Credit: REUTERS/Sonali Paul By Praveen Menon and Sonali Paul

SYDNEY/MELBOURNE, May 20 (Reuters) – Uranium miners are racing to revive projects mothballed after the Fukushima disaster more than a decade ago, spurred by renewed demand for nuclear energy and a leap in yellowcake prices after Russia’s invasion of Ukraine.

Spot prices for uranium have doubled from lows of $28 per pound last year to $64 in April, sparking the rush on projects set aside after a 2011 earthquake and tsunami crippled Japan’s Fukushima nuclear power plant.

"Things are moving very quickly in our industry, and we’re seeing countries and companies turn to nuclear with an appetite that I’m not sure I’ve ever seen in my four decades in this business," Tim Gitzel, CEO of Canada’s Cameco CCO.TO, which mothballed four of its mines after Fukushima, said on a May 5 earnings call .Uranium prices began to rise in mid-2021 as several countries […]

Mining: Global overview

This article is an extract from GTDT Mining 2022. Click here for the full guide .

The global mining economy commenced 2021 on an upswing and continued with strong contributions to the global economy despite the ongoing impact of the covid-19 pandemic on industries around the world. The past year has demonstrated the resiliency of the mining industry and today the mining industry is a crucial component in pandemic recovery efforts. Trends in the industry today include a growing focus on mining companies’ environmental, social and governance commitments and opportunities for green energy transition.

North America and Greenland

In Canada, the mining sector accounts for a significant portion of the economy. Canada is a leading global producer of several minerals and metals, most notably in the production of cobalt, diamonds, gold, nickel, potash, platinum group metals, primary aluminium, salt, titanium concentrates and uranium.Key exports include aluminium, coal, copper, diamonds, gold, iron ore, […]

FOCUS-Unloved since Fukushima, uranium is hot again for miners

Credit: REUTERS/Sonali Paul By Praveen Menon and Sonali Paul

SYDNEY/MELBOURNE, May 20 (Reuters) – Uranium miners are racing to revive projects mothballed after the Fukushima disaster more than a decade ago, spurred by renewed demand for nuclear energy and a leap in yellowcake prices after Russia’s invasion of Ukraine.

Spot prices for uranium have doubled from lows of $28 per pound last year to $64 in April, sparking the rush on projects set aside after a 2011 earthquake and tsunami crippled Japan’s Fukushima nuclear power plant.

"Things are moving very quickly in our industry, and we’re seeing countries and companies turn to nuclear with an appetite that I’m not sure I’ve ever seen in my four decades in this business," Tim Gitzel, CEO of Canada’s Cameco CCO.TO, which mothballed four of its mines after Fukushima, said on a May 5 earnings call .Uranium prices began to rise in mid-2021 as several countries […]

Bannerman Energy Announces Agreement To Acquire Strategic Stake in Namibia Critical Metals Inc.

HALIFAX – Namibia Critical Metals Inc. (‘Namibia Critical Metals’ or the ‘Company’ or ‘NMI’) (TSXV: NMI) (OTC PINK: NMREF) announced that Bannerman Energy Limited, an Australian listed uranium development company, has issued a news release on May 18, 2022 announcing it has entered into an agreement to acquire 82,290,680 common shares (41.8%) of NMI pursuant to a private share purchase agreement with two shareholders of the Company, including Philco 192 (Pty) Ltd. which holds 75,201,603 shares (38.2%) of NMI.

Bannerman has announced that the NMI Share Acquisition is expected to complete within 30 days.

The NMI Share Acquisition by Bannerman offers significant strategic alignment and development synergies with Bannerman’s flagship Etango Uranium Project in Namibia.

The Company also announced today that Steve Kapp will not be standing for re-election at the Company’s Annual and Special Meeting to be held on May 19, 2022. The Company intends to identify a replacement for Mr. […]

Click here to view original web page at www.marketscreener.com

NA Proactive news snapshot: KULR Technology Group, American Resources, Adcore, MAS Gold, Planet 13 Holdings, UPDATE…

Your daily round-up from the world of Proactive KULR Technology Group Inc , a leading developer of next-generation lithium-ion battery safety and thermal management technologies, told investors that it had positioned itself strategically to secure a revenue opportunity of up to $350 million while reporting its first-quarter results. The San Diego, California-based company said that with demand for battery cell supplies “skyrocketing to all-time highs” and showing no signs of slowing down, KULR has taken “a key step in positioning itself to capture as much market share by securing access up to $55 million in additional capital.” In total, KULR said it expects to procure lithium-ion battery cells providing up to 500-megawatt hours (MWh) of energy capacity, enough to power approximately 40,000 homes using currently available domestic energy storage options. “Within applications for the energy storage and e-mobility markets, the battery cell supplies would equate to a revenue opportunity […]

Click here to view original web page at ca.proactiveinvestors.com

Genel Energy climbs after making interim CFO appointment permanent

Genel Energy PLC (LSE:GENL, OTC:GEGYY) jumped 4% to 176.2p after announcing its permanent chief financial officer.

Luke Clements was previously the interim chief financial officer, and “has been responsible for a broad range of financial, commercial, and treasury related activities,” according to a statement.

“Luke is the ideal person to continue delivering the financial platform that facilitates our strategy, a strategy he has been integral in building,” said chair David McManus. 2.00pm: Yellow Cake jumps on Uranium delivery

Uranium company Yellow Cake PLC (AIM:YCA) jumped 5%, or 9p, to 384p after it announced it has taken delivery of over 2mln lbs of triuranium octoxide.Triuranium octoxide is a compound of uranium that is converted into uranium hexafluoride for the purpose of uranium enrichment.Yellow Cake exercised a buyback option it had with Kazatomprom , a Kazakhstan producer and seller of uranium at a price of US$43.25/lb.According to the statement, it now holds over […]

Click here to view original web page at www.proactiveinvestors.com.au

WESTERN URANIUM & VANADIUM CORP. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q)

Forward-Looking Statements The information disclosed in this quarterly report, and the information incorporated by reference herein, include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "possible," "potential," "predict," "project," "should," "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained or incorporated by reference in this quarterly report are based […]

Click here to view original web page at www.marketscreener.com

Genel Energy climbs after making interim CFO appointment permanent

Genel Energy PLC (LSE:GENL, OTC:GEGYY) jumped 4% to 176.2p after announcing its permanent chief financial officer.

Luke Clements was previously the interim chief financial officer, and “has been responsible for a broad range of financial, commercial, and treasury related activities,” according to a statement.

“Luke is the ideal person to continue delivering the financial platform that facilitates our strategy, a strategy he has been integral in building,” said chair David McManus. 2.00pm: Yellow Cake jumps on Uranium delivery

Uranium company Yellow Cake PLC (AIM:YCA) jumped 5%, or 9p, to 384p after it announced it has taken delivery of over 2mln lbs of triuranium octoxide.Triuranium octoxide is a compound of uranium that is converted into uranium hexafluoride for the purpose of uranium enrichment.Yellow Cake exercised a buyback option it had with Kazatomprom , a Kazakhstan producer and seller of uranium at a price of US$43.25/lb.According to the statement, it now holds over […]

Click here to view original web page at www.proactiveinvestors.co.uk

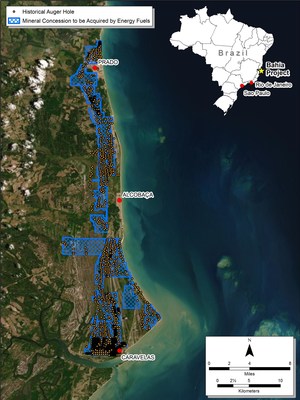

Energy Fuels Secures Major Rare Earth Land Position in Brazil

~58.3 square mile (~37,300 acre) heavy mineral sand position has potential to feed the Company’s White Mesa Mill with rare earth element and uranium bearing natural monazite sand for decades

Energy Fuels Inc. ( NYSE American: UUUU ) ( TSX: EFR ) ( " Energy Fuels " or the "Company" ) is pleased to announce that it has entered into binding agreements (the " Purchase Agreements ") to acquire seventeen (17) mineral concessions (the " Transaction ") between the towns of Prado and Caravelas in the State of Bahia, Brazil totaling 15,089.71 hectares (approximately 37,300 acres or 58.3 square miles) (the " Bahia Project ").

Based on significant historical drilling performed to date, it is believed that the Bahia Project holds significant quantities of heavy minerals, including monazite, that will feed Energy Fuels ‘ quickly emerging U.S.-based rare earth element (" REE ") supply chain. The Bahia Project has […]

Unloved since Fukushima, uranium is hot again for miners

View of Dampierre nuclear power plant (Stock Image) Uranium miners are racing to revive projects mothballed after the Fukushima disaster more than a decade ago, spurred by renewed demand for nuclear energy and a leap in yellowcake prices after Russia’s invasion of Ukraine.

Spot prices for uranium have doubled from lows of $28 per pound last year to $64 in April, sparking the rush on projects set aside after a 2011 earthquake and tsunami crippled Japan’s Fukushima nuclear power plant.

“Things are moving very quickly in our industry, and we’re seeing countries and companies turn to nuclear with an appetite that I’m not sure I’ve ever seen in my four decades in this business,” Tim Gitzel, CEO of Canada’s Cameco, which mothballed four of its mines after Fukushima, said on a May 5 earnings call.

Uranium prices began to rise in mid-2021 as several countries seeking to limit climate change said they […]

Uranium inventories are scarily low – here’s what that means for energy security, prices and new projects

US nuclear utilities have only 16 months of inventory, and the EU has only two years’ worth

COVID and Russia/Ukraine war have impacted supply chain security and pushed up prices

Geopolitically stable locations will have the advantage as industry rushes to meet demand

The International Atomic Energy Agency’s (IAEA) Uranium Production Specialist Dr Adrienne Hanly has flagged that uranium inventories are precariously low.At the recent World Nuclear Fuel Cycle conference in London, Dr Hanly said uranium fuel inventory levels for US nuclear utilities are at just 16 months of requirements – below recommended 2+ years minimum.And that US utilities may have limited capability to independently manage a protracted supply disruption.Compounding this, EU stocks on aggregate equate to two years’ supply, but many individual utilities fall far short of this ESA-prescribed benchmark. Here are the most important 3 slides from Ms. Hanly’s talk. Show #uranium inventories in the U.S. […]

NexGen Files Management Information Circular in Connection with Annual General and Special Meeting of Shareholders

NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE MKT: NXE) (ASX: NXG) is pleased to announce it has mailed the Notice of Meeting and Management Information Circular to shareholders of record as of May 9, 2022 in connection with the Annual General and Special Meeting to be held on Thursday, June 23, 2022 at 2:00 p.m. (Pacific Time) .

Your vote is important – please vote today.

NexGen encourages shareholders to read the meeting materials, which have been filed on SEDAR ( www.sedar.com ) and ASX ( www.asx.com.au ) and are on our website at www.nexgenenergy.ca .

Shareholders will be asked to vote on the following matters: > Set the number of directors at nine; Elect directors for the ensuing year; Re-appoint the auditors for the ensuing year; and Re-approve the current stock option plan Meeting Access and Location: Conference dial-in: Toronto […]

Are Yellow Cake Shares, YCA, Undervalued At the Current Uranium Price?

Key points:

There’s a reasonable argument that Yellow Cake is currently undervalued

There’s another, equally valid, that they’re not

Trading positions depend upon which argument is believed Yellow Cake (LON: YCA) shares are an oddity really. For the company itself, YCA, doesn’t particularly do anything. But then that’s rather the point of the company itself, not to do anything but simply to be.The background here is that yellow cake is the traded form of uranium. This isn’t what is put into reactors, it’s earlier in the process than that. It’s actually the output from the normal mining and processing system. This is then what is traded around within the nuclear business. It’s only once an actual reactor is ready for refueling that the yellow cake (uranium oxides) is sent through the isotopic separation plant to become actual reactor fuel. Different reactors require different styles of fuel, but all of […]

Blue Sky Uranium Applies to Extend Warrants

VANCOUVER, BC, May 20, 2022 /PRNewswire/ – Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2) (OTC: BKUCF), ("Blue Sky" or the "Company") announces that it has made an application to the TSX Venture Exchange (" TSXV ") to extend the term of the outstanding warrants as follows: 4,203,182 unexercised warrants (4,528,182 original granted) that are set to expire on June 4 and July 11, 2022 to be extended to June 4 and July 11, 2024 respectively. These warrants were originally issued under a private placement completed by the Company in 2 Tranches in June and July 2019.

Of the 325,000 warrants that have been exercised, 100,000 have been exercised by one shareholder within the past 6 months. The Company notes that, at the request of the TSXV, it has received a Consent from this shareholder for this application to extend the expiry date of the remaining warrants.

The exercise price […]

Skyharbour Secures Option to Acquire an Initial 51% and Up to 100% of the Russell Lake Uranium Project from Rio Tinto in the Athabasca Basin of Saskatchewan

Vancouver, BC, May 19, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that it has entered into an Option Agreement with Rio Tinto Exploration Canada Inc. (“RTEC”), a wholly owned subsidiary of Rio Tinto Limited (“Rio Tinto”), to acquire up to 100% of the Russell Lake Uranium Project (the “Property” or “Project”), which comprises 26 claims covering 73,294 hectares of prospective exploration ground strategically situated between the Company’s Moore Uranium project (to the east) and Denison Mines’ Wheeler River project (to the west) in the eastern portion of the Athabasca Basin.

Russell Lake Project Location Map:

http://www.skyharbourltd.com/_resources/images/SKY-RussellLake-20220325-Inset.jpgThe Project is a premier, advanced-stage exploration property given its large size, proximity to critical regional infrastructure, and the significant amount of historical exploration carried out on the property, which has identified numerous prospective target areas and […]

Click here to view original web page at www.globenewswire.com

Uranium inventories are scarily low – here’s what that means for energy security, prices and new projects

US nuclear utilities have only 16 months of inventory, and the EU has only two years’ worth

COVID and Russia/Ukraine war have impacted supply chain security and pushed up prices

Geopolitically stable locations will have the advantage as industry rushes to meet demand

The International Atomic Energy Agency’s (IAEA) Uranium Production Specialist Dr Adrienne Hanly has flagged that uranium inventories are precariously low.At the recent World Nuclear Fuel Cycle conference in London, Dr Hanly said uranium fuel inventory levels for US nuclear utilities are at just 16 months of requirements – below recommended 2+ years minimum.And that US utilities may have limited capability to independently manage a protracted supply disruption.Compounding this, EU stocks on aggregate equate to two years’ supply, but many individual utilities fall far short of this ESA-prescribed benchmark. Here are the most important 3 slides from Ms. Hanly’s talk. Show #uranium inventories in the U.S. […]

Uranium Energy Corp. (UEC) Is A Good Stock To Invest In

Uranium Energy Corp. (AMEX:UEC) concluded the trading at $3.36 on Wednesday, May 18 with a fall of -9.92% from its closing price on previous day.

Taking a look at stock we notice that its last check on previous day was $3.73 and 5Y monthly beta was reading 2.07 with its price kept floating in the range of $3.30 and $3.76 on the day. Considering stock’s 52-week price range provides that UEC hit a high price of $6.60 and saw its price falling to a low level of $1.89 during that period. Over a period of past 1-month, stock came subtracting -41.05% in its value.

Here’s Your FREE Report on the #1 Small-Cap Uranium Stock of ’22.

Small-cap Uranium stocks are booming in 2022! The company we’re about to show you is the ONLY small-cap stock in the space that benefits from ALL aspects of the global Uranium industry with […]

Energy Fuels Secures Major Rare Earth Land Position in Brazil

~58.3 square mile (~37,300 acre) heavy mineral sand position has potential to feed the Company’s White Mesa Mill with rare earth element and uranium bearing natural monazite sand for decades

LAKEWOOD, Colo., May 19, 2022 /PRNewswire/ – Energy Fuels Inc. ( NYSE American: UUUU ) ( TSX: EFR ) ( "Energy Fuels" or the "Company" ) is pleased to announce that it has entered into binding agreements (the " Purchase Agreements ") to acquire seventeen (17) mineral concessions (the " Transaction ") between the towns of Prado and Caravelas in the State of Bahia, Brazil totaling 15,089.71 hectares (approximately 37,300 acres or 58.3 square miles) (the " Bahia Project ").

Based on significant historical drilling performed to date, it is believed that the Bahia Project holds significant quantities of heavy minerals, including monazite, that will feed Energy Fuels’ quickly emerging U.S.-based rare earth element (" REE ") supply chain. The […]

Why Uranium Stocks Keep Dropping

Uranium is getting cheaper. So are uranium stocks.

What happened

Uranium mining stocks were looking radioactive in Wednesday afternoon trading — in a bad way, as in, investors were running away from them. At the close of the session, Denison Mines ( DNN -7.56%) was down 7.6%, Energy Fuels ( UUUU -9.82%) was down 9.8%, and Uranium Energy ( UEC -9.92%) was down 9.9%.

But you probably shouldn’t be surprised. Image source: Getty Images. So what Fact is, after topping out near $65 per pound in mid-April, the spot price of uranium has plunged by about 25% to a recent price of $48.75 per pound, according to data from TradingEconomics.com .Indeed, the situation is even a bit worse than that. According to a report just out from the uranium experts at Ocean Wall, uranium prices have actually fallen as far as $48 a pound today, and are now at their […]

Arizona’s Havasupai push back as interest in nearby uranium mine grows

Coverage of tribal natural resources is supported in part by Catena Foundation Havasupai tribal councilman Stuart Chavez is opposed to the Pinyon Plain Mine. The quiet and shade of the Kaibab National Forest ends at a chain-link fence posted with No Trespassing signs. The hum of a giant pump cuts through the still air. A sign proclaims this site Energy Fuels’ Pinyon Plain Mine with an American flag emblazoned beneath. The Havasupai Nation has another name for it.

"Mat Taav Tijundva … a gathering point," explains Stuart Chavez, a tribal councilman. "This location that was only used for ceremonial purposes that’s now been tarnished and tainted was our heirloom."

We walk around the enclosed mine to where water pours from a pipe into a lined pond. Energy Fuels breached an aquifer here in 2016, and the uranium and arsenic heavy water’s been pumped out ever since at the speed of a […]

Uranium inventories are scarily low – here’s what that means for energy security, prices and new projects

US nuclear utilities have only 16 months of inventory, and the EU has only two years’ worth

COVID and Russia/Ukraine war have impacted supply chain security and pushed up prices

Geopolitically stable locations will have the advantage as industry rushes to meet demand

The International Atomic Energy Agency’s (IAEA) Uranium Production Specialist Dr Adrienne Hanly has flagged that uranium inventories are precariously low.At the recent World Nuclear Fuel Cycle conference in London, Dr Hanly said uranium fuel inventory levels for US nuclear utilities are at just 16 months of requirements – below recommended 2+ years minimum.And that US utilities may have limited capability to independently manage a protracted supply disruption.Compounding this, EU stocks on aggregate equate to two years’ supply, but many individual utilities fall far short of this ESA-prescribed benchmark. Here are the most important 3 slides from Ms. Hanly’s talk. Show #uranium inventories in the U.S. […]

Skyharbour Secures Option to Acquire an Initial 51% and Up to 100% of the Russell Lake Uranium Project from Rio Tinto in the Athabasca Basin of Saskatchewan

Skyharbour Resources Ltd Vancouver, BC, May 19, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that it has entered into an Option Agreement with Rio Tinto Exploration Canada Inc. (“RTEC”), a wholly owned subsidiary of Rio Tinto Limited (“Rio Tinto”), to acquire up to 100% of the Russell Lake Uranium Project (the “Property” or “Project”), which comprises 26 claims covering 73,294 hectares of prospective exploration ground strategically situated between the Company’s Moore Uranium project (to the east) and Denison Mines’ Wheeler River project (to the west) in the eastern portion of the Athabasca Basin.

Russell Lake Project Location Map:

http://www.skyharbourltd.com/_resources/images/SKY-RussellLake-20220325-Inset.jpgThe Project is a premier, advanced-stage exploration property given its large size, proximity to critical regional infrastructure, and the significant amount of historical exploration carried out on the property, which has identified numerous prospective […]

Best Penny Stocks to Buy as May Ends? 3 to Watch Right Now

3 Penny Stocks to Watch as May Comes to an End

With another rough day of trading penny stocks and blue chips, there is a lot for investors to understand. Right now, investors need to consider what is going on in the stock market and how to take advantage.

In 2022, we have three factors at play. The first two are rising interest rates and climbing inflation. These have been the largest factors for the bearish trading patterns of the stock market in the past few weeks. And, they are likely going to continue being the largest reasons for market momentum moving forward. The last factor in this is the effects of geopolitical tensions on the world economy. While Ukraine is not causing havoc on the U.S. economy like it had, it is still causing shifts in pricing for energy globally.

At the end of the day, buying and selling […]

What happened

Uranium mining stocks were looking radioactive in Wednesday afternoon trading — in a bad way, as in, investors were running away from them. At the close of the session, Denison Mines (NYSEMKT: DNN) was down 7.6%, Energy Fuels (NYSEMKT: UUUU) was down 9.8%, and Uranium Energy (NYSEMKT: UEC) was down 9.9%.

But you probably shouldn’t be surprised. So what

Fact is, after topping out near $65 per pound in mid-April, the spot price of uranium has plunged by about 25% to a recent price of $48.75 per pound, according to data from TradingEconomics.com .

Indeed, the situation is even a bit worse than that. According to a report just out from the uranium experts at Ocean Wall, uranium prices have actually fallen as far as $48 a pound today, and are now at their "lowest levels since the beginning of March" (which also tallies with TradingEconomics’ data).What’s the problem with uranium […]

Why These 3 Uranium Stocks Jumped More Than 10% Today

New reports came out recently of utilities signing contracts to buy uranium at high prices.

What happened

Uranium stocks were back on the rise Tuesday after several down weeks, with names across the sector surging as the session progressed. Here’s how much the top-performing uranium stocks had rallied at their highest points in the trading day:

Uranium prices have dropped in recent weeks, and they aren’t ticking upward yet. So why were uranium stocks starting to rebound? Three reasons: investor sentiment, fossil fuels, and encouraging activity in the crucial uranium contract market. So what Uranium prices are currently hovering near two-month lows, according to data from TradingEconomics.com. Prices hit 11-year highs of $64.50 per pound in mid-April, but started to fall soon after as rising interest rates triggered fears that an economic slowdown in the U.S. was coming, while demand from China was expected to fall due to the COVID-19 […]