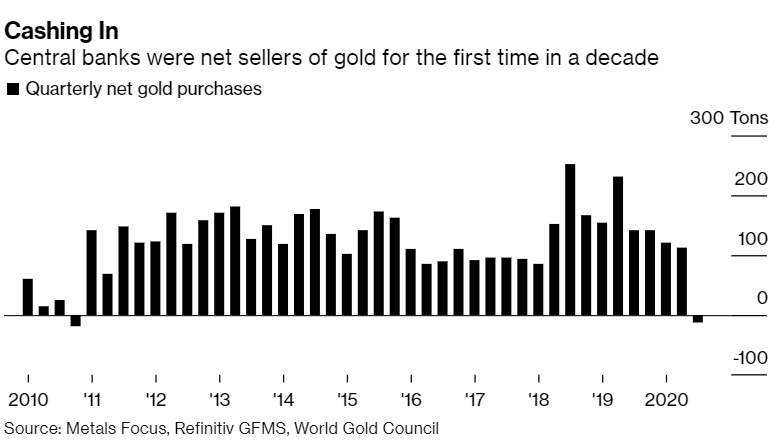

Taking advantage of the near-record high prices in order to cushion the economic shock from the coronavirus pandemic, central banks have turned into gold sellers for the first time in a decade, Bloomberg cites a report published by the World Gold Council (WGC). Key takeaways

“Net sales totaled 12.1 tons of bullion in the third quarter, compared with purchases of 141.9 tons a year earlier.”

“Selling was driven by Uzbekistan and Turkey, while Russia’s central bank posted its first quarterly sale in 13 years”.

“It’s not surprising that in the circumstances banks might look to their gold reserves. Virtually all of the selling is from banks who buy from domestic sources taking advantage of the high gold price at a time when they are fiscally stretched.”“The central banks of Turkey and Uzbekistan sold 22.3 tons and 34.9 tons of gold, respectively, in the third quarter.” Information on these pages contains forward-looking […]

Click here to view original web page at www.fxstreet.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments