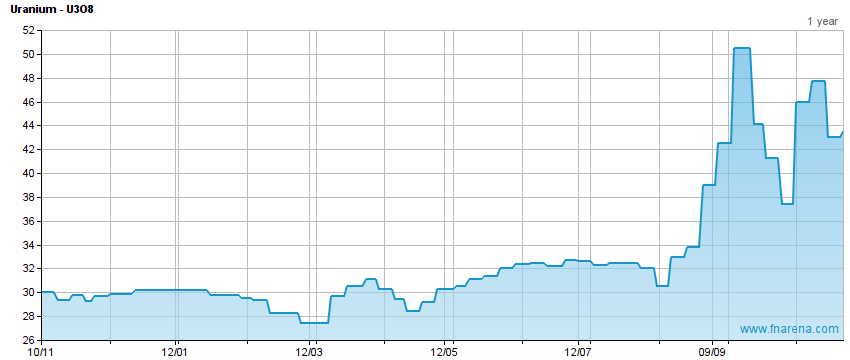

As the spot uranium price climbed just over 1% last week, Sprott Asset Management may add further impetus to equities after acquiring a pure-play uranium ETF.

-Sprott Asset Management acquires uranium ETF URNM

-COP26 highlights main advantage of small modular reactors

-Kazatomprom lowers production guidance

-Uranium spot price rises just over 1% for the week

In additional significant news for uranium equity investors, Sprott Asset Management has announced an agreement to acquire the US-listed North Shore Global Uranium Mining ETF (code:URNM), which will be re-badged as the Sprott Uranium Miners ETF.Settlement is expected to occur in the first quarter of 2022.According to Brandon Munro, Managing Director and Chief Executive Officer of ASX-listed Bannerman Energy ((BNM)) “Acquiring a pure-play uranium ETF provides Sprott with a one two punch to broaden their appeal to generalist investors attracted to the uranium space. The broader marketing channel that Sprott can deliver […]

Click here to view original web page at www.fnarena.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments