Growing fears over the second-wave of the coronavirus globally combined with pre-US election jitters will continue to underpin the haven demand for the US dollar, keeping the bearish bias intact in gold (XAU/USD) going forward.

Gold is set to test the September low of $1849, having breached the critical 100-DMA earlier this week. US fiscal stimulus package remains elusive and offsets the optimism over the record US Q3 GDP rebound, as all eyes shift towards next week’s Presidential election.

See Gold Price Analysis: XAU/USD has three ways go in response to the 2020 Presidential Elections

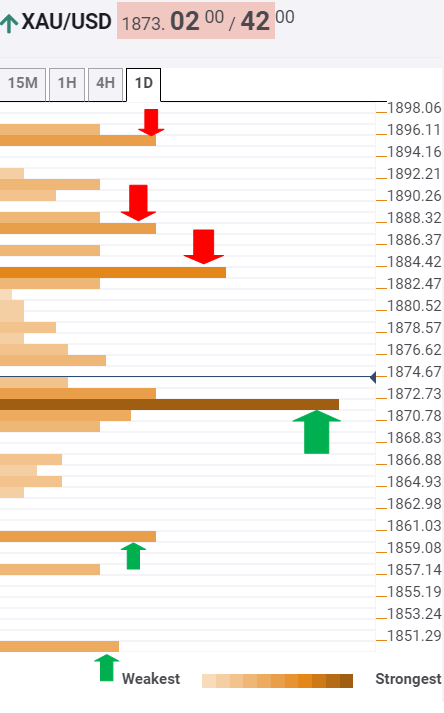

How is gold positioned on the charts? Gold: Key resistances and supports The Technical Confluences Indicator shows that the yellow metal has managed to recapture powerful resistance at $1872, which is the confluence of the SMA5 four-hour and Fibonacci 161.8% one-week.The next relevant upside barrier awaits at $1883, where the Fibonacci 23.6% one-month lies.Further up, the […]

Click here to view original web page at www.fxstreet.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments