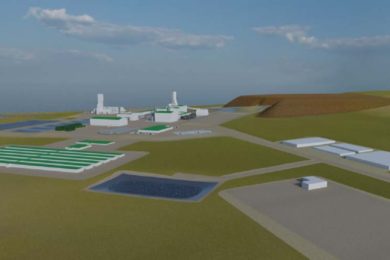

NexGen Energy CEO, Leigh Curyer, says the company’s Rook I uranium project has earnt its place as one of the “leading global resource projects with an elite ESG profile” after the publication of feasibility study results on the project’s Arrow deposit in the Athabasca Basin of Saskatchewan, Canada.

The study was completed jointly by consultants including Stantec, Wood and Roscoe Postle Associates (now part of SLR Consulting), with other technical inputs completed by sub-consultants.

Financial highlights from this study included an initial capital bill of C$1.3 billion ($1.03 billion) repaid with a post-tax net present value (8% discount) of C$3.47 billion based on a $50/Ib uranium price. From years 1-5 average annual production was due to come in at 28.8Mlb of uranium oxide, with average production over the life of mine of 10.7 years of 21.7 MIb/y.

The company laid out plans for a 1,300 t/d mill processing an average feed […]

Click here to view original web page at im-mining.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Comments