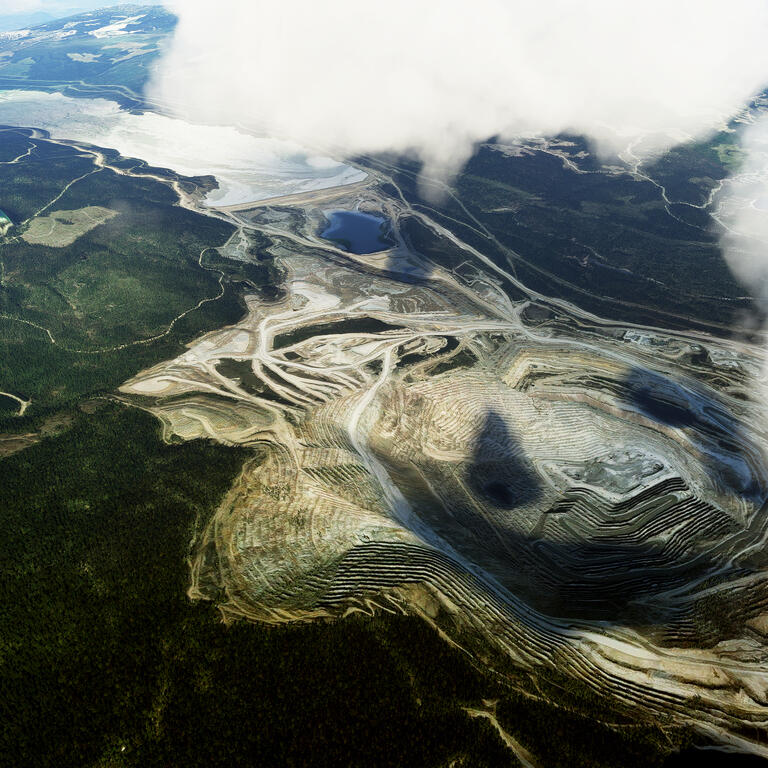

Vonkara1/iStock via Getty Images Overview

Denison Mines ( DNN ) is a $1.1 billion uranium development company with a world class deposit expected to enter production in 2024.

I have previously highlighted the bullish case for uranium . In a nutshell, the world supply drastically falls short of world demand. The Sprott Physical Uranium Trust ( OTCPK:SRUUF ) has stacked 44 million pounds of uranium over the past several months. This has removed supply from a market that consumes ~190 million pounds per year with a supply deficit of 30 million pounds per year. By the time Denison’s flagship project enters production, I expect the price of uranium to be much higher than the $45 it currently trades at.

In the last month two new catalysts have emerged that could have serious implications for the price of uranium and in turn shares of DNN. Kazakhstan Political Turmoil Recently there was serious […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments