)

Ur-Energy (NYSE: URG) Before we dive into these investing opportunities, let’s look at key industry trends. The market is slowly moving away from fossil fuels and nuclear is a top contender… Is Uranium and Nuclear Energy Safe Going Forward? To see where we’re going, we must look back. On top that, it’s useful to understand market sentiment. The public image of nuclear energy isn’t great…When you ask people their opinion on nuclear, you’ll often hear about Three Mile Island, Chernobyl or Fukushima Daiichi. The memories of […]

The Future Belongs To Uranium Energy Corp. (NYSE:UEC) For Risk-Tolerant Investors

During the last session, Uranium Energy Corp. (NYSE:UEC)’s traded shares were 4,510,199, with the beta value of the company hitting 2.48. At the end of the trading day, the stock’s price was $3.06, reflecting an intraday loss of -3.77% or -$0.12. The 52-week high for the UEC share is $3.67, that puts it down -19.93% from that peak though still a striking +80.72% gain since the share price plummeted to a 52-week low of $0.59. The company’s market capitalization is $689.31 Million, and the average intraday trading volume over the past 10 days was 5.93 Million shares, and the average trade volume was 6.51 Million shares over the past three months.

Uranium Energy Corp. (UEC) received a consensus recommendation of Buy from analysts. That translates to a mean rating of 1.7. UEC has a Sell rating from none of the analyst(s) out of 5 analysts who have looked at this […]

Click here to view original web page at marketingsentinel.com

CanAlaska Uranium Grants Options

Vancouver, British Columbia–(Newsfile Corp. – April 8, 2021) – CanAlaska Uranium Ltd. (TSXV: CVV) (OTCQB: CVVUF) (FSE: DH7N ) ("CanAlaska" or the "Company") announces that it has granted incentive stock options to certain directors, officers and consultants of the Company to purchase up to an aggregate of 2,475,000 common shares of the Company pursuant to the company’s share option plan. The options are exercisable for a period of two years at a price of $0.71 per share.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in […]

Click here to view original web page at www.juniorminingnetwork.com

Stocks in play: Fission Uranium Corp.

CINCINNATI, April 08, 2021 (GLOBE NEWSWIRE) — LSI Industries Inc. (NASDAQ: LYTS, or the “Company”), a leading U.S. based manufacturer of indoor/outdoor lighting and graphics solutions, today announced that it will release third quarter fiscal 2021 results before the market opens on Thursday, April 22, 2021. A conference call will be held that same day at 11:00 a.m. ET to review the Company’s financial results, discuss recent events and conduct a question-and-answer session. A webcast of the conference call and accompanying presentation materials will be available in the Investor Relations section of LSI Industries’ website at www.lsicorp.com. Individuals can also participate by teleconference dial-in. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software. Details of the conference call are as follows: Call Dial-In: 877-407-4018Conference […]

Click here to view original web page at ca.finance.yahoo.com

Fission Uranium Resource Expansion Program Hits Wide Mineralization in all 20 Holes

KELOWNA, BC, April 7, 2021 /CNW/ – FISSION URANIUM CORP. (" Fission " or " the Company ") is pleased to announce results from the first of its 2021 drill programs on the R780E zone of the high-grade Triple R deposit at its’ PLS project, in the Athabasca Basin region of Saskatchewan, Canada. Twenty holes were completed in 7,147.8m, including 1 hole restarted due to excessive deviation. All twenty holes hit wide mineralization in multiple stacked intervals, with thirteen intercepting significant intervals of >10,000 cps radioactivity. The goal of the winter program was to upgrade key sections of the Triple R deposit’s R780E zone to "indicated" category by increasing drill hole density where the resource is largely classified as Inferred. These recently completed holes have the potential to increase the Indicated category resource which may positively impact the planned feasibility study. The holes include PLS21-606 (line 900E), which intersected […]

Click here to view original web page at www.juniorminingnetwork.com

Boss is ‘premier uranium developer’, says leading North American broker

Investors are scrambling to secure exposure to uranium amid growing evidence that the market is tightening rapidly, setting the scene for significant price rises. And now a new report from influential North American broker Sprott has named Boss Energy (ASX:BOE) as the “premier next-in-production uranium developer”.

Boss increased its exposure to the uranium market substantially last week when it raised $60 million to buy a large uranium stockpile.

As well as enabling the company to capitalise instantly on rises in the price of uranium, the strategy also delivers Boss a range of options for funding the equity component of its Honeymoon project in South Australia.

Boss has the choice of selling some or all of the stockpile to fund Honeymoon or simply sitting on it as a means of increasing exposure to the uranium price.But the stockpile acquisition also brings other key strategic benefits. These include strengthening its hand in offtake negotiations […]

Purepoint Uranium Group Inc. Closes its Private Placement

/NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES/

TORONTO, April 7, 2021 /CNW/ – Purepoint Uranium Group Inc. (TSXV: PTU ) (" Purepoint " or the " Company ") announced the closing of its brokered private placement (the " Private Placement ") previously announced on March 17, 2021 with Red Cloud Securities Inc. (" Red Cloud ") pursuant to which Red Cloud acted as lead agent and sole bookrunner. In connection with the closing, the Company issued 20,404,095 flow-through units (" FT Units ") at a price of $0.105 per unit and 31,750,778 hard-dollar units ( "Units" together with the FT Units are hereinafter referred to as the " Offered Securities ") at a price of $0.09 per unit for aggregate gross proceeds of $5,000,000. Each Unit consists of one common share in the capital of the Company and one common share purchase warrant (each, […]

A 128% Increase in Measured and Indicated Uranium Resources Spikes Momentum In Markets

Click to enlarge Uranium that’s produced in Wyoming is, at present, in-situ—which means in place—uranium is dissolved into solution, pumped to the surface and then processed into yellowcake.

Azarga Uranium ( TSX:AZZ , OTCQB:AZZUF , Forum ) is one company currently focused on Wyoming through several projects in the state, including its 100 per cent-owned Gas Hills Uranium Project, which has a deep mining history.

The company recently announced that it had completed an updated National Instrument 43-101 (NI 43-101) resource estimate on the project after additional uranium mineralization had been identified.

Key highlights

Measured and indicated uranium resources rose from 4.73 million pounds to 10.77 million pounds, representing a 128 per cent increase Measured and indicated in-situ recovery (“ISR”) uranium resources totalling 7.71 million pounds (72% of the overall measured and indicted resources) at an average grade of 0.101 per cent U3O8 The Gas Hills Project having the potential […]

Uranium Participation Corporation Reports Estimated Net Asset Value at March 31, 2021

View PDF URANIUM PARTICIPATION CORPORATION REPORTS ESTIMATED NET ASSET VALUE AT MARCH 31, 2021 (CNW Group/Uranium Participation Corporation) On the last trading day of March 2021, the common shares of UPC closed on the TSX at a value of CAD$5.45, which represents a 9.88% premium to the net asset value of CAD$4.96 per share.

About Uranium Participation Corporation

Uranium Participation Corporation is a company that invests substantially all of its assets in uranium oxide in concentrates ("U 3 O 8 ") and uranium hexafluoride ("UF 6 ") (collectively "uranium"), with the primary investment objective of achieving appreciation in the value of its uranium holdings through increases in the uranium price. UPC provides investors with a unique opportunity to gain exposure to the price of uranium without the resource or project risk associated with investing in a traditional mining company. Additional information about Uranium Participation Corporation is available on SEDAR […]

Psst: If You’re Looking for an Unloved Investment Sector, How About Uranium?

