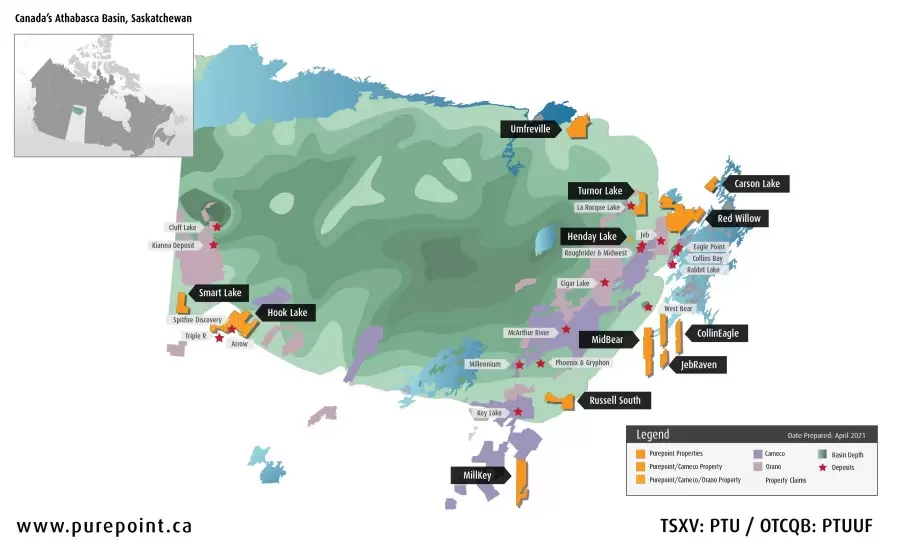

Toronto, Ontario–(Newsfile Corp. – May 16, 2022) – Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) ("Purepoint" or the "Company" ) today outlined their remaining 2022 exploration plans for the Hook Lake Joint Venture and eight of their 100% owned projects in the Athabasca Basin, Saskatchewan Canada. These plans include follow-up drilling at the Company’s Red Willow project where this winter’s program outlined an astounding 1.2 kilometres of continuous elevated radioactivity ( see news release April 19, 2022 ).

"By the end of the year we will have completed updated field work at all of our ten, 100% owned uranium projects. This work has included follow-up drilling at some of our high priority targets, inaugural drilling at our more advanced prospects and initial geophysical work over our earlier stage properties," noted Chris Frostad, President & CEO of Purepoint. "Although we continue to advance our entire portfolio, we are most […]

Click here to view original web page at www.juniorminingnetwork.com