Impact of COVID-19 on Uranium Mining Market Report analysis 2021-2027 presents a complete assessment of the market and comprises future trends, current growth factors, attentive opinions, facts, historical information, and forecasts. This Uranium Mining Market is defined with its related details such as product types, business overview, sales, manufacturers, applications, and other specifications. It provides a systematic approach to the current and prospective scenario of the global regions. Detailed information of the Uranium Mining Market Report growth rate, technological innovations, and key strategies implemented by the main leading industry players.

Request for FREE PDF Sample Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4570673

Top Company Profile Analysis in this Report-

KazatompromState Atomic Energy Corporation RosatomChina National Nuclear Corp.Orano SACameco Corp.BHPImpact of COVID-19 on Uranium Mining Market Report provides historical and forecast data analysis on uranium production, production by country and prices. The report also includes an extensive demand drivers section providing information on […]

Uranium Participation Corporation Announces Mailing of Information Circular and Provides Update to Transaction Consideration

TSX Trading symbol: U

TORONTO, June 21, 2021 /CNW/ – Uranium Participation Corporation ("UPC") (TSX: U ) is pleased to announce that the management information circular (the "Circular") and related meeting and proxy materials have been mailed to shareholders in connection with the upcoming special meeting of shareholders. A copy of the Circular is also available on UPC’s website at https://uraniumparticipation.com/ and under UPC’s profile at www.sedar.com . View PDF version . View PDF Uranium Participation Corporation Announces Mailing of Information Circular and Provides Update to Transaction Consideration (CNW Group/Uranium Participation Corporation) The special meeting has been called for shareholders of UPC to consider the proposed plan of arrangement among UPC and shareholders of UPC, Sprott Asset Management LP ("Sprott Asset Management"), a wholly owned subsidiary of Sprott Inc. ("Sprott") (NYSE/TSX: SII ), Sprott Physical Uranium Trust (the "Trust"), a newly formed trust to be managed by Sprott Asset Management, […]

Boss Energy unveils enhanced feasibility study for Honeymoon with boosted revenue and reduced costs

Boss Energy managing director Duncan Craib says the enhanced study shows Honeymoon to be an “extremely robust project”. Boss Energy (ASX: BOE) has unveiled its much anticipated enhanced feasibility study for the proposed Honeymoon uranium mine in South Australia, with the study identifying lower costs and a higher pre-tax net present value of US$309 million (A$411.93 million).

The US$309 million NPV is 35% more than estimated in last year’s feasibility study.

In the enhanced study, the forecast pre-tax IRR is 47%, while the earnings before interest tax depreciation and amortisation margin is estimated at 62%.

Post-tax free cash flow is up from US$332 million to U$425 million, with gross life of mine revenue of almost US$1.28 billion calculated.Underpinning this is a 22.5% increase to nameplate production capacity to 2.45 million pounds of uranium.Total payback has decreased from four to 3.5 years.“The study shows conclusively that the changes we plan to make to […]

Uranium Market Will Witness Substantial Growth in the Upcoming years

Overview Of Uranium Industry 2021-2028:

This has brought along several changes in This report also covers the impact of COVID-19 on the global market.

The report offers detailed coverage of Uranium industry and main market trends. The market research includes historical and forecast market data, demand, application details, price trends, and company shares of the leading Uranium by geography. The report splits the market size, by volume and value, on the basis of application type and geography.

The Top key vendors in Uranium Market include are:- Jinduicheng Molybdenum, Sinohydro, Sinosteel, U3O8 Corp, Orano, CNNC, Cameco, BHP Billiton, AREVA, Kazatomprom Get a Sample PDF copy of this Uranium Market Report @ https://www.reportsinsights.com/sample/402436 This research report categorizes the global Uranium market by top players/brands, region, type and end user. This report also studies the global Uranium market status, competition landscape, market share, growth rate, future trends, market drivers, opportunities and […]

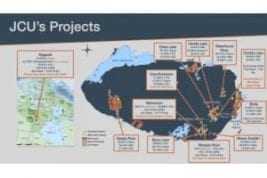

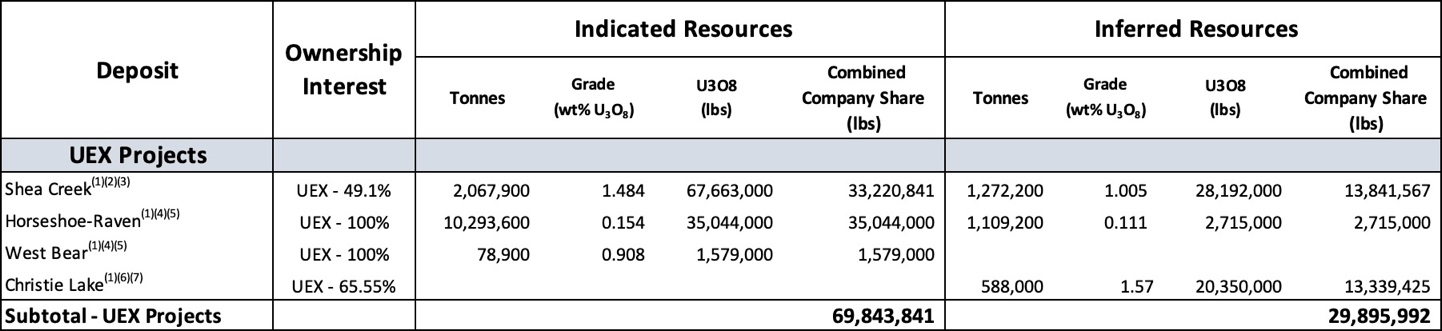

Shareholders of Overseas Uranium Resources Development Co., Ltd. approve UEX acquisition of JCU (Canada) Exploration Company

UEX Corporation [ UEX -TSX; UEXCF -OTC] has been notified that shareholders of Overseas Uranium Resources Development Co., Ltd. (OURD) approved the sale to UEX of OURD’s wholly-owned subsidiary, JCU (Canada) Exploration Company, Limited.

The JCU Transaction Click to enlarge. UEX will acquire 100% of the shares of JCU from OURD by paying C$41million and assuming JCU’s existing liabilities, under the terms of the share purchase agreement and amending agreement). The transaction is expected to close by August 3, 2021. UEX has committed to retaining JCU as a corporate subsidiary in order for JCU to meet its existing joint venture commitments.

UEX has signed a binding agreement with Denison Mines Corp. [DML-TSX; DNN-NYSE American] whereby UEX agreed to sell 50% of the JCU shares to Denison for C$20.5 million following the close of the JCU transaction.

Key terms of the UEX Denison transaction are as follows. Denison agreed to provide UEX […]

NRC Approves Centrus Energy’s License Amendment for HALEU Production

BETHESDA, Md., June 14, 2021 /PRNewswire/ — Centrus Energy Corp. (NYSE American: LEU) today announced that the U.S. Nuclear Regulatory Commission (NRC) approved the Company’s license amendment request to produce High-Assay, Low-Enriched Uranium (HALEU) at the Piketon, Ohio, enrichment facility. The Piketon plant is now the only U.S. facility licensed to enrich uranium up to 20 percent Uranium-235 (U-235) and expects to begin demonstrating HALEU production early next year.

"This approval is a major milestone in our contract with the Department of Energy," said Daniel B. Poneman, Centrus President and CEO. "We appreciate the dedicated and rigorous work of the NRC staff and Commissioners in their review and approval of our license amendment request."

HALEU-based fuels will be required for most of the advanced reactor designs currently under development and may also be utilized in next-generation fuels for the existing fleet of reactors in the United States and around the world. […]

Shareholders of Overseas Uranium Resources Development Co., Ltd. Approve UEX Acquisition of JCU Exploration Company, Limited

(TheNewswire) Saskatoon, Saskatchewan TheNewswire – June 18, 2021 – UEX Corporation (TSX:UEX ) ( OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that UEX has been notified that the shareholders of Overseas Uranium Resources Development Co., Ltd. (“OURD”) have approved the sale to UEX of OURD’s wholly-owned subsidiary, JCU (Canada) Exploration Company, Limited (“JCU”).

The JCU Transaction

UEX will acquire 100% of the shares of JCU from OURD by paying C$41million and assuming JCU’s existing liabilities (the “ JCU Transaction ”), under the terms of the share purchase agreement (See April 22, 2021 News Release) and amending agreement (See June 15, 2021 News Release). The transaction is expected to close on or prior to August 3, 2021.

UEX has committed to retaining JCU as a corporate subsidiary in order for JCU to meet its existing joint venture commitments. Agreement with Denison Mines Corp. UEX […]

Shareholders of Overseas Uranium Resources Development Co., Ltd. Approve UEX Acquisition of JCU (Canada) Exploration Company, Limited

Saskatoon, Saskatchewan – TheNewswire – June 18, 2021 – UEX Corporation (TSX:UEX) (OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that UEX has been notified that the shareholders of Overseas Uranium Resources Development Co., Ltd. (“OURD”) have approved the sale to UEX of OURD’s wholly-owned subsidiary, JCU (Canada) Exploration Company, Limited (“JCU”).

The JCU Transaction

UEX will acquire 100% of the shares of JCU from OURD by paying C$41million and assuming JCU’s existing liabilities (the “JCU Transaction”), under the terms of the share purchase agreement (See April 22, 2021 News Release) and amending agreement (See June 15, 2021 News Release). The transaction is expected to close on or prior to August 3, 2021.

UEX has committed to retaining JCU as a corporate subsidiary in order for JCU to meet its existing joint venture commitments.Agreement with Denison Mines Corp.UEX has signed a binding agreement with Denison Mines Corp. (“Denison”) pursuant to which […]

Click here to view original web page at www.juniorminingnetwork.com

Analyst Canaccord Genuity Price Target And Rating For Uranium Energy Corp. (UEC)

Uranium Energy Corp. (AMEX:UEC) at last check was buoying at $2.93 on Thursday, June 17, with a fall of -8.44% from its closing price on previous day.

Taking a look at stock we notice that its last check on previous day was $3.20 with its price kept floating in the range of $3.10 and $3.28 on the day. Considering stock’s 52-week price range provides that UEC hit a high price of $3.67 and saw its price falling to a low level of $0.82 during that period. Over a period of past 1-month, stock came subtracting -1.23% in its value.

In last 7 days, analysts came adjusting their opinions about stock’s EPS with no upward and no downward revisions, an indication which could give clearer idea about the company’s short term price movement. In contrast, when we review UEC stock’s current outlook then short term indicators are assigning it an average of […]

Why Energy Fuels, Denison Mines, and Uranium Energy Stocks All Crashed Today

What happened

Shares of uranium miners Energy Fuels (NYSEMKT: UUUU), Denison Mines (NYSEMKT: DNN), and Uranium Energy (NYSEMKT: UEC) stocks resumed falling Thursday, dropping 7.6%, 9.7%, and 10.2%, respectively, through 12:50 p.m. EDT after rebounding in price earlier in the week.

According to The Wall Street Journal , investors are reacting (or perhaps overreacting) to news that a nuclear power plant in southeast China is seeing an increase in "noble gases in one of its reactors’ primary circuits, which is part of the reactor’s cooling system." So what

Now, Electricite de France SA , which co-owns the nuclear plant, says these gases are not "dangerous in small quantities," and crucially, we’re not talking about any sort of a radiation leak — yet. In the Journal ‘s estimation, the sell-off we’re seeing is an "unnecessary investor meltdown" because, as it goes on to explain, "uranium mining companies tend to operate on […]

Uranium Energy Corp. (AMEX:UEC) trade information

In last trading session, Uranium Energy Corp. (AMEX:UEC) saw 6.67 million shares changing hands with its beta currently measuring 2.45. Company’s recent per share price level of $3.20 trading at $0.14 or 4.58% at ring of the bell on the day assigns it a market valuation of $730.11M. That closing price of UEC’s stock is at a discount of -14.69% from its 52-week high price of $3.67 and is indicating a premium of 74.38% from its 52-week low price of $0.82. Taking a look at company’s average trading volume for last 10-days demonstrates a volume of 5.69 million shares which gives us an average trading volume of 6.71 million if we extend that period to 3-months.

For Uranium Energy Corp. (UEC), analysts’ consensus is at an average recommendation of a Buy while assigning it a mean rating of 1.70. Splitting up the data highlights that, out of 4 analysts covering […]

Click here to view original web page at marketingsentinel.com

Up 207% over the past year, Ur-Energy’s revenue is ‘forecast’ to rise exponentially in the next 2 years

Uranium prices have grinded higher in 2021 and the outlook has never looked better for U.S uranium miners with forecast uranium deficits in the years ahead. US uranium producers are well placed to benefit from the Biden policies that understand the importance of nuclear and securing uranium. Right now the USA produces virtually zero uranium and is dependent upon Russia (including Russia controlled sources in Kazakhstan) for about 50% of their uranium supply. 20% of U.S electricity relies on nuclear as does much of the U.S Navy fleet.

Ur-Energy Inc. (NYSE American: URG | TSX: URE) is among the top two U.S uranium producers and is a global low cost uranium producer. Ur-Energy operates the Lost Creek in-situ recovery uranium facility in south-central Wyoming, USA, currently on hold due to the uranium prices bear market. The stock is having a stellar year, up 207% over the past year boosted […]

Skyharbour Resources Expands its Current Drill Program at its High Grade Moore Uranium Project, Saskatchewan

VANCOUVER, British Columbia, June 16, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that it is expanding its current diamond drilling program at its flagship 35,705 hectare Moore Uranium Project, located approximately 15 kilometres east of Denison Mine’s Wheeler River project and near regional infrastructure on the southeast side of the Athabasca Basin, Saskatchewan. The current drilling program at Moore is progressing well and has provided significant encouragement to expand the current 3,500 metres drilling program to a total of 5,000 metres in 12 to 14 holes. This fully funded and permitted program will focus on following-up on existing unconformity and basement-hosted targets along the high grade Maverick structural corridor as well as newly defined targets at the Grid Nineteen area.

Moore Uranium Project Claims Map: https://skyharbourltd.com/_resources/maps/MooreLakeRegionalTenure-v1.jpg

Winter/Spring 2021 Geophysical and Diamond Drilling Programs […]

Click here to view original web page at www.juniorminingnetwork.com

Appia Announces Start of Summer Exploration Program on Rare Earth Elements and Uranium Projects

Toronto, Ontario–(Newsfile Corp. – June 14, 2021) – Appia Energy Corp. (CSE: API) (OTCQB: APAAF) (FSE: A0I.F) (FSE: A0I.MU) (FSE: A0I.BE) (the "Company" or "Appia") is pleased to provide details regarding the Company’s planned aggressive exploration activities on the high-grade critical rare earth elements* (" REE ") Alces Lake project, and the North Wollaston and Loranger uranium projects, Athabasca Basin area, northern Saskatchewan.

ALCES LAKE HIGH-GRADE REE PROJECT

With a planned comprehensive aerial survey and core drilling program to establish the project’s resource potential, the exploration team has been deployed to the project area. Planned activities have commenced and include the following:

– 6,000+ metres of helicopter-supported diamond drilling with two diamond drill rigs focused on discovering new high-grade zones and delineating the extent of known high-grade REE mineralization;- flying a high-resolution airphoto survey as well as a digital elevation model over the entire property to aid in aerial geophysical […]

Argentina: the future of uranium

The uranium industry has definitely been on a rollercoaster ride for the past 20 years, but sentiment continues to rise as the role of nuclear power gains momentum in today’s climate. While Australia, Kazakhstan and Canada have led the way for production in recent years, Blue Sky Uranium believes they hold the key to the future of uranium in the Americas: Argentina.

The TSX Venture, FSE and OTC-listed Blue Sky Uranium Corp has staked its claim on Argentina’s nuclear ambitions, with 100% control of more than 450,000 hectares of mining tenures, after discovering a 145-kilometre uranium trend more than 15 years ago.

The Amarillo Grande Uranium-Vanadium project in the central Rio Negro province includes the country’s largest NI 43-101 resource estimate for uranium, as well as a significant vanadium credit.

Blue Sky’s President and CEO Nikolaos Cacos said the company is already drilling two of its targets within the deposit while awaiting […]

Skyharbour Expands its Current Drill Program at its High Grade Moore Uranium Project, Saskatchewan

Skyharbour Resources Ltd. is pleased to announce that it is expanding its current diamond drilling program at its flagship 35,705 hectare Moore Uranium Project, located approximately 15 kilometres east of Denison Mine’s Wheeler River project and near regional infrastructure on the southeast side of the Athabasca Basin, Saskatchewan. The current drilling program at Moore is progressing well and has provided …

Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that it is expanding its current diamond drilling program at its flagship 35,705 hectare Moore Uranium Project, located approximately 15 kilometres east of Denison Mine’s Wheeler River project and near regional infrastructure on the southeast side of the Athabasca Basin, Saskatchewan. The current drilling program at Moore is progressing well and has provided significant encouragement to expand the current 3,500 metres drilling program to a total of 5,000 metres in […]

Why Uranium Energy, Cameco Corporation, and NexGen Energy Stocks All Crashed Today

What happened

Shares of uranium miners Energy Fuels ( NYSEMKT:UUUU ), Cameco ( NYSE:CCJ ), and NexGen Energy ( NYSEMKT:NXE ) stocks all dropped in afternoon trading Monday, falling 7.5%, 8.7%, and 9.2%, respectively, through 12:30 p.m. EDT.

That’s curious, considering how the price of uranium has been behaving lately. Image source: Getty Images. So what

Since its most recent bottom in late April, the spot price on uranium has run up 12.5% to $30.26 per pound today — and you’d think that investors in miners Energy Fuels, Cameco, and NexGen would take that as good news, but here’s the thing: Today’s uranium price is roughly equal to what the atomic power raw material cost 11 months ago, in July 2020. It’s not so much a spike in price we’re seeing, therefore, as a climb back toward normal.It also may not be enough to turn these companies profitable . Now […]

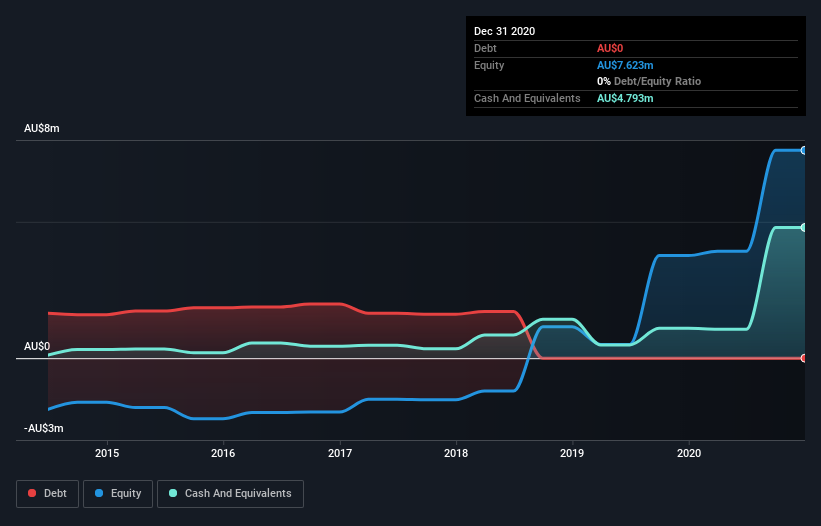

We’re Not Very Worried About Elevate Uranium’s (ASX:EL8) Cash Burn Rate

There’s no doubt that money can be made by owning shares of unprofitable businesses. By way of example, Elevate Uranium ( ASX:EL8 ) has seen its share price rise 704% over the last year, delighting many shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky Elevate Uranium’s cash burn is. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let’s start with an examination of the business’ cash, relative to its cash burn. Does Elevate Uranium Have A Long Cash Runway?

You can calculate a company’s cash runway by dividing the amount of cash it has by the rate […]

Skyharbour Expands its Current Drill Program at its High Grade Moore Uranium Project, Saskatchewan

Article content

VANCOUVER, British Columbia, June 16, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH )

(OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) is pleased to announce that it is expanding its current diamond drilling program at its flagship 35,705 hectare Moore Uranium Project, located approximately 15 kilometres east of Denison Mine’s Wheeler River project and near regional infrastructure on the southeast side of the Athabasca Basin, Saskatchewan. The current drilling program at Moore is progressing well and has provided significant encouragement to expand the current 3,500 metres drilling program to a total of 5,000 metres in 12 to 14 holes. This fully funded and permitted program will focus on following-up on existing unconformity and basement-hosted targets along the high grade Maverick structural corridor as well as newly defined targets at the Grid Nineteen area.Moore Uranium Project Claims Map:

https://skyharbourltd.com/_resources/maps/MooreLakeRegionalTenure-v1.jpg Winter/Spring 2021 Geophysical […]

Skyharbour Resources Ltd: Skyharbour Expands its Current Drill Program at its High Grade Moore Uranium Project, Saskatchewan

SKYHARBOUR RESOURCES LTD Chart 1 Jahr SKYHARBOUR RESOURCES LTD 5-Tage-Chart VANCOUVER, British Columbia, June 16, 2021 ) ) ) (the "Company") is pleased to announce that it is expanding its current diamond drilling program at its flagship 35,705 hectare Moore Uranium Project, located approximately 15 kilometres east of Denison Mine’s Wheeler River project and near regional infrastructure on the southeast side of the Athabasca Basin, Saskatchewan. The current drilling program at Moore is progressing well and has provided significant encouragement to expand the current 3,500 metres drilling program to a total of 5,000 metres in 12 to 14 holes. This fully funded and permitted program will focus on following-up on existing unconformity and basement-hosted targets along the high grade Maverick structural corridor as well as newly defined targets at the Grid Nineteen area.

Moore Uranium Project Claims Map:

https://skyharbourltd.com/_resources/maps/MooreLakeRegionalTenure-v1.jpgWinter/Spring 2021 Geophysical and Diamond Drilling Programs […]

Click here to view original web page at www.finanznachrichten.de

Uranium Investors Have Become Overly Reactive

Monday’s reaction came after CNN reported that the U.S. government was assessing a report of a leak—not of radiation but of inert gases—at a Chinese nuclear power plant co-owned by two Chinese energy companies and French energy company EDF.

The market response is almost comparable to what happened after the Fukushima nuclear accident in 2011, which led Cameco shares to fall almost 13%. But that turned into a major hit to nuclear-fuel demand affecting the industry for years.

Monday’s drop looks like an outsize reaction for several reasons. Uranium mining companies tend to operate on multiyear supply contracts with utilities, so there is little risk that a nuclear power plant would immediately pull back buying from these mining companies.

Instead, the risk of a nuclear incident is if it saps future demand—either by shutting down the nuclear-power plant in question or if the incident changes governments’ and companies’ decisions to build new […]

Why these ASX uranium shares are plunging today

ASX uranium shares are in a sea of red on Tuesday. At the time of writing, leading ASX uranium producers and explorers such as Paladin Energy Ltd (ASX: PDN) , Boss Energy Ltd (ASX: BOE) and Deep Yellow Limited (ASX: DYL) are plunging by 13.91%, 8.11% and 7.78% respectively. What’s driving the selloff for ASX uranium shares?

ASX uranium shares are on the slide following reports the US Government is assessing a leak at a Chinese nuclear power plant.

The plant is a joint venture between state-run China General Nuclear Power Group, which owns 70%, and French power giant Electricite de France (EDF) which owns the remaining 30%.

According to the Wall Street Journal , EDF requested an extraordinary board meeting with Chinese managers to gather more information about the buildup of gases inside one of the plant’s reactors. The French company warned of an “imminent radiological threat”.The BBC reported […]

A uranium company making waves in the rare earths space

“One Ring to rule them all” is a central plot element in J. R. R. Tolkien’s fictional novel The Lord of the Rings , as well as Peter Jackson’s movie trilogy, both of which I highly recommend. The One Ring was one of the most powerful artifacts ever created and was crafted by Lord Sauron. Sauron’s intent was to enhance his own power, and to exercise control over the other Rings of Power as he hoped to gain lordship over the Elves and all of the other races in Middle-earth. A pretty powerful theme for a fictional story, but where might I be going with this in real life today? Bear with me, it’ll take a bit to follow the tangled way my brain works.

At the recently concluded G7 meeting there was seeming consensus to chastise both China and Russia for various assorted reasons. It’s a reasonable bet that […]

92 Energy powers ahead with uranium exploration in Canada’s Athabasca Basin

Canada’s Athabasca Basin hosts the world’s highest grade uranium deposits and is home to Cameco’s Cigar Lake and McArthur River mines. After listing on the ASX in April with projects in the world’s highest grade uranium district Athabasca in Canada, 92 Energy (ASX: 92E) has powered ahead with exploration to take advantage of the expected uranium rebound.

The company was admitted to official quotation in mid-April after raising $7 million via the issue of 35 million shares at $0.20 each.

According to 92 Energy, the Athabasca Basin in Canada’s Saskatchewan Province hosts the highest-grade and lowest cost uranium deposits globally.

It is home to Cameco’s Cigar Lake, McArthur River operations, and NextGen Energy’s Arrow deposit, as well as Rio Tinto’s (ASX: RIO) and Roughrider project. Right place, right time As demand for clean, base-load energy solutions continues, a rebound in the uranium price is widely anticipated in the coming years.By 2040, it […]

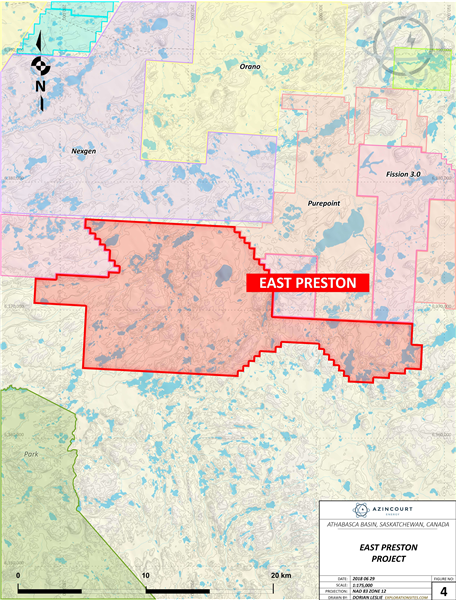

Heading Towards the Uranium Sweet Spot at East Preston

Is this the year uranium is finally gearing up for a bull run?

After the uranium spot price dipped to 12-year lows in 2016 to US$18.75, U308 has slowly been gaining traction over the last five years, having most recently hit the $31.60 mark. This has largely been influenced by the global uranium production dipping to 123 million pounds last year as a result of the COVID-19 pandemic — its lowest levels since 2008 — but hopes are high that 2021 has big things in store for the market.

Case in point, a new report from research firm Global Data estimates that uranium production will increase by 3.1 per cent this year to reach roughly 51,200 tons as production returns at top mines such as the Cigar Lake Mine, which is owned and operated by Cameco, and is located in Saskatchewan’s prolific Athabasca Basin uranium district.

The Athabasca Basin, which hosts 19 […]