Summary

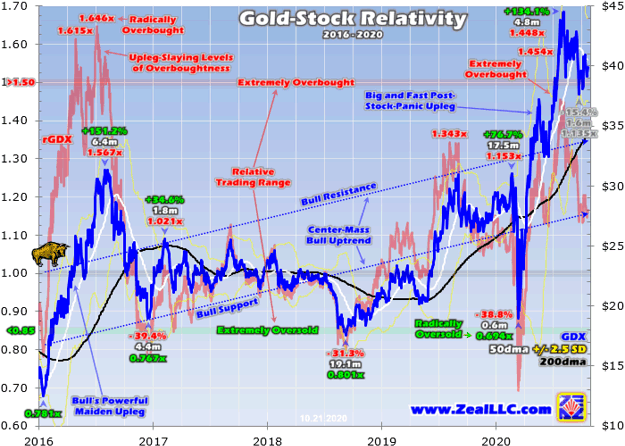

Gold stocks are still correcting. Their necessary selloff to work off overboughtness and rebalance sentiment after their latest upleg peak hasn’t finished its mission.

The major gold stocks have yet to revisit oversold levels and eradicate early August’s universal greed. And they haven’t yet fallen far enough to leverage gold’s own correction normally.

The depth and duration of this gold-stock correction is dependent on gold’s own. And that doesn’t look over yet either since gold remains so far above its 200-day-moving-average support zone.The gold miners’ stocks are still correcting, continuing to rebalance both technicals and sentiment. This sector’s huge surge into early August spawned extreme overboughtness and universal euphoria, which are gradually being bled away. This same necessary and healthy corrective process is underway in gold itself, which overwhelmingly drives gold-stock price levels. This is leading to great buying opportunities.Gold-stock speculators and investors are growing weary, wondering when miners’ next upleg […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments