What happened

Shares of Uranium Energy ( NYSEMKT:UEC ) rose by as much as 10.5% on Monday. Although the uranium company didn’t hold on to all of that advance, the stock was still up by nearly 10% as daily trading drew to a close. The interesting thing is that the company filed a prospectus with the Securities and Exchange Commission that might normally be considered a negative. So what

On May 14, the last day of trading before a weekend, Uranium Energy filed a shelf registration with the SEC for up to $200 million worth of warrants . These securities give investors the right to buy stock at a pre-set price sometime in the future. There’s no time frame on when the warrants will be sold or how many, but in the end the result will be more shares of stock. The sale of these securities and their […]

Alligator Energy Ltd (ASX:AGE) Acquires EL6350 Adjacent to Samphire Project

Alligator Energy ( ASX:AGE ) is pleased to announce that it has entered into a Binding Terms Sheet to acquire EL6350 from Stellar Resources Limited ( ASX:SRZ ). The tenement, which contains existing historic uranium intersections, borders the southern end of Alligator’s 100% owned Samphire Uranium Project (refer Figure 1*) and is deemed prospective for extensions to the historic non JORC compliant Plumbush Uranium Deposit.

Under the terms, Alligator through its wholly owned subsidiary S Uranium Pty Ltd will acquire a 100% interest in EL 6350 from Stellar Resources for $135,000 to be satisfied through the issue of AGE shares. The number of Consideration Shares to be issued will be determined based on the lower of $0.019 and the 10 business day volume weighted average price (VWAP) immediately prior to execution of the binding terms sheet.

Greg Hall, Alligator CEO, said: "We are very pleased to consolidate our holding of the […]

Centrus sees strong growth in nuclear fuel sales

US nuclear fuel and services provider Centrus Energy Corporation today announced it has secured new nuclear fuel sales contracts and commitments valued at about USD225 million over the past 12 months. This, the company said, was the strongest period for new sales since 2015. (Image: Centrus Energy)

The company’s revenues come from multi-year contracts with major utilities, often signed years in advance. The new sales contracts and commitments cover deliveries in North America, Asia, and Europe from 2021 through to 2027, with revenues to be recognised in the year of delivery.

The USD225 million total includes the more than USD100 million in contracts and commitments secured between November 2020 and the end of January 2021 that were disclosed in the Centrus’ Annual Report for the year ended 31 December 2020. In its 2020 Annual Report, Centrus said its order book of sales under contract in the low-enriched uranium (LEU) segment extends […]

Click here to view original web page at world-nuclear-news.org

Why Uranium Energy Stock Rallied as Much as 10.5% Today

What happened

Shares of Uranium Energy (NYSEMKT: UEC) rose by as much as 10.5% on Monday. Although the uranium company didn’t hold on to all of that advance, the stock was still up by nearly 10% as daily trading drew to a close. The interesting thing is that the company filed a prospectus with the Securities and Exchange Commission that might normally be considered a negative. So what

On May 14, the last day of trading before a weekend, Uranium Energy filed a shelf registration with the SEC for up to $200 million worth of warrants . These securities give investors the right to buy stock at a pre-set price sometime in the future. There’s no time frame on when the warrants will be sold or how many, but in the end the result will be more shares of stock. The sale of these securities and their ultimate […]

Uranium Energy Corp. (NYSE:UEC): Trading Information

In the last trading session, 4,160,202 shares of the Uranium Energy Corp.(NYSE:UEC) were traded, and its beta was 2.45. Most recently the company’s share price was $2.94, and it changed around $0.24 or 0.09% from the last close, which brings the market valuation of the company to $677.74 Million. UEC currently trades at a discount to its 52-week high of $3.67, offering almost -24.83% off that amount. The share price’s 52-week low was $0.59, which indicates that the current value has risen by an impressive 79.93% since then. We note from Uranium Energy Corp.’s average daily trading volume that its 10-day average is 5.93 Million shares, with the 3-month average coming to 6.51 Million.

Uranium Energy Corp. stock received a consensus recommendation rating of Buy, based on a mean score of 1.7. If we narrow it down even further, the data shows that none out of 4 analysts rate the […]

Click here to view original web page at marketingsentinel.com

Uranium Week: Open Letter On Climate Change

As the uranium spot price rose 1% for the week, while six nuclear industry groups banded together to highlight nuclear’s role in the fight against climate change.

-Open letter to world leaders on climate change

-Four positive covid-19 results at Cameco

-Uranium spot price rose by 1% for the weekNuclear power is currently the biggest source of low-carbon electricity in developed economies and the second largest globally. By 2040, global electricity demand is expected to increase by 50%. However, over the same period more than 100 gigawatts of nuclear capacity is due to retire.Against this backdrop, six nuclear industry groups have penned an open letter to world leaders. It pointed to a critical opportunity at the upcoming G7 and Pre-COP summits "to set a bold new direction" in the fight against climate change.The Conference of the Parties (COP) is trhe decision-making bueau of the United Nations Framework Convetion […]

Penny Stocks – Is it Time to Buy the Uranium Miners?

Penny Stocks – Is it Time to Buy the Uranium Miners?

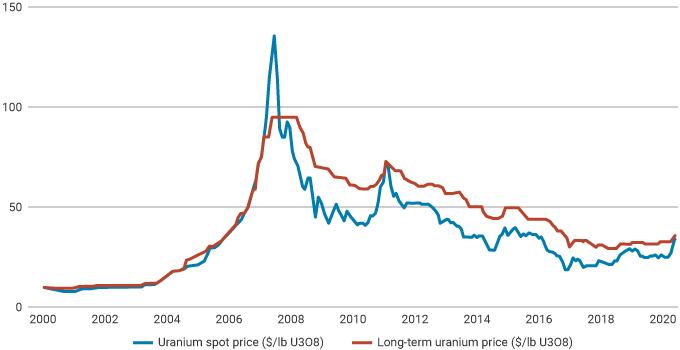

With the disastrous failure of a nuclear power plant at Chernobyl in the Ukraine fading into memory, nuclear power as a source of clean electricity generation seemed poised for a comeback going into 2011. The price of uranium was on an upward roll. The following price movement chart is from the World Nuclear Association.

In March of 2011, an earthquake spawned a 15-metre tsunami with three nuclear reactors at Fukushima in Japan in its path. The three reactors were disabled, with the reactor cores melting within three days.

The world’s reaction was quick and severe, with Japan shutting down all their nuclear power plants and Germany shutting down seven of their total seventeen nuclear power plants. Germany now says all nuclear power plants will be phased out by 2022. Virtually all countries initiated safety reviews on existing facilities.While it seemed the […]

Uranium Energy Corp: Biden’s Support For Nuclear Plant Subsidies Constructive For Miners

In her May 6 testimony before the Appropriations subcommittee of the U.S. House of Representatives, U.S. Energy Secretary Jennifer Granholm voiced support for subsidizing U.S. nuclear power plants to ensure existing facilities do not close. This is consistent with reports that the White House has privately told lawmakers that it backs taxpayer subsidies for the plants, as they are needed to achieve the Administration’s climate goals. President Biden hopes that U.S. power generation is “emissions free” by the year 2035.

Nuclear facilities would receive “production tax credits” as part of President Biden’s infrastructure bill. Tax credits will also be extended or created for wind and solar generators and for battery manufacturers.

The Administration’s nuclear stance is a positive for owners of U.S. uranium projects, such as Uranium Energy Corp. (NYSE: UEC) . Very little uranium has been produced in the U.S. since 2018, and effectively none since 1Q 2019. It would […]

Is it Time to Buy the Uranium Miners?

With the disastrous failure of a nuclear power plant at Chernobyl in the Ukraine fading into memory, nuclear power as a source of clean electricity generation seemed poised for a comeback going into 2011. The price of uranium was on an upward roll. The following price movement chart is from the World Nuclear Association. In March of 2011, an earthquake spawned a 15-metre tsunami with three nuclear reactors at Fukushima in Japan in its path. The three reactors were disabled, with the reactor cores melting within three days.

The world’s reaction was quick and severe, with Japan shutting down all their nuclear power plants and Germany shutting down seven of their total seventeen nuclear power plants. Germany now says all nuclear power plants will be phased out by 2022. Virtually all countries initiated safety reviews on existing facilities.

While it seemed the future of nuclear power as an energy generating source […]

Fission Uranium Closes C$34.5 Million Bought Deal Offering

Eight Capital and Sprott Capital Partners LP acted as co-lead underwriters on behalf of a syndicate of underwriters including Canaccord Genuity Corp., BMO Nesbitt Burns Inc. and H.C. Wainwright & Co., LLC (collectively, the " Underwriters ").

Each Unit consisted of one common share of the Company and one-half of one common share purchase warrant (each whole warrant, a " Warrant "). Each Warrant shall entitle the holder to purchase one common share of the Company (each, a " Warrant Share ") at a price of C$0.85 at any time on or before 5:00 pm on May 11, 2024.

The Company intends to use the net proceeds of the Offering to fund the further development of the Triple R deposit in Saskatchewan and for working capital and general corporate purposes.

The Offering was completed pursuant to a prospectus supplement to the Company’s base shelf prospectus dated December 7, 2020.The securities offered have […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Energy Corp. Also Can’t Make American Uranium Great Again

Photo by kasezo/iStock via Getty Images Understand the nature of the companies you own and the specific reasons for holding the stock. ("It is really going up!" doesn’t count.) – Peter Lynch , One Up on Wall Street Investment thesis

Back in March, I wrote an article on U.S.-focused uranium miner Energy Fuels (NYSEMKT: UUUU ) titled "Energy Fuels Can’t Make American Uranium Great Again".

My idea was that the USA is no longer a factor in the uranium sector and that the businesses of local companies are next to worthless. This includes Uranium Energy Corp. (NYSE: UEC ), which has a market capitalization of $638.6 million as of the time of writing.

Based on the quality of Uranium Energy’s assets, I think the company shouldn’t be worth much higher than $100 million. Overview of the operations While Energy Fuels advertises itself as the largest U.S. producer of uranium, […]

Purepoint Uranium Provides Overview of Red Willow Project Targets for Upcoming Diamond Drill Program

TORONTO, May 13, 2021 /CNW/ – Purepoint Uranium Group Inc. (TSXV: PTU ) (" Purepoint " or the " Company ") today provided an overview of the exploration targets scheduled to be initially drill tested on its 100%-owned Red Willow project in the eastern uranium mine district of the Athabasca Basin, Saskatchewan Canada. By far, the Company’s largest project, Red Willow is located close to several uranium deposits including Orano Resources Canada Inc.’s JEB mine, approximately 10 kilometres to the southwest, and Cameco’s Eagle Point mine that is approximately 10 kilometres due south.

"The Red Willow property covers numerous high value targets over which we have performed extensive preparatory geophysical surveys and, in some instances, first pass drilling" said Chris Frostad, Purepoint’s President and CEO. "Drill permits are in place and it is our intention to begin diamond drilling at this project as soon as possible."

Highlights The 100%-owned Red […]

Energy Fuels Announces Q1-2021 Results, Including Robust Balance Sheet, Continued Readiness to Supply Uranium into the U.S. Uranium Reserve when Established & Continued Ramp-up to Commercial Rare Earth Production; Webcast on Monday, May 17, 2021

LAKEWOOD, Colo., May 13, 2021 /PRNewswire/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) ("Energy Fuels" or the "Company") today reported its financial results for the quarter ended March 31, 2021. The Company’s annual report on Form 10-K has been filed with the U.S. Securities and Exchange Commission (" SEC ") and may be viewed on the Electronic Document Gathering and Retrieval System (" EDGAR ") at www.sec.gov/edgar.shtml , on the System for Electronic Document Analysis and Retrieval (" SEDAR ") at www.sedar.com , and on the Company’s website at www.energyfuels.com . Unless noted otherwise, all dollar amounts are in U.S. dollars.

Highlights: At March 31, 2021, the Company had $60.37 million of working capital, including $44.11 million of cash and marketable securities and $27.98 million of inventory, including approximately 690,800 pounds of uranium and 1,672,000 pounds of high-purity vanadium in the form of immediately marketable product.

[…]

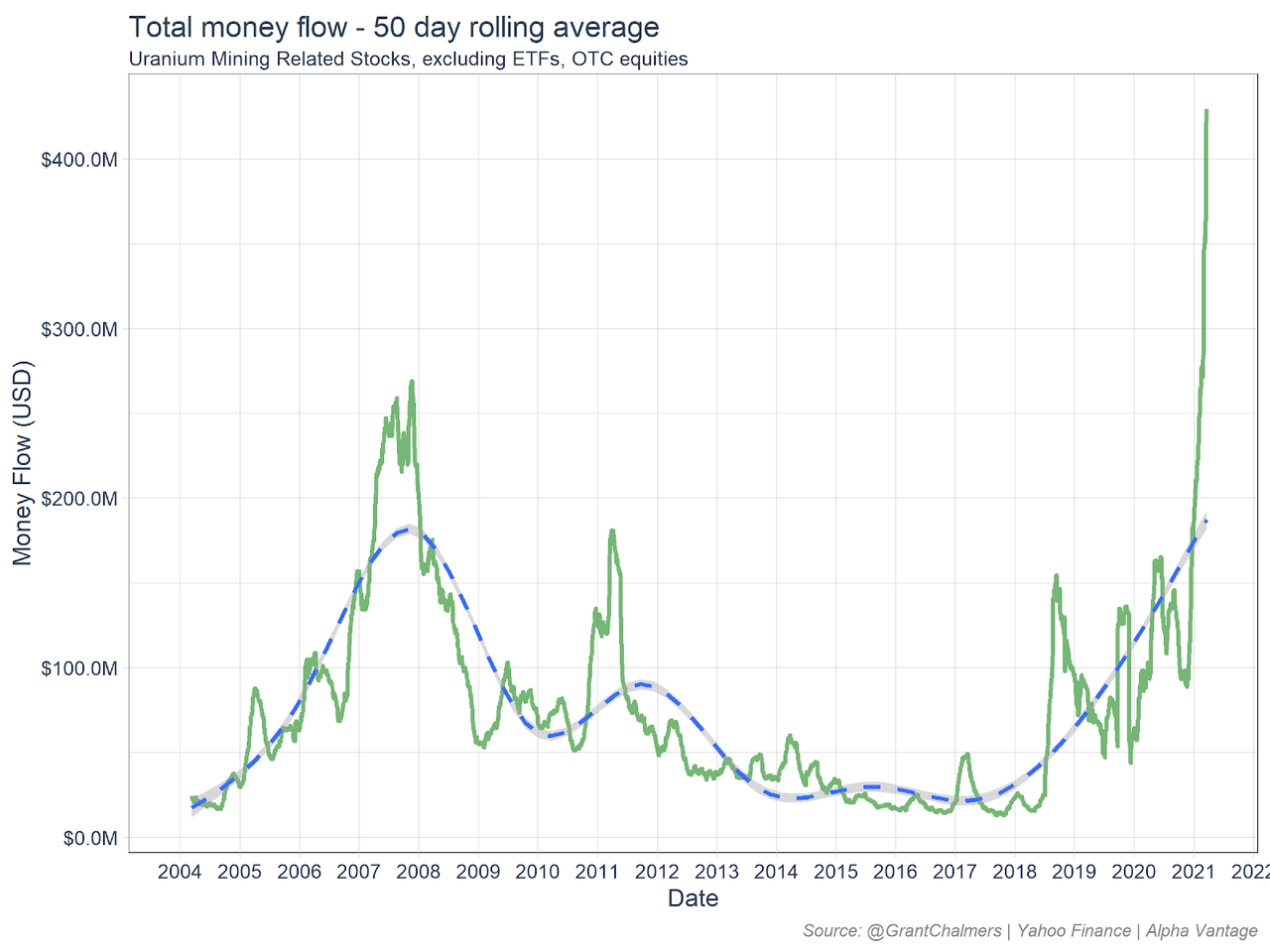

Nuclear Nirvana: A Tipping Point in the Uranium Cycle? Contributed Opinion

This past week was particularly enjoyable for a number of reasons, and while the action in the precious metals sector finally gave me something about which to cheer, prices for the base metals had terrific moves led by GGMA commodity favorite copper , which hit record highs above US$4.70/lb for the first time in the history of global currency debasement.

Notwithstanding the arrival of an "overbought" condition in this poster child for the electrification movement, copper’s performance is a testimonial to a surge in global demand and delayed supply shock brought on by mine closures and COVID-related issues. There exists a confluence of bullish factors in the copper market that supersedes an easier explanation, such as a "weak dollar" or "Chinese hoarding," which includes changes in Chilean tax laws pertaining to mammoth copper production from their Andean cache.

However, it is not simply a copper story. Thirty-day charts for zinc, nickel […]

Click here to view original web page at www.streetwisereports.com

Energy Fuels Announces Q1-2021 Results, Including Robust Balance Sheet, Continued Readiness to Supply Uranium into the U.S. Uranium Reserve when Established & Continued Ramp-up to Commercial Rare Earth Production; Webcast on Monday, May 17, 2021

LAKEWOOD, Colo., May 13, 2021 /CNW/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) ("Energy Fuels" or the "Company") today reported its financial results for the quarter ended March 31, 2021. The Company’s annual report on Form 10-K has been filed with the U.S. Securities and Exchange Commission (" SEC ") and may be viewed on the Electronic Document Gathering and Retrieval System (" EDGAR ") at www.sec.gov/edgar.shtml , on the System for Electronic Document Analysis and Retrieval (" SEDAR ") at www.sedar.com , and on the Company’s website at www.energyfuels.com . Unless noted otherwise, all dollar amounts are in U.S. dollars.

Highlights: At March 31, 2021, the Company had $60.37 million of working capital, including $44.11 million of cash and marketable securities and $27.98 million of inventory, including approximately 690,800 pounds of uranium and 1,672,000 pounds of high-purity vanadium in the form of immediately marketable product.

[…]

Purepoint Uranium Provides Overview of Red Willow Project Targets for Upcoming Diamond Drill Program

TORONTO, May 13, 2021 /PRNewswire/ – Purepoint Uranium Group Inc. (TSXV: PTU) (" Purepoint " or the " Company ") today provided an overview of the exploration targets scheduled to be initially drill tested on its 100%-owned Red Willow project in the eastern uranium mine district of the Athabasca Basin, Saskatchewan Canada. By far, the Company’s largest project, Red Willow is located close to several uranium deposits including Orano Resources Canada Inc.’s JEB mine, approximately 10 kilometres to the southwest, and Cameco’s Eagle Point mine that is approximately 10 kilometres due south.

"The Red Willow property covers numerous high value targets over which we have performed extensive preparatory geophysical surveys and, in some instances, first pass drilling" said Chris Frostad, Purepoint’s President and CEO. "Drill permits are in place and it is our intention to begin diamond drilling at this project as soon as possible."

Highlights The 100%-owned Red Willow […]

Skyharbour Resources President & CEO, Jordan Trimble, to Present at the Red Cloud Uranium Conference (Virtual)

VANCOUVER, British Columbia, May 11, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that President and CEO, Jordan Trimble, will present at the Red Cloud Conference "Uranium: Fueling the Path Towards Electrification", which will take place virtually on May 13, 2021.

Mr. Trimble will provide an overview of Skyharbour’s current activity as an exploration company, together with next steps for the Company’s high-grade uranium exploration projects and prospect generator model in Saskatchewan.

Skyharbour Presentation Date: May 13, 2021

Time: 1:40pm ET / 10:40am PT Spokesperson: Jordan Trimble B.SC., CFA, President and CEO Investors interested in attending the Skyharbour Resources webcast at the event can register here: https://www.redcloudfs.com/uraniumconference2021/ About Skyharbour Resources Ltd.: Skyharbour holds an extensive portfolio of uranium exploration projects in Canada’s Athabasca Basin and is well positioned to benefit from improving uranium market […]

Click here to view original web page at www.globenewswire.com

Alligator Energy signs with Traxys in first step towards becoming a uranium producer

Uranium and cobalt-nickel explorer, Alligator Energy (ASX:AGE) , has made the first step towards becoming a uranium producer, after announcing a strategic agreement with global commodities trader, Traxys. The agreement saw Alligator forming an exclusive partnership with Traxys North America LLC, the US arm of the commodities trading group Traxys.

Under the deal, Traxys will provide a full scope of work for Alligator’s uranium project, which includes marketing services on future uranium production, long term off-take contracting, and project development financing.

Traxys will also assist Alligator in project acquisition opportunities. Becoming a uranium producer

Traxys is a well-known global player in the trading of metals, minerals and alloys, with a turnover exceeding US$6 billion annually.The company’s uranium trading division covers the regions of Americas, Europe, Australia and Asia, and transacts up to 15 million pounds of U308 annually. It also manages contract supply books in conversion, UF6, futures and options.Alligator believes […]

Is Uranium the next commodity to move higher?

As Ur-Energy Inc. (NYSE American: URG | TSX: URE) looks to break through its $1.57 (C$1.99) high reached in February of this year it’s time to take another look at this company and Uranium in general. The Company announced some exciting news late last week – they received three approvals representing the final major permits required to begin construction of their Shirley Basin project. This is good news considering Ur-Energy is engaged in uranium mining, recovery and processing operations, as well as the exploration and development of uranium mineral properties.

The Shirley Basin project would be complementary to the existing Lost Creek project with its recently announced increase to nine licensed mine units and the licensed limit annual plant production of 2.2 million pounds U 3 O 8 which includes wellfield production of up to 1.2 million pounds U 3 O 8 and toll processing up to one million pounds […]

Denison Mines: Low-Cost Uranium The Key To Upside

Summary

The last few years have shown that within the uranium industry, the cost of mining is particularly important with many mining operations with costs over the spot price.

Even experienced, large-scale uranium miners like Cameco can struggle with keeping production costs below the spot uranium price.

Denison Mines has a flagship project at Wheeler River that stacks up well relative to many of its peers. Prior to the Fukushima nuclear accident in 2011, Denison Mines was close to $3.50. There is a lot to like about Denison Mines, and if you like the uranium sector, then this stock is a strong contender to be part of the mix. Photo by Searsie/iStock via Getty Images Introduction Often the focus on mining stocks centers on the resources that a company has in the ground and attempting to value those resources. Whilst finding large reserves is of course an important […]

Skyharbour Resources President & CEO, Jordan Trimble, to Present at the Red Cloud Uranium Conference

Skyharbour Resources Ltd. is pleased to announce that President and CEO, Jordan Trimble, will present at the Red Cloud Conference “Uranium: Fueling the Path Towards Electrification”, which will take place virtually on May 13, 2021. Mr. Trimble will provide an overview of Skyharbour’s current activity as an exploration company, together with next steps for the Company’s high-grade uranium exploration projects and …

Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that President and CEO, Jordan Trimble, will present at the Red Cloud Conference “Uranium: Fueling the Path Towards Electrification”, which will take place virtually on May 13, 2021.

Mr. Trimble will provide an overview of Skyharbour’s current activity as an exploration company, together with next steps for the Company’s high-grade uranium exploration projects and prospect generator model in Saskatchewan.

Skyharbour Presentation Date: May 13, 2021 Time: 1:40pm ET / […]

Alligator Energy signs with Traxys in first step towards becoming a uranium producer

ASX-listed Alligator Energy signs deal with global commodities trader Traxys. Picture: Getty Images share

Uranium and cobalt-nickel explorer, Alligator Energy (ASX:AGE) , has made the first step towards becoming a uranium producer, after announcing a strategic agreement with global commodities trader, Traxys.

The agreement saw Alligator forming an exclusive partnership with Traxys North America LLC, the US arm of the commodities trading group Traxys.

Under the deal, Traxys will provide a full scope of work for Alligator’s uranium project, which includes marketing services on future uranium production, long term off-take contracting, and project development financing.Traxys will also assist Alligator in project acquisition opportunities. Becoming a uranium producer Traxys is a well-known global player in the trading of metals, minerals and alloys, with a turnover exceeding US$6 billion annually.The company’s uranium trading division covers the regions of Americas, Europe, Australia and Asia, and transacts up to 15 million pounds of U308 annually. […]

New uranium trust could be ‘game changer’ for spot market, Cameco says

The uranium spot market may be on the verge of a fundamental shift after the takeover of Uranium Participation Corp. by Sprott Asset Management LP, according to Canadian uranium producer Cameco Corp.

Sprott Asset Management, a subsidiary of Sprott Inc., entered into an agreement with Uranium Participation, a uranium asset investment manager, in late April to form the Sprott Physical Uranium Trust, removing Denison Mines Corp. as head of the entity. Managers of the new trust plan to pursue a listing on the New York Stock Exchange, potentially resulting in an increase of trading liquidity and access to capital for future uranium purchases, according to corporate filings.

Executives for Cameco, the operator of the largest uranium-producing mine in the world, said during a May 7 earnings call that the deal could create broad investment in uranium mining and the purchase of uranium on the spot market. The market could enter […]

Resources Top 5: Silver hits dazzle as uranium, lithium stocks ride bullish wave

Uranium explorer Alligator teams up with giant US commodities trader Traxys

Recent IPO Prospech hits high grade silver in Slovakia

Vimy (uranium), GL1 (lithium) and Ikewzi (coal) up on no news

Here are the biggest small cap resources winners in morning trade, Monday May 10.Giant US commodities trader Traxys has inked a deal to potentially provide long term offtake and project development financing to ~$60m market cap uranium explorer Alligator.Traxys – which enjoys annual revenues of +$6 billion – will also assist in uranium project acquisition opportunities.Alligator began early exploration at its newly acquired Samphire uranium project in South Australia in February this year . A drilling program is due to kick off in July, primarily focused on upgrading the existing resource.“This exciting strategic partnership with Traxys will provide expanded opportunities for Alligator in the project development, uranium offtake and targeted acquisition arenas,” Alligator chief exec Greg Hall says.“With […]

NexGen Annual General and Special Meeting of Shareholders to be Held June 10, 2021

NexGen Energy Ltd. (“NexGen” or the “Company”) (TSX: NXE) (NYSE MKT: NXE) is pleased to announce it has mailed the Notice of Meeting and Management Information Circular to shareholders record as of April 30, 2021 in connection with the Annual General and Special Meeting to be held Thursday, June 10, 2021 at 2:00 p.m. (Pacific Time) .

Due to the impacts of the COVID-19 pandemic, governmental recommendations and/or orders for physical distancing, restrictions on group gatherings, non-essential travel and business activities we request that shareholders do no attend the meeting in person. To mitigate any risks to stakeholders, employees, partners and community members, the Company will hold this year’s meeting by conference call, details below. Shareholders are encouraged to cast their votes in advance by proxy.

Conference Call dial in details:

To join the conference call please dial:International Callers: (+1) 416 764 8659North America Callers: (+1) 888 664 6392 Conference […]