Summary

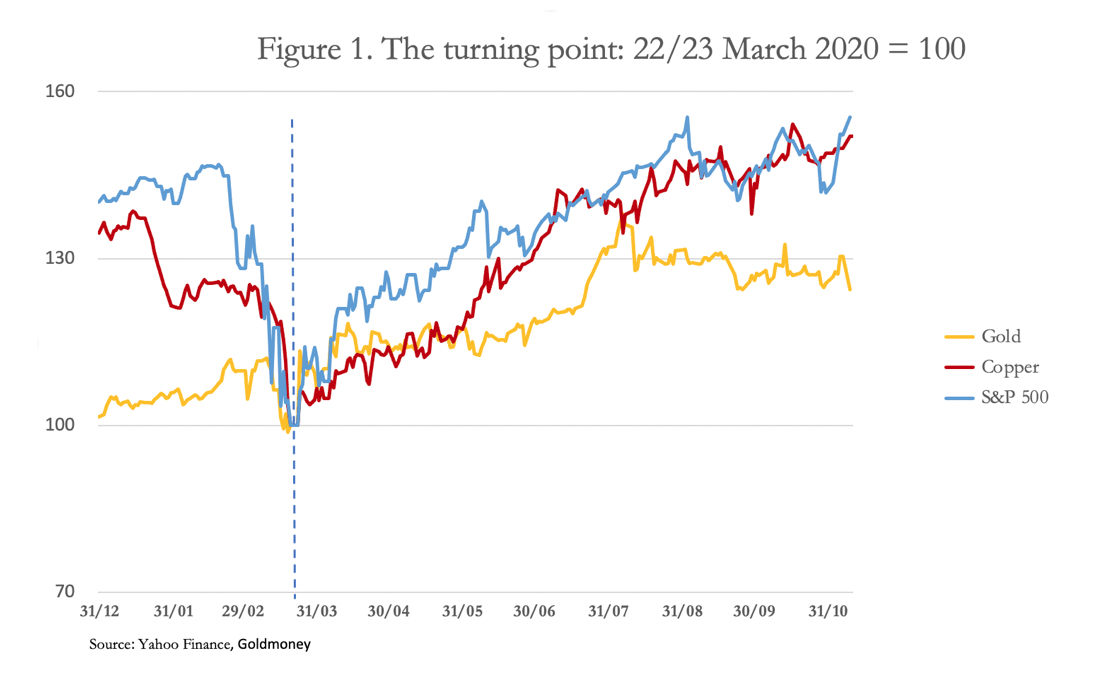

Equity markets rallied strongly ignoring rapidly deteriorating fundamentals, and gold slumped on a minor recovery in the dollar’s trade weighted index.

It is a common misconception among monetarists that the relationship between the quantity of money and its purchasing power is the only determinant of the relationship.

It is impossible to forecast when the collapse of the fiat currency will happen, other than to note the factors involved.A considered reflection of current events leads to only one conclusion, and that is accelerating inflation of the dollar’s money supply is firmly on the path to destroying the dollar’s purchasing power – completely.This article looks at the theoretical and empirical evidence from previous fiat money collapses in order to impart the knowledge necessary for individuals to seek early protection from an annihilation of fiat currencies. It assesses the likely speed of the collapse of fiat money and debates the future of money in […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments