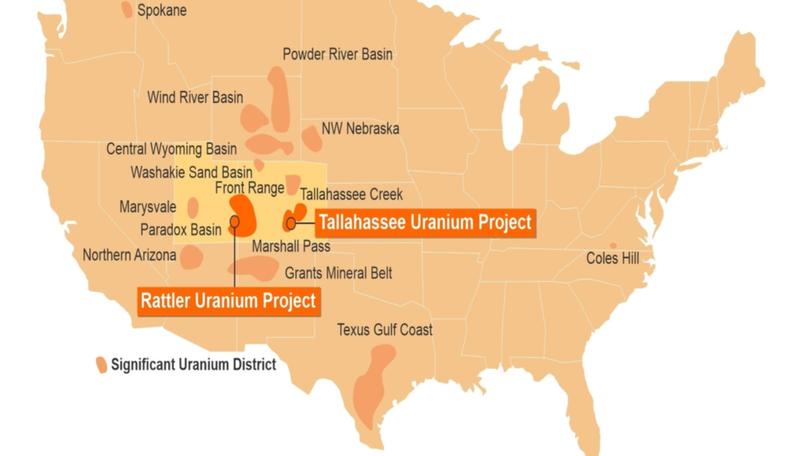

Location map of Okapi Resources’ new US uranium project areas. Credit: File ASX-listed junior explorer Okapi Resources has scored a potentially company-making package of high-grade brownfields uranium assets in the uranium friendly jurisdiction of the US via an all-scrip acquisition of private Australian outfit Tallahassee Resources.

The Perth-based company will pay the vendors of Tallahassee Resources 33.5 million new Okapi shares and 16.75 million options as consideration for the deal, subject to shareholder and statutory approvals.

Okapi will assume 100 per cent ownership of the mineral rights over the Tallahassee uranium project tenure spanning about 7,500 acres in central Colorado’s prolific Tallahassee Creek uranium district about 140km south-west of Denver.

Also included in the newly acquired Tallahassee Resources portfolio of properties is an option for Okapi to acquire 100 per cent of the Rattler uranium project, including the historical high-grade Rattlesnake open-cut mine in north-eastern Utah.In tandem with what Okapi management describes […]

Click here to view original web page at thewest.com.au

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments