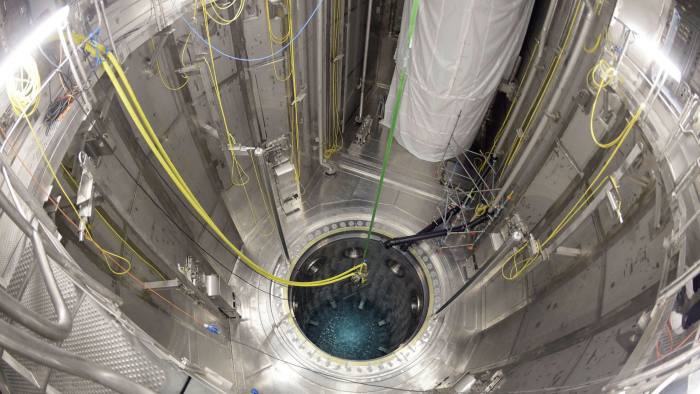

Nuclear power has been added to the EU’s green taxonomy © Lehtikuva/AFP via Getty Images Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

The launch of the first two European-listed uranium exchange traded funds, coming hot on the heels of a $1bn US uranium ETF acquisition, are the latest indicators of what has been a flurry of fund activity in nuclear fuel investment.

But despite the huge speculative interest, especially from investors in an investment trust that is less than a year old, industry observers warn there are no guarantees that last year’s strong performance will be repeated — even with a looming European energy crisis sparked by the Ukraine war.The speculative activity has been led by Sprott Asset Management, which gained notoriety last year after its Sprott Physical Uranium Trust (SPUT), which launched in July, began stockpiling […]

Click here to view original web page at www.ft.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments