Bailouts and stimulus are not the best solution to the Covid pandemic.

What is? Possibly…insurance.

I know it’s far from perfect, but I think it could still be the best overall option.

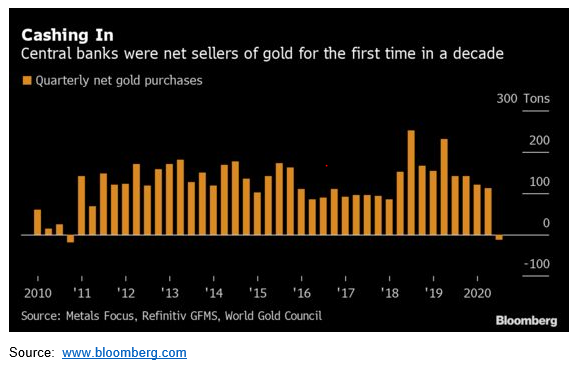

On some level, it’s surprising that the role of insurance has gotten so little attention in this crisis.After all, us and future generations will have to pay for all these massive bailouts.Of course, most of that responsibility has fallen on government so far.Some have resorted to printing, while others have turned to selling a portion of their gold reserves.In my view, that points to the ultimate solution; we should all be aiming to self-insure.And gold promises to be a top choice to that end. Pandemic Insurance: Underrated? In its latest report, the Global Preparedness Monitoring Board (GPMB), a joint effort by the world Health Organization (WHO) and the World Bank Group, said the pandemic has cost over $11 trillion so […]

Gold Is a Hedge Against Bad Government Decisions

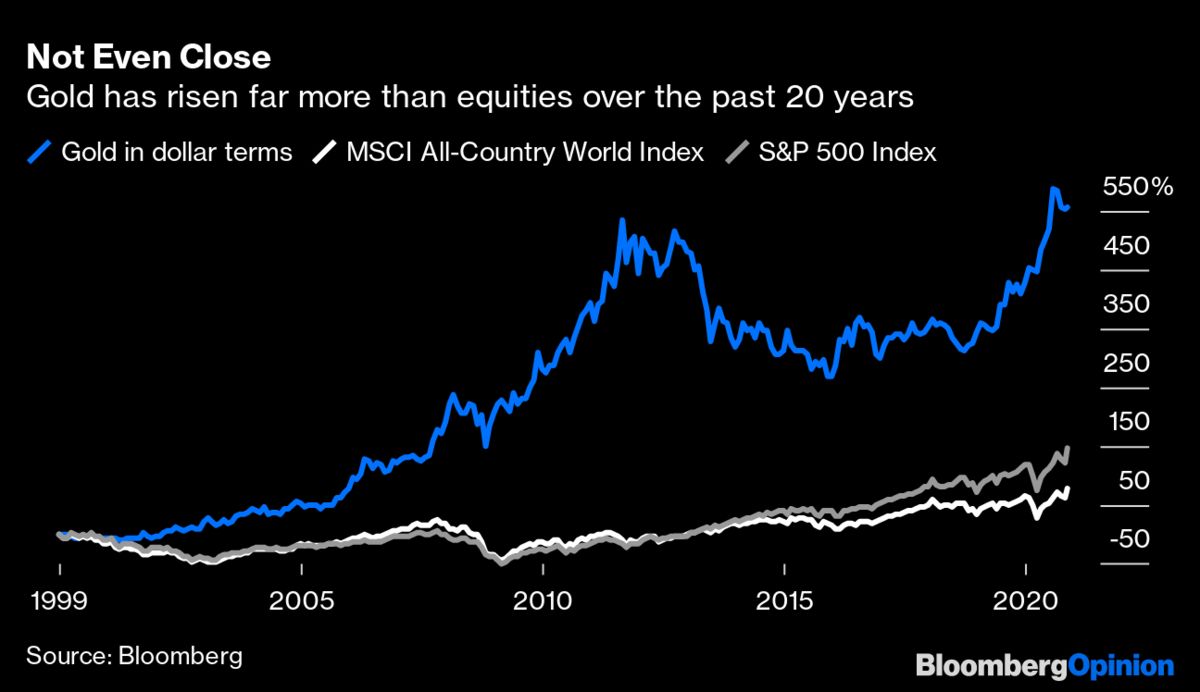

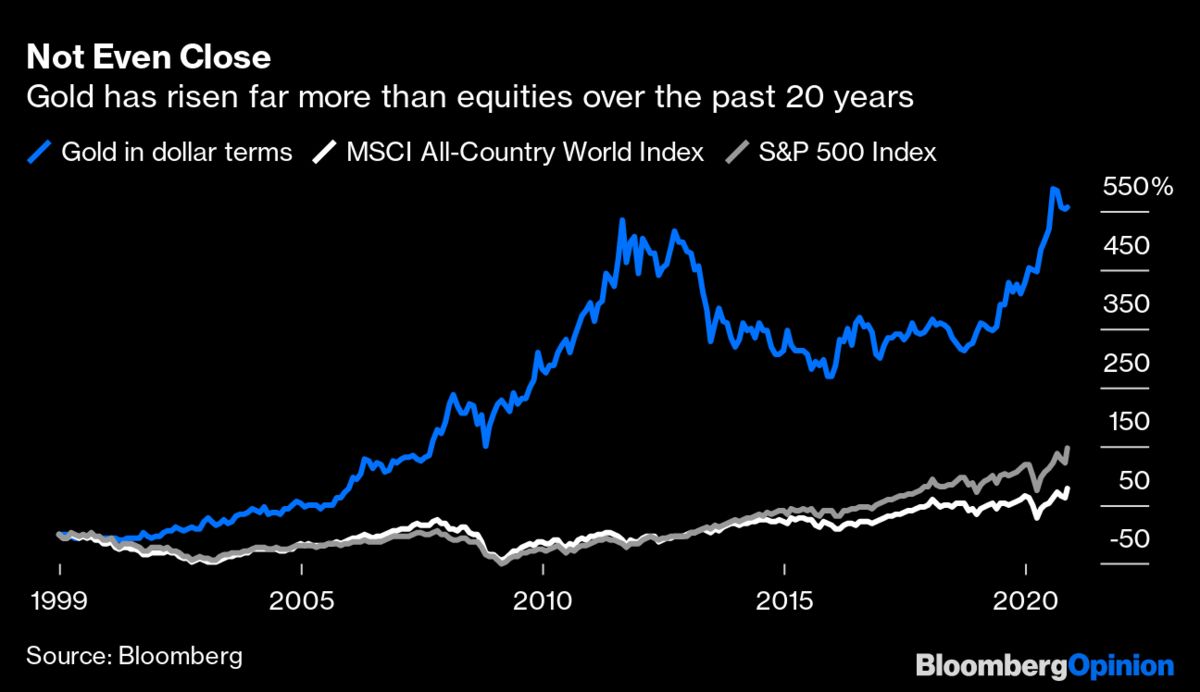

(Bloomberg Opinion) — Investors don’t really have a handle on what gold is or what it represents. Many erroneously believe gold is some sort of inflation hedge, because of our experience in the 1970s. It’s also not a hedge against stock market crashes, as we discovered in March. Gold is a hedge on government authorities making poor economic choices. Inflation is usually the result of those poor decisions, but people confuse cause and effect here. Gold is a hedge on policy makers screwing up, and there has been a lot of screwing up in the last 20 years.

Gold has significantly outperformed stocks this century, gaining about 555% versus 79% for the MSCI All-Country World Index of stocks and 146% for the S&P 500 Index. This is a direct result of significantly looser financial conditions, and no constraints on monetary and fiscal policy . From a financial perspective, the global […]

Click here to view original web page at www.bloombergquint.com

Gold Price Futures (GC) Technical Analysis – Rangebound for Eighth Straight Session

Gold futures are drifting lower on Thursday, pressured by a slightly stronger U.S. Dollar as progress toward a COVID-19 vaccine offset worries over spiking coronavirus cases in the United States and hopes of more stimulus.

COVID-19 vaccines from Pfizer Inc and Moderna Inc could be ready for U.S. authorization and distribution within weeks, setting the stage for inoculation to begin as soon as this year, U.S. Health and Human Services Secretary Alex Azar said on Wednesday.

Daily December Comex Gold Daily Swing Chart Technical Analysis

The main trend is down according to the daily swing chart. A trade through $1848.00 will signal a resumption of the downtrend. The main trend will change to up on a move through $1966.10. This is highly unlikely but there is room for a short-covering rally on a breakout over $1907.10.The main range is $1690.10 to $2089.20. The market is currently trading inside its retracement zone […]

Do You Know Where Your Watch’s Gold Came From?

Pier Marco Tacca/Getty Images

A mechanical timepiece is powered by clean kinetic energy and can run, at least theoretically, forever and a day.

To support that image of inherent sustainability, many Swiss watchmakers over the past decade have partnered with conservation groups, implemented energy-saving measures at their factories and, more recently, experimented with recycled materials for things like packaging and straps.

When it comes to the gold and gemstones used to make watches, however, the industry lags behind other sectors such as electronics in understanding and communicating how its materials are obtained and ensuring their extraction has not harmed people and the environment.“We always compare the watch industry here in Switzerland to the textile industry 20 years ago,” said Dario Grünenfelder, a consultant to WWF Switzerland and lead author of the WWF Watch and Jewellery Report 2018 . “They’re not really tackling the big issues: the raw materials that go into their […]

A ‘sober’ 2021 gold price target; say goodbye to ‘phenomenal’ drivers – HSBC’s Jim Steel

2020 has seen a “phenomenal” inflow of gold-backed exchange-traded funds, fueling an investment-led rally, but while ETF inflows are still expected to be strong, 2020’s level of inflows would be hard to keep up.

Jim Steel, chief precious metals analyst at HSBC, said that gold will average a price of $1,965 an ounce in 2021, owing to competing macroeconomic forces; accommodative monetary policy will continue to provide tailwinds, but an unwinding of geopolitical risk from a Biden Administration will ease the appetite for gold.

“Gold is sensitive to geopolitical risk,” he said. “If we’re going to get some rapprochement on the trade issues between the United States and the other countries, and it’s not just one country, it could be from several, and we also get a charm offensive from the Biden Administration to U.S. allies or to others, and the geopolitical risks come down and there’s progress made on the […]

Revealed: What Gold Coast businesses think about future

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend […]

Click here to view original web page at www.couriermail.com.au

Gold Is a Hedge Against Bad Government Decisions

(Bloomberg Opinion) — Investors don’t really have a handle on what gold is or what it represents. Many erroneously believe gold is some sort of inflation hedge, because of our experience in the 1970s. It’s also not a hedge against stock market crashes, as we discovered in March. Gold is a hedge on government authorities making poor economic choices. Inflation is usually the result of those poor decisions, but people confuse cause and effect here. Gold is a hedge on policy makers screwing up, and there has been a lot of screwing up in the last 20 years.

Gold has significantly outperformed stocks this century, gaining about 555% versus 79% for the MSCI All-Country World Index of stocks and 146% for the S&P 500 Index. This is a direct result of significantly looser financial conditions, and no constraints on monetary and fiscal policy . From a financial perspective, the global […]

Click here to view original web page at www.bloombergquint.com

Why subscribe to become a Member?

Frequently asked questions

Why subscribe to become a Member?

Because you’ll get extra extra every day.

As a Digital or Digital + Delivery Member you’ll get unrestricted access to journalists you know and trust across web and app on your favourite devices PLUS there are heaps of unreal +Rewards, like special offers, extras and exclusives, as well as a tonne of discounts and unique experiences to enjoy. They’re worth hundreds of dollars a year and are yours as a Digital or Digital + Delivery Member.As a App Only Member you’ll get unrestricted access on The Courier-Mail app, with thousands of stories, live sport scores, games and much more, it’s the best way to never miss what matters to you and it’s right at your fingertips. Who gets to enjoy Member’s benefits and +Rewards? Do you have a Digital membership with your papers home delivered or just a standalone Digital membership […]

Click here to view original web page at www.couriermail.com.au

$1 PER WEEK FOR THE FIRST 12 WEEKS

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend Delivery […]

Click here to view original web page at www.goldcoastbulletin.com.au

Gold Price Analysis: XAU/USD look to snap three-day downtrend below $1,900

Gold bounces off $1,869.60 while consolidating three-day losses from $1,899.14.

S&P 500 Futures open with mild gains despite virus woes, risk-negative news concerning China.

Vaccine hopes gain a boost after Pfizer joins Moderna with 95% effective rate.

Risk catalysts to dominate in Asia, US data can add to the watch-list afterward. Gold prices ease to $1,871 during the pre-Tokyo open Asian trading on Thursday. Even so, the yellow metal marks a halt to the previous three days’ declines. While the bullion’s earlier losses could be traced to the coronavirus (COVID-19) woes, also ignoring the vaccine euphoria, the latest criticism of China’s position in Tibet and Hong Kong gained a little reaction from the markets. Bears catch a breather, not out of the woods… Despite the recent halt in the short-term bearish moves, gold prices aren’t immune to the global worries concerning the COVID-19 resurgence. Not […]

Gold falls Rs 357, silver declines Rs 532

Representative image. Credit: iStock Gold prices fell Rs 357 to Rs 50,253 per 10 gram in Delhi on Wednesday on rupee appreciation and muted demand by investors, according to HDFC Securities.

The yellow metal had closed at Rs 50,610 per 10 gram in the previous trade.

Silver prices also declined Rs 532 to Rs 62,639 per kilogram from Rs 63,171 per kilogram on Tuesday.

"Spot gold prices for 24 karat gold in Delhi fell by Rs 357, pressured by sharp rupee appreciation on central bank interventions despite firm global prices," HDFC Securities Senior Analyst (Commodities) Tapan Patel said.He added that the rupee was trading around 32 paise stronger against the dollar during the day.Gold prices were muted as investors turned cautious about safe-haven buying on two positive announcements about COVID-19 vaccines in a month, Patel said."Gold prices are expected to trade sideways to down in absence of any major triggers from economic […]

Click here to view original web page at www.deccanherald.com

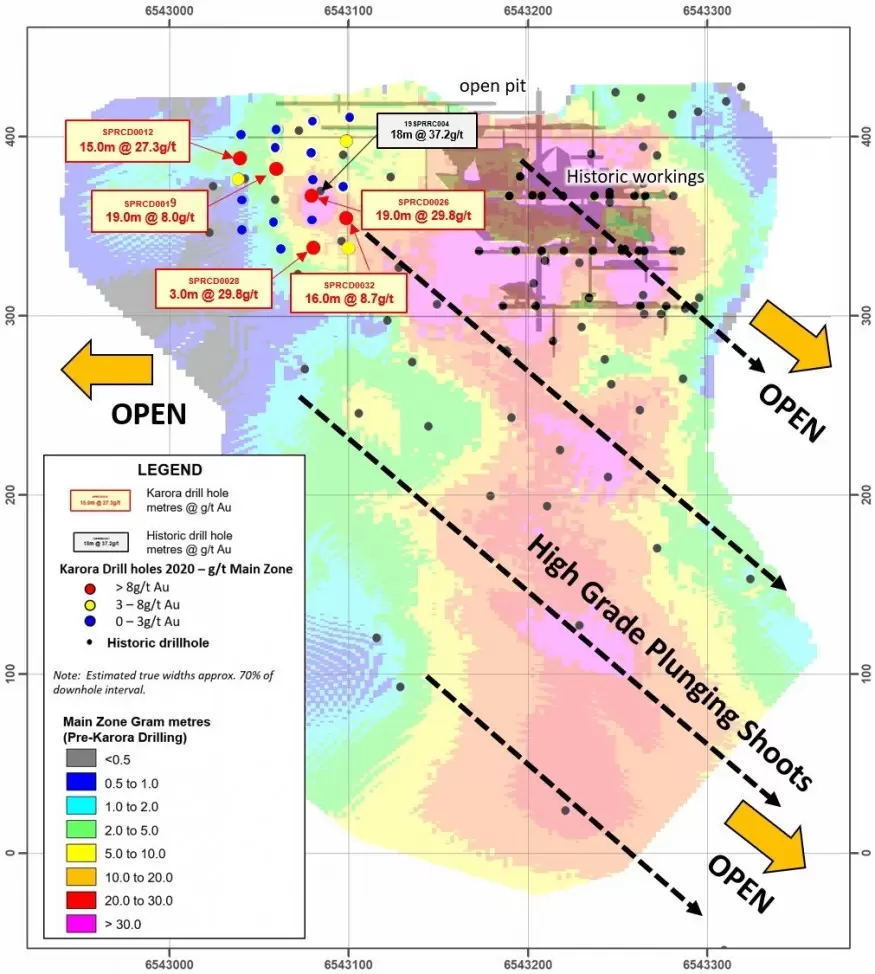

Karora Resources Intersects 29.8 g/t Gold Over 19.0 Metres and 27.3 g/t Gold Over 15.0 Metres from Initial Drilling at Spargos Project

Highlights: Initial drill results 1 within 100 metres of the surface have intersected new high grade gold intercepts at the Spargos Project. These include: SPRC0026: 29.8 g/t over 19.0 metres, including 99.5 g/t over 5.0 metres

SPRC0012: 27.3 g/t over 15.0 metres, including 168.0 g/t over 1.3 metres

SPRC0019: 8.0 g/t over 19.0 metres, including 20.6 g/t over 2.0 metres

SPRC0028: 29.8 g/t over 3.0 metres SPRC0032: 8.7g/t over 16.0 metres 1. Downhole intervals. Estimated true widths are approximately 70% of the downhole interval. Two RC drill rigs now actively drilling at Spargos A new Spargos Mineral Resource is expected to be included in the upcoming fourth quarter mineral resource and reserve update Paul Andre Huet, Chairman & CEO, commented: "Our exploration drilling program at Spargos is off to a tremendous start. I am thrilled to share our new drill results with […]

Click here to view original web page at www.juniorminingnetwork.com

Daily Gold News: Wednesday, Nov. 18 – Gold Closer to $1,850 Again

The gold futures contract lost 0.14% on Tuesday, as it extended its short-term consolidation following last week’s Monday’s 5% sell-off. Gold sold off after global financial markets’ euphoria rally in reaction to Covid-19 Pfizer ’s vaccine news release. The yellow metal has retraced all of its previous advance. It came back down to $1,850 price level, as we can see on the daily chart ( the chart includes today’s intraday data ):

Gold is 0.4% lower this morning, as it continues to trade within the mentioned short-term consolidation. What about the other precious metals? Silver lost 0.61% on Tuesday and today it is 0.5% lower. Platinum gained 1.04% and today it is 0.5% lower. Palladium lost 0.79% yesterday and today it’s 0.4% higher. So precious metals are generally lower this morning .

Yesterday’s Retail Sales release has been slightly lower than expected at +0.3%. The Industrial Production number has been as […]

Gold Price Slips as ‘Vaccine Relief’ Ignores Worsening 2nd Wave, Silver Shows Record Deficit

GOLD PRICES slipped against a falling US Dollar on Wednesday, rallying $10 from a re-test of Monday’s low at $1865 per ounce as further positive news on Covid vaccines was offset by this winter’s worsening second wave.

After competitor Moderna (NYSE: MRNA) said Monday that its Covid vaccine shows 94.5% efficacy – and with much simpler and cheaper distribution – Pfizer (NYSE: PFE) today updated last week’s figure of 90% for its product to 95%, with "observed efficacy in adults over 65 years of age" now over 94%.

World stock markets recovered yesterday’s dip and major government bond yields held unchanged, but data collated by Johns Hopkins University today said the virus’s global death toll has passed 1.3 million with a total of 55.7m infections.

"The psychological relief and a shift in risk sentiment may still weigh on gold in the immediate term," says a note from London bullion market-making and clearing […]

Click here to view original web page at www.bullionvault.com

We think gold and silver are vulnerable

OUTSIDE MARKET DEVELOPMENTS: Global equity markets were evenly mixed overnight, waffling around both sides of unchanged. Overnight economic news included negative Japanese imports and exports for October, softer than expected wage readings from Australia, and hotter than expected UK consumer and producer price readings. However, overall Euro zone pricing showed mostly as expected, benign inflation readings. The North American session will start out with a weekly private survey of mortgage applications, followed by October housing starts, which are expected to have a modest uptick from September’s 1.415 million annualized rate. October building permits are forecast to have a minimal uptick from September’s 1.553 million annualized rate. October Canadian CPI is expected to have a minimal downtick from September’s 0.5% year-over-year rate. Chicago Fed President Evans will speak during morning US trading hours, and New York Fed President Williams, St. Louis Fed President Bullard, Dallas Fed President Kaplan and Atlanta […]

Vaccine news could weigh on gold prices amidst shifting interest rate expectations – ABN AMRO

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – The gold market will remain sensitive to further vaccine news, but that doesn’t mean the rally is over just yet, according to one Dutch bank.

In a report released Wednesday, Georgette Boele, currency and precious metals strategist at ABN AMRO, said that gold’s direction could all depend on how expectations for a potential vaccine could impact economic growth going forward.

The comments come as gold prices continue to struggle below $1,900 an ounce. December gold futures last traded at $1,876.30 an ounce, down 0.47% on the day.

Boele noted that since 2019 gold has been an attractive safe-haven asset, protecting investors in case of a collapse of the financial system as well as a hedge against rising inflation; however, […]

Gold erases losses with dollar slumping, lockdowns widening

Gold erased losses as a slumping dollar and widening lockdowns to curtail the coronavirus bolstered demand for the metal as a haven.

Bullion fell as much as 0.9 per cent earlier after Pfizer Inc. said it plans to apply for the first U.S. regulatory authorization for a coronavirus shot within days. Gold investors took advantage of the price decline, buying as the greenback extended losses and expectations mounted for further virus lockdowns.

The new Pfizer announcement “triggered a couple of waves of liquidation in gold to session lows, but buy programs are pushing it back up,” said Tai Wong, head of metal derivatives trading at BMO Capital Markets. “Gold seems to have found short-term equilibrium.”

Spot gold rose less than 0.1 per cent to US$1,880.70 an ounce at 11:59 a.m. in New York.The US$1,895-US$1,900 range is becoming an important short-term hurdle for gold, Wong said. Even with effective vaccines in the pipeline, […]

There are still scenarios where gold price can push back above $2,000 – Franklin Templeton

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – The gold market continues to struggle below $1,900 an ounce as investor sentiment is weight down by further news of potential vaccines for the COVID-19 pandemic; however, one fund manager doesn’t think this will keep gold prices down for very long.

In a recent telephone interview with Kitco News, Steve Land, vice-president and portfolio manager for Franklin Templeton’s Franklin Gold and Precious Metals Fund, said that although the vaccine is good for economic growth, governments and central banks still have to deal with the economic devastation that the COVID-19 pandemic has already created.

"We can now see a path forward, but there are still a lot of questions unanswered," he said. "There’s still … a lot of work […]

Gold price to hit $2,300 next year on inflation risks, Goldman says

Stock image. Spot gold declined 0.3% to $1,873.08/oz by 1:50 p.m. ET Wednesday. US gold futures were down 0.6% to $1,872.60/oz in New York.

In the near term, gold doesn’t have a clear catalyst to lift or drag on prices, analysts Mikhail Sprogis and Jeffrey Currie said. Yet, the precious metal is poised to break out in 2021 as inflation concerns take center stage, they added.

Goldman has set a $2,300/oz price target for gold, which equates to a 22% rally from current levels over the next 12 months and another all-time high. Long-term inflation

Gold prices typically fall when interest rates climb, but the 2008 recession showed the market focusing more on short-term rates. Even as longer-term rates moved higher, gold rose in the wake of the financial crisis as concerns around policy-fueled inflation lifted demand, according to Goldman.The metal will follow the same path next year, Goldman analysts said. […]

Gold Price Prediction – Prices Consolidate in Tight Range

Gold prices traded sideways despite rising US yields. The US dollar moved lower but this failed to buoy the yellow metal, which has become uncorrelated to riskier assets. It appears that Bitcoin has taken the mantel from gold as an alternative asset that is buoyed by risk-on news.

Trade gold with FXTM Technical analysis

Gold prices edged lower sandwiched between resistance near the 10-day moving average at 1,891. The weekly chart of gold is forming a bull flag continuation pattern which is a pause that refreshes higher. Support is seen near the October lows at 1,850. Short-term momentum has turned negative as the fast stochastic generated a crossover sell signal. Medium-term momentum is neutral to negative as the MACD (moving average convergence divergence) histogram prints in the red with a declining trajectory which points to consolidation. US Housing Start Rise More than Expected

US housing starts rose more than expected […]

Gold Price Analysis: XAU/USD moving sideways between $1,880 and $1,865

XAU/USD edges lower, with upside attempts capped below $1,880.

The precious metal struggles on a moderate risk-on market.

Longer-term, gold remains trading back and forth between $1,850 and $1,900.

Gold futures remain heavy on Wednesday, with prices dropping for the third day in a row amid a moderate risk-on mood. Bullion prices remain limited below $1,880, with downside attempts contained above $1,860 so far.The precious metal lost footing during the European trading session, as the drugmaker Pfizer announced more positive news about the latest tests of its COVID-19 vaccine.Pfizer’s news comes after Moderna announced more promising coronavirus vaccine tests earlier this week. This has contributed to easing market concerns about the economic impact of the pandemic, as global infections reach new record levels, and has triggered a moderate appetite for risk.XAU/USD retreated from $1,885 to session lows at 1,865 before bouncing up on the early US […]

Western Copper and Gold Announces Over-Night Marketed Public Offering

VANCOUVER, BC, Nov. 18, 2020 /PRNewswire/ – Western Copper and Gold Corporation ("Western" or the "Company) (TSX: WRN) (NYSE American: WRN) has today filed a preliminary prospectus supplement in connection with an over-night marketed public offering (the "Offering") of common shares of the Company (the "Common Shares"). The definitive price shall be determined in the context of the market and the size of the Offering is not to be less than $20,000,000. It is expected that Cormark Securities Inc. (the "Lead Underwriter") and a syndicate of underwriters (collectively the "Underwriters") will enter into a definitive underwriting agreement with the Company on the successful marketing of the Offering. The Company has granted the Underwriters an over-allotment option to purchase up to that number of additional Common Shares equal to 15% of the Common Shares sold pursuant to the Offering, exercisable at any time up to 30 days from the closing […]

Michael Gayed Launches RORO, A Tactical Rotation ETF “Worth Its Weight In Gold”

A new tactical rotation strategy ETF based on the behavior of lumber relative to gold began trading on the New York Stock Exchange on Wednesday.

The ATAC US Rotation ETF (NYSEArca: RORO) is the brainchild of Michael A. Gayed, CFA, Portfolio Manager of Toroso Investments, an investment management company specializing in ETF focused research, investment strategies, and services designed for financial advisors.

The ETF will track the ATAC Risk-On/Risk-Off Domestic Index (RORO.Index), designed to be a tactical US stock/Treasury rotation strategy based on the behavior of lumber relative to gold.

“We could not ask for a better ticker,” notes Gayed. “Historically, when lumber is outperforming gold, that tends to suggest we’re in a risk-on period of lower stock market volatility, on average.”He continues, “When lumber is outperforming gold, the average volatility for the S&P is about 13.5%. When gold outperforms lumber, the average stock market volatility rises to about 19.4%, making for […]

Digital gold gains currency

Digital payment firms such as Paytm and PhonePe, which sold digital gold, reported strong demand emerging from smaller towns and cities this year, in addition to metros.

Flipkart-owned PhonePe reported an over sixfold jump in the volume of digital gold sold on its platform, while Paytm reported a 86% jump.(REUTERS) Millions of Indians continued the age-old tradition of buying gold during Diwali this year with a new-age twist.

Consumers took to the relatively new digital gold category to avoid trips to crowded markets during the pandemic; that they could buy without a minimum purchase restriction added to the attractiveness of digital gold as the price of the precious metal hovered near a record high.

Digital payment firms such as Paytm and PhonePe, which sold digital gold, reported strong demand emerging from smaller towns and cities this year, in addition to metros. The companies saw digital gold sales rise substantially over Dhanteras […]

Click here to view original web page at www.hindustantimes.com

Gold price ‘death cross’; sharp drop coming soon warns Gary Wagner

The 100-day and 50-day moving averages for gold have just crossed following months of a consistent differential, and this pattern is indicative of a "sharp drop" down in the gold price, said Gary Wagner, editor of the GoldForecast.com.

“When the short term [average] moves below a longer term chart, it forms an X just like the Skull and Bones,” Wagner said. “Towards December of last year into January of this year, we had an inversion, an inversion meaning that we had the longer term moving average above the shorter term.”

The cross signals a sharp drop in pricing.

Wagner said that the next support level is at $1,845 an ounce.“The major reason we’re seeing weakness in gold recently is that traders have been anticipating an additional fiscal stimulus bill to be passed by Congress, Senate, and the Administration. Of course, that hasn’t happened, and that has what has pushed pressure on gold.” […]