FinancialNewsMedia.com News Commentary

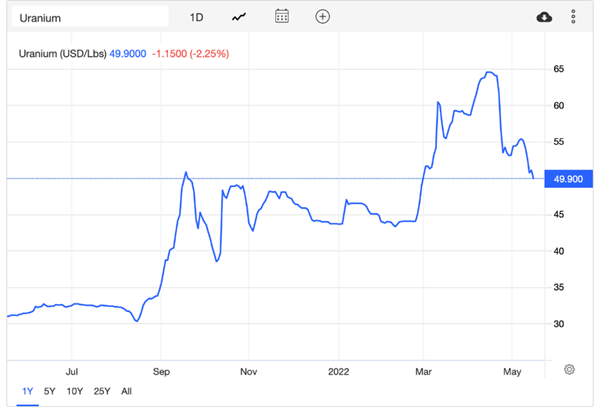

PALM BEACH, Fla., May 25, 2022 /PRNewswire/ — Uranium is one of the few commodities that has seen two years of solid gains in the midst of the coronavirus pandemic, which most analysts believe indicates that the metal’s price is not dropping any time soon. However, on the supply side, current supply of the metal cannot meet demand. It is expected that constrained supply will push the price of uranium even higher this year. Last year, the price of uranium rose by 45%, going from about $29 per pound at the start of the year to $50 per pound in September. This increase followed growth in 2020, which saw uranium go from $24 in January to $30 by year’s end. Despite not being able to maintain that $50 level, the value of the energy fuel has remained at about $40 since then. An article in Mining […]

Click here to view original web page at www.finanznachrichten.de