Nuclear Fuels Market Forecast and Opportunity Analysis for Major Types, Applications, Regions, and Competitive Analysis

“Nuclear Fuels Market Report 2021” offers an industry-wide analysis of the market, including precise assessment of the demand for the Nuclear Fuels Market and accurate market insights that allow readers to identify the existing opportunities and threats and optimize their investments. It offers the global sector across key regional markets and gives an extensive investigation and statistical analysis of vital market elements.

The study also performs an elaborate industry-wide competitive analysis, highlighting the major companies in the Nuclear Fuels Market that regulate a substantial portion of the global market share and infers beneficial prospects and hurdles to help the reader invest wisely.

“ Don’t miss the trading opportunities on Nuclear Fuels Market. Talk to our analysts and gain key industry insights that will help your business grow as you get PDF sample reports “ […]

Megawatt Lithium and Battery Metals appoints Elmore Limited to Lead Fieldwork at Prime Australian Rare Earth & Uranium Projects

Australia.

Legacy desktop work has verified the two properties are prospective for rare earth elements, especially neodymium and praseodymium, and uranium oxide mineralisation. Arctic Fox is contiguous and along strike from the world-class Nolans Bore REE project, which is set for commissioning in mid-2022 and has a JORC Compliant Mineral Resource. Additionally, Isbjorn is contiguous to the advanced Charley Creek REE project.

Internal review of recent reports by Adamas Intelligence on rare earth elements (REEs) and Canaccord Genuity on uranium have indicated favorable forward demand-supply dynamics, resulting in potential upward price pressure over the balance of the decade. Much of the anticipated incremental demand for REEs and uranium arises from green stimulus, decarbonization polices and increasing uptake of electric vehicles.

Geological consultancy appointed Megawatt has appointed ASX-listed Elmore Limited (ASX: ELE), an experienced geological consultancy and mining contract processor to manage the inaugural exploration campaign across the Artic Fox and Isbjorn […]

Click here to view original web page at www.juniorminingnetwork.com

3 Oversold Uranium Stocks That Are Glowing Buys

Investors may want to consider uranium stocks.

Just days ago, related stocks were nuked after CNN said the U.S. was looking into reports of a leak at a Chinese nuclear power plant. However, it appears investors overreacted.

“Monday’s drop looks like an outsize reaction for several reasons,” noted The Wall Street Journal’s Jinjoo Lee . “Uranium mining companies tend to operate on multiyear supply contracts with utilities, so there is little risk that a nuclear power plant would immediately pull back buying from these mining companies.”

China denied a leak, but did admit fuel rods had been damaged in a reactor.There are other reasons to keep your eyes on these uranium stocks. For example, oversold uranium stocks could get a boost from President Biden’s push for a potential uranium reserve. Plus, global demand for uranium was close to 180 million pounds in 2020. Market experts believe that this figure is set to […]

Revisiting Fission Uranium: The Stock Still Looks Overvalued Based On Fundamentals

Summary

The net present value of Patterson Lake South is close to zero at today’s long-term uranium prices.

There is an ongoing disconnect between uranium prices and the share prices of uranium miners.

In view of this, I think this is a good time to sell Fission Uranium. Professor25/iStock via Getty Images Investment thesis In December 2020, I wrote a bearish article on SA about Canadian uranium miner Fission Uranium ( OTCQX:FCUUF ) and the result is embarrassing. I wrote that the Patterson Lake South (PLS) uranium project looked worthless and Fission Uranium’s valuation has increased by more than 50% as of the time of writing.As Peter Lynch likes to say, if you’re good, you’re right six times out of ten. Sometimes, the share price of a company keeps soaring despite the fundamentals of the business not changing. It’s just how the stock market works.Looking at current uranium […]

enCore Energy Announces Positive Preliminary Economic Assessment (PEA) Results and combined, N.I. 43-101 Technical Report for its Juan Tafoya-Marquez Project, New Mexico

The PEA reports the Net Present Value ("NPV") for the project that ranges from $20.9 million using $60.00 per pound of yellowcake (U 3 O 8 ) to $71.2 million using $70.00 per pound of yellowcake with internal rate of returns ("IRR") ranging from 17% to 39% with corresponding yellowcake prices; these scenarios are pre-tax and assume a 7% discount rate. The break-even price of production is estimated to be $56.00 per pound.

"This initial PEA enables enCore to illustrate the economic opportunities of the combined Juan Tafoya and Marquez deposits which have been consolidated with the Westwater Resources transaction completed at year end 2020. This report assumed conventional underground operation and recovery through a newly constructed conventional mill, though the authors did acknowledge that further research may prove the property amenable to either in-situ recovery ("ISR") or heap leach processing; either of which would have a positive material […]

Click here to view original web page at www.juniorminingnetwork.com

NexGen to List on the Australian Securities Exchange

VANCOUVER, BC, June 24, 2021 /PRNewswire/ – NexGen Energy Ltd. (" NexGen " or the " Company ") (TSX: NXE) (NYSE: NXE ) is pleased to announce that it has filed a prospectus with the Australian Securities and Investments Commission ("ASIC") in connection with NexGen’s application for admission to the Australian Securities Exchange ("ASX") as a Foreign Exempt Listing and quotation of its shares as Chess Depositary Instruments ("CDIs") on July 2, 2021 under the code " NXG ".

Leigh Curyer, Chief Executive Officer, commented: "NexGen has grown a substantial investor following in Australia and the Asia Pacific region since its founding in 2011. At present, approximately 30% of the NexGen’s outstanding share capital is held by investors in the region. Given the stage of the Company’s development, the exceptional economic strength of the Rook I Project, and the accelerating demand for the responsible production of clean energy worldwide, it […]

Global Atomic Announces Results of Annual Meeting

TORONTO, June 24, 2021 /CNW/ – Global Atomic Corporation ("Global Atomic" or the "Company") (TSX: GLO ) (Frankfurt: G12) (OTCQX: GLATF) today announced shareholder voting results from the Annual Meeting of Shareholders held June 24, 2021.

Directors were elected to the Board as per the voting results in the table below:

Shareholders also approved the re-appointment of PricewaterhouseCoopers LLP as auditors of the Company.

About Global Atomic Global Atomic Corporation ( www.globalatomiccorp.com ) is a publicly listed company that provides a unique combination of high-grade uranium mine development and cash-flowing zinc concentrate production.The Company’s Uranium Division includes four deposits with the flagship project being the large, highgrade Dasa Project, discovered in 2010 by Global Atomic geologists through grassroots field exploration. With the issuance of the Dasa Mining Permit and an Environmental Compliance Certificate by the Republic of Niger, the Dasa Project is fully permitted for commercial production. Final design in support […]

Uranium Energy Corp. (AMEX:UEC) trade information

Uranium Energy Corp. (AMEX:UEC)’s traded shares stood at 3.43 million during the last session, with the company’s beta value hitting 2.46. At the close of trading, the stock’s price was $2.81, to imply a decrease of -0.71% or -$0.02 in intraday trading. The UEC share’s 52-week high remains $3.67, putting it -30.6% down since that peak but still an impressive 70.82% since price per share fell to its 52-week low of $0.82. The company has a valuation of $671.28M, with an average of 7.43 million shares in intraday trading volume over the past 10 days and average of 5.86 million shares over the past 3 months.

Analysts have given a consensus recommendation of a Buy for Uranium Energy Corp. (UEC), translating to a mean rating of 1.70. Of 3 analyst(s) looking at the stock, 0 analyst(s) give UEC a Sell rating. 0 of those analysts rate the stock as Overweight […]

Click here to view original web page at marketingsentinel.com

50% Reduction in Carbon Emissions by 2030 Means Opportunities Now

NEW YORK, June 24, 2021 /PRNewswire/ — Every president wants a legacy and President Joe Biden wants to put his stamp on climate change. Only a few months into his term, President Biden has pledged to slash U.S. greenhouse gas emissions by a minimum of 50–52 percent by 2030, an undertaking that doubles the nation’s prior promise under the 2015 Paris Climate Agreement. Further out, the target is net zero carbon emissions by 2050. These aggressive goals require immediate action, including addressing the fact that almost 40 percent all carbon dioxide pollution is created by power plants burning fossil fuels. The International Energy Agency (IEA) recently published its comprehensive plan to cap the global temperature rise to 1.5°C by 2050, which includes a combination of wind, solar and nuclear to phase out fossil fuels. Today, the world is at a tipping point for the energy sector, presenting opportunities to […]

enCore Energy Announces Positive Preliminary Economic Assessment (PEA) Results and combined, N.I. 43-101 Technical Report for its Juan Tafoya-Marquez Project, New Mexico

CORPUS CHRISTI, Texas, June 24, 2021 /CNW/ – enCore Energy Corp. (TSXV: EU ) (OTCQB: ENCUF) (the " Company " or " enCore ") is pleased to announce the results of a Preliminary Economic Assessment ("PEA") for the company’s recently consolidated Juan Tafoya and Marquez projects located in the Grant’s Uranium District in northwest New Mexico. This is the first PEA for the projects as this is the only time in recent history that the two contiguous mineralized properties have been held under the same company. The PEA was constructed based on a combined and updated NI 43-101 Technical Report using an Indicated resource of 7.1 million tons at a grade of 0.127% eU 3 O 8 for a total of 18.1 million pounds of U 3 O 8 .

The PEA reports the Net Present Value ("NPV") for the project that ranges from $20.9 million using $60.00 per pound […]

Megawatt appoints Elmore Limited to Lead Fieldwork at Prime Australian Rare Earth & Uranium Projects

VANCOUVER, BC, June 24, 2021 /PRNewswire/ – Megawatt Lithium and Battery Metals Corp. (CSE: MEGA) (FSE: WR20) (OTC PINK: WALRF) (the "Company" or "Megawatt") is pleased to announce that geological consultancy, Elmore Limited of Perth Australia has been appointed to take the lead in developing the Artic Fox and Isbjorn properties in Northern Territory, Australia.

Legacy desktop work has verified the two properties are prospective for rare earth elements, especially neodymium and praseodymium, and uranium oxide mineralisation. Arctic Fox is contiguous and along strike from the world-class Nolans Bore REE project, which is set for commissioning in mid-2022 and has a JORC Compliant Mineral Resource. Additionally, Isbjorn is contiguous to the advanced Charley Creek REE project.

Internal review of recent reports by Adamas Intelligence on rare earth elements (REEs) and Canaccord Genuity on uranium have indicated favorable forward demand-supply dynamics, resulting in potential upward price pressure over the balance of the […]

Why these 2 ASX uranium shares are leaping higher again today

ASX uranium shares have broadly outperformed the market in 2021. And 2 of the biggest ASX uranium shares are gaining once more, charging higher in late afternoon trade.

The Paladin Energy Ltd (ASX: PDN) share price is up 9.03% at time of writing, trading at 51 cents per share.

The Boss Energy Ltd (ASX: BOE) share price is also running hot, up 6.9% to 15.5 cents per share. What’s driving investor interest in ASX uranium shares?

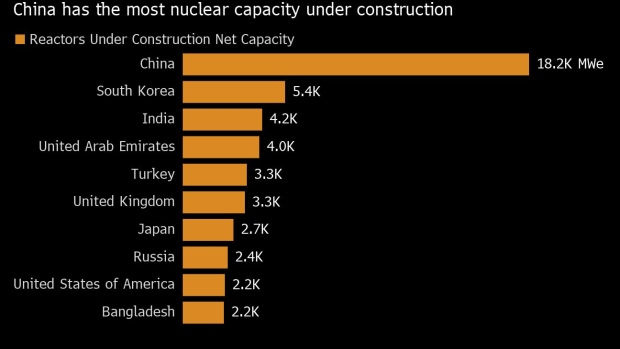

Demand for nuclear fuel plummeted following Japan’s earthquake and tsunami driven Fukushima nuclear disaster in 2011. Which spelled bad news for ASX uranium shares in the aftermath.But as the world is increasingly focused on decarbonising, uranium is back in the spotlight. And prices have been steadily rising since hitting lows of US$24 per pound in February 2020, up to US$32.30 per pound currently.Atop growing interest in new nuclear power plants in the United States under […]

Lotus Resources kicks off first drilling in 15 years at Kayelekera uranium project

A 5,000 metre RC drilling program will commence this week at Lotus’ Kayelekera uranium project. Lotus Resources (ASX: LOT) will this week begin a 5,000m drilling program at its Kayelekera uranium mine in Malawi, the first uranium exploration drilling program at the project in more than 15 years.

This is the next stage in the company’s plan to re-open the mine’s after more than six years in mothballs.

Lotus has a current resource of 376.5 million pounds of uranium oxide.

Reverse circulation drilling will test airborne radiometric anomalies located close to the existing processing plant and will aim at increasing the project’s 14-year mine life forecast.Lotus says a regional uranium exploration assessment is also under way. Mining can proceed on existing resource This includes a more detailed review of the historical data available on the four most prospective exploration licences, together with mapping, radiometric prospecting and sampling.However, managing director Keith Bowes notes […]

Argentina: the future of uranium

The uranium industry has definitely been on a rollercoaster ride for the past 20 years, but sentiment continues to rise as the role of nuclear power gains momentum in today’s climate. While Australia, Kazakhstan and Canada have led the way for production in recent years, Blue Sky Uranium believes they hold the key to the future of uranium in the Americas: Argentina.

The TSX Venture, FSE and OTC-listed Blue Sky Uranium Corp has staked its claim on Argentina’s nuclear ambitions, with 100% control of more than 450,000 hectares of mining tenures, after discovering a 145-kilometre uranium trend more than 15 years ago.

The Amarillo Grande Uranium-Vanadium project in the central Rio Negro province includes the country’s largest NI 43-101 resource estimate for uranium, as well as a significant vanadium credit.

Blue Sky’s President and CEO Nikolaos Cacos said the company is already drilling two of its targets within the deposit while awaiting […]

Click here to view original web page at www.mining-journal.com

Watch These Commodity Stocks

The recent sharp decline in commodities put the skids on the red-hot bull run we saw in the first half of this year. The U.S. Fed’s signal that the rate hike could come sooner than expected pushed up the U.S. dollar, and sent commodities tumbling due to the inverse relationship between the two. The commodities downdraft further intensified on the signs of the Chinese government tightening its monetary policy. Analysts say the pullback was overdue after increased industrial demand on the back of economic reopening sent commodities soaring in the first half of the year. The S&P GSCI, index that serves as a benchmark for commodities investments, has gained 27% for the year to date, far surpassing the nearly 11% gains for the S&P 500 index and just over than 17% for the S&P/TSX Composite Index, as of June 18.

Investors looking to add commodity exposure may want to keep […]

Australia Lines Up Third Uranium Mine as Nuclear Momentum Builds

BC-Australia-Lines-Up-Third-Uranium-Mine-as-Nuclear-Momentum-Builds , James Thornhill (Bloomberg) — The planned restart of a mothballed uranium mine in Australia — the world’s third-largest producer — is a fresh sign that developers are beginning to respond to an improving demand outlook and the support of the Biden administration for zero-emissions nuclear energy.

The Honeymoon mine, which was shuttered in 2014 due to weak prices, could be re-started in 12 months, developer Boss Energy Ltd. said in a feasibility study. The company was just waiting for a stronger price signal, according to Chief Executive Officer Duncan Craib, adding that he was confident market dynamics were moving in the right direction.

“There is significant uncovered demand in the coming decades — and post-2023, primary supply to meet that demand is severely limited,” Craib said in a phone interview. He was seeing most interest from potential buyers in the U.S., which accounted for over 20% of global uranium […]

Australia lines up third uranium mine as nuclear momentum builds

By James Thornhill

June 23, 2021 — 1.55pm

, register or subscribe to save articles for later.

The planned restart of a mothballed uranium mine in here Australia is a fresh sign that developers are beginning to respond to an improving demand outlook and the support of the Biden administration for zero-emissions nuclear energy.The Honeymoon mine in South Australia, which was shuttered in 2014 due to weak prices, could be re-started in 12 months, developer Boss Energy said in a feasibility study. The company was just waiting for a stronger price signal, according to Chief Executive Officer Duncan Craib, who said he was confident market dynamics were moving in the right direction.“There is significant uncovered demand in the coming decades — and post-2023, primary supply to meet that demand is severely limited,” Craib said in a phone interview. He was seeing most interest from potential buyers in the US, which accounted […]

Frederick Kozak on Appia Energy’s rare earths and uranium exploration program, recent financing and Jack Lifton appointment

In a recent InvestorIntel interview, Tracy Weslosky speaks with Frederick Kozak, President of Appia Energy Corp. (CSE: API | OTCQB: APAAF) about Appia’s fully-funded summer rare earths and uranium exploration program plans in the prolific Athabasca Basin.

In this InvestorIntel interview, which may also be viewed on YouTube ( click here to subscribe to the InvestorIntel Channel ), Frederick went on to explain why there is so much industry interest in Appia Energy and explained the significance of Appia’s recently closed $5.75 million bought deal financing . Having closed the financing only a month ago on May 19th, Frederick said, “…the equity holders in the financing are looking at a great return on their investment so far.” Appia recently announced the appointment of global rare earths expert, Jack Lifton, as a consultant and advisor to the Board of Directors. “If you are going to have a strategic advisor on your […]

Australia Lines Up Third Uranium Mine as Nuclear Momentum Builds

The planned restart of a mothballed uranium mine in Australia — the world’s third-largest producer — is a fresh sign that developers are beginning to respond to an improving demand outlook and the support of the Biden administration for zero-emissions nuclear energy.

The Honeymoon mine, which was shuttered in 2014 due to weak prices, could be re-started in 12 months, developer Boss Energy Ltd. said in a feasibility study . The company was just waiting for a stronger price signal, according to Chief Executive Officer Duncan Craib, adding that he was confident market dynamics were moving in the right direction.

“There is significant uncovered demand in the coming decades — and post-2023, primary supply to meet that demand is severely limited,” Craib said in a phone interview. He was seeing most interest from potential buyers in the U.S., which accounted for over 20% of global uranium demand, while he was also […]

London Shares Trade Flat; Crude Gains Lift Oil -2-

Global News Select 0850 GMT – DS Smith still faces hurdles, but the outlook is improving, says Interactive Investor after the packaging manufacturer reported lower annual revenue and profit. Like other companies, Smith has had to tackle higher costs resulting from pandemic-related safety and operational changes and extreme supply constraints, hitting profit and revenue in the year to April, Interactive says. Still, the year ended better than it started, leaving Smith relatively well-placed to cash in on increased demand for packaging as people buy more goods online. "In particular, strong second-half momentum has continued into the new financial year, which bodes well for prospects, while some of the previously incurred costs will be recovered by higher pricing for customers," Interactive’s Richard Hunter says. (philip.waller@wsj.com)

Uranium Market Fundamentals Point to Price Strengthening

0847 GMT – The uranium price is up 7.5% year to date, supported by a recovery of sentiment around global […]

LIBERTY STAR URANIUM & METALS : Management’s Discussion and Analysis of Financial Condition and Results of Operations. (form 10-Q)

Much of the information included in this quarterly report includes or is based upon estimates, projections or other "forward-looking statements". Such forward-looking statements include any projections or estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Such estimates, projections or other "forward-looking […]

Click here to view original web page at www.marketscreener.com

Uranium Energy Corp. Insider Trading: What Did We Learn?

