Image source: The Motley Fool. Eldorado Gold Corp ( NYSE:EGO )

Q3 2020 Earnings Call

Oct 30, 2020, 11:30 a.m. ET Contents:Prepared Remarks

Questions and Answers Call Participants Prepared Remarks: Operator Thank you for standing by. This is the conference operator. Welcome to the Eldorado Gold Corporation Third Quarter 2020 Conference Call. [Operator Instructions]I would now like to turn the conference over to Peter Lekich, Manager, Investor Relations. Please go ahead, Mr. Lekich. Peter Lekich — Manager, Investor Relations Thank you, operator, and thank you, ladies and gentlemen, for taking the time to dial into our conference call today. On the line today are George Burns, President and CEO; Phil Yee, Executive Vice President and CFO; Joe Dick, Executive Vice President and COO; and Jason Cho, Executive Vice President and Chief Strategy Officer. Our release yesterday details our 2020 third quarter financial and operating results. This should be […]

Gold Dips 0.8% in October while Silver Climbs 0.7%; US Mint Bullion Sales Surge

Gold prices slipped 0.8% in October Most precious metals posted gains on Friday, but they all dropped on the week and only silver eked out a win for October. Gold’s loss on the month was its third in a row following six straight monthly increases.

Gold for December delivery rose $11.90, or 0.6%, to settle at $1,879.90 an ounce on the Comex division of the New York Mercantile Exchange. "October has been a surprisingly uneventful month for gold in spite of the volatility that hit equity markets," said Ryan Giannotto, director of research at GraniteShares, which offers the GraniteShares Gold Trust. "Two countervailing forces on gold were the indefinite postponement of [U.S.] stimulus talks, a negative for gold, countered with the weakening of the dollar through much of the month," he told MarketWatch . Gold futures logged losses of 1.3% for the week and 0.8% for October. The yellow […]

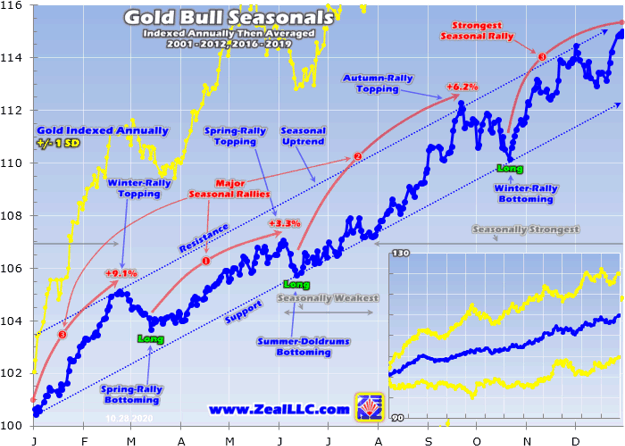

Gold Stocks’ Winter Rally 5

Summary

Gold stocks are just entering their seasonally-strongest period of the year. Their big winter rally is fueled by gold’s own, which is driven by outsized demand from holiday jewelry buying.

Later new-year investment buying kicks in. So both the metal and its miners’ stocks have strong tendencies to rally between late October to late February in bull-market years.

This year’s winter rally has great upside potential after these gold and gold-stock corrections run their courses. The gold miners’ fundamentals remain powerfully-bullish, with earnings soaring on higher gold prices.The gold miners’ stocks have mostly been correcting in recent months, after blasting higher with gold last summer. While this necessary and healthy selloff to rebalance sentiment likely isn’t over yet, this sector is entering its strongest seasonal rally of the year. That portends big gains in coming months as the next bull-market uplegs in gold and its miners’ stocks get underway. These seasonal […]

Sandstorm Gold (SAND) Q3 2020 Earnings Call Transcript

Image source: The Motley Fool. Sandstorm Gold (NYSEMKT: SAND)

Q3 2020 Earnings Call

Oct 30, 2020, 11:30 a.m. ET Contents:Prepared Remarks

Questions and Answers Call Participants Prepared Remarks: Operator Good morning, my name is Mike and I will be your conference operator today. At this time, I would like to welcome everyone to the Sandstorm Gold conference call. All lines have been placed on mute to prevent any background noise. Please be aware that some of the commentary, may contain forward-looking statements.There can be no assurance that forward-looking statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. After the speakers’ remarks, there will be a question-and-answer session. If you’d like to ask a question during this time simply press then the number one on your telephone keypad. If you would like to withdraw your question […]

Jewellers Gear Up For Next Festival As Gold Sales Pick Up

Bengaluru/Mumbai:

Healthy sales during a recent festival encouraged Indian jewellers to continue stocking up this week, while more supply started to make its way into Singapore and Hong Kong as dealers navigate around COVID-19-led bottlenecks. The country celebrated the Dussehra festival on Sunday, and now await Diwali and Dhanteras in November.

"Dussehra sales gave confidence to jewellers. They’re now buying for Diwali," said a Mumbai-based dealer with a bullion importing bank.

Premiums of $1 an ounce were charged over official domestic prices, including 12.5 per cent import and 3 per cent sales levies, from $5 premiums last week. Domestic gold futures were trading around ₹ 50,500 ($682.96) per 10 grams."Retail consumers are slowly adjusting to higher prices," said Aditya Pethe, director at Waman Hari Pethe Jewellers.In Singapore, premiums of $0.80-$1.30 an ounce were charged over international spot prices."As more countries adjust to the ‘new normal’, we see less logistical constraints as […]

Newmont sees best quarter in 100-year history as gold prices soar

Newmont Corp. recorded its highest quarterly sales revenue in more than a decade from its gold mines, allowing it to hike its dividend and declare its third quarter the best in its 100-year history.

The Denver-based company’s revenue rose 17% year over year to $3.17 billion in the third quarter.

Newmont (NYSE: NEM) was helped by gold prices that, fueled by pandemic economic uncertainties, have risen steadily for months and hit a summer high not seen since a gold peak in 2011.

Newmont recorded $1.3 billion free cash flow from the quarter and, on Wednesday, declared a 60% increase in the dividend it pays to shareholders.“This was the best quarterly financial performance in Newmont’s history,” said Tom Palmer , president and CEO of Newmont.The company’s dividend increase added to a 79% dividend hike earlier in the year and pushed Newmont’s annual shareholder dividend rate to a gold-industry high of $1.60 per share.The […]

Gold Up, Poised for $1,900, on US Election Jitters, New Stimulus Hope

By Barani Krishnan Investing.com – Gold prices rose Friday, appearing poised to return to the key $1,900 level, as the safe haven crowd leveraged on uncertainty over next week’s U.S. election and that the winner will attempt to undertake a new major Covid-19 stimulus for the economy.

New York-traded gold for December delivery settled at $1,879.90, up $11.90, or 0.6% on the day. For the month, however, the benchmark U.S. gold contract was down 1.3%, accounting for losses occurring mostly in mid-October as a surge in risk appetite then had weighed on safe-havens.

Spot gold , which reflects real-time trades in bullion, was up $10.26, or 0.6%, at $1,878.12 by 4:00 PM ET (20:00 GMT).

“Haven buying is expected to increase in the coming days,” Jeffrey Halley, analyst for OANDA in New York, said, adding that gold could attempt to try and get over $1,900. “It should be enough to at […]

Gold market changing, rearranging

By Ellsworth Dickson

While many people are wrapped up in the different and sometimes difficult changes in their lives due to the consequences of the COVID-19 pandemic, the virus has also caused changes in the gold market – some to be expected and some surprising.

According to a new report by the World Gold Council, demand for gold in Q3 2020 – 2,972 tonnes year to date – demand is 10% below the same period in 2019. Q3 demand was 892.3 tonnes – the lowest quarterly total since Q3 2009.

However, these figures don’t really tell the story.The WGC report notes that while jewellery demand improved from the dark days of the record Q2 low, the continued social restrictions, economic slowdown and a strong gold price dissuaded many potential buyers of jewellery; in other words, the perfect storm for not splurging on beautiful baubles. Gold demand for jewellery at 333 tonnes was […]

Gold is now looking past the political games

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – Hopefully, we have just one more weekend to go before we can put this year’s U.S. general election behind us.

With the COVID-19 pandemic devastating the U.S. and the global economy, this election season has been one for the history books and has been chock full of uncertainty and turmoil. According to political pundits, there are growing expectations of a blue wave in Washington with the Democrats taking control of Congress and the White House; however, memories of 2016 continue to loom large on the horizon, so at this point, anything could happen.

Regardless of what the government looks like for 2021, they will have a heck of a mess to clean up. Earlier this week, economic data […]

Gold stocks’ winter rally 5

Stock image. Gold stocks exhibit strong seasonality because their price action mirrors that of their dominant primary driver, gold. Gold’s seasonality generally isn’t driven by supply fluctuations like grown commodities see, as its mined supply remains relatively steady year-round. Instead gold’s major seasonality is demand-driven , with global investment demand varying considerably depending on the time in the calendar year.

This gold seasonality is fueled by well-known income-cycle and cultural drivers of outsized gold demand from around the world. And the biggest seasonal surge of all is just getting underway heading into winter. As the Indian-wedding-season gold-jewelry buying that normally drives this metal’s big autumn rally winds down, the Western holiday season ramps up. The holiday spirit puts everyone in the mood to spend money.

Men splurge on vast amounts of gold jewelry for Christmas gifts for their wives, girlfriends, daughters, and mothers. The holidays are also a major engagement season, […]

Risks remain to the downside for oil and gold

Oil back under pressure

Oil couldn’t hang on to earlier gains, slipping back into negative territory as the session wore on.

WTI is closing in on $35 again and further losses are looking likely. The next key level is $33, a particular area of interest back in May when crude was trading around these levels.This also coincides with $35 in Brent, a break of which could be the tipping point as far as OPEC+ are concerned.

There’s a couple of weeks until the next JMMC meeting and the next full meeting of OPEC and its allies isn’t until the end of November/start of December. Can they afford to wait that long? A move back towards $30 may force them to act sooner, in some form or another. A postponement of January’s two million barrel increase may be enough for now. Gold bounce nothing to get excited about Gold prices are bouncing […]

Southern Gold builds South Korean exploration position as it drill tests targets in search of world-class gold discovery

The company has also secured significant funding, largely from ‘technically astute’ institutional investors looking at the long term prospects. The company continues to build a high-quality portfolio of epithermal gold-silver targets in the South-West district of South Korea Southern Gold Ltd ( ASX:SAU ) is building a strong South Korean exploration position and is drill testing its targets, many generated over the past two years of fieldwork.

After switching focus from Western Australia to South Korea, the gold explorer is now busy drilling and maximising the chances of making a world-class gold deposit discovery.

It has also secured significant funding, largely from ‘technically astute’ institutional investors looking at the long-term prospects of the company. Earlier stage of exploration

Southern Gold principally operates an exploration business focused on its 100%-owned projects in South Korea, which largely comprise a portfolio of epithermal gold-silver projects.Several of these targets are high-quality exploration projects, where high-grade […]

Click here to view original web page at www.proactiveinvestors.com.au

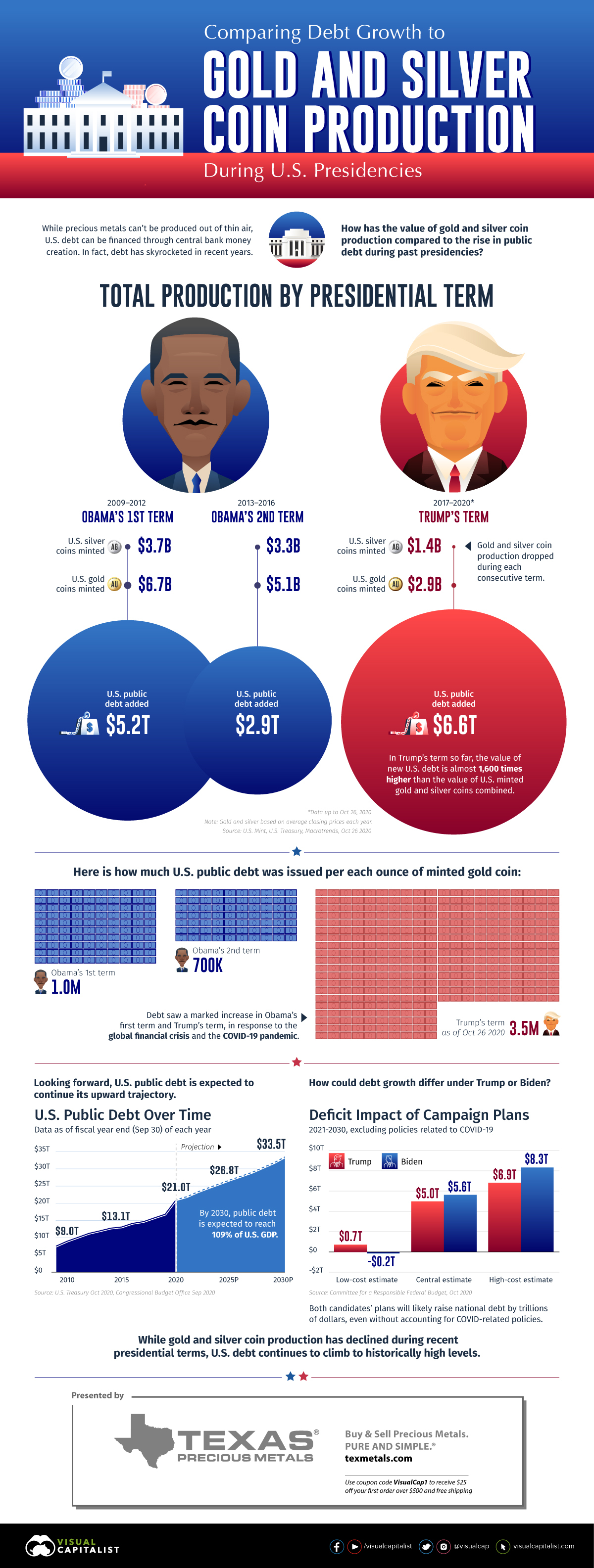

Comparing Recent U.S. Presidents: New Debt Added vs. Precious Metals Production

Recent U.S. Presidents: Debt vs. Coins Added

While precious metals can’t be produced out of thin air, U.S. debt can be financed through central bank money creation. In fact, U.S. debt has skyrocketed in recent years under both Democrat and Republican administrations.

This infographic from Texas Precious Metals compares the increase in public debt to the value of gold and silver coin production during U.S. presidencies. Total Production by Presidential Term

We used U.S. public debt in our calculations, a measure of debt owed to third parties such as foreign governments , corporations, and individuals, while excluding intragovernmental holdings. To derive the value of U.S. minted gold and silver coins, we multiplied new ounces produced by the average closing price of gold or silver in each respective year.Here’s how debt growth stacks up against gold and silver coin production during recent U.S. presidencies:Over each consecutive term, gold and silver coin […]

Click here to view original web page at www.visualcapitalist.com

Green pot of gold at bottom of the barrel

Alberta is setting its sights on non-transportation markets for oil-sands bitumen that could drive a vast increase in the value of production by 2035 – assuming that major technological hurdles can be overcome.

Alberta Innovates – a Crown agency – says the biggest opportunity lies in the production of carbon fibre, a high-strength material that can be used in wind turbines, automotive applications and the aerospace industry. The agency has launched a $15-million “Grand Challenge” in which 20 laboratories around the world are participating in research to commercialize the production of carbon fibre from the heavy asphaltenes contained in bitumen, in the so-called bottom of the barrel.

“We are finding new ways to use bitumen not as transportation fuel but as value-added non-combustion materials that are worth more than transportation fuel but with a low GHG emissions – products like carbon fibre,” said John Zhou, vice-president of clean resources at Alberta […]

Click here to view original web page at www.corporateknights.com

Roman gold coin commemorating the assassination of Julius Caesar 2,000 years ago sells for a record £3.24 MILLION at auction

A rare gold coin which commemorates the assassination of the Roman general Julius Caesar sold at auction for a record £3.24 million — including premium — yesterday.

Over two millennia old, the token is one of three of the same design known to have been cast in gold, making it the ‘holy grail’ for ancient coin collectors, experts said.

Previously held in a private collection in Europe, the mint-condition gold coin was sold at auction by London-based Roma Numismatics on October 29, 2020.

The name of the winning bidder has not been revealed by the auctioneers.The minting of the coin has been described as a ‘naked and shameless celebration’ of Caesar’s murder two years previously in 44 BC.The assassination was prompted by concern among the Roman senate that Caesar — having recently been named ‘dictator in perpetuity’ — would name himself king.Fear of this tyranny fostered a conspiracy of 60 senators who […]

Cofounder of True Religion, Kym Gold, Brings Fashion Home with the Launch of Style Union Home

Kym Gold LOS ANGELES, Oct. 30, 2020 /PRNewswire/ — After selling her denim empire for $835M, style icon Kym Gold is bringing her disheveled sexy aesthetic to the home with the launch of a luxury line of entertaining, décor and petware called Style Union Home. The line of ceramics, lovingly designed and fancifully named by Gold herself, is handmade in Los Angeles. During a time in which our homes are so much more than just a home, Style Union Home launches in Q4 at StyleUnionHome.com and is soon to roll out in independent luxury retailers and e-tailers nationally.

Style Union Home is the birth of yet another iconic style statement by Gold, whose headline contribution to the fashion world includes True Religion, the iconic thick white thread-stitched, tab-pocketed designer jeans with the immediately recognizable jolly Buddha logo. Since True Religion, Gold has been flipping homes. For this venture, she brought […]

Gold looks good heading into the US sesion but watch out for these levels

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here!

( Kitco News ) – There are a couple of key areas that gold may find some resistance in the US session. The first is the black line at $1884.8. This level has been used around three times as support and could be significant as the price rebounds slightly. If the level does break then the red line looks slightly stronger as it was the mean distribution support area close to the place where the most volume had been traded at price ($1905).

Elsewhere there is a small trendline that could cause some issues but it is very close to the black resistance zone. Since there was a decent amount of volume in the sell-off yesterday it would […]

Newmont CEO Trumpets Rising Free Cash Flow on Higher Gold Prices

Engineers set off explosions to remove soil while mining for gold in a pit at the Yanacocha gold mine in Cajamarca, Peru. Operations at Yanacocha, South America’s largest gold mine, are a joint venture between Newmont, Minas Buenaventura, and International Finance Corp. Newmont is coming off a record quarter and its chief executive, Tom Palmer, is seeking to broaden the mining company’s ownership base by emphasizing its growing dividend, long-lived assets, rising free cash flow, strong corporate governance, and exposure to a higher gold price.

“Our portfolio is hitting its stride and we’ve built momentum for the fourth quarter, which will be the strongest quarter of the year,” Palmer tells Barron’s .

Palmer, 52, is a fourth-generation Australian miner who got the top job at Denver-based Newmont a year ago. Before Newmont (ticker: NEM), Palmer worked at mining giant Rio Tinto (RIO), which has significant Australian operations.

Newmont is one of the […]

Indian jewellers gear up for next festival as gold sales pick up pace

A salesman shows a gold necklace to customers at a jewellery showroom in Ahmedabad BENGALURU/MUMBAI (Reuters) – Healthy sales during a recent festival encouraged Indian jewellers to continue stocking up this week, while more supply started to make its way into Singapore and Hong Kong as dealers navigate around COVID-19-led bottlenecks.

Indians celebrated the Dussehra festival on Sunday, and now await Diwali and Dhanteras in November.

"Dussehra sales gave confidence to jewellers. They’re now buying for Diwali," said a Mumbai-based dealer with a bullion importing bank.

Premiums of $1 an ounce were charged over official domestic prices, including 12.5% import and 3% sales levies, from $5 premiums last week. Local gold futures were trading around 50,500 rupees ($682.96) per 10 grams."Retail consumers are slowly adjusting to higher prices," said Aditya Pethe, director at Waman Hari Pethe Jewellers.In Singapore, premiums of $0.80-$1.30 an ounce were charged over international spot prices."As more countries […]

Click here to view original web page at www.marketscreener.com

Gold Price Forecast – Gold Markets Attempting to Stabilize

Gold markets have rallied a bit during the trading session on Friday, reaching towards the $1890 level rather quickly. At this point, it looks like the $1900 level will be targeted, but we have the 50 day EMA just above there and of course a lot of supply. Quite frankly, this is a market that will probably dip from here, but I also think that will be a nice buying opportunity as central banks around the world will continue to flood the markets with liquidity. This should drive down the value of fiat currency, and thereby drive up the demand for metal such as gold and silver. Gold Price Predictions Video 02.11.20

Even if we break down below the $1850 level, I think that the $1800 level will be targeted as it was a major breakout previously and we have the 200 day EMA sitting there. Furthermore, we also […]

Who Do You Choose, Gold? Trump or Biden?

There are only a few days left until the elections. Who will become the next American president? Donald Trump or Joe Biden? Recent national polls indicate that the latter continues to maintain his lead over the incumbent running for reelection. Biden has an average polling lead of 10.0 percentage points over Trump, as the chart below shows. It is a massive advantage that puts Biden in a better position than any other challenger since 1936, when the first scientific polls were taken in a presidential race.

The big difference stems from several factors, one of which is the fact that white seniors, a significant group of voters who helped Trump win in 2016, are now dissatisfied with the president’s erratic handling of the pandemic . People simply believe that Biden will deal better with the epidemic . He is also showing strength in the Midwest, which was Trump’s key to […]

Gold Price Prediction – Prices Rebound Despite a Rising Greenback

Gold prices moved higher on Friday rebounding from Thursday slide despite a gain in the greenback and higher US yields. Riskier assets sold off as traders took profits on technology equities despite robust earnings results. US consumer spending was stronger than expected while the Chicago PMI (the final regional PMI number)ahead of the National number on Monday) edged slightly lower.

Trade gold with FXTM Technical analysis

Gold prices higher generating a higher low and a higher high and are poised to test resistance seen near the 10-day moving average at 1,897. Support on the yellow metal is seen near the September lows at 1,848. Short-term momentum is negative as the fast stochastic recently generated a crossover sell signal on the upper end of the neutral range and continues to accelerate lower. The current reading on the fast stochastic is 17, below the oversold trigger level of 20 which could foreshadow […]

Gold/silver strategies for 2021

Market jitters were the underlying theme in this week’s trading environment, which is understandable given that we are days away from the U.S. election. Multiple central bank meetings, i.e., ECB, caused Global markets to play off one another, with the Dollar signaling "overbought" as the likely catalyst for gold/silver correction this week. The other near term "risk" to gold/silver would be a contested election that would lead to another stimulus delay. Don’t worry; the massive fiscal wave will come, the money supply will continue to surge, and higher inflation will show up sooner or later.

This week I wanted to look at position sizing in the metals markets and concentration of bets, which often gives us clues to how the price could play out. I am noticing that the small speculators positioned already, the proprietary traders are trading away, the locals are mostly long; however, CTA’s, hedge funds, and money […]

Latest updates as Gold Coast goes to the polls

Introductory Subscription Offers

1 Offers to be billed as follows: Digital Subscription $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $28 (min. cost) billed approximately 4 weekly. Digital Subscription + Weekend Delivery $4 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $30 (min. cost) billed approximately 4 weekly. Digital Subscription + 7 Day Delivery $28 (min. cost) for the first 12 weeks, then after the initial 12 weeks it is $60 (min. cost) billed approximately 4 weekly. Renewals occur unless cancelled in accordance with the full Terms and Conditions. Additional terms in for All Subscription Offers section below.12 Month Plan Subscription Offers

2 12 Month Plan subscription offers to be billed for the first 12 months as follows, approximately 4 weekly: Digital Subscription $20, min. cost $260; Digital Subscription + Weekend […]

Click here to view original web page at www.adelaidenow.com.au

Attention Investors: This Gold Stock Just Increased its Dividend by 75%

Agnico-Eagle Gold Mines (TSX:AEM) (NYSE:AEM) is a top gold stock that is firing on all cylinders. This means production growth, cash flow growth, and dividend growth. It also means stock price performance. Agnico-Eagle stock rallied almost 5% yesterday. It has a one-year return of 33% and a three-year return of 82%.

But what are the forces that are driving Agnico-Eagle’s strong growth today? Gold stocks rule in a crisis

In today’s environment, dividend cuts and economic troubles have been the norm. But gold stocks have been one of the exceptions. The price of gold is rapidly closing in on $2,000 per ounce. Prices have surpassed 2011 peak levels and appear to be headed higher. This is predicted by increasing global economic troubles, a falling U.S. dollar, and gold’s place as a safe haven.

In this pandemic crisis, one thing investors can count on is gold as a safe haven. You see, […]