Summary

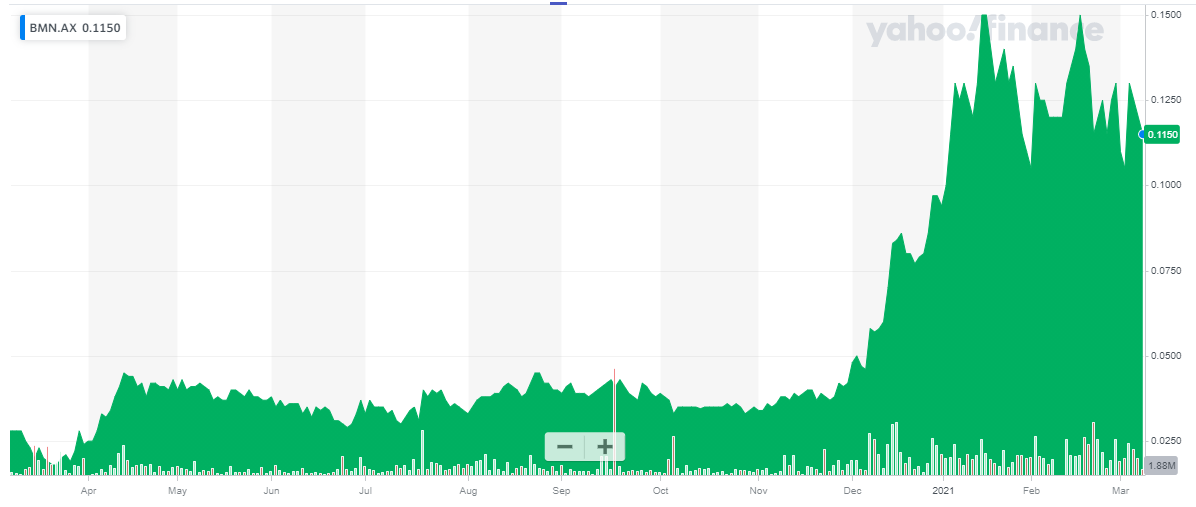

Bannerman’s share price has recently tripled, but this is not backed by fundamental value.

The Etango flagship project has a breakeven price of $46/pound, and this excludes project financing expenses.

Bannerman could be seen as a call option on a high double-digit uranium price, but in that scenario, you may as well buy any other uranium company out there. At the current valuation, Bannerman’s market capitalization may have gotten ahead of itself, and I’m not interested in a long position at this time. Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More » Introduction Bannerman Resources ( OTCQB:BNNLF ) has been working on its Namibian uranium portfolio for over a decade now, but as the uranium price hasn’t really been cooperating, the flagship Etango uranium project isn’t being built anytime soon. […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Comments