Normally, gold mining is a tough business…

First, you’ve got to find a deposit. Then you have to build a mine – something that’s labor- and capital-intensive. Then you’ve got to run the whole project to get the metal out of the ground.

After all that work, you get to sell the gold. But you don’t get to decide the price of your product. The market sets it, so you’re a "price taker."

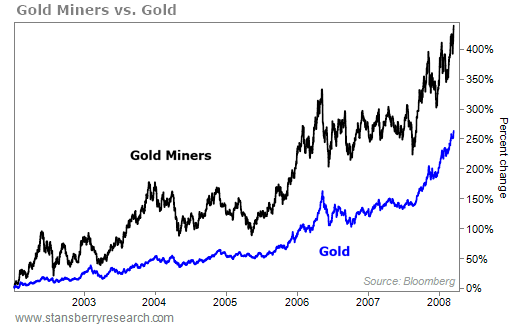

If gold prices fall, tough luck. You get what you get.So the business involves lots of fixed costs, combined with a variable sales price. For investors, that means one thing: Gold miners give you massive amounts of leverage to the price of gold…Yesterday, I explained why gold prices could soar dramatically from here. And given that backdrop, it means gold miners could easily soar triple digits.Let me explain…When gold prices fall, gold miners can become worthless fast. But when […]

Click here to view original web page at dailywealth.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments