Nathan Barsi becomes UEX District Geologist UEX Corporation is pleased to announce the promotions of Mr. Christopher Hamel to the Company’s new Vice President, Exploration and Mr. Nathan Barsi to the role of District Geologist, Athabasca Basin effective October 1, 2021 Christopher “Chris” Hamel P.Geo., joined UEX in 2016 and held the positions of Chief Geologist from 2017 to 2020 and Exploration Manager since …

(TheNewswire) Nathan Barsi becomes UEX District Geologist

UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“ UEX ” or the “ Company ”) is pleased to announce the promotions of Mr. Christopher Hamel to the Company’s new Vice President, Exploration and Mr. Nathan Barsi to the role of District Geologist, Athabasca Basin effective October 1, 2021

Christopher “Chris” Hamel P.Geo., joined UEX in 2016 and held the positions of Chief Geologist from 2017 to 2020 and Exploration Manager since January, 2021. Chris has been employed in mineral […]

We’re Hopeful That Elevate Uranium (ASX:EL8) Will Use Its Cash Wisely

There’s no doubt that money can be made by owning shares of unprofitable businesses. For example, Elevate Uranium ( ASX:EL8 ) shareholders have done very well over the last year, with the share price soaring by 600%. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky Elevate Uranium’s cash burn is. In this report, we will consider the company’s annual negative free cash flow, henceforth referring to it as the ‘cash burn’. The first step is to compare its cash burn with its cash reserves, to give us its ‘cash runway’. How Long Is Elevate Uranium’s Cash Runway?

A company’s cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In […]

Global Atomic Signs Letter of Intent with CMAC-Thyssen for Portal and Underground Development

Global Atomic Corporation has signed a letter of intent with CMAC-Thyssen Mining Group to collar the portal and complete initial underground development at the Dasa Uranium Project in the Republic of Niger. The selection of CMAC-Thyssen resulted from a multi-party bidding process that required bidders to have project experience in West Africa. The Box-Cut excavation is scheduled to begin in January 2022 using local …

Global Atomic Corporation (“Global Atomic” or the “Company”), (TSX: GLO) (OTCQX: GLATF) (FRANKFURT: G12) has signed a letter of intent with CMAC-Thyssen Mining Group to collar the portal and complete initial underground development at the Dasa Uranium Project in the Republic of Niger. The selection of CMAC-Thyssen resulted from a multi-party bidding process that required bidders to have project experience in West Africa. Global Atomic Corporation Logo (CNW Group/Global Atomic Corporation) The Box-Cut excavation is scheduled to begin in January 2022 using local contractors in […]

Uranium: what the explosion in prices means for the nuclear industry

It is a year since Horizon Nuclear Power, a company owned by Hitachi , confirmed it was pulling out of building the £2bn Wylfa nuclear power plant on Anglesey in north Wales. The Japanese industrial conglomerate cited the failure to reach a funding deal with the UK government over escalating costs, and the government is still in negotiations with other players to try and take the project forward.

Hitachi’s share price went up 10% when it announced its withdrawal, reflecting investors’ negative sentiment towards building complex, highly regulated large nuclear power plants. With governments reluctant to subsidise nuclear power because of the high costs, particularly since the 2011 Fukushima disaster , the market has undervalued the potential of this technology to tackle the climate emergency by providing abundant and reliable low-carbon electricity.

Uranium prices long reflected this reality. The primary fuel for nuclear plants was sliding for much of the 2010s, […]

Uranium Royalty Corp. (UROY) is on the roll with an average volume of 579.40K in the recent 3 months

Uranium Royalty Corp. (UROY) is priced at $4.33 after the most recent trading session. At the very opening of the session, the stock price was $3.92 and reached a high price of $4.40, prior to closing the session it reached the value of $3.88. The stock touched a low price of $3.79.Recently in News on September 16, 2021, Uranium Royalty Corp. Announces Director Appointment. Uranium Royalty Corp. (NASDAQ: UROY) (TSXV: URC) (“URC” or the “Company”) is pleased to announce the appointment of John Griffith to the board of directors of URC. You can read further details here

Uranium Royalty Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price for the company’s stock is recorded $5.60 on 09/16/21, with the lowest value was $1.04 for the same time period, recorded on 01/11/21.

3 Tiny Stocks Primed to Explode The world’s greatest investor […]

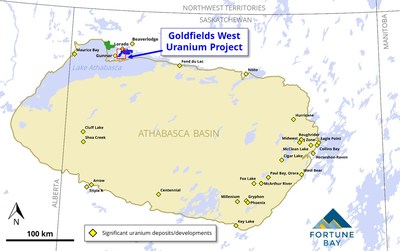

Uranium Stocks in the News: Fortune Bay (TSXV: $FOR.V) Announces Goldfields West Uranium Project, Northern Saskatchewan

HALIFAX, NS – September 28, 2021 (Investorideas.com Newswire) Fortune Bay Corp. ( TSXV:FOR , Frankfurt:5QN) ("Fortune Bay" or the "Company") is pleased to announce identification of the Goldfields West Uranium Project ("Goldfields West" or the "Project").

The Project comprises the western claims of the Company’s flagship Goldfields Project in northern Saskatchewan, which have been identified to have potential for high-grade unconformity-related, basement-hosted uranium deposits typical of the Athabasca Basin margin (Figure 1).

Combined with the recently announced Strike Uranium Project (see News Release dated September 16, 2021 ), the Project gives Fortune Bay a dominant land position of the electromagnetic ("EM") conductors in Canada’s original uranium mining district (Figure 2).

The Company plans to commence target area selection over the coming weeks in preparation for planned field activities in 2022, with the aim of generating targets for drill testing.Dale Verran, CEO for Fortune Bay, commented, "We are pleased to announce a second […]

Click here to view original web page at www.investorideas.com

DevEx identifies new targets in ‘treasure trove’ of historical data at the Nabarlek uranium project

The company’s extensive tenement package covers a historic mine in the heart of the Alligator Rivers uranium province. Pic: gchutka (E+) via Getty Images. share

Uranium explorer DevEx Resources has kicked off exploration at its Nabarlek uranium project in the Northern Territory – but the company has an ace up its sleeve.

Instead of starting from scratch like most juniors, DevEx has a head start with over 50 years of historical exploration data from the project, which previously produced 24 million pounds at 1.84% uranium.

The company has spent the last six months reviewing the data and it’s paid off. DevEx Resources (ASX: DEV) has highlighted multiple new uranium, copper and gold exploration targets which present an outstanding exploration opportunity at the project. Prime real estate in a Tier-1 uranium province “Some months ago, we commissioned a project-wide technical review to re-evaluate the potential of Nabarlek and the surrounding […]

Why this uranium bull sold all his holdings, except one

The nuclear fuel precursor is currently seeing something of a "bubble", but write-off uranium at your peril says Michael Goldberg of Collins St Value Fund. And he’s probably worth listening to, having helped deliver a jaw-dropping 65% (net of fees) in the 12 months to the end of June 2021.

Nuclear power has copped a bad rap, and not only for the obvious calamities that can result – as former residents of Russia’s Pripyat (those who weren’t fatally burned or poisoned by Chernobyl’s fallout, that is) and Fukushima can attest. There are also the political meltdowns often accompanying the “clean” but often problematic fuel source.

In the latest episode of The Rules of Investing , Goldberg details: Why nuclear is a huge but underappreciated theme

His fund’s near-perfect uranium bail-out Why "old energy" still has plenty of life yet A handful of stocks with which he’s playing energy. […]

Click here to view original web page at www.livewiremarkets.com

Cameco Stock Rebounds Along With Uranium

This article was written exclusively for Investing.com. Uranium is an energy commodity with lots of applications

The price moved higher over the past weeks

Cameco rebounded with the commodity

A highly speculative stock and metal Levels to watch in CCJ The commodity asset class has been nothing more than a bullish relay race since mid-2020. After reaching lows as pandemic-related selling gripped markets across all asset classes over the early months of 2020, commodities took off on the upside.The first market to reach an all-time high was gold , as the yellow metal reached a record $2063 per ounce in August 2020. While gold corrected, other raw materials took the bullish baton. Grains rose to over eight-year highs in 2021. In May 2021, lumber , copper , and palladium reached record levels. In July and August, soft commodities exploded higher, with coffee , sugar and even frozen concentrated orange […]

American Lithium: Drill-Ready Uranium Targets Added at Macusani with surface grab samples averaging 18,270 ppm U (2.15% U3O8)

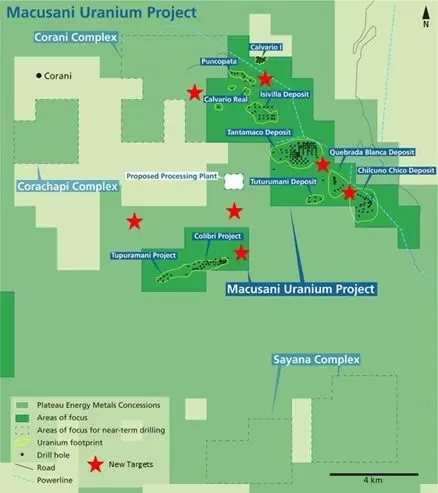

VANCOUVER, British Columbia, Sept. 28, 2021 (GLOBE NEWSWIRE) — American Lithium Corp . (“American Lithium” or the “Company”) (TSX-V:LI | OTCQB:LIACF | Frankfurt:5LA1) is pleased to announce positive prospecting, mapping and sampling results from the Company’s Macusani Uranium Project (“Macusani”), located in the Puno region in southeastern Peru, and to provide an update on upcoming drilling plans for the project.

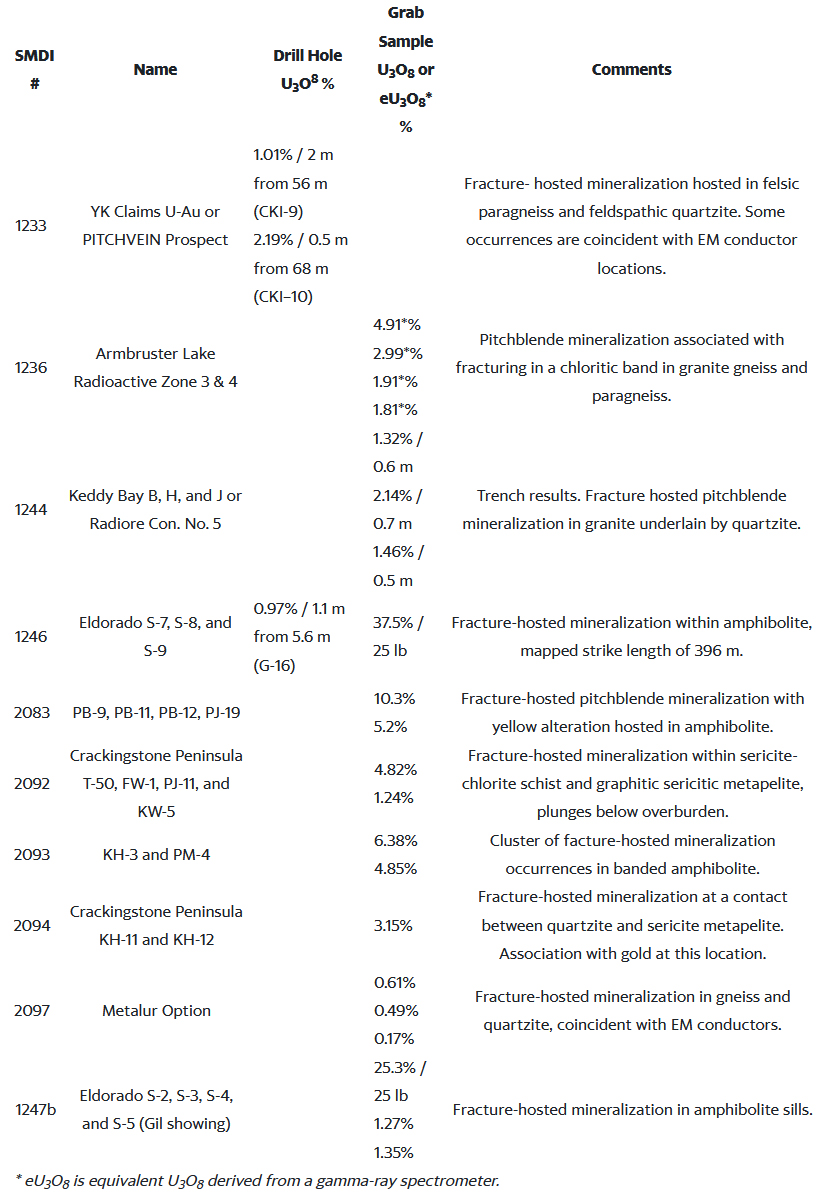

Highlights: 2021 radiometric prospecting and sampling work has identified possible extensions to five existing uranium deposits and three new anomalies for drill testing (see Figure 1 – Macusani Project Location Map with new target areas highlighted, below);

Results include over 90 grab sample with grades ranging from a low of of 6.3 ppm U to a high of 377,400 ppm U (44.5% U 3 O 8 ) with all samples averaging 18,270 ppm U (2.15% U 3 O 8 ) 1 ;

Drilling is planned at Macusani to expand […]

Click here to view original web page at www.juniorminingnetwork.com

Drill-Ready Uranium Targets Added at Macusani with surface grab samples averaging 18,270 ppm U

American Lithium Corp . is pleased to announce positive prospecting, mapping and sampling results from the Company’s Macusani Uranium Project located in the Puno region in southeastern Peru, and to provide an update on upcoming drilling plans for the project. Highlights: 2021 radiometric prospecting and sampling work has identified possible extensions to five existing uranium deposits and three new anomalies for …

American Lithium Corp . (“ American Lithium ” or the “Company”) (TSX-V:LI | OTCQB:LIACF | Frankfurt:5LA1) is pleased to announce positive prospecting, mapping and sampling results from the Company’s Macusani Uranium Project (“Macusani”), located in the Puno region in southeastern Peru, and to provide an update on upcoming drilling plans for the project.

Highlights: 2021 radiometric prospecting and sampling work has identified possible extensions to five existing uranium deposits and three new anomalies for drill testing (see Figure 1 – Macusani Project Location Map with new target […]

Fortune Bay Announces Goldfields West Uranium Project, Northern Saskatchewan

HALIFAX, NS, Sept. 28, 2021 /CNW/ – Fortune Bay Corp. (TSXV: FOR ) (Frankfurt: 5QN) ("Fortune Bay" or the "Company") is pleased to announce identification of the Goldfields West Uranium Project ("Goldfields West" or the "Project").

The Project comprises the western claims of the Company’s flagship Goldfields Project in northern Saskatchewan, which have been identified to have potential for high-grade unconformity-related, basement-hosted uranium deposits typical of the Athabasca Basin margin (Figure 1). Figure 1: Goldfields West Uranium Project location map. (CNW Group/Fortune Bay Corp.) Figure 2: Goldfields West and Strike Uranium Projects infrastructure and geological setting. (CNW Group/Fortune Bay Corp.) Figure 3: Goldfields West Uranium Project geology and uranium occurrences. (CNW Group/Fortune Bay Corp.) Combined with the recently announced Strike Uranium Project (see News Release dated September 16, 2021 ), the Project gives Fortune Bay a dominant land position of the electromagnetic ("EM") conductors in Canada’s original uranium mining district […]

Why Ur-Energy, Uranium Royalty, and Denison Mines Stocks Popped on Monday

What happened

Uranium stocks were back in action Monday after an unsettling last week, with most stocks surging on Sept. 27 before settling a bit lower by market close. Denison Mines ( NYSEMKT:DNN ) and Ur-Energy ( NYSEMKT:URG ) each popped during the day and closed up 8.3% and 4.3%, respectively. Uranium Royalty ( NASDAQ:UROY ) shot up 11.6% by market close.

Investors saw an opportunity in the red-hot uranium stocks after last week’s decline in prices, especially with natural gas prices soaring. So what

After a heady rally that saw uranium prices surge almost 60% in less than a month’s time, prices took a breather last week and drove most uranium stocks lower.The Sprott Physical Uranium Trust Fund ( OTC:SRUU.F ) seems to have taken a breather from its aggressive uranium buys — it last announced a purchase of 1.45 million pounds on Sept. 17. This has investors worried, […]

Why Ur-Energy, Uranium Royalty, and Denison Mines Stocks Popped on Monday

What happened

Uranium stocks were back in action Monday after an unsettling last week, with most stocks surging on Sept. 27 before settling a bit lower by market close. Denison Mines (NYSEMKT: DNN) and Ur-Energy (NYSEMKT: URG) each popped during the day and closed up 8.3% and 4.3%, respectively. Uranium Royalty (NASDAQ: UROY) shot up 11.6% by market close. Investors saw an opportunity in the red-hot uranium stocks after last week’s decline in prices, especially with natural gas prices soaring. So what

After a heady rally that saw uranium prices surge almost 60% in less than a month’s time, prices took a breather last week and drove most uranium stocks lower.

The Sprott Physical Uranium Trust Fund (OTC: SRUU.F) seems to have taken a breather from its aggressive uranium buys — it last announced a purchase of 1.45 million pounds on Sept. 17. This has investors worried, as Sprott’s buying […]

Closing Bell: ASX shrugs off some sharp falls in uranium stocks to close in the green

The ASX had a positive start to the week, even with a dip in red-hot uranium shares. The ASX 200 finished 0.57% higher at 7,384 points while the ASX Emerging Companies Index finished 0.13% up at 2,555 points. Energy and financials were the best sectors, gaining 1.81% and 1.52% respectively, with energy being boosted by the rise in oil prices over the weekend.

Sectors in the red included health and tech which retreated 1.03% and 0.70%. TODAY’S BIGGEST WINNERS

Scroll or swipe to reveal table. Click headings to sort. Stocks highlighted in yellow rose after making announcements during the trading day. AO1 Assetowl Limited 0.006 20 155000 RBX Resource B 0.245 20 12725693 LEL Lithenergy 0.685 15 4341302 Debuting today was cancer diagnostics company Pacific Edge (ASX:PEB) , gaining 18%.

Resource Base (ASX:RBX) announced it was acquiring applications prospective for rare earths across the Murray Basin. Lithium Energy (ASX:LEL) rose […]

Uranium: what the explosion in prices means for the nuclear industry

It is a year since Horizon Nuclear Power, a company owned by Hitachi , confirmed it was pulling out of building the £20bn Wylfa nuclear power plant on Anglesey in north Wales. The Japanese industrial conglomerate cited the failure to reach a funding deal with the UK government over escalating costs, and the government is still in negotiations with other players to try and take the project forward. Hitachi’s share price went up 10% when it announced its withdrawal, reflecting investors’ negative sentiment towards building complex, highly regulated large nuclear power plants. With governments reluctant to subsidise nuclear power because of the high costs, particularly since the 2011 Fukushima disaster , the market has undervalued the potential of this technology to tackle the climate emergency by providing abundant and reliable low-carbon electricity.

Uranium prices long reflected this reality. The primary fuel for nuclear plants was sliding for much of the […]

Click here to view original web page at www.bizcommunity.com

Uranium Energy Corp. (UEC) Investors To Reap Good Returns Once Again

Uranium Energy Corp. (AMEX:UEC) has a beta value of 2.35 and has seen 9.95 million shares traded in the last trading session. The company, currently valued at $725.41M, closed the last trade at $2.93 per share which meant it lost -$0.18 on the day or -5.79% during that session. The UEC stock price is -28.67% off its 52-week high price of $3.77 and 72.01% above the 52-week low of $0.82. If we look at the company’s 10-day average daily trading volume, we find that it stood at 10.19 million shares traded. The 3-month trading volume is 6.03 million shares.

The consensus among analysts is that Uranium Energy Corp. (UEC) is a Buy stock at the moment, with a recommendation rating of 1.50. 0 analysts rate the stock as a Sell, while 0 rate it as Overweight. 0 out of 3 have rated it as a Hold, with 3 advising it […]

Click here to view original web page at marketingsentinel.com

What the explosion in uranium prices means for the nuclear industry

Stand well back. Credit: RHJPhtotoandilustration It is a year since Horizon Nuclear Power, a company owned by Hitachi , confirmed it was pulling out of building the £20 billion Wylfa nuclear power plant on Anglesey in north Wales. The Japanese industrial conglomerate cited the failure to reach a funding deal with the UK government over escalating costs, and the government is still in negotiations with other players to try and take the project forward.

Hitachi’s share price went up 10% when it announced its withdrawal, reflecting investors’ negative sentiment towards building complex, highly regulated large nuclear power plants. With governments reluctant to subsidize nuclear power because of the high costs , particularly since the 2011 Fukushima disaster , the market has undervalued the potential of this technology to tackle the climate emergency by providing abundant and reliable low-carbon electricity.

Uranium prices long reflected this reality. The primary fuel for nuclear plants […]

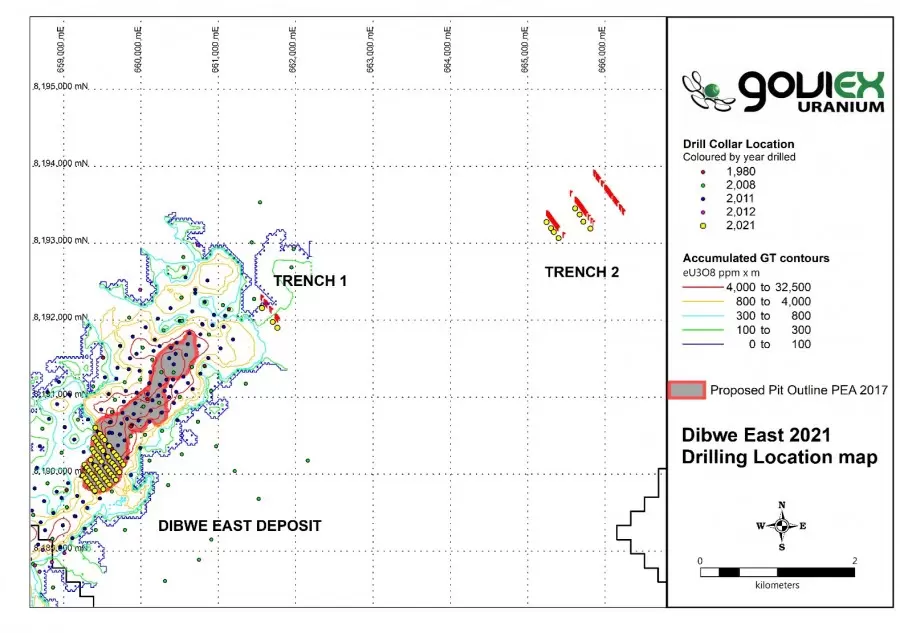

GoviEx Uranium Reports Positive Drilling Results at Mutanga Project, Zambia

GVXXF ) (" GoviEx or the " Company ") is pleased to announce the completion of its initial infill drilling campaign at the Dibwe East deposit in its wholly owned, mine permitted Mutanga Uranium Project in Zambia (the " Mutanga Project ") . The Mutanga Project consists of three mining permits that cover some 720km 2 , and contains five deposits: Dibwe, Dibwe East, Mutanga, Gwabe and Njame.

Drilling highlights Mineralisation is continuous from hole to hole and section to section and shows a very close correlation to the current inferred resource interpreted ore boundaries;

average reported grades, after taking into account disequilibrium, is 330 ppm eU 3 O 8, highlighting the consistency of the deposit;

drill results show potential to extend the mineralised zone beyond the initially interpreted ore boundary in some sections, especially as several holes finished in mineralisation; and the Mutanga Project area is still prospective […]

Click here to view original web page at www.juniorminingnetwork.com

A sea of red for ASX uranium shares. Is the run over?

ASX uranium shares have enjoyed some monstrous gains in the past month thanks to skyrocketing uranium prices. Between 31 August and 16 September, the largest ASX-listed uranium player, Paladin Energy Ltd (ASX: PDN) surged almost 120% from 51 cents to 9-year highs of $1.120. Prospective explorers such as Deep Yellow Limited (ASX: DYL) , Peninsula Energy Ltd (ASX: PEN) , 92 Energy Ltd (ASX: 92E) and Boss Energy Ltd (ASX: BOE) delivered similar triple digit gains over the same period.

But more recently, ASX uranium shares have been running out of steam, many of which have declined 20-30% from recent multi-year highs. Why are ASX uranium shares tumbling?

The sharp re-rate across the uranium sector was fueled by Sprott’s Physical Uranium Trust, a Canadian investment fund focused on aggressively buying physical uranium off the spot market.

Uranium is an illiquid commodity that does not trade on an open market like copper […]

Closing Bell: ASX shrugs off some sharp falls in uranium stocks to close in the green

The ASX had a positive start to the week, even with a dip in red-hot uranium shares. The ASX 200 finished 0.57% higher at 7,384 points while the ASX Emerging Companies Index finished 0.13% up at 2,555 points. Energy and financials were the best sectors, gaining 1.81% and 1.52% respectively, with energy being boosted by the rise in oil prices over the weekend.

Sectors in the red included health and tech which retreated 1.03% and 0.70%. TODAY’S BIGGEST WINNERS

Scroll or swipe to reveal table. Click headings to sort. Stocks highlighted in yellow rose after making announcements during the trading day. AO1 Assetowl Limited 0.006 20 155000 RBX Resource B 0.245 20 12725693 LEL Lithenergy 0.685 15 4341302 Debuting today was cancer diagnostics company Pacific Edge (ASX:PEB) , gaining 18%.

Resource Base (ASX:RBX) announced it was acquiring applications prospective for rare earths across the Murray Basin. Lithium Energy (ASX:LEL) rose […]

Uranium price explosion foresees new nuke power role

Share on Facebook

Tweet on Twitter

The Japanese industrial conglomerate cited the failure to reach a funding deal with the UK government over escalating costs, and the government is still in negotiations with other players to try and take the project forward.

Hitachi’s share price went up 10% when it announced its withdrawal, reflecting investors’ negative sentiment towards building complex, highly regulated large nuclear power plants.With governments reluctant to subsidize nuclear power because of the high costs, particularly since the 2011 Fukushima disaster , the market has undervalued the potential of this technology to tackle the climate emergency by providing abundant and reliable low-carbon electricity.Uranium prices long reflected this reality. The primary fuel for nuclear plants was sliding for much of the 2010s, with no signs of a major turnaround. Yet since mid-August, prices have surged by about 60% as investors and speculators scramble to snap up the […]

Fission Advances Feasibility Study with Completion of Summer Work Program

TSX SYMBOL: FCU OTCQX SYMBOL: FCUUF FRANKFURT SYMBOL: 2FU Fission Uranium Corp. is pleased to announce the completion of a 72-hole geotechnical drill program in addition to the resource upgrade drilling and the metallurgical drilling . The 72-hole geotechnical program was designed to advance the feasibility study at its’ PLS project, in the Athabasca Basin region of Saskatchewan, Canada . The primary goals were …

TSX SYMBOL: FCU

OTCQX SYMBOL: FCUUF FRANKFURT SYMBOL: 2FUFission Uranium Corp. (” Fission ” or ” the Company “) is pleased to announce the completion of a 72-hole geotechnical drill program in addition to the resource upgrade drilling (news release dated August 31, 2021 ), and the metallurgical drilling (news release dated September 7 2021). The 72-hole geotechnical program was designed to advance the feasibility study at its’ PLS project, in the Athabasca Basin region of Saskatchewan, Canada . The primary […]

Is Cameco Stock the Best Way to Invest in Uranium?

Investing in commodities can be a risky proposition, especially if you have little knowledge about this asset class. Generally, commodities are cyclical, as the prices depend on supply and demand, making them highly volatile in the short run. This year, the price of uranium has surged higher, which means companies that mine this commodity have seen a significant spike in their stock prices. According to a report by Market Insider , the spot price of uranium has risen by 65.5% year to date, making it one of the hottest commodities in the energy sector. Does this make Cameco (TSX:CCO) (NYSE:CCJ) stock a top bet right now? Cameco stock is up close to 60% in 2021

One of the best-performing stocks on the TSX this year has been Cameco, which has gained 58% year to date at the time of writing. Cameco produces and sells uranium. It operates in […]

Why Denison Mines and Energy Fuels Crashed Today

What happened

Uranium mining stocks Denison Mines ( NYSEMKT:DNN ) and Energy Fuels ( NYSEMKT:UUUU ) tumbled in Friday afternoon trading, falling 7.6% and 10%, respectively, despite analysts at Canaccord Genuity having just yesterday hiked their price target for Denison. So what

In a brief note Thursday, TheFly.com advised that Canaccord had raised its price target on Denison Mines stock 20% to three Canadian dollars per share. The analyst also reiterated its "speculative buy" rating on the still-unprofitable uranium mining stock .

And yet, things aren’t glowing quite as brightly for the uranium stocks this week as they were last week. On Monday, Sprott Asset Management told The Financial Times that it is not attempting to "corner the market" on nuclear fuel. To an extent, that was something of a self-serving statement, as Sprott may worry that if it is thought to be buying up control over most of the […]