For the readers interested in the stock health of Uranium Energy Corp. (UEC). It is currently valued at $2.92. When the transactions were called off in the previous session, Stock hit the highs of $3.15, after setting-off with the price of $3.08. Company’s stock value dipped to $3.00 during the trading on the day. When the trading was stopped its value was $3.13.Recently in News on August 2, 2021, Uranium Energy Corp Announces Results of Annual General Meeting. NYSE American symbol – UEC. You can read further details here

Uranium Energy Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $3.67 on 03/16/21, with the lowest value was $1.51 for the same time period, recorded on 01/21/21.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula […]

There’s an ETF sending one market haywire. A hedge-fund pro says bitcoin-like gains may come next.

Rail trucks loaded with rocks containing uranium ore wait for transportation in the Rozna mine, in 2014. We’ll take a break from the is-bad-news-on-economy-good-news-for-the-stock market discussion, to take a look at a commodities market skyrocketing in recent weeks — uranium.

Uranium futures topped $40 per pound on Tuesday for the first time in six years, and have surged 33% since mid-August. That’s propelled other uranium plays, such as Canadian producer Cameco CCJ, +5.88% , and the Global X Uranium ETF URA, +4.18% , which invests in uranium miners and other nuclear component producers. Uranium futures have surged since mid-August. Harris Kupperman, the president of hedge fund Praetorian Capital, said what’s happening is that one exchange-traded fund, the Sprott Physical Uranium Trust , is now buying uranium to store it — basically, to keep it out of the hands of the nuclear power plant operators who need it. “It’s just going […]

Bears Are Back On The Defensive As Uranium Energy Corp. (UEC) swung 5.03%

Uranium Energy Corp. (AMEX:UEC) has a beta value of 2.42 and has seen 9.08 million shares traded in the last trading session. The company, currently valued at $583.06M, closed the last trade at $3.13 per share which meant it gained $0.15 on the day or 5.03% during that session. The UEC stock price is -17.25% off its 52-week high price of $3.67 and 73.8% above the 52-week low of $0.82. If we look at the company’s 10-day average daily trading volume, we find that it stood at 7.61 million shares traded. The 3-month trading volume is 4.81 million shares.

The consensus among analysts is that Uranium Energy Corp. (UEC) is a Buy stock at the moment, with a recommendation rating of 1.50. 0 analysts rate the stock as a Sell, while 0 rate it as Overweight. 0 out of 2 have rated it as a Hold, with 2 advising it […]

Click here to view original web page at marketingsentinel.com

Guy on Rocks: Uranium — glowing in the dark

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”. Market Ructions

Gold was up US$18 at one-point before settling at US$1,828/ounce for the week after abysmal non-farm payrolls that came in at 235,000 (consensus 720,000). Data for July and August however was revised upwards slightly while US unemployment fell from 5.4% (July) to 5.25% (August).

Wage inflation was up 0.60% in August from 0.40% recorded in July.

I wonder what Uncle Jerome is going to do now? Let me guess, print more greenbacks…? Other economic data out last week was also somewhat tepid with the Institute for Supply Management (ISM) non-manufacturing index returning 61.7% (consensus 61.9%) for […]

Sprott’s investment in uranium is paying off and it’s just the start

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! (Kitco News) – Sprott Inc’s foray into the uranium market appears to be paying off as prices have recently climbed to new decade highs with an increase in trading activity.

According to some analysts, the Sprott Physical Uranium Trust (NYSE: U.U), which began trading July 19, is a critical factor behind the recent push in the energy metal’s price. The Trust gives investors direct access to physical metal.

According to TradeTech, which tracks uranium, the price is currently trading around $33.80 per pound. In 2008 the metal was trading around $136 a pound.

In an interview with Kitco News, when the Trust first launched, Peter Grosskopf, CEO of Sprott Inc., said he saw this as a game-changer for the Uranium […]

GoviEx Uranium Appoints Endeavour Financial as Financial Advisor

GVXXF ) (" GoviEx " or " Company "), is pleased to announced today the appointment of Endeavour Financial to provide financial advisory services with respect to GoviEx’s mine permitted Madaouela uranium project in the Republic of Niger (the " Madaouela Project ").

Daniel Major, Chief Executive Officer, commented, "We look forward to working with the Endeavour Financial in developing the optimum financing solution for the Madaouela Project. Endeavour Financial provides a full service approach towards the financial advisory role including support on debt advisory, offtake finance and technical and environmental guidance. Endeavour Financial’s track record in mine financing and especially in developing jurisdictions including Africa speaks for itself and their decision to work with GoviEx I believe underlines the quality of the Madaouela Project. We expect that ultimately production financing will be some combination of debt, royalties or streaming, and equity, with a focus on keeping the equity […]

Click here to view original web page at www.juniorminingnetwork.com

Guy on Rocks: Uranium — glowing in the dark

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”. Market Ructions

Gold was up US$18 at one-point before settling at US$1,828/ounce for the week after abysmal non-farm payrolls that came in at 235,000 (consensus 720,000). Data for July and August however was revised upwards slightly while US unemployment fell from 5.4% (July) to 5.25% (August).

Wage inflation was up 0.60% in August from 0.40% recorded in July.

I wonder what Uncle Jerome is going to do now? Let me guess, print more greenbacks…? Other economic data out last week was also somewhat tepid with the Institute for Supply Management (ISM) non-manufacturing index returning 61.7% (consensus 61.9%) for […]

enCore Energy and Azarga Uranium To Combine To Create Leading American Uranium ISR Company

enCore Energy Corp. (CNW Group/enCore Energy Corp.) Azarga Uranium Corp. (CNW Group/enCore Energy Corp.) CORPUS CHRISTI, Texas, Sept. 7, 2021 /PRNewswire/ – enCore Energy Corp. (" enCore ") (TSXV: EU) (OTCQB: ENCUF ) and Azarga Uranium Corp. (" Azarga ") (TSX: AZZ) (OTCQB: AZZUF ) (FRA: P8AA) are pleased to announce that they have entered into a definitive arrangement agreement (the " Agreement ") whereby enCore will acquire all of the issued and outstanding common shares of Azarga pursuant to a court-approved plan of arrangement (the " Transaction "). The Transaction consolidates an industry leading pipeline of exploration and development staged in-situ recovery (" ISR ") focused uranium projects located in the United States, including the licensed Rosita & Kingsville Dome past producing uranium production facilities in South Texas, the advanced stage Dewey Burdock development project in South Dakota, which has been issued its key federal permits, the PEA-staged […]

GoviEx Appoints Endeavour Financial as Financial Advisor

GoviEx Uranium Inc. is pleased to announced today the appointment of Endeavour Financial to provide financial advisory services with respect to GoviEx’s mine permitted Madaouela uranium project in the Republic of Niger .Daniel Major, Chief Executive Officer, commented, “We look forward to working with the Endeavour Financial in developing the optimum financing solution for the Madaouela Project. Endeavour …

GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) (“GoviEx” or “Company”), is pleased to announced today the appointment of Endeavour Financial to provide financial advisory services with respect to GoviEx’s mine permitted Madaouela uranium project in the Republic of Niger (the “Madaouela Project”).

Daniel Major, Chief Executive Officer, commented, “ We look forward to working with the Endeavour Financial in developing the optimum financing solution for the Madaouela Project. Endeavour Financial provides a full service approach towards the financial advisory role including support on debt advisory, offtake finance and technical and environmental guidance. […]

GoviEx Appoints Head of Investor Relations and Corporate Communications

GoviEx Uranium Inc. announces that it has appointed Isabel Vilela as Head of Investor Relations and Corporate Communications, effective immediately.Ms. Vilela brings with her over ten years of experience in investor relations, having previously worked as head of Investor Relations for Hochschild Mining plc and Cookson Group plc, as well as a wealth of experience in ESG, corporate communications and public relations. …

GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) (“GoviEx” or “Company”) announces that it has appointed Isabel Vilela as Head of Investor Relations and Corporate Communications, effective immediately.

Ms. Vilela brings with her over ten years of experience in investor relations, having previously worked as head of Investor Relations for Hochschild Mining plc and Cookson Group plc, as well as a wealth of experience in ESG, corporate communications and public relations.

Ms. Vilela will build on GoviEx’s current Investor Relations program to grow and diversify the Company’s shareholder base as […]

GoviEx Uranium Appoints Head of Investor Relations and Corporate Communications

Ms. Vilela brings with her over ten years of experience in investor relations, having previously worked as head of Investor Relations for Hochschild Mining plc and Cookson Group plc, as well as a wealth of experience in ESG, corporate communications and public relations.

Ms. Vilela will build on GoviEx’s current Investor Relations program to grow and diversify the Company’s shareholder base as well as to enhance its communications with shareholders and stakeholders, and will be actively engaged in the ongoing development of GoviEx’s ESG management programs. Isabel will work closely with the management team to further develop the company’s internal and external communications with a focus on strategy, branding, social media presence and investor communications.

Ms. Vilela will report to Daniel Major, CEO, and will be based in the UK. In conjunction with her appointment and pursuant to the Company’s stock option plan, Ms. Vilela is eligible to be granted a […]

Click here to view original web page at www.juniorminingnetwork.com

Fission Uranium Metallurgical Hole Hits 50.3m of continuous mineralization including 28.5m of continuous +10,000 cps at R840W Zone

Additional highlights include 82.5m of continuous mineralization with 8.74m composite +10,000 cps

June 10, 2021). All seven holes intersected mineralization with all four metallurgical and two geotechnical holes intersecting wide intervals of strong mineralization. They follow the recently announced, highly successful resource expansion drilling on the zone that hit high-grade mineralization in nineteen holes (see news release dated August 31, 2021). Of particular note, hole PLS21-MET-004 (line 615W) intersected 50.3m of continuous mineralization, including 28.5m of total composite radioactivity >10,000 cps (with a peak of 65,500 cps) . Assays are pending. The metallurgical and geotechnical testwork drilling at the R840W is part of the data collection in anticipation that the R840W zone will be included in the Feasibility Study.

Ross McElroy, President and CEO for Fission, commented, " The metallurgical and geotechnical testwork holes on the R840W zone serve a dual purpose. They not only provide material and information necessary […]

Click here to view original web page at www.juniorminingnetwork.com

Europe Uranium Mining Market Pointing to Capture Largest Growth 2028

Media releases are provided as is by companies and have not been edited or checked for accuracy. Any queries should be directed to the company itself.

Uranium Mining Market Size By Regional(Europe, North America, South America, Asia Pacific, Middle East And Africa), Industry Growth Opportunity, Price Trends, Competitive Shares, Market Statistics and Forecasts 2021 – 2028

" Uranium Mining Market ( 2021 Updated )

The Global Uranium Mining Market report provides information about the Global industry, including valuable facts and figures. This research study explores the Global Market in detail such as industry chain structures, raw material suppliers, with manufacturing The Uranium Mining Sales market examines the primary segments of the scale of the market. This intelligent study provides historical data from 2015 alongside a forecast from 2021 to 2028.Results of the recent scientific undertakings towards the development of new Uranium Mining products have been studied. Nevertheless, the factors affecting the […]

Uranium Week: Record Jump For Uranium Price

After the largest three week rise on record for the uranium price, brokers lift their long-term uranium price forecasts and raise price targets for shares.

-Largest spot market volumes since 1966

-Long-term uranium forecast price of US$60

-The long-term uranium price is trading -2% below the mid-term price

-Uranium spot price rises over 15% for the week

After trending upward since May, the uranium price has climbed the most on record for a three-week period. Over the last week, TradeTech’s Weekly Spot Price Indicator jumped by US$5.20 to US$39.00/lb. More than 3.7mlbs U3O8 involving 21 transactions occurred in the final three days of last week.The total spot market volume for August was 13.2mlbs from 55 transactions. This is the largest transaction volume total recorded in a single month in the uranium spot market since 1996. A significant contributing factor in the price rise has been the mid-August launch of […]

Why Did Uranium Royalty Corp. (NASDAQ: UROY) Drop So Much?

Uranium Royalty Corp. (NASDAQ:UROY) traded at $3.20 at close of the session on Friday, September 3, made a downward move of -1.54% on its previous day’s price.

Looking at the stock we see that its previous close was $3.25 with the day’s price range being $3.12 – $3.30. In terms of its 52-week price range, UROY has a high of $3.81 and a low of $0.81. The company’s stock has gained about 20.75% over that past 30 days.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for […]

The Match Out: ‘Buy the Dip’ alive & well, IT leads the way, Uranium remains hot

While a +5pt gain at the index level implies a lacklustre session, there was a lot happening under the hood. It was a major turnaround from early weakness which had the market hit a 7440 low before rallying unabated to close at 7528, a +88pt turnaround as the wall of money buys weakness.

That is very typical of a strong market and while some will list all the entertaining reasons for a market top, the trend remains up and that’s all we need to focus on for now, plus of course backing the right ponies in the race. The ASX 200 finished up +5pts / +0.07% to 7528

Tech & Retailers did best while a delay in the DD timeline for the Santos (STO) & Oil Search (OSH) tie up saw the energy sector lag

Materials down 1% however FMG down ~11% didn’t help, a drop of $2.28 […]

Click here to view original web page at www.livewiremarkets.com

Resources Top 5: More uranium, an aborted pump, and another stock jumps on the lithium gravy train

share

Another alleged Telegram group pump, this time involving recently listed explorer Albion Resources

Eastern Iron inks deal with $7.7 billion market cap Chinese firm Yahua to acquire and develop lithium projects

Energy Metals, A-Cap today’s beneficiaries of emerging uranium boom Another alleged Telegram group pump, similar to last week’s TTA Holdings (ASX:TTA) effort.While the pumpers used the same playbook, this time the ASX fun police jumped in before Albion could build up real momentum.The recently listed ~$13m market cap explorer gained about 24% before being paused, just 4 minutes and 8 seconds into trading. It fell back once trading resumed.Albion’s main projects include the ‘Lennard Shelf’ (zinc, lead) and ‘Leinster’ (nickel, copper, gold) projects, both in WA. Drilling Leinster will be announced soon, the company said in August. Another small cap looking to jump on the lithium gravy train .The iron ore explorer has inked […]

DR Congo to beef up security at uranium mine for WWII era bombs

The rush for cobalt, a mineral used in aircraft engines and lithium-ion batteries, has spurred illegal mining in the DR Congo

AFP/File | SAMIR TOUNSI

LUBUMBASHI – Authorities in DR Congo say they will beef up security against illegal mining at a pit that provided the uranium for the bombs dropped by the United States on Japanese cities Hiroshima and Nagasaki in 1945.

Illicit miners have been entering the Shinkolobwe mine, in the southeastern Democratic Republic of Congo, in search of cobalt and copper which fetch high prices, a local campaigner says.Uranium, in small quantities and locked in copper ore, can also be found in the Shinkolobwe mine, located 150 kilometres (95 miles) north of Lubumbashi.Owned by the state mining giant Gecamines, Shinkolobwe provided most of the uranium ore that was used to make the "Little Boy" and "Fat Man" bombs — and was officially closed in 1960.However, "surreptitious mining" has been […]

5 Top Weekly TSXV Stocks: Uranium Explorers Surge Ahead

The S&P/TSX Venture Composite Index (INDEXTSI: JX ) was on the rise last week, opening at 893.19 and finishing on Friday (September 3) at 923.99.

A weaker-than-expected jobs report out of the US proved beneficial for the gold price during the period.

Meanwhile, uranium stocks on the TSXV were on the rise last week after the commodity reached its highest level since 2015, with futures trading above the US$38 per pound level. Uranium Price Forecasts and Top Uranium Stocks to Watch Last week’s five TSXV-listed mining stocks that saw the biggest gains are as follows: IsoEnergy (TSXV: ISO )

ALX Resources (TSXV:AL) Standard Uranium (TSXV:STND) Kiplin Metals (TSXV: KIP ) GoviEx Uranium (TSXV: GXU ) Here’s a look at those companies and the factors that moved their share prices last week. 1. IsoEnergy IsoEnergy is a uranium exploration and development company focused on the eastern part of Saskatchewan’s […]

5 Top Weekly TSX Stocks: Uranium Price Rises, Stocks Follow

The S&P/TSX Composite Index (INDEXTSI: OSPTX ) opened higher last Friday (September 3), trading at 20,809.25 by midday. It closed the five day period at 20,819.98.

Commodities prices pushed mining stocks up, which supported gains for the index.

On Friday, gold and silver climbed following a US jobs report that came in well below expectations . Meanwhile, uranium saw a price surge to a six year high, with junior mining stocks also going up. Uranium Price Forecasts and Top Uranium Stocks to Watch Uranium Soared Last Year While Other Resources Tumbled

What’s In Store For Uranium This Year? Find Out In Our Exclusive FREE 2021 Uranium Outlook Report featuring trends, forecasts, expert interviews and more! Last week’s five TSX-listed mining stocks that saw the biggest gains are as follows: Fission Uranium (TSX:FCU) Mega Uranium (TSX: MGA ) Global Atomic (TSX: GLO ) Forsys Metals (TSX: FSY ) Laramide Resources […]

Hot Money Monday: Uranium runs hot; helium runs hotter

Just like when the recent lithium frenzy saw the Running Hot list populated by junior lithium plays, this week saw ASX uranium stocks make their move. But it was the $6.5m oil & gas minnow Grand Gulf Energy (ASX:GGE) which ran hottest this week with an RSI of 92. Each week, Stockhead recaps ASX stocks that are “running hot” as deduced by the Relative Strength Index (RSI).

The RSI is a technical gauge which measures how trading momentum is affecting the price action.

A reading of 70 is seen as the level at which a company may have been overbought. If a stock has a reading of 30 or below, it could be undervalued.

Click here for a more detailed rundown of what the RSI does and how it’s used.While there’s usually a pretty good reason if a given stock is running hot (or cold), investors are also on the lookout […]

Engineering firm enters Kazakhstan uranium industry

The GJC uranium packaging plant headed to Kazakhstan this week. GJC has been involved in the uranium industry for more than 20 years and has previously exported packaging plants to Africa, but the Kazakhstan sale is the company’s first export to the region, which has produced most of the world’s uranium in the last decade.

The fully automated plant, which is built to fit inside a shipping container to allow for shipping ease and has taken a year to complete, was manufactured and constructed in Adelaide using many components also locally produced.

It is GJC’s third-generation unit that is used to remove the human element of packaging the radioactive yellowcake produced from uranium mining into drums before it is transported.

GJC has exported the packaging plants to developing countries since 2007 due to the shortage of resources and skilled tradespeople in the regions making it difficult for quality products to be engineered […]

Hot Money Monday: Uranium runs hot; helium runs hotter

Pic: Giphy.com share

Just like when the recent lithium frenzy saw the Running Hot list populated by junior lithium plays, this week saw ASX uranium stocks make their move.

But it was the $6.5m oil & gas minnow Grand Gulf Energy (ASX:GGE) which ran hottest this week with an RSI of 92.

Each week, Stockhead recaps ASX stocks that are “running hot” as deduced by the Relative Strength Index (RSI).The RSI is a technical gauge which measures how trading momentum is affecting the price action.A reading of 70 is seen as the level at which a company may have been overbought. If a stock has a reading of 30 or below, it could be undervalued. Click here for a more detailed rundown of what the RSI does and how it’s used.While there’s usually a pretty good reason if a given stock is running hot (or cold), investors are also on the […]

Where Fundamentals Meet Technicals: TCEHY, TWTR, CCJ

This issue of “Where Fundamentals Meet Technicals” looks at two growth stocks and one commodity stock.

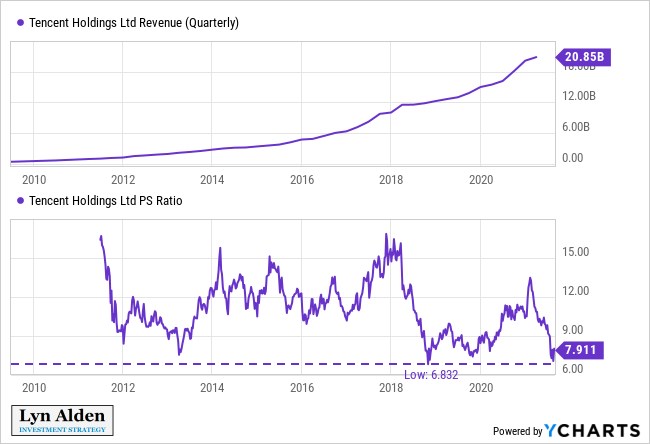

Tencent: Decision Time

Tencent (TCEHY) is a diversified corporation that operates China’s biggest social networks, one of the two main Chinese payment platforms, and a global gaming business. They hold stakes in companies like JD (JD) and Sea Ltd (SE), as well as many other companies around the world.

And like most Chinese companies, especially tech/media companies, their stock has been utterly destroyed by a major government crackdown on the industry, along with a downturn in China’s credit cycle. Sentiment on China is about as bad as it gets.In terms of valuation, the stock bounced off the all-time low valuation level that it reached a few years ago when the Chinese government stopped approving its games for a year: The F.A.S.T. Graph shows either 1) analysts are wrong about their earnings forecasts, or 2) […]

Click here to view original web page at www.elliottwavetrader.net

Q&A: Orano Conversion & Enrichment CEO Jacques Peythieu

Jacques Peythieu, Chief Executive Officer of Orano Conversion & Enrichment, discusses the company’s recovery from the impacts of the pandemic and industrial action, 2020 results, production ramp up at its Philippe Coste plant in France, and possible transformation of the conversion market due to the recently announced restart of Honeywell’s conversion plant at Metropolis in the USA. He also assesses the prospects of enrichment market and the expected requirements for HALEU (high-assay low-enriched uranium), as well as potential hurdles to supply capabilities or to transportation of this material. A multinational nuclear fuel cycle company headquartered in Hauts-de-Seine, France, Orano has an order book worth EUR26 billion (USD31 billion). Jacques Peythieu (Image: Orano)

How has Orano managed the disruption caused by COVID-19 and what are the lessons learned from the strikes at the Malvési conversion plant?

Given the situation in Wuhan we decided as soon as January 2020 to revisit […]

Click here to view original web page at www.world-nuclear-news.org