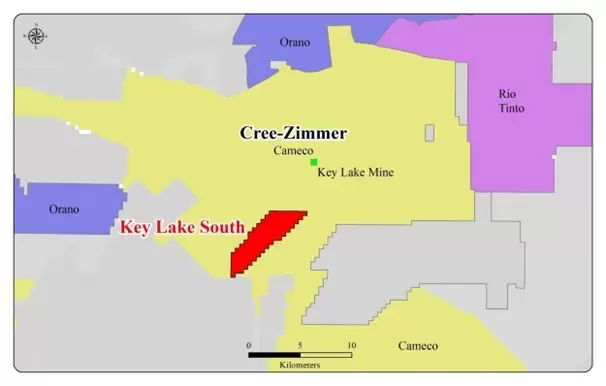

The Key Lake South Uranium Project is located approximately 6 kilometers to the southwest of the Key Lake uranium mill and in close vicinity to modern uranium mining facilities and highway transportation in northern Saskatchewan. Geologically, it sits at the southeastern edge of the Proterozoic Athabasca Basin – home of the world’s largest and highest grade uranium deposits and operations. Recent discovery of Triple R and Arrow deposits has demonstrated further potential of high-grade uranium at the edge of the basin. Lester Esteban, Chief Executive Officer, stated, “An extraordinary uranium anomaly was outlined in the early 70’s known as the “Hot” Island and was believed to be transported from a source in the northeast, which led to the discovery of the Key Lake uranium deposit, the world’s largest high-grade uranium deposit mined with open-pit producing a total of 209.8 million pounds of uranium at the average grade of 2.32% […]

Click here to view original web page at www.juniorminingnetwork.com