Summary

Yamana Gold has reached a friendly agreement to buy Monarch Gold.

The price is C$152 million and a 43% premium to Monarch’s share price as on Friday, October 30.

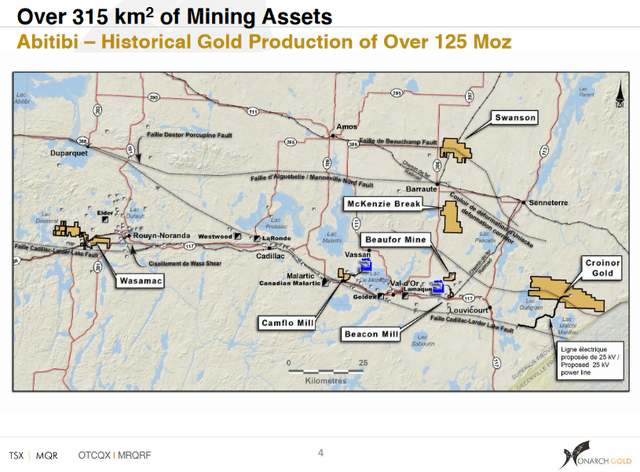

The deal undervalues Monarch’s assets, and I wouldn’t be surprised to see a competing bid emerge, as I explain below. Note: This article was originally published to subscribers on November 2, 2020. Gold M&A activity is heating up as mid-tier gold miner Yamana Gold ( AUY ) has agreed to buy gold developer Monarch Gold ( OTCQX:MRQRF ) for a total consideration of C$200 million, or C$.63 per share, representing a 43% premium to Monarch stock price as of closing on last Friday, October 30.In connection with the takeover, Monarch will spin out other assets into a new company with a cash balance of C$14 million.Following completion of the spin-out, each Monarch share will be exchanged for the following: > C$0.192 in […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments