Gold keeps pullback from $1,889.86, latest inaction portrays a range of $5 below $1,880.

Risks remain heavy amid the virus woes, cautious sentiment ahead of the US elections.

Delay in the American stimulus, US dollar strength also probe gold buyers.

Monthly PMI data can offer immediate direction, US presidential voting will be the key. Gold prices remain mostly choppy between $1,877.30 and $1,879.45 during the early Asian trading on Monday. The yellow metal refreshed October month’s low on Thursday before rising for the first time in two days on Friday. However, traders have turned cautious ahead of the key events as November begins. Nothing positive except for the US dollar… Be it the worsening coronavirus (COVID-19) conditions or the delay in the US COVID-19 aid package, not to forget about the jitters ahead of the American presidential election, everything weighs the risks. The UK has […]

BTFD gold

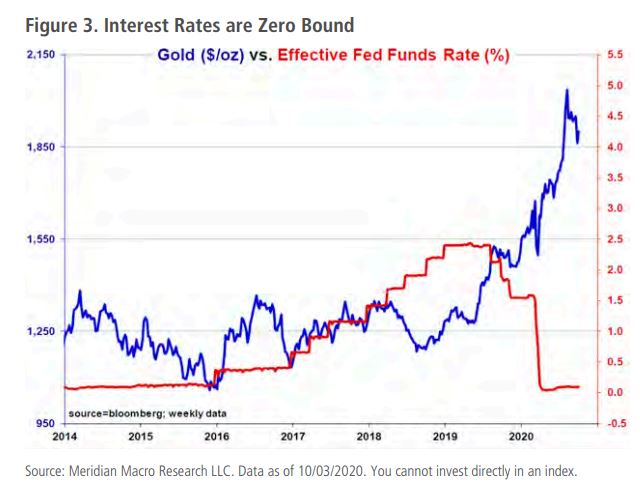

Via Sprott: The current pullback in the precious metals sector is a buying opportunity. Since trading at a closing high of $2,064 an ounce on August 6, gold bullion has declined 8.34% as of this writing. Gold mining shares have followed suit, declining 9.26% since the August high. It is possible that gold and related mining shares could continue to chop sideways to lower until the U.S. presidential election results are known and even into yearend as the implications are sorted out. Whatever the electoral outcome, the path towards monetary debasement is bipartisan. It is crucial for investors to focus on the long-term trend and to avoid the distractions of short-term timing considerations. The very strong investment fundamentals for gold and gold mining shares are based on what has been a slow irreversible drift towards significant U.S. dollar (USD) devaluation. Paper assets, including equities, bonds and currencies, have underperformed […]

Click here to view original web page at www.macrobusiness.com.au

Gold or Oil? 2 Top TSX Stocks to Buy

Gold and energy stocks have seen a lot of volatility this year. It would be an understatement to say that energy dipped while gold soared. That being said, should you invest in gold or oil stocks?

The continuation of the COVID-19 pandemic means that there is still substantial risk in oil stocks today. Moreover, while gold looks like a solid buy, the high price cautions investors to ask themselves if the price of gold has hit a peak. No one wants to buy at the top of the market.

Here are two stocks to consider buying in November if you want to invest in gold or energy before the year ends. Franco-Nevada: Gold and oil royalty stock

Franco-Nevada (TSX:FNV) (NYSE:FNV) rose from a 52-week low of $105.93 to a 52-week high of $222.15 after the March 2020 market sell-off. At the time of writing, the stock is trading for $178.72 […]

Click here to view original web page at www.oilandgas360.com

‘The fundamentals are strong’: Gold still glitters for Newcrest’s Sandeep Biswas

The head of Australia’s largest gold miner, Newcrest’s Sandeep Biswas, will be watching this week’s presidential election closely. "Gold reacts to uncertainty and it reacts to monetary policy," explains Biswas.

In the final days before the November 3 vote, both issues are looming large for stockmarket investors as a resurgence of coronavirus infections rips through the United States and future stimulus plans to cushion the economic impact could vary depending on the election result. Newcrest CEO Sandeep Biswas.Credit:Jesse Marlow Then there’s the threat of a close contest and a delayed result due to this year’s rise in mail-in ballots, and Donald Trump’s threat that he may not accept a peaceful transfer of power if he loses, which could escalate uncertainty even further.

But after the virus-induced global recession sent gold prices soaring 30 per cent this year, surpassing $US2000 an ounce for the first time in history, Biswas is not alone […]

Markets Week Ahead: Nasdaq 100, Gold, US Dollar, Crude Oil, All Eyes on Election

On average, the Dow Jones , S&P 500 and Nasdaq 100 suffered their worst week in over 7 months ahead of the US Presidential Election. This is as the VIX ‘fear gauge’ spiked the most since June over the same period. Rising volatility and a premium for safety propelled the anti-risk US Dollar and Japanese Yen . Anti-fiat gold prices suffered.

A combination of rising Covid-19 cases, an erosion of US fiscal stimulus hopes and a contested election have likely worked together to deteriorate risk appetite. The sentiment-linked Australian and New Zealand Dollars underperformed. Growth-linked crude oil prices declined the most since the middle of April.

All eyes turn to the November 3rd election as markets will try to digest what the outcome could mean for another fiscal package. The Senate adjourned for recess this past Monday until perhaps November 9th. Without its blessing, policymakers won’t be able to get […]

What is the Gold Spot Price and How is It Set?

Trading gold or other precious metals the very first question you may ask is, how much does gold cost? The answer lies in the gold spot price. This is the price gold is trading for at any given time on the markets where it is available.

Here we will take a closer look at exactly what the spot price for gold is, what you actually get for the spot price of gold and the major factors that move the price on the markets. What Does the Spot Price of Gold Mean?

The spot price you see first of all is based on one troy ounce of gold. This is the standard measure in which gold is traded on the international markets. You will also notice that the price of gold (and other precious metals) is quoted in US Dollars. Again this is the currency in which gold is priced […]

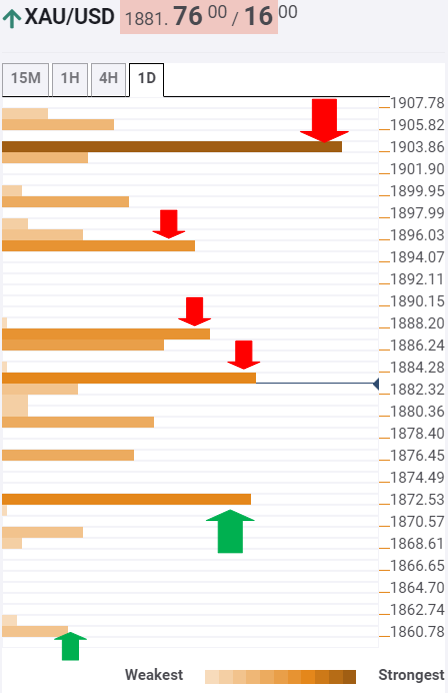

Gold Price Analysis: XAU/USD bears eye a decisive break below $1871 – Confluence Detector

Gold (XAU/USD) licks wounds after hitting fresh monthly lows below $1870 on Wednesday. The yellow metal fell amid resurgent haven demand for the US dollar, as partial lockdowns implemented in Germany and France threatened to derail the global economic recovery.

“Sell everything mode” returned to markets amid renewed coronavirus fears, as gold tumbled alongside stocks. The metal closed below the critical 100-DMA support of $1887 on a daily basis for the first time since March. Let’s take a look at the charts to see if gold will resume its downtrend. Gold: Key resistances and supports

The Technical Confluences Indicator shows that the yellow metal is flirting with the $1884 barrier, which is the confluence of the SMA5 four-hour and Fibonacci 23.6% one-month.

The next upside cap appears at $1887, where the pivot point one-week S1 coincides with SMA100 one-day.Further up, the intersection of the previous week low and SMA10 four-hour at […]

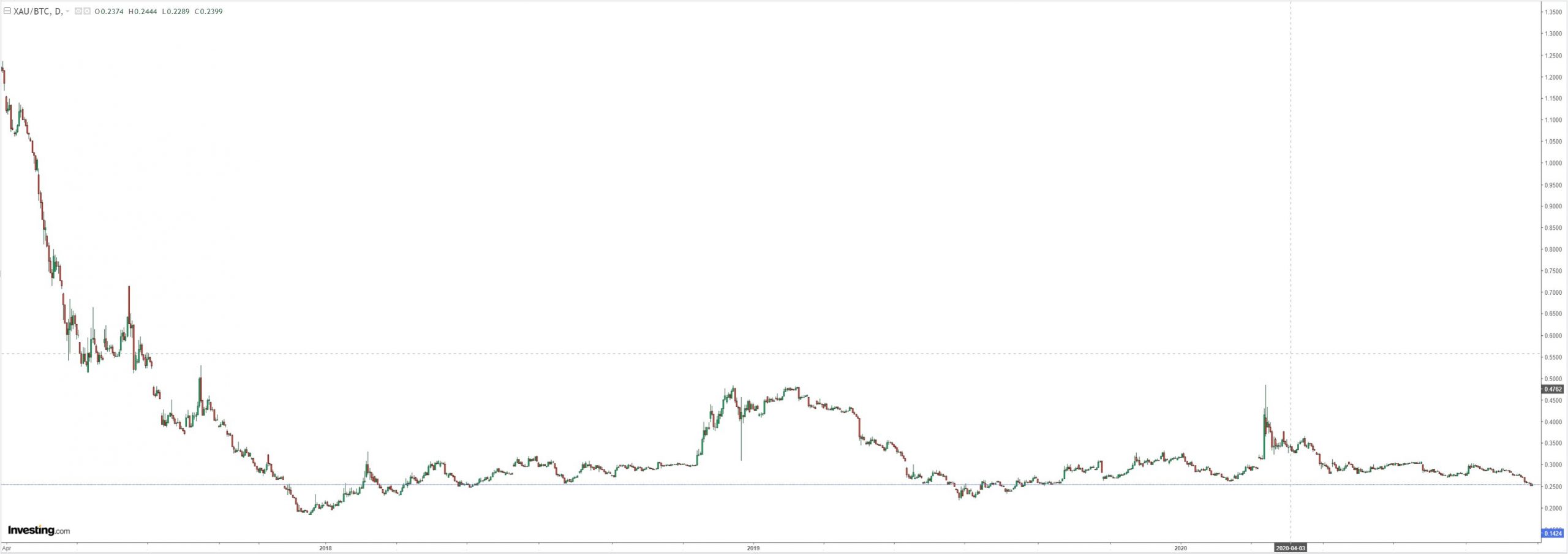

Is Bitcoin about to replace gold?

Raoul Pal asks the question: Bitcoin is eating the world… It has become a supermassive black hole that is sucking in everything around it and destroying it. This narrative is only going to grow over the next 18 months. You see, gold is breaking down versus bitcoin…and gold investors will flip to BTC pic.twitter.com/ox7KRY5VRo — Raoul Pal (@RaoulGMI) October 27, 2020 Is this true? Here’s the same chart without the dubious technical support line: It is true that gold faded against BTC in the last few weeks after PayPal allowed its use of the latter on its platform. But, in context, the move looks news-related, not structural. BTC has been yoked to the gold price for about three years in the current range. Drawing a line on a ficticious market for an imaginary product using made-up technicals is evidence only that Mr Pal has caught BTC voodoo.

That is not […]

Click here to view original web page at www.macrobusiness.com.au

Gold Price Analysis: XAU/USD could extend slide with a daily close below $1,860

XAU/USD lost more than 1% last week and closed near $1,880.

Bearish pressure could gather strength is gold drops below $1,860.

100-day SMA at $1,890 aligns as first resistance.

The XAU/USD pair suffered heavy losses on Wednesday and Thursday but staged a rebound on Friday. Despite the fact that the pair gained 0.6% on the last day of the week, it closed 1.2% lower on a weekly basis at $1,879. XAU/USD technical outlook On Thursday, gold touched its lowest level in a month at $1,860, where the Fibonacci 61.8% retracement of June-August rally is located. Although strong support seems to have formed around that level with the price turning north on Friday, the pair closed the third straight day below the 100-day SMA at $1,890. Unless XAU/USD successfully makes a daily close above $1,890, it is likely to retest $1,860. Below $1,860, $1,850 (September 24/26 low) […]

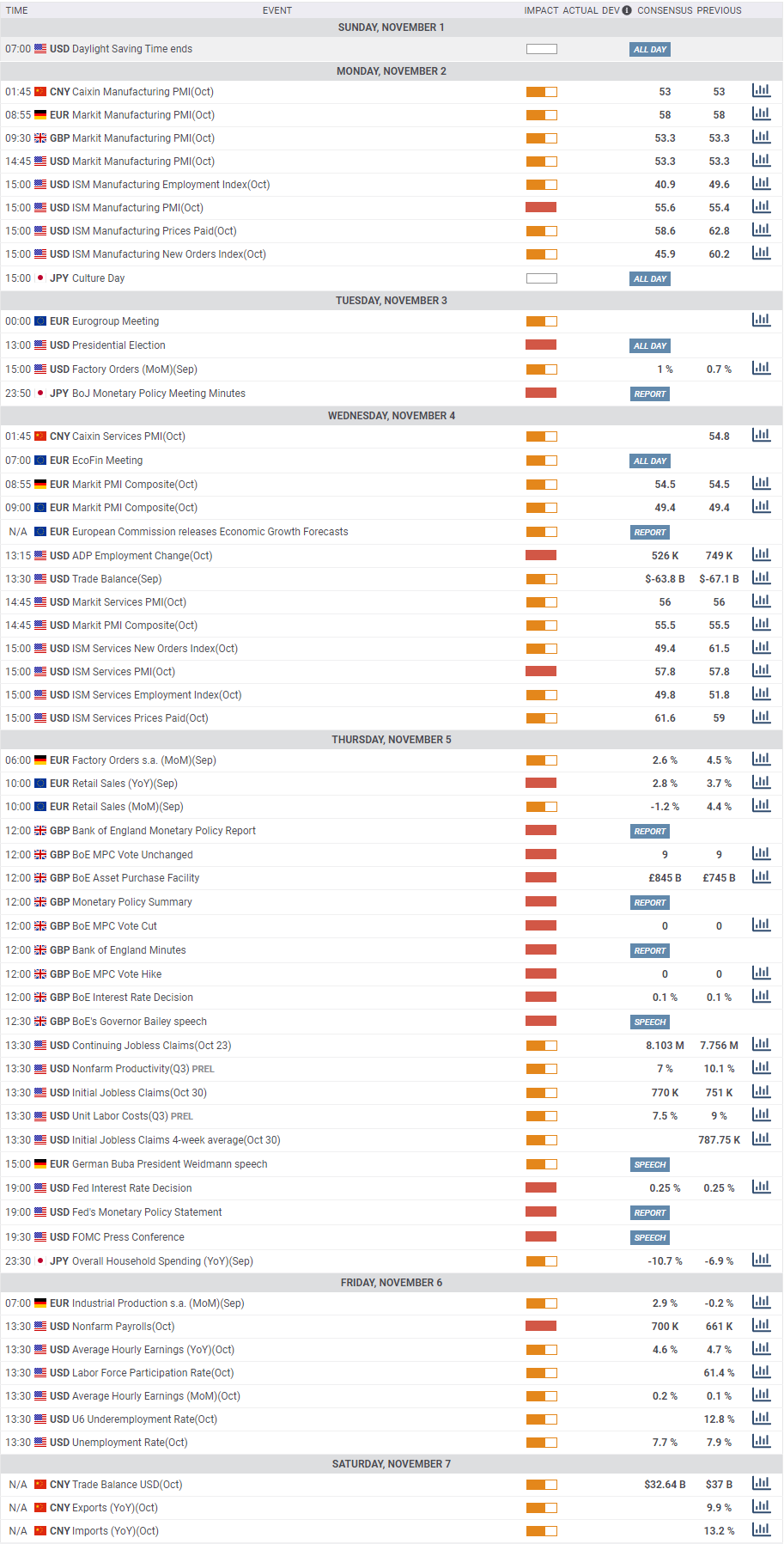

Gold: Next week’s key macroeconomic events to keep an eye on

After starting the week above $1,900, gold lost its traction and dropped to a fresh monthly low of $1,860 on Thursday as the European Central Bank’s dovish tone and the risk-off environment boosted the demand for the USD. Although XAU/USD was able to stage a technical correction on Friday, it lost more than 1% on a weekly basis and closed at $1,879. Coming up next week

All eyes next week will be on the United States presidential election on November 3rd and the market volatility is expected to heighten with the outcome having a significant impact on market sentiment.

Previewing the potential impact of the election outcome on gold, "gold heavily depends on stimulus, and the more, the merrier," said FXStreet analyst Yohay Elam. "The optimal scenario is a clean Democratic sweep, followed by a Trump victory. A split between President Trump and the Senate is the worst outcome."

The IHS […]

What’s Hitting Demand For Gold Jewellery?

The demand for gold jewellery in the third quarter for the calendar year 2020, has been disastrous. Not only gold jewellery, it’s running across other gold products as well. The biggest reason for the fall in demand has been on account of the weakness caused by COVID. In the quarter ending Sept 30, 2020, gold jewellery demand across the globe fell 29 per cent, year-on-year to 333 tonnes. While China and India accounted for the largest volume declines, weakness was global. The big reasons for the fall in gold jewellery demand

Apart from covid, probably an equally bigger reason was the surge in gold prices, which led to demand for jewellery falling.

Louise Street, Market Intelligence at the World Gold Council, said: "The impact of COVID-19 is still being felt in the gold market across the world. The combination of continued social restrictions in many markets, the economic impact of […]

Yamana Gold: On Track For A Massive Yearly Breakout

Summary

Yamana Gold released its Q3 results on Thursday and announced its first quarter of sales growth in over a year, with quarterly revenue coming in at $439.4 million.

The company managed to beat its annual earnings per share estimates, and FY2021 earnings estimates continue to climb, now sitting at $0.45.

Assuming a yearly close above $4.35, Yamana Gold will flip to bullish on its yearly chart for the first time in nearly a decade.While I see better opportunities in the sector among more attractive operating jurisdictions, Yamana’s competitive yield makes it a low-risk buy at $5.05 or lower.We’re more than one-third of the way through the Q3 Earnings Season for the Gold Miners Index ( GDX ), and the most recent name to release its results is Yamana Gold ( AUY ). While it’s been a challenging year and a half for the company relative to its peers as it’s had […]

Gold Miners: Beautiful Pictures In Play

After a well-deserved correction of nearly 3 months, the gold stock sector is still flashing positive signs beneath the surface, as the correction matures.

The correction that began in August amid the ‘ Buffett Buys a Gold Stock! ‘ tout has now ground on for nearly 3 months. As noted in the NFTRH 626 Opening Notes segment: “Thus far the correction in gold , silver and the miners is perfect, where perfection means long, drawn out and maddeningly frustrating to bulls (and bears thus far). That’s what corrections are, remedies to excitement, confidence and of course, greed.” We are managing the technical details (and associated strategies) of the correction in HUI and individual gold stocks each week in NFTRH , but as a gold stock investor, it has not been a time for making money since August. As a trader, it has been a difficult time for making money […]

Gold Price Predictions If Biden Or Trump Wins Presidency

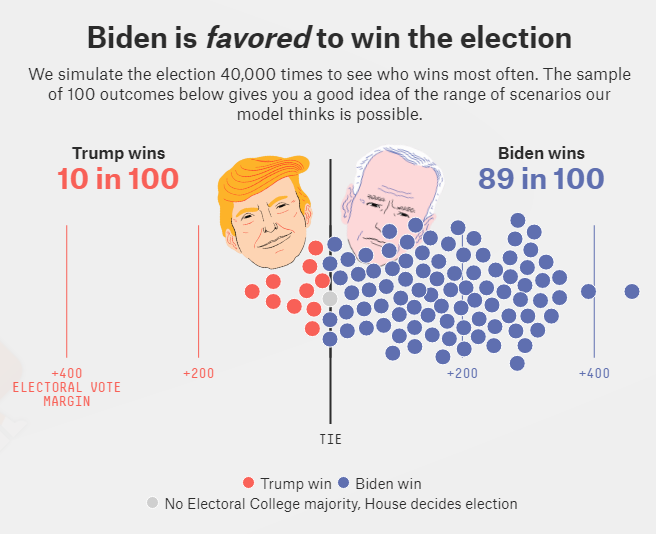

The 2020 U.S. election is taking place on Nov. 3 with President Donald Trump and former VIce President Joe Biden battling for the lead position.

Gold Price Analysis : The U.S. presidential election will play a huge role in shaping the global economy and gold prices are expected to react in the run up to the election day. So how important is it for the safe haven asset gold if Biden or Trump makes it to the White House?

“There is no doubt that we are likely to see increased volatility in stock markets in the run up to the election day and investors seeking traditional safe havens such as gold, particularly if the race between the two candidates gets very close and there is a growing risk of a contested outcome,” writes Saida Litosh, manager of precious metals analysis at Refinitiv.

