Uranium stocks are likely to stay in the limelight as the U.S. looks to decrease reliance on Russian suppliers.

Cameco Corporation ( CCJ ): This uranium producer is keeping some of its mines idle, betting on higher uranium prices in the future.

Global X Uranium ETF ( URA ): This thematic fund provides exposure to global companies involved in uranium exploration and mining.

Uranium Energy ( UEC ): The acquisition of Uranium One offers access to Irigaray, a large uranium processing facility that has become a central hub for satellite uranium mining projects in Wyoming. Powdered and solid uranium in front of a white background. Source: RHJPhtotos / ShutterstockUranium stocks have been flaming hot since Russia invaded Ukraine in late February. Rising fossil fuel costs have prompted several countries, including the U.S., to look at nuclear energy more closely.Recent metrics suggest “At the end of […]

Tag: uranium

Nuclear Fuels Sales Market Size, Development Data, Growth Analysis & Forecast 2022 to 2028 | ARMZ Uranium Holding Company, Cameco, Energy Resources of Australia, BHP Billiton, Canalaska Uranium, Ka…

Global “ Nuclear Fuels Sales Market ” Reports 2022 provide key industry studies for Nuclear Fuels Sales manufacturers with specific statistics, significance, definition, SWOT analysis, expert opinion and the latest developments in the world. The research report also covers market size, price, sales, revenue, market shares, gross margin, growth rate and cost structure. The report aims to provide a further selection of the latest scenario, the economic downturn and the effect of Covid-19 on the industry in general.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://reportsglobe.com/download-sample/?rid=60453

The authors of the report make an encyclopedic assessment of the most important regional markets and their development in recent years. Readers are provided with accurate facts and figures about the Nuclear Fuels Sales market and its important factors such as consumption, production, revenue growth and CAGR. The report also shares the gross […]

Click here to view original web page at manufacturelink.com.au

Uranium Royalty Corp. (NASDAQ:UROY) trade information

Uranium Royalty Corp. (NASDAQ:UROY)’s traded shares stood at 0.77 million during the last session. At the close of trading, the stock’s price was $3.32, to imply a decrease of -0.60% or -$0.02 in intraday trading. The UROY share’s 52-week high remains $5.95, putting it -79.22% down since that peak but still an impressive 32.23% since price per share fell to its 52-week low of $2.25. The company has a valuation of $305.96M, with average of 719.90K shares over the past 3 months.

After registering a -0.60% downside in the last session, Uranium Royalty Corp. (UROY) has traded red over the past five days. The stock hit a weekly high of 3.53 this Friday, 05/06/22, dropping -0.60% in its intraday price action. The 5-day price performance for the stock is -1.48%, and -18.63% over 30 days. With these gigs, the year-to-date price performance is -9.04%.

Here’s Your FREE Report on the […]

Click here to view original web page at marketingsentinel.com

Sprott: The AUM Growth Continues In 2022

akinbostanci/iStock via Getty Images Investment Thesis

The Sprott (NYSE: SII ) stock price has had a relatively turbulent 2022, where it sold off initially, then recovered substantially, to finally decline with most stocks over the last few weeks. Data by YCharts Figure 1 – Source: YCharts

Historically, Sprott has traded mostly with the precious metals industry. More recently, the stock has had a very close correlation with the uranium industry. Part of it makes sense given that the Sprott Physical Uranium Trust ( OTCPK:SRUUF ) and Sprott Uranium Miners ETF ( URNM ) have increased the exposure to the industry. However, the vast majority of Sprott’s AUM is precious metals focused and only 20-25% is in uranium.

Sprott is a company which has had very impressive AUM and earnings growth over the last few years, but that has also been reflected in the stock price. Figure 2 – Source: Quarterly […]

Skyharbour’s Partner Company Basin Uranium Corp. Announces Completion of Second Drill Hole at Mann Lake Uranium Project, Saskatchewan

Skyharbour Resources Ltd Vancouver, BC, May 05, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. ’s ( TSX-V: SYH ) ( OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company, Basin Uranium Corp. (“Basin Uranium”) is pleased to announce it has completed the second diamond drill hole at the Mann Lake uranium project in Saskatchewan’s prolific Athabasca Basin. The Mann Lake project is located 25 km southwest of the McArthur River Mine, the largest high-grade uranium deposit in the world, and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit.

Highlights : Second diamond drill hole was completed to a depth of 683 metres

Third diamond drill hole currently being collared ahead of drilling to target depth of 700 metres

Anomalous gamma probe and scintillometer readings were recorded at 660 metres depth with visual uranium mineralization (allanite) observed Core logging and sampling remains […]

Click here to view original web page at ca.finance.yahoo.com

Can You Invest in Uranium? 3 Stocks to Consider

Uranium stocks are likely to stay in the limelight as the U.S. looks to decrease reliance on Russian suppliers.

Cameco Corporation ( CCJ ): This uranium producer is keeping some of its mines idle, betting on higher uranium prices in the future.

Global X Uranium ETF ( URA ): This thematic fund provides exposure to global companies involved in uranium exploration and mining.

Uranium Energy ( UEC ): The acquisition of Uranium One offers access to Irigaray, a large uranium processing facility that has become a central hub for satellite uranium mining projects in Wyoming. Source: RHJPhtotos / ShutterstockUranium stocks have been flaming hot since Russia invaded Ukraine in late February. Rising fossil fuel costs have prompted several countries, including the U.S., to look at nuclear energy more closely.Recent metrics suggest “At the end of 2021, there were 93 operating reactors with a combined generation capacity of about 95,492 […]

Why Uranium is an interesting investment in 2022?

Uranium investment has gained a lot of attention in the past few months. Uranium is an important source of fuel for the nuclear energy industry.

With the increasing threat of escalation of Russia-Ukraine war does this make an important investment? &

How can I trade Uranium?

Uranium Price over the last two decades Uranium is an important source of fuel for the nuclear energy industry. Uranium has a high price volatility and tends to move along with the forces of supply & demand and geopolitical pressures. The price of Uranium between 2000-2010 has shown great volatility. Uranium price was at a low of 7$/lb in 2000, from 2003 Uranium started showing an upward trend in prices, with prices booming from 2005 to 2007 and peaking at $138/lb. Then the price of Uranium saw a dramatic fall to 40$/lb in 2010. As it was clear that demand will remain much larger than […]

Skyharbour’s Partner Company Basin Uranium Corp. Announces Completion of Second Drill Hole at Mann Lake Uranium Project, Saskatchewan

Vancouver, BC, May 05, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. ’s ( TSX-V: SYH ) ( OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company, Basin Uranium Corp. (“Basin Uranium”) is pleased to announce it has completed the second diamond drill hole at the Mann Lake uranium project in Saskatchewan’s prolific Athabasca Basin. The Mann Lake project is located 25 km southwest of the McArthur River Mine, the largest high-grade uranium deposit in the world, and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit.

Mann Lake Uranium Project

https://www.skyharbourltd.com/_resour c es/maps/SKY_MannLake_20211129.jpgHighlights : Second diamond drill hole was completed to a depth of 683 metres

Third diamond drill hole currently being collared ahead of drilling to target depth of 700 metres Anomalous gamma probe and scintillometer readings were recorded at 660 metres depth with visual uranium mineralization (allanite) observed Core […]

Click here to view original web page at www.globenewswire.com

ETF launches cap frenetic fund activity in uranium sector

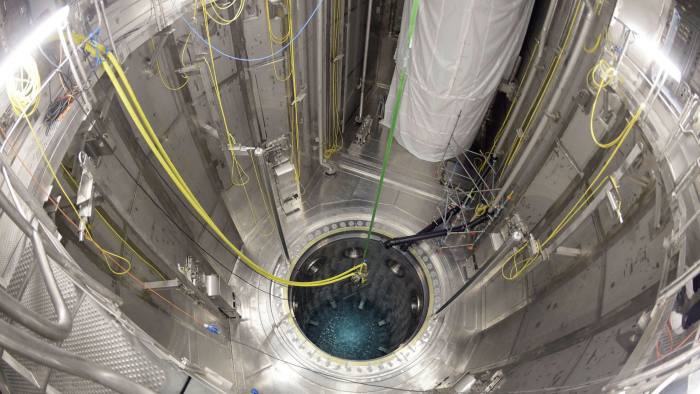

Nuclear power has been added to the EU’s green taxonomy © Lehtikuva/AFP via Getty Images Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

The launch of the first two European-listed uranium exchange traded funds, coming hot on the heels of a $1bn US uranium ETF acquisition, are the latest indicators of what has been a flurry of fund activity in nuclear fuel investment.

But despite the huge speculative interest, especially from investors in an investment trust that is less than a year old, industry observers warn there are no guarantees that last year’s strong performance will be repeated — even with a looming European energy crisis sparked by the Ukraine war.The speculative activity has been led by Sprott Asset Management, which gained notoriety last year after its Sprott Physical Uranium Trust (SPUT), which launched in July, began stockpiling […]

Sprott Announces First Quarter 2022 Results

TORONTO, May 06, 2022 (GLOBE NEWSWIRE) — Sprott Inc. (NYSE/TSX: SII) (“Sprott” or the “Company”) today announced its financial results for the quarter ended March 31, 2022.

Management commentary

"Sprott continued to deliver outstanding financial results in the first quarter of 2022, as Assets Under Management (“AUM”) increased to $23.7 billion, up $3.2 billion (16%) from December 31, 2021. Net income was $6.5 million ($0.26 per share), up $3.3 million ($0.13 per share) from the quarter ended March 31, 2021. Adjusted base EBITDA was $18.2 million ($0.73 per share), up 24%, or $3.6 million ($0.14 per share) from the quarter ended March 31, 2021. Our strong operating performance during the quarter was driven by market value appreciation in our uranium, gold and silver strategies and more than $1.3 billion of inflows to our exchange listed product offerings," said Peter Grosskopf, CEO of Sprott.

"As a leading provider of both precious […]

Click here to view original web page at www.globenewswire.com

Uranium price has a lot more runway left and needs to double for supply to meet demand – Sprott’s Ciampaglia

Editor’s Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today’s must-read news and expert opinions. Sign up here! (Kitco News) – A global energy crisis that threatens to get worse and ongoing climate change issues mean there is plenty of upside potential for nuclear energy, according to the world’s biggest uranium investment firm.

In a telephone interview with Kitco News, John Ciampaglia, CEO of Sprott Asset Management, noted that in less than a year, the Sprott Physical Uranium Trust, which gives investors direct access to physical metal, has seen significant growth. The fund started with initial holdings of 18.1 million pounds of uranium, valued at $630 million, and now holds 55.5 million pounds, valued at $3 billion dollars. At the same time, the price of uranium has jumped from $28 a pound to around $53 a […]

Skyharbour’s Partner Company Basin Uranium Corp. Announces Completion of Second Drill Hole at Mann Lake Uranium Project, Saskatchewan

Skyharbour Resources Ltd Vancouver, BC, May 05, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. ’s ( TSX-V: SYH ) ( OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company, Basin Uranium Corp. (“Basin Uranium”) is pleased to announce it has completed the second diamond drill hole at the Mann Lake uranium project in Saskatchewan’s prolific Athabasca Basin. The Mann Lake project is located 25 km southwest of the McArthur River Mine, the largest high-grade uranium deposit in the world, and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit.

Highlights : Second diamond drill hole was completed to a depth of 683 metres

Third diamond drill hole currently being collared ahead of drilling to target depth of 700 metres

Anomalous gamma probe and scintillometer readings were recorded at 660 metres depth with visual uranium mineralization (allanite) observed Core logging and sampling remains […]

Cameco promises patience as uranium market realigns

It will maintain a balanced and disciplined approach to supply decisions in the early stages of a security of supply-driven market transition, CEO Tim Gitzel said in the Canadian company’s quarterly results webinar. The company is on track to restart its Canadian operations but is delaying deliveries from its Kazakh operations until a new shipping route is finalised. Cameco is headquartered in Saskatoon, Saskatchewan (Image: Cameco) A not-previously-seen durability in the demand side is largely being driven by accountability for achieving the net-zero carbon targets being set at both country and company levels, with some 90% of the world’s economy now covered by net-zero commitments, he said. These targets are turning attention to a triple challenge: lifting one-third of the global population out of energy poverty; replacing the 85% of the current global electricity grid that runs on carbon-emitting thermal power with clean reliable alternative; and expansion of the […]

Click here to view original web page at www.world-nuclear-news.org

Uranium Energy Corp. (AMEX:UEC) trade information

Uranium Energy Corp. (AMEX:UEC)’s traded shares stood at 14.42 million during the last session, with the company’s beta value hitting 2.03. At the close of trading, the stock’s price was $4.77, to imply an increase of 4.38% or $0.2 in intraday trading. The UEC share’s 52-week high remains $6.60, putting it -38.36% down since that peak but still an impressive 60.38% since price per share fell to its 52-week low of $1.89. The company has a valuation of $1.41B, with an average of 15.83 million shares in intraday trading volume over the past 10 days and average of 14.92 million shares over the past 3 months.

Analysts have given a consensus recommendation of an Overweight for Uranium Energy Corp. (UEC), translating to a mean rating of 1.60. Of 4 analyst(s) looking at the stock, 0 analyst(s) give UEC a Sell rating. 0 of those analysts rate the stock as Overweight […]

Click here to view original web page at marketingsentinel.com

Sprott Physical Uranium Trust Provides Update on Application for U.S. Stock Exchange Listing

This news release constitutes a “designated news release” for the purposes of the Sprott Physical Uranium Trust’s prospectus supplement dated November 22, 2021 to its second amended and restated short form base shelf prospectus dated November 22, 2021.

TORONTO, April 27, 2022 (GLOBE NEWSWIRE) — Sprott Asset Management LP (“ Sprott Asset Management ”), on behalf of the Sprott Physical Uranium Trust (TSX: U.UN and U.U) (the “ Trust ” or “ SPUT ”), announced today that it has been informed that the U.S. Securities and Exchange Commission (“ SEC ”) has declined to consider the application submitted earlier this year in respect of a U.S. stock exchange listing for the units of the Trust.

“Unfortunately, we have been informed that the SEC has rejected the application to list the units of SPUT on the NYSE Arca at this time. We understand the rejection was based on the Trust not […]

Click here to view original web page at au.finance.yahoo.com

Cameco Reports First Quarter Results, Beginning to Benefit From Strategic Decisions as Uranium Prices Improve; Well-Positioned With Leverage to Market Transition

SASKATOON, Saskatchewan–( BUSINESS WIRE )–Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated financial and operating results for the first quarter ended March 31, 2022 in accordance with International Financial Reporting Standards (IFRS).

“With the recent uranium price increase, we are beginning to enjoy the benefits of the strategic and deliberate decisions we have made. And, with leverage to rising prices, we are well-positioned to continue to capture value from the market transition we believe is underway, and that is supported by the fundamentals; fundamentals characterized by durable, full-cycle demand against a backdrop of growing concerns about security of supply,” said Tim Gitzel, Cameco’s president and CEO.

“Durable demand is being driven by the accountability for achieving net-zero carbon targets, while balancing the need for affordable, reliable and secure baseload electricity, all while diversifying away from reliance on Russian energy supplies. Governments and policy makers are increasingly recognizing the role that […]

Click here to view original web page at www.businesswire.com

Can You Invest in Uranium? 3 Stocks to Consider

Uranium stocks are likely to stay in the limelight as the U.S. looks to decrease reliance on Russian suppliers.

Cameco Corporation ( CCJ ): This uranium producer is keeping some of its mines idle, betting on higher uranium prices in the future.

Global X Uranium ETF ( URA ): This thematic fund provides exposure to global companies involved in