With no disasters happening in Kazakhstan, spot uranium traded inside a narrow range last week, as utilities are considering risk-mitigating strategies.

-Last week spot uranium traded inside a narrow range

-Traders and financial participants accounted for all 17 spot market transactions for the week

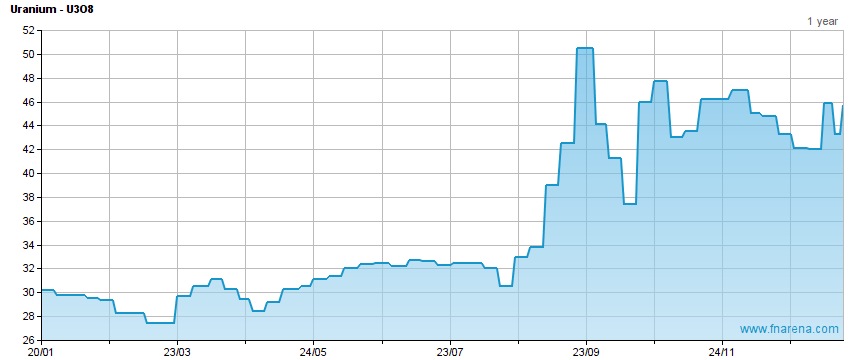

-TradeTech reports utilities are more risk conscious and looking into risk-mitigating strategiesBy Rudi Filapek-Vandyck, Editor FNArenaWith investors keeping a close eye on news and developments from Kazakhstan, spot uranium traded side-ways throughout the week ending on Friday, 14th January 2022. Industry consultant TradeTech reports its daily spot price hardly moved during the week, trading within a narrow range of US$45.50/lb to US$50/lb.By the end of the period, spot U3O8 had lost -US10c to US$45.75/lb from the previous week’s close.Total transaction volume grew to 17 transactions involving more than 2.3m pounds U3O8 equivalent compared with 1.8m for the previous week. Traders and financial entities One […]

Click here to view original web page at www.fnarena.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments