(Bloomberg Opinion) — Investors don’t really have a handle on what gold is or what it represents. Many erroneously believe gold is some sort of inflation hedge, because of our experience in the 1970s. It’s also not a hedge against stock market crashes, as we discovered in March. Gold is a hedge on government authorities making poor economic choices. Inflation is usually the result of those poor decisions, but people confuse cause and effect here. Gold is a hedge on policy makers screwing up, and there has been a lot of screwing up in the last 20 years.

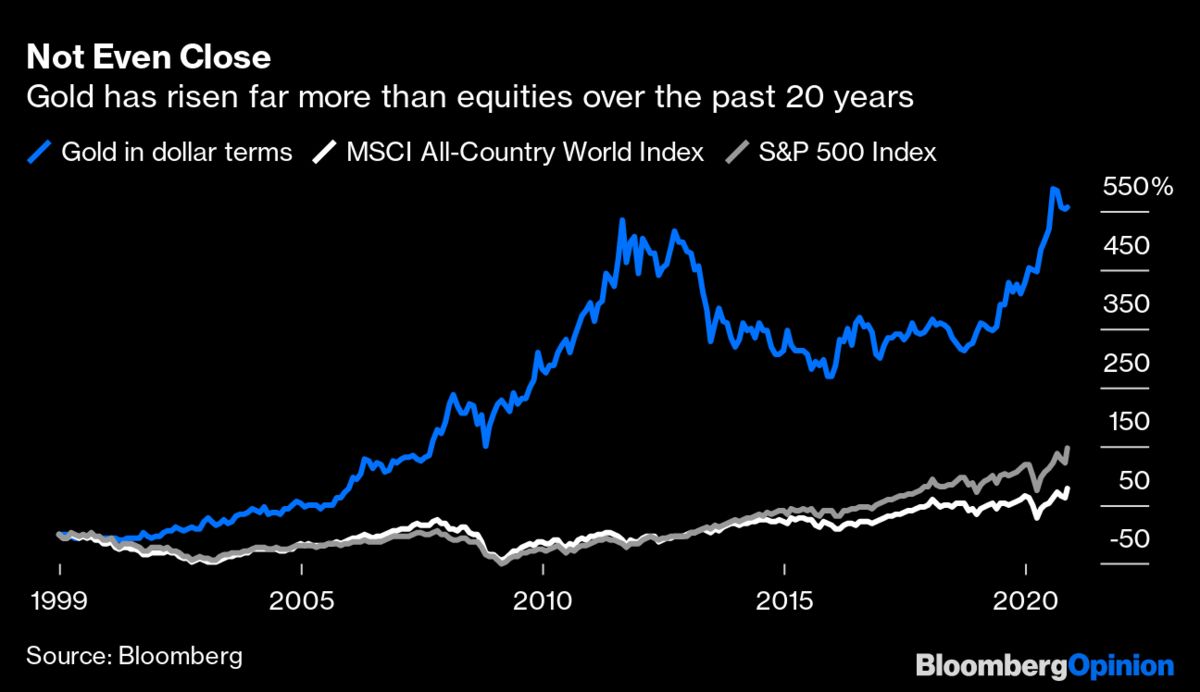

Gold has significantly outperformed stocks this century, gaining about 555% versus 79% for the MSCI All-Country World Index of stocks and 146% for the S&P 500 Index. This is a direct result of significantly looser financial conditions, and no constraints on monetary and fiscal policy . From a financial perspective, the global […]

Click here to view original web page at www.bloombergquint.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments