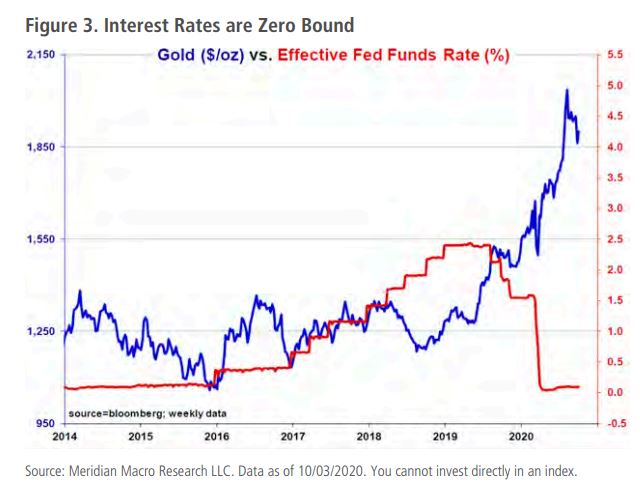

Via Sprott: The current pullback in the precious metals sector is a buying opportunity. Since trading at a closing high of $2,064 an ounce on August 6, gold bullion has declined 8.34% as of this writing. Gold mining shares have followed suit, declining 9.26% since the August high. It is possible that gold and related mining shares could continue to chop sideways to lower until the U.S. presidential election results are known and even into yearend as the implications are sorted out. Whatever the electoral outcome, the path towards monetary debasement is bipartisan. It is crucial for investors to focus on the long-term trend and to avoid the distractions of short-term timing considerations. The very strong investment fundamentals for gold and gold mining shares are based on what has been a slow irreversible drift towards significant U.S. dollar (USD) devaluation. Paper assets, including equities, bonds and currencies, have underperformed […]

Click here to view original web page at www.macrobusiness.com.au

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments