Click to enlarge Uranium that’s produced in Wyoming is, at present, in-situ—which means in place—uranium is dissolved into solution, pumped to the surface and then processed into yellowcake.

Azarga Uranium ( TSX:AZZ , OTCQB:AZZUF , Forum ) is one company currently focused on Wyoming through several projects in the state, including its 100 per cent-owned Gas Hills Uranium Project, which has a deep mining history.

The company recently announced that it had completed an updated National Instrument 43-101 (NI 43-101) resource estimate on the project after additional uranium mineralization had been identified.

Key highlights

Measured and indicated uranium resources rose from 4.73 million pounds to 10.77 million pounds, representing a 128 per cent increase Measured and indicated in-situ recovery (“ISR”) uranium resources totalling 7.71 million pounds (72% of the overall measured and indicted resources) at an average grade of 0.101 per cent U3O8 The Gas Hills Project having the potential […]

Uranium Participation Corporation Reports Estimated Net Asset Value at March 31, 2021

View PDF URANIUM PARTICIPATION CORPORATION REPORTS ESTIMATED NET ASSET VALUE AT MARCH 31, 2021 (CNW Group/Uranium Participation Corporation) On the last trading day of March 2021, the common shares of UPC closed on the TSX at a value of CAD$5.45, which represents a 9.88% premium to the net asset value of CAD$4.96 per share.

About Uranium Participation Corporation

Uranium Participation Corporation is a company that invests substantially all of its assets in uranium oxide in concentrates ("U 3 O 8 ") and uranium hexafluoride ("UF 6 ") (collectively "uranium"), with the primary investment objective of achieving appreciation in the value of its uranium holdings through increases in the uranium price. UPC provides investors with a unique opportunity to gain exposure to the price of uranium without the resource or project risk associated with investing in a traditional mining company. Additional information about Uranium Participation Corporation is available on SEDAR […]

Psst: If You’re Looking for an Unloved Investment Sector, How About Uranium?

As a market strategist I have no choice but to track the hottest sectors of the market, but I also keep a close watch on the most unloved areas. Like Wayne Gretzky, I like to skate to where the puck will be, not where it is; and today I’m focusing on uranium. Remember nuclear energy? Many don’t, so let’s review. Smashing together atoms of uranium or uranium derivatives causes a chain reaction that unleashes enough energy to destroy the world or, wait for it, power the world. Speaking from Firsthand Experience

My expertise in this area is personal. As a Naval aviator I spent the better part of a decade sleeping on top of two nuclear reactors on several of our nation’s finest aircraft carriers. Those

two reactors could send a 90,000-ton vessel around the world countless times at a top speed that remains confidential. So, with global concern over […]

Plateau Energy Metals Announces Break-through in Process Testing of Macusani Uranium Deposits

TORONTO, March 30, 2021 (GLOBE NEWSWIRE) — Plateau Energy Metals Inc . (“Plateau” or the “Company”) (TSX-V:PLU | OTCQB:PLUUF) is pleased to announce positive preliminary pre-concentration test results from the Colibri II-III and Corachapi uranium deposits at the Company’s Macusani Uranium Project (“Macusani”) in Peru. This process testing was completed by TECMMINE E.I.R.L. (“TECMMINE”), a metallurgical consulting company based in Lima, Peru, and also involved DRA Global in South Africa. These results build from, and improve on, previous work completed by the Cameco Corporation in 2013 when they were involved with the Tantamaco uranium deposit discovery. These results should substantially improve on the encouraging potential economics for Macusani reported in the previous 2016 Preliminary Economic Assessment (“PEA”) 1 and will help form the basis for an updated PEA, currently being contemplated.

Highlights: Colibri II-III Deposit – 81.6% of U retained in 35.3% of original mass passing 300 μm; Calculated […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Week: Uranium Price Rise Forecast

As the uranium prices continue to rally, Morgan Stanley expects inventories to diminish and prices to trend higher

-Morgan Stanley forecasts US$48/lb by 2024.

-Disposal of uranium waste deemed safe

-Spot uranium price climbs nearly 13% in MarchThe pandemic has been a greater disruption to uranium supply than to demand, with nuclear power proving to be very resilient in most markets. Nonetheless, sales from inventories have capped price upside. As inventories diminish, Morgan Stanley expects the uranium price to trend higher.Increased contracting activity in the enrichment market could be the start of a new long-term uranium contracting cycle. While global nuclear power capacity fell -2.7GW in 2020, Morgan Stanley sees a net 8GW increase in 2021 as new plants come online in China, other Asia and Eastern Europe.Meanwhile, in the recent 14th five-year plan, China is targeting 70GW of nuclear capacity by 2025 from 48GW in 2020. […]

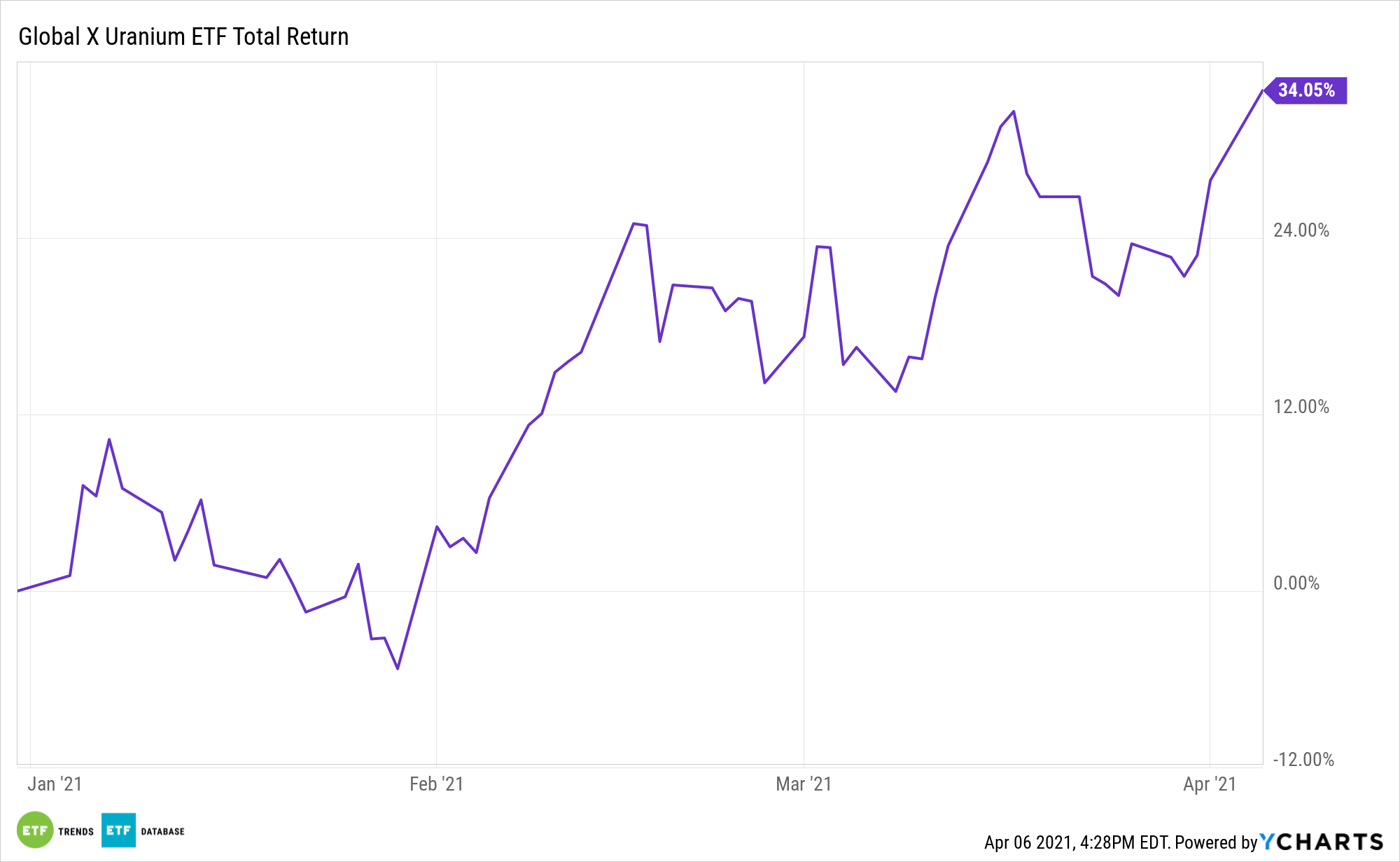

Uranium May Be Growing after Biden’s American Jobs Plan Announcement

U.S. president Joe Biden’s $2 trillion plan includes initiatives to help bolster jobs in America, including a push for clean electricity via energy sources like nuclear power. This may help put the Global X Uranium ETF (URA) back on the map.

URA can give ETF investors niche exposure when compared to a broad-based clean energy fund. The announcement of the plan has been having a positive effect thus far, with the fund up close to 7% the past 5 days.

"As the recent Texas power outages demonstrated, our aging electric grid needs urgent modernization," a White House fact sheet noted. "The President’s plan will create a more resilient grid, lower energy bills for middle class Americans, improve air quality and public health outcomes, and create good jobs, with a choice to join a union, on the path to achieving 100% carbon-free electricity by 2035."

Overall, URA seeks to provide investment results that […]

Boss is ‘premier uranium developer’, says leading North American broker