Uranium Energy Corp. (AMEX:UEC) price is hovering lower on Monday, June 21, dropping -3.98% below its previous close.

A look at today’s price movement shows that the recent level at last check reads $2.89, with intraday deals fluctuating between $2.85 and $3.04. Taking into account the 52-week price action we note that the stock hit a 52-week high of $3.67 and 52-week low of $0.82. The stock subtracted -6.47% on its value in the past month.

Uranium Energy Corp., which has a market valuation of $690.39 million. Analysts tracking UEC have forecast the quarterly EPS to shrink by 0 per share this quarter, while the same analysts predict the annual EPS to hit -$0.06 for the year 2021 and up to $0.01 for 2022. In this case, analysts estimate an annual EPS growth of 25.00% for the year and 116.70% for the next year.

Staying with the analyst view, there is a […]

Uranium Energy Corp. (UEC) is on the roll with an average volume of 6.23M in the recent 3 months

Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $2.89 to be very precise. The Stock rose vividly during the last session to $3.04 after opening rate of $2.96 while the lowest price it went was recorded $2.85 before closing at $2.96.

Recently in News on June 9, 2021, Uranium Energy Corp Files Fiscal 2021 Q3 Quarterly Report. NYSE American: UEC. You can read further details here

Investing in stocks under $10 could significantly increase the returns on your portfolio, especially if you pick the right stocks! Within this report you will find 5 top stocks that offer investors huge upside potential and the best bang for their buck.

Add them to your watchlist before they take off! Get the Top 5 Stocks Now! SponsoredUranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for […]

Global Atomic Strengthens Operations and Corporate Teams in Preparation for Building the Dasa Project

Global Atomic Corporation announced today the appointment of four new members to its operations and corporate teams as the Company nears the completion of its Feasibility Study for the Dasa Uranium Project in the Republic of Niger . Recent appointments include: Pierre Hardouin VP Finance Ian Moffatt Project Superintendent, Dasa Project Becher Raffoul Information Technology Manager Jacques Tremblay P. Eng., Manager, …

Global Atomic Corporation (“Global Atomic” or the “Company”), (TSX: GLO) (OTCQX: GLATF) (FRANKFURT: G12) announced today the appointment of four new members to its operations and corporate teams as the Company nears the completion of its Feasibility Study for the Dasa Uranium Project in the Republic of Niger . Recent appointments include: Pierre Hardouin , VP Finance

Ian Moffatt , Project Superintendent, Dasa Project

Becher Raffoul , Information Technology Manager Jacques Tremblay , P. Eng., Manager, Mining Operations, Dasa Project Stephen G. Roman , […]

Enriched Uranium Market Detailed Analysis of Current Industry Figures With Forecasts Growth by 2027| Sinosteel, CNNC, Sinohydro

Los Angeles, United State: QY Research studies the Global Enriched Uranium Market in its latest research report. The report is a fine example of comprehensive and accurate research study on the global Enriched Uranium market. It digs deep into critical aspects of the global Enriched Uranium market, including market dynamics, competition, regional advancement, and segmentation. It provides verified market figures such as CAGR, market share, revenue, volume, production, consumption, gross margin, and price. The global Enriched Uranium market is segmented by type, application, and geography. The report is compiled with the use of latest primary and secondary research methodologies and tools. Buyers can ask for customization of the report as per their needs. You can also purchase specific sections of the report if your requirement is not for the complete research study.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample-form/form/3205717/global-enriched-uranium-market […]