As a market strategist I have no choice but to track the hottest sectors of the market, but I also keep a close watch on the most unloved areas. Like Wayne Gretzky, I like to skate to where the puck will be, not where it is; and today I’m focusing on uranium. Remember nuclear energy? Many don’t, so let’s review. Smashing together atoms of uranium or uranium derivatives causes a chain reaction that unleashes enough energy to destroy the world or, wait for it, power the world. Speaking from Firsthand Experience

My expertise in this area is personal. As a Naval aviator I spent the better part of a decade sleeping on top of two nuclear reactors on several of our nation’s finest aircraft carriers. Those

two reactors could send a 90,000-ton vessel around the world countless times at a top speed that remains confidential. So, with global concern over […]

Plateau Energy Metals Announces Break-through in Process Testing of Macusani Uranium Deposits

TORONTO, March 30, 2021 (GLOBE NEWSWIRE) — Plateau Energy Metals Inc . (“Plateau” or the “Company”) (TSX-V:PLU | OTCQB:PLUUF) is pleased to announce positive preliminary pre-concentration test results from the Colibri II-III and Corachapi uranium deposits at the Company’s Macusani Uranium Project (“Macusani”) in Peru. This process testing was completed by TECMMINE E.I.R.L. (“TECMMINE”), a metallurgical consulting company based in Lima, Peru, and also involved DRA Global in South Africa. These results build from, and improve on, previous work completed by the Cameco Corporation in 2013 when they were involved with the Tantamaco uranium deposit discovery. These results should substantially improve on the encouraging potential economics for Macusani reported in the previous 2016 Preliminary Economic Assessment (“PEA”) 1 and will help form the basis for an updated PEA, currently being contemplated.

Highlights: Colibri II-III Deposit – 81.6% of U retained in 35.3% of original mass passing 300 μm; Calculated […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Week: Uranium Price Rise Forecast

As the uranium prices continue to rally, Morgan Stanley expects inventories to diminish and prices to trend higher

-Morgan Stanley forecasts US$48/lb by 2024.

-Disposal of uranium waste deemed safe

-Spot uranium price climbs nearly 13% in MarchThe pandemic has been a greater disruption to uranium supply than to demand, with nuclear power proving to be very resilient in most markets. Nonetheless, sales from inventories have capped price upside. As inventories diminish, Morgan Stanley expects the uranium price to trend higher.Increased contracting activity in the enrichment market could be the start of a new long-term uranium contracting cycle. While global nuclear power capacity fell -2.7GW in 2020, Morgan Stanley sees a net 8GW increase in 2021 as new plants come online in China, other Asia and Eastern Europe.Meanwhile, in the recent 14th five-year plan, China is targeting 70GW of nuclear capacity by 2025 from 48GW in 2020. […]

Uranium May Be Growing after Biden’s American Jobs Plan Announcement

U.S. president Joe Biden’s $2 trillion plan includes initiatives to help bolster jobs in America, including a push for clean electricity via energy sources like nuclear power. This may help put the Global X Uranium ETF (URA) back on the map.

URA can give ETF investors niche exposure when compared to a broad-based clean energy fund. The announcement of the plan has been having a positive effect thus far, with the fund up close to 7% the past 5 days.

"As the recent Texas power outages demonstrated, our aging electric grid needs urgent modernization," a White House fact sheet noted. "The President’s plan will create a more resilient grid, lower energy bills for middle class Americans, improve air quality and public health outcomes, and create good jobs, with a choice to join a union, on the path to achieving 100% carbon-free electricity by 2035."

Overall, URA seeks to provide investment results that […]

Boss is ‘premier uranium developer’, says leading North American broker

Investors are scrambling to secure exposure to uranium amid growing evidence that the market is tightening rapidly, setting the scene for significant price rises. And now a new report from influential North American broker Sprott has named Boss Energy (ASX:BOE) as the “premier next-in-production uranium developer”.

Boss increased its exposure to the uranium market substantially last week when it raised $60 million to buy a large uranium stockpile.

As well as enabling the company to capitalise instantly on rises in the price of uranium, the strategy also delivers Boss a range of options for funding the equity component of its Honeymoon project in South Australia.

Boss has the choice of selling some or all of the stockpile to fund Honeymoon or simply sitting on it as a means of increasing exposure to the uranium price.But the stockpile acquisition also brings other key strategic benefits. These include strengthening its hand in offtake negotiations […]