Investors are scrambling to secure exposure to uranium amid growing evidence that the market is tightening rapidly, setting the scene for significant price rises. And now a new report from influential North American broker Sprott has named Boss Energy (ASX:BOE) as the “premier next-in-production uranium developer”.

Boss increased its exposure to the uranium market substantially last week when it raised $60 million to buy a large uranium stockpile.

As well as enabling the company to capitalise instantly on rises in the price of uranium, the strategy also delivers Boss a range of options for funding the equity component of its Honeymoon project in South Australia.

Boss has the choice of selling some or all of the stockpile to fund Honeymoon or simply sitting on it as a means of increasing exposure to the uranium price.But the stockpile acquisition also brings other key strategic benefits. These include strengthening its hand in offtake negotiations […]

Uranium May Be Growing after Biden’s American Jobs Plan Announcement

U.S. president Joe Biden’s $2 trillion plan includes initiatives to help bolster jobs in America, including a push for clean electricity via energy sources like nuclear power. This may help put the Global X Uranium ETF (URA) back on the map.

URA can give ETF investors niche exposure when compared to a broad-based clean energy fund. The announcement of the plan has been having a positive effect thus far, with the fund up close to 7% the past 5 days.

“As the recent Texas power outages demonstrated, our aging electric grid needs urgent modernization,” a White House fact sheet noted. “The President’s plan will create a more resilient grid, lower energy bills for middle class Americans, improve air quality and public health outcomes, and create good jobs, with a choice to join a union, on the path to achieving 100% carbon-free electricity by 2035.”

Overall, URA seeks to provide investment results that […]

Denison Announces Execution of Agreements with the English River First Nation

Denison Mines Corp. is pleased to announce that it has entered into a Participation and Funding Agreement and Letter of Intent with the English River First Nation in connection with the advancement of the proposed in-situ recovery uranium mining operation at Denison’s 90% owned Wheeler River Uranium Project which is located in the eastern portion of the Athabasca Basin region, in northern Saskatchewan. …

Denison Mines Corp. (“Denison” or the “Company”) (TSX: DML) (NYSE American: DNN) is pleased to announce that it has entered into a Participation and Funding Agreement (the “Participation Agreement”) and Letter of Intent (the “LOI”) with the English River First Nation (“ERFN”) in connection with the advancement of the proposed in-situ recovery (“ISR”) uranium mining operation at Denison’s 90% owned Wheeler River Uranium Project (“Wheeler River Project”), which is located in the eastern portion of the Athabasca Basin region, in northern Saskatchewan. Additionally, Denison and ERFN […]

Global Uranium Market 2021 to 2026 Analysis by Top Key players like Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, etc

“ Uranium Market Report Coverage: Key Growth Factors & Challenges, Segmentation & Regional Outlook, Top Industry Trends & Opportunities, Competition Analysis, COVID-19 Impact Analysis & Projected Recovery, and Market Sizing & Forecast.

Latest launched research on Global Uranium Market , it provides detailed analysis with presentable graphs, charts and tables. This report covers an in depth study of the Uranium Market size, growth, and share, trends, consumption, segments, application and Forecast 2027. With qualitative and quantitative analysis, we help you with thorough and comprehensive research on the global Uranium Market. This report has been prepared by experienced and knowledgeable market analysts and researchers. Each section of the research study is specially prepared to explore key aspects of the global Uranium Market. Buyers of the report will have access to accurate PESTLE, SWOT and other types of analysis on the global Uranium market. Moreover, it offers highly accurate estimations on […]

These Companies Are Ready for the Next Uranium Surge … Are You?

(Image via Azincourt Energy Corp.) 2021 is shaping up to be a big year for uranium as global demand continues to rise with trends pointing toward greater energy consumption and lower carbon solutions ….

A decade since the Fukushima disaster and the spot price for U3O8 moved above $30 per pound for the first time this year, a rebound from an 11-month low of $27.60 nearly a month ago. Producers and mine developers are collecting inventories above-ground and reactor construction continues for a number of others. Major uranium companies (Such as Kazakhstan’s JSC National Atomic Company Kazatomprom and Toronto-based Denison Mines Corp ( TSX: TDML ) ) recently announced plans to make purchases of this nuclear fuel.

Uranium prices have yet to reach their values from early 2020 … but that could mean opportunity awaits for investors. There are several producers and explorers out there who have seen their share […]

Uranium Energy Corp Expands Physical Uranium Initiative to Purchase 2.1 Million Pounds U3O8 and Announces Financing

NYSE American Symbol – UEC

CORPUS CHRISTI, Texas, April 6, 2021 /PRNewswire/ – Uranium Energy Corp (NYSE American: UEC) (the "Company" or "UEC") is pleased to report that it has now secured an additional 705,000 pounds of U.S. warehoused uranium, with delivery dates out to December 2022.

Including the previously announced contracts to acquire 1,400,000 pounds of uranium concentrates, UEC has now entered into additional purchase contracts for a total of 2,105,000 pounds of U 3 O 8 at a volume weighted average price of ~$30 per pound.

The Company is also pleased to announce that it has entered into definitive agreements with institutional investors to purchase an aggregate of 3,636,364 common shares of the Company (each, a "Share") at a purchase price of $3.30 per Share and for gross proceeds of approximately $12,000,000 in a registered direct offering (the "Offering"). The closing of the Offering is expected to occur on […]

Peninsula Energy’s uranium book expected to deliver US$8-9 million net cash margin in 2022

The uranium producer will purchase nearly half a million pounds of natural uranium concentrate through until the end of next year to meet demand. PEN has entered into multiple binding purchase agreements to procure natural uranium concentrates. Peninsula Energy Ltd ( ASX:PEN ) ( OTCMKTS:PENMF ) (FRA:P1M) is predicting a net cash margin of between US$8-$9 million in 2022, as it stocks up on uranium concentrate to meet demand.

The company has entered into multiple binding purchase agreements to procure natural uranium concentrates – as U3O8 – sufficient to meet the entirety of its 2022 committed sales of 450,000 pounds.

U3O8, more formally known as triuranium octoxide, is a compound of uranium that has long-term stability and an extremely long half-life of over 4 billion years, meaning it emits radiation at a very slow rate, making it suitable for commercial and industrial use. Strong demand

Peninsula CEO and managing director Wayne […]

Click here to view original web page at www.proactiveinvestors.com.au

Here’s Our Rant About Uranium Energy Corp. (UEC)

Uranium Energy Corp. (AMEX:UEC) went up by 12.24% from its latest closing price compared to the recent 1-year high of $3.67. The company’s stock price has collected 16.30% of gains in the last five trading sessions. Press Release reported on 03/26/21 that (CNW) Uranium Energy Corp’s Executive VP Scott Melbye Testifies at the U.S. Senate Committee on Energy & Natural Resources Is It Worth Investing in Uranium Energy Corp. (AMEX :UEC) Right Now?

Plus, the 36-month beta value for UEC is at 2.48. Opinions of the stock are interesting as 5 analysts out of 5 who provided ratings for Uranium Energy Corp. declared the stock was a “buy,” while 0 rated the stock as “overweight,” 0 rated it as “hold,” and 0 as “sell.”

Even if you’re not actively in crypto, you deserve to know what’s actually going on…

Because while leading assets such as Bitcoin (BTC) and Ethereum (ETH) are […]

Reasons Why Long-term Faith on Uranium Energy Corp. (UEC) Could Pay Off Investors

Let’s start up with the current stock price of Uranium Energy Corp. (UEC), which is $3.56 to be very precise. The Stock rose vividly during the last session to $3.21 after opening rate of $2.93 while the lowest price it went was recorded $2.88 before closing at $3.21.

Recently in News on March 30, 2021, InvestorBrandNetwork (IBN) Announces Latest Episode of The Bell2Bell Podcast featuring the Return of Amir Adnani, President & CEO of Uranium Energy Corp. (via InvestorWire) InvestorBrandNetwork (“IBN”), a multifaceted communications organization engaged in connecting public companies to the investment community, is pleased to announce the release of the latest episode of The Bell2Bell Podcast as part of its sustained effort to provide specialized content distribution via widespread syndication channels. You can read further details here

A Backdoor Way To Profit From Today’s Crypto Bull Market

Even if you’re not actively in crypto, you deserve to […]

Why Uranium Stocks Popped Monday

What happened

Uranium stocks went nuclear on Monday, with shares of Denison Mines ( NYSEMKT:DNN ) surging 10.2%, Uranium Energy ( NYSEMKT:UEC ) rising 10.6%, and Energy Fuels ( NYSEMKT:UUUU ) closing 14.3% higher.

It’s not hard to figure out why: Uranium prices are way up. Image source: Getty Images. So what

As OilPrice.com reported over the weekend, the spot price for U308 (triuranium octoxide, also known as yellowcake, and the most stable form of uranium oxide found in nature) last week surged past $30 per pound for the first time this year, approaching its highs of last year.Investment banks BMO Capital Markets and Morgan Stanley both believe that uranium prices have set a floor, and are unlikely to fall back below $30. To the contrary, the analysts are predicting that uranium will continue to rally, and could hit $50 by 2024.The reason: According to energy experts , it’s unlikely […]

GoviEx Uranium Files Updated Pre-Feasibility Study for the Madaouela Project

Start-Up Capital and Operating Costs Reduced

Vancouver, British Columbia–(Newsfile Corp. – April 5, 2021) – GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) ("GoviEx or the Company") is pleased to announce that a technical report titled, "An Updated Pre-Feasibility Study for the Madaouela Project, Niger" dated effective April 5, 2021 (the " Report "), which supports the disclosure in the Company’s news release dated February 18, 2021, has been filed today under the Company’s profile on SEDAR.

Key Highlights of the Report, as previously described in the February 18, 2021, news release: Open pit mining in the early years with CapEx reduced by 15% and OpEx down by 20%

Captive water source, consumption reduced by 66% Grid level electrical power existing within Madaouela Project boundary Prioritize local skilled labour and local venders Straightforward industry standard process design – reducing construction and operational risks Mining Permit and Environmental Certificate already secured Potential […]

Click here to view original web page at www.juniorminingnetwork.com

5 Top Weekly TSXV Stocks: Uranium Companies Make Moves

The S&P/TSX Venture Composite Index (INDEXTSI: JX ) spent the last week of March moving higher, starting the period at 941.98 and closing Thursday (April 1) at 961.19.

Gold also registered a gain for the four day session. After slipping to US$1,678 per ounce on Tuesday (March 30), the yellow metal rallied to US$1,729.10.

Silver had a less pronounced uptick, holding in the US$24 per ounce range. Uranium was another gainer as the energy fuel breached the US$30 per pound range for the first time in 2021. Uranium Price Forecasts and Top Uranium Stocks to Watch Did You Know That Uranium Was A Top Commodity In 2020?

Don’t Miss Out This Year With Our Exclusive FREE 2021 Uranium Outlook Report! Against that backdrop, the TSXV-listed mining stocks below saw the biggest share price moves last week: Rusoro Mining (TSXV: RML ) Telson Mining (TSXV: TSN ) CanAlaska Uranium […]

Global Uranium Mining Market 2021 Opportunities, Key-Players, Revenue, Emerging-Trends, Business-Strategy Till 2025

Latest Survey On Uranium Mining Market:

‘Market Growth Insight’ has presented an updated research report on ‘The Global Uranium Mining market’ which offers insights on key aspects and an overview of the fundamental verticals of the market. The Uranium Mining report aims to educate buyers on the crucial impactful factors like drivers, challenges and opportunities for the market players, and risks. It comprises a thorough analysis of current Uranium Mining market trends as well as future trends. It also throws light on various quantitative and qualitative assessments of the market. The Uranium Mining research report covers every crucial aspect of the industry that impacts the existing market share, market size, profitability status, and more. A comprehensive evaluation on impacting factors the influence growth opportunities for Uranium Mining market players and remuneration. North America has a significant international presence in the global Uranium Mining market in 2021 accompanied by the […]

GoviEx Files Updated Pre-Feasibility Study for the Madaouela Project

Start-Up Capital and Operating Costs ReducedGoviEx Uranium Inc. is pleased to announce that a technical report titled, “An Updated Pre-Feasibility Study for the Madaouela Project, Niger” dated effective April 5, 2021 which supports the disclosure in the Company’s news release dated February 18, 2021, has been filed today under the Company’s profile on SEDAR.Key Highlights of the Report, as previously described in …

Start-Up Capital and Operating Costs Reduced

GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) (“GoviEx or the Company”) is pleased to announce that a technical report titled, “An Updated Pre-Feasibility Study for the Madaouela Project, Niger” dated effective April 5, 2021 (the “Report”), which supports the disclosure in the Company’s news release dated February 18, 2021, has been filed today under the Company’s profile on SEDAR.

Key Highlights of the Report, as previously described in the February 18, 2021, news release: Open pit mining in the early years with CapEx […]

Uranium Royalty Corp: Speculative Play On A Beaten Down Sector

On March 30, Uranium Royalty Corp. (TSXV: URC) exercised its option to buy US$10 million of physical uranium (U3O8) under the terms of its investment in the 2018 IPO of Yellow Cake plc. Uranium Royalty purchased 348,068 pounds of uranium at a price of US$28.73 per pound, a 7% discount to the U3O8 spot price on March 29, 2021.

Uranium Royalty makes royalty or streaming investments in the uranium sector, thereby allowing an investor to gain exposure, including through the purchase of physical uranium, to a beaten down sector with potentially improving fundamentals without taking on explicit uranium mining risk. In this way, Uranium Royalty is applying the same model to a highly speculative sector that many successful royalty/streaming companies employ in gold mining and oil and gas businesses.

The company has interests in 15 uranium projects primarily in the U.S. and Canada, plus a 5.9% stake in Yellow Cake plc, […]

Energy Penny Stocks to Consider in 2021

If you’re an investor that doesn’t mind risk, energy penny stocks might be worth considering. Their potential returns are huge.

Last year was a low point for the energy sector. But the market is looking up as COVID-19 vaccines roll out. People are looking forward to traveling and that will increase energy demand. Below you’ll find a list of energy penny stocks that offer high risk-to-reward opportunities.

Also, if you want to see how your investments can grow, check out our investment calculator . It’s a free tool that can help you plan and reach your financial goals. Five Energy Penny Stocks to Consider

> Southwestern Energy Company (NYSE: SWN) American Resources Corp. (Nasdaq: AREC) Denison Mines Corp. (NYSE: DNN) Ur-Energy Inc. (NYSE: URG) Uranium Energy Corp. (NYSE: UEC) We’ll look at these companies in more detail below. But first, I’m going to show you why both energy stocks and penny […]

GoviEx Engages Uranium Marketing Professional

GoviEx Uranium Inc. is pleased to announce that it has engaged Mr. Christopher Mark Lewis to head the Company’s Uranium Marketing efforts.”Chris brings considerable experience in uranium marketing to the GoviEx Team. Having recently updated our pre-feasibility study for the Madaouela Uranium Project and given our positive outlook for the uranium market, we are focused on putting in place the key areas necessary to …

GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) (“GoviEx” or “Company”), is pleased to announce that it has engaged Mr. Christopher Mark Lewis to head the Company’s Uranium Marketing efforts.

“Chris brings considerable experience in uranium marketing to the GoviEx Team. Having recently updated our pre-feasibility study for the Madaouela Uranium Project (1) and given our positive outlook for the uranium market, we are focused on putting in place the key areas necessary to support the future development of Madaouela – including technical capabilities to advance our […]

Uranium Royalty (CVE:URC) Is In A Strong Position To Grow Its Business

We can readily understand why investors are attracted to unprofitable companies. By way of example, Uranium Royalty ( CVE:URC ) has seen its share price rise 305% over the last year, delighting many shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given its strong share price performance, we think it’s worthwhile for Uranium Royalty shareholders to consider whether its cash burn is concerning. For the purpose of this article, we’ll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we’ll determine its cash runway by comparing its cash burn with its cash reserves. When Might Uranium Royalty Run Out Of Money?

A company’s cash runway is calculated by dividing its cash hoard by its cash burn. Uranium Royalty has such […]

Uranium Participation Corporation Reports Financial Results for the Year Ended February 28, 2021

TSX Trading symbol: U

TORONTO, April 1, 2021 /CNW/ – Uranium Participation Corporation ("UPC" or the "Corporation") today filed its Financial Statements and Management’s Discussion & Analysis ("MD&A") for the year ended February 28, 2021. Both documents can be found on the Company’s website ( www.uraniumparticipation.com ) or on SEDAR ( www.sedar.com ). The highlights provided below are derived from these documents and should be read in conjunction with them. All amounts are in Canadian dollars, unless otherwise noted. View PDF version

Selected financial information: View PDF URANIUM PARTICIPATION CORPORATION REPORTS FINANCIAL RESULTS FOR THE YEAR ENDED FEBRUARY 28, 2021 (CNW Group/Uranium Participation Corporation) Overall Performance

The net gain for the year ended February 28, 2021 was mainly driven by unrealized net gains on investments in uranium of $40,370,000, realized gains on the sale of conversion components of $5,154,000, and income from uranium lending and relocation agreements of $1,536,000, slightly […]