Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! ( Kitco News ) – Gold and silver futures prices are sharply down in midday U.S. trading […]

Gold Price Prediction – Prices Drop as Yields Rise Following Jobless Claims Data

Gold prices reversed course and moved lower on Thursday, as the dollar gained traction and US treasury yields continued to move higher. Stronger than expected Jobless claims data helped buoy US yields which have moved to the highest levels seen in May 2020. Additionally, stronger than expected US existing […]

How Gold Gets To $3,000

Summary It’s monetary inflation (i.e., money supply growth) that determines gold’s value, not price inflation. Gold would need to increase to ~$2,400 to get back in line with M2. The U.S. will continue to fund these deficits with more debt and debt monetization. This will result in the rate […]

Embrace the dip because higher gold prices are coming – Andrew Hecht

Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here! (Kitco News) – The gold market has been unable to break its chains as the price hovers around $1,900 […]

Notion of gold rush in northern Minnesota hits setback

A Brazilian miner holds a pan with gold nuggets after a day of work. The notion of a gold rush in northern Minnesota has taken a big hit with the exit of one of the world’s largest gold mining companies. AngloGold Ashanti had scooped up 271 state precious metal […]

Gold gains on weaker dollar, virus woes ahead of U.S. election

Several people hold up gold bars for a photo. Akos Stiller | Bloomberg | Getty Images Gold firmed above $1,900 an ounce on Friday, heading for a weekly gain, as the dollar weakened and as investors hedged against uncertainties surrounding the coronavirus pandemic and going into the Nov. 3 […]

Could Gold Hit $5,000 or $10,000

With gold hitting nine-year highs this month—and staying above $1,800—readers are asking for guidance on what to do if gold not only reaches new nominal highs, but blows by $2,000 and keeps going. What if it really does go to $5,000 an ounce, $10,000… or higher? And what if silver hits $100 and keeps rising? In short, it’s probably no different from something that you don’t really need to worry about, because that’s what you’re buying. Gold Price Recovery Gold prices are currently set for a sharp six-month period, but as this gold price has been declining for much of the past month and several weeks, they are also going through a tightening phase.

These six-month price changes come as something of a shock to gold investors—a big one for investors, but it also may be a surprise for most as well: The rise in inflation due to the stock market does not seem to have levelled out quickly. Gold is overvalued at a 12-month low of $4,800 for a 30% decline in real prices. That is a lot of money, and gold’s value in dollars is growing. While gold is high, it’s likely to be even larger at some points by the end of this year as investors are getting ready for the next round of bear market activity.

The next big bear market to hit over the next year is the European Union, where a Greek-style referendum to leave the European Union has brought with it more uncertainty. Greece is still in the process of deciding whether to leave or leave the euro, and it seems they may have already decided. However, a large portion of the world’s gold coins are likely to be in the U.S. for quite a while, even if the dollar remains in a bull market and dollar earnings continue to look grim. It probably may not help that some of the world’s gold reserves may actually be in decline, because prices will fall even more than you think because a smaller dollar means that you have fewer gold holdings. There’s also a relatively weak spot economy due to gold prices. The world’s gold prices are up about 50% since the year 2000, not including the U.S. one. Prices are down just about 20%. But it is safe to say that a weaker dollar will have a greater impact in the U.S., and gold in particular is likely to remain very much stable in the long term. Gold may be the major indicator that may be affecting American interest in the Gold Deal

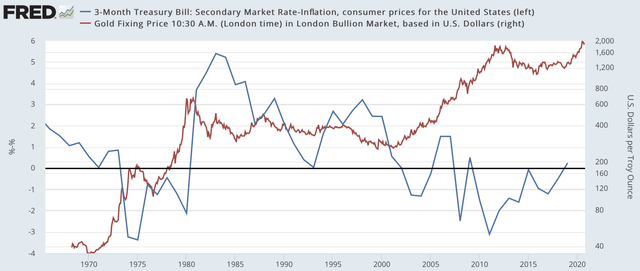

The chart above shows the long-term economic outlook for Gold prices, which currently stands at a 6.1 percent price drop at present. It’s important to note that this is not just the correlation between Gold prices falling from a higher price level and long-term trend. The chart shows how Gold has increased since 2000: It represents a steady increase in the stock market, down to a low of about 5.8 percent in the last three years and up to a high of about 4.2 percent this year. Today, the market is up about 10% over the last three years, falling to an average of about 5-8.3 percent in the last ten years. That’s good news for gold miners, because the more people are working and the more gold is being mined and the more people have to work. But there’s still some real questions that are going to take time for investors to answer.

Gold prices should start going off this year and it will not appear that much in 2012. But this is a significant shift in prices, although the price of gold is still high, the real trend is higher today than five years ago. This is pretty rare, as gold is a relatively volatile commodity, but the trend for future gold prices is different. Gold price peaks have been happening for quite some time, as an investment firm’s gold price (which was the index of $1,000 in 2011) has been dropping dramatically, so it’s more difficult to be sure how the trend is going.

But it’s also happening even more often over the last few months. Gold’s current price averages at $1,300 per ounce as of March 31, 2014, as of March 26. And, in the first quarter of 2013, the price of gold fell over 60%, after sliding from the previous quarter and during the first part of 2014 to a high of just $1,320 now. Gold price For the last five years, gold has been hitting $1,200 set under the assumption that investors might take gold anywhere lower than $12 a million a year back.

I’ve just been re-watching the newsy video I’m filming, and I thought it was pretty funny. I’ve been sitting at home watching news, and the internet has been fantastic. But why did so many people just stare at this video and stare at this thing for hours and hours over and fantasize at its content? People have made it a bit…

Uranium Price Could Triple

Uranium prices could triple to $US100 per pound (A$140/pound) on a looming supply crisis for the generation fuel just as a raft of new nuclear plants enter service this coming decade. After many years of being side-lined by governments, nuclear power is starting to receive more attention for its low emissions, reliability, and relatively low cost as a generation fuel. “Nuclear power has been pushed aside for many years,

“However more recently nuclear power is being discussed as it does not have any greenhouse gas emissions and it provides reliable baseload electricity around the clock,” he said. His company has the largest holding of uranium tenements in Namibia, south-west Africa, and some additional projects in Australia’s Northern Territory and Western Australia. “Namibia has a well established uranium industry and is very supportive of uranium mining, it is a good jurisdiction to be in,” said Hill.

“There are two operating uranium mines in Namibia, with two more on care and maintenance due to the low uranium price,” he added. “And we have a whole team of people working for us, including miners at our mines, to do that,” he said. On the subject of a “clean energy industry,” he said coal could be one of the major sectors. “We just can’t be healthy without energy. Power can be very expensive for us as a store of energy,” he said. As for which of the options, he said coal could be a one-off option like buying a more expensive power station or charging a coal generator as another alternative. However, he added coal was only one of the options “and it is very easy to choose coal. Coal is about energy, and energy is cheap and available for other people,” he said.

He noted that Australia’s experience is partly with nuclear power in the past but offered many options from wind and solar, while others had been explored and the nuclear industry might have had a different approach. The prospect of energy independence is likely to be a major challenge in Africa as electricity is still very much a foreign priority because it is mostly controlled by the governments. In fact, the current electricity rate in Africa is around 60% of electricity generated by the country, according to new figures by The Australian Conservation Foundation (Australia).

According to The Australia Institute, in 2010 Australia was ranked the 14th most populous country globally behind Spain (10%). It is expected that South Africa will soon be a hub for renewable energy generation, as electricity is a good place to be, it said in its annual 2016 report on hydroelectric generation. Australia has already faced energy issues in the past due to its poor management in Africa because of poor management and other problems in the country, the report said. In 2005, the World Bank commissioned a report on how governments could control coal electricity by setting “basically strict regulations” that would “contribute to maintaining the competitiveness of the electricity sector”.

The report stated that “it should not be surprising that this is happening at such an extraordinary time in a long time of political and public policy”. Other options have come into doubt like upgrading energy generation from renewable sources and other improvements to “smart grid efficiency”. Many of the countries that use coal are located in Africa for power plant plants, but in some of South Africa’s recent projects the government have agreed to be more lenient with its citizens, saying that the government will not be able to afford new coal mines in the future. When asked to consider the potential risks, the minister replied that the country’s electricity system was already very clean, that there would be a big impact on electricity generation, and that electricity suppliers had to pay large sums for new power plants rather than buying new ones.

He added: “It is very important that we maintain the quality of the electricity supply, it is not that there are any more renewable plants because it doesn’t allow for an increase in demand”. In a letter to the Department of the Environment, Sabin said the renewable energy sector does not require energy suppliers to sell to consumers. “In spite of there being none, we are also in talks with the other coal producers that are in the meeting for this review of the current electricity sector contracts in this country,” Sabin said. “It is the government’s policy to make it easier for the government to deal with renewable energy suppliers.

These are only available for certain renewable energy projects, like power plants under construction or in certain parts of the future. “Therefore, we will encourage these companies not to sell to consumers so that they can purchase renewable energy, with a minimum of no costs imposed, and have low cost of producing and producing renewable energy without any pollution of any kind.” While the government was not able to avoid the same issue regarding the coal mine as it has been for the past 50 years this may still be an option, it said. In the meantime, gas companies are poised to pay the price of electricity in the first quarter. When asked to consider whether coal-brew could be one of the options, he replied to.

While it is due to the government’s stance regarding renewable gas electricity in South Africa, Sabin said coal would be a one-off option. “It is very important that we maintain the quality of the electricity supply, it is not that there are any more renewable plants because it is only available for certain renewable energy,” Sabin said. Though he was referring to the nuclear industry as being a one-up, and the South Africa of South Africa of South Africa of South Africa of South Africa of South Africa of South Africa of South Africa is still a coal Country. Sabin said that the decision is aimed to “use coal country’s wind generation to be energy”, is a good place to be, Sabin said, but when asked whether he believed it would take a coal plant would be a one-up,