Biden or Trump Impact : If the past […]

Gold Price Forecast – The Calm Before the US Election Storm

Gold (XAU/USD) Analysis, Price and Chart

With just a few days to go before the 59th US presidential election on November 3, incumbent Donald Trump is said to be trailing the Democratic candidate Joe Biden in the polls, and in the all-important state of Florida. Bookmaker Paddy Power has Biden at 2/5 to win the election while Trump is available at a much more generous 15/8. The final couple of days before the vote, and the days after it, will likely be highly charged and this volatility will reach across all financial markets. Gold will remain under the spell of the US dollar, and safe-haven flows, and will likely see choppy trading conditions as markets gyrate between risk-on and risk-off.

The price of gold has dipped recently alongside a small pick-up in US real yields. At the start of the month, gold printed a high of $1,913/oz. while US real […]

Barrick Gold (GOLD) Moves to Strong Buy: Rationale Behind the Upgrade

Barrick Gold (GOLD) could be a solid choice for investors given its recent upgrade to a Zacks Rank #1 (Strong Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The Zacks rating relies solely on a company’s changing earnings picture. It tracks EPS estimates for the current and following years from the sell-side analysts covering the stock through a consensus measure — the Zacks Consensus Estimate.

Since a changing earnings picture is a powerful factor influencing near-term stock price movements, the Zacks rating system is very useful for individual investors. They may find it difficult to make decisions based on rating upgrades by Wall Street analysts, as these are mostly driven by subjective factors that are hard to see and measure in real time.

Therefore, the Zacks rating upgrade for Barrick Gold basically reflects positivity about its […]

Rimfire Pacific completes $2.6 million capital raising to advance exploration for large-scale gold and copper targets

The company has raised $500,000 in a share purchase plan that follows a recent $2.1 million placement. Funds will be used for exploration activities outside the GPR earn-in area in the Lachlan Fold Belt Rimfire Pacific Mining NL ( ASX:RIM ) has completed a $2.6 million capital raising drive after closing a share purchase plan for proceeds of $500,000 with funds to aggressively pursue gold-copper targets in the prolific Lachlan Fold Belt of central NSW.

The SPP provided eligible shareholders with the opportunity to subscribe for up to $30,000 of new fully paid ordinary shares in the company, at an issue price of 1.25 cents per new share, subject to any scale back.

Rimfire received applications totalling $162,500 from eligible shareholders and the SPP was fully underwritten by Trans Global Capital Ltd, who will subscribe for the remaining $337,500. Proceeds to assist copper-gold strategy

Managing director Craig Riley said: “We are […]

Click here to view original web page at www.proactiveinvestors.com.au

Gold Price Analysis: XAU/USD trims losses and approaches $1,900

Gold trims weekly losses and returns to $1,885 area.

The precious metal bounces up amid moderate dollar weakness.

A clear Biden’s victory might open the doors for gold’s recovery.

Gold futures have bounced up from $1,860 lows, returning to $1,885 area, buoyed by a slightly brighter market mood on Friday which has eased safe-haven demand for the US dollar. Gold depreciates in a cautious market The yellow metal, however, remains negative on the week, on track for a 1,1% depreciation. Market concerns about the impact of a second COVID 19 wave and the uncertainty above the US elections have strengthened the US dollar, on the detriment of dollar-denominated commodities, like gold, which dropped to levels right above multi-month lows at $1,850.A round of short-covering in the last trading day of the month could explain the moderate pullback of the US dollar , which has helped bullion […]

Sandstorm Gold (SAND) Q3 2020 Earnings Call Transcript

Image source: The Motley Fool. Contents:

Prepared Remarks

Questions and Answers

Call Participants Prepared Remarks: Operator Good morning, my name is Mike and I will be your conference operator today. At this time, I would like to welcome everyone to the Sandstorm Gold conference call. All lines have been placed on mute to prevent any background noise. Please be aware that some of the commentary, may contain forward-looking statements.There can be no assurance that forward-looking statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. After the speakers’ remarks, there will be a question-and-answer session. If you’d like to ask a question during this time simply press then the number one on your telephone keypad. If you would like to withdraw your question press the pound key.Thank you. Mr. Watson, you may begin your conference. Nolan Watson — […]

Gold Price News and Forecast: XAU/USD started on the defensive

Gold Price Analysis: XAU/USD breaches 100-day SMA for first since March

Gold looks south , having breached the widely-tracked 100-day simple moving average (SMA) support for the first time since March 23. The yellow metal fell by 1.67% on Wednesday and closed below the 100-day SMA, flipping the long-term technical support into resistance. The SMA is currently located at $1,887, and the metal is trading at $1,878 per ounce.

Wednesday’s drop also marked a downside break of the ascending channel represented by trendlines connecting Sept. 28 and Oct. 14 lows and Oct. 2 and Oct. 12 highs. Asia Market: Global markets tremble

Gold started on the defensive and racked up further losses . Initially, the USD was slightly firmer in response to Europe’s falling equities on concerns over rising Covid-19 cases on both sides of the Atlantic. That seemed to provide a level of anxiety for gold investors. […]

Daily Gold News: Gold Rebounding but Still Below $1,900

The gold futures contract lost 0.60% on Thursday, as it extended its short-term downtrend following breaking below $1,900 price level on Wednesday. In September the market was retracing a rally from around $1,800 to August 7 record high of $2,089.20 in reaction to U.S. dollar advance. Then gold has bounced from the support level marked by mid-August local low of around $1,875, as we can see on the daily chart ( the chart includes today’s intraday data ):

Gold is 0.4% higher this morning, as it is retracing some of yesterday’s decline. What about the other precious metals? Silver was unchanged on Thursday and today it is 0.8% higher. Platinum lost 2.91% and today it is 0.7% higher. Palladium lost 2.31% yesterday and today it is 0.1% lower. So precious metals’ prices are generally advancing this morning .

Yesterday’s GDP number release has been better than expected at +33.1% q/q. […]

Gold Price Weekly Forecast: XAU/USD needs a blue wave for a golden era, all eyes on the elections

Rising coronavirus cases and election uncertainty have hit gold.

All eyes are on the elections, but central bank decisions are also of interest.

Early November’s daily chart is showing bears have gained some ground.

Meltdown – the formal end of fiscal stimulus talks was only the beginning of a down week for gold, which also struggled with the covid-related gloom. The fate of the precious metal hinges on the elections, yet surprise stimulus from central banks could also move XAU/USD. This week in XAU/USD: Gloom hits gold The yellow metal had been rocking on the scope for more greenbacks from Uncle Sam – fiscal stimulus talks seemed to be making progress, but after Congress adjourned, the final nail hit the coffin of talks. The breakdown in talks weighed on the precious metal .Democrats and Republicans were hovering around a $2 trillion deal that could have helped […]

Ambrosia Gold has broad appeal

After more than a decade of robust category performance in the U.S.A., Ambrosia continues to hold its position as one of America’s favorite apples. Hungry shoppers can seek out Ambrosia year-round in more than 10,000 retail locations across America—one of the highest distributions of any branded apple.

Danelle Huber, Marketing Specialist for CMI Orchards, reports on the most recent season-to-date Nielsen data showing results from August 15 through October 3 compared to the same time period in 2019.

“Ambrosia has an extremely solid threshold in both sales and volume, holding the third position of all branded apples and the ninth position of all apples overall – core and branded,” Huber said. “Volume has increased by more than 19%, and just over 2% in sales dollars.”

Huber shared that the dollar per pound basis shows that retailers are promoting Ambrosia at reduced pricing, leading to a 14% decrease on a dollar per pound […]

Next week’s gold price chaos: U.S. election, Fed meeting, U.S. jobs data

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) The gold market is holding its breath before the most eventful week of the year, according to analysts.

The first week of November will not only see the most anticipated event of the year — the U.S. election, but also the Federal Reserve interest rate decision and some key datasets, including the U.S. employment figures from October.

And this is already on top of the extremely volatile price action gold has been seeing during the last week of October. The precious metal wrapped up the month by losing its key $1,900 an ounce level as prices touched a one-month low of $1,859 on Thursday. At the time of writing, December Comex gold futures were trading at $1,880.20 an ounce, […]

Yamana Gold Inc (AUY) Q3 2020 Earnings Call Transcript

Image source: The Motley Fool. Yamana Gold Inc ( NYSE:AUY )

Q3 2020 Earnings Call

Oct 30, 2020, 9:00 a.m. ET Contents:Prepared Remarks

Questions and Answers Call Participants Prepared Remarks: Operator All participants please standby, your conference is ready to begin. Thank you all for joining us this morning. Before I turn the call over, I need to advise that certain statements made during this call today may contain forward-looking information and actual results could differ from the conclusions or projections in that forward-looking information, which include but are not limited to statements with respect to the estimation of mineral reserves and resources, the timing and amount of estimated future production, cost of production, capital expenditures, future metal prices, and the cost and timing of the development of new projects.For a complete discussion of the risks and uncertainties and factors which may lead to actual financial results and […]