Summary

Because uranium is a non-cyclical commodity, Cameco and other uranium miners did alright last year despite all the upheaval.

Between utilities drawing down their nuclear fuel stockpiles and new reactors being built around the world, global mined uranium demand is set to increase significantly in coming years.

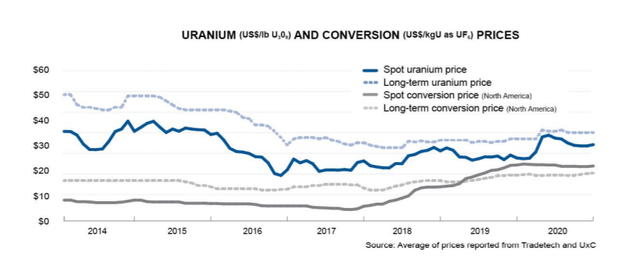

In anticipation of higher demand going forward, the spot uranium price did bottom half a decade ago. Uranium prices need to go much higher in order to stimulate more production. Cameco is set to benefit from higher prices, given its ample economic reserves, an ability to produce uranium profitably, as well as its capacity to increase mined production in response to higher prices. When I first mentioned that uranium prices may have bottomed half a decade ago, there were many people who doubted that it could happen. I did buy some Cameco (NYSE: CCJ ) stock soon after I called what […]

Click here to view original web page at seekingalpha.com

Posting Guidelines

- Do contribute something to the discussion

- Do post factual information, analysis and your view on company valuations

- Do disclose if you have an interest in a security

- Do take our Terms of Use seriously

- Do not make low-content posts, unsubstantiated ramps or untruthful/misleading statements

- Do not complain about a post unless you have reported it first, and not on the forum.

- Do not post financial advice

- Do not advertise or post sponsored content

Get involved!

Get Connected!

Come and join our community. Expand your network and get to know new people!

Comments