Summary

We investigate several correlations of gold with a variety of parameters.

Copper, the dollar, and the 10-year rates are all connected to the gold market.

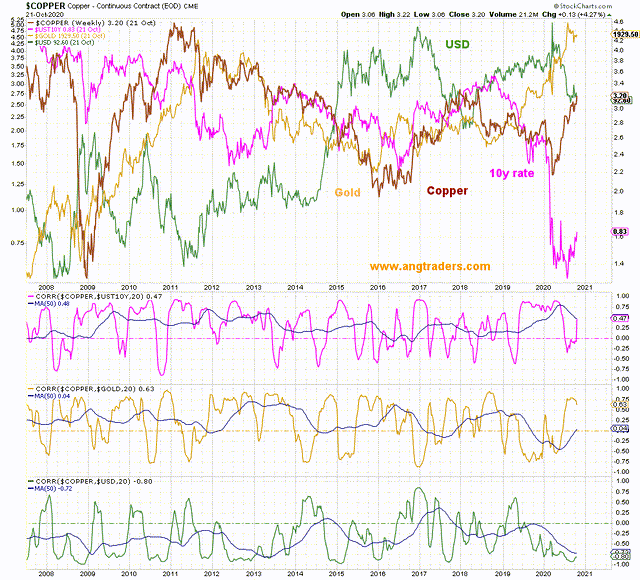

We summarize the balance of probabilities for gold, the dollar, and the 10-year bond rate going forward.In this piece, we investigate several correlations of gold with a variety of parameters, including copper, the dollar, inflation, and the 10-year rates. Copper Copper correlates: Strongly positive with the 10-year rate Positively with gold Negatively with the dollar Copper has been rising throughout the recovery and is likely to continue moving higher. This implies gold and the 10-year rate are likely to go higher and the dollar is likely to move lower. Pring Inflation Index Gold has a positive correlation with the Pring Inflation index, but on occasion, the correlation spikes negative. Half the negative spikes were followed by rallies in gold and half by drops in the gold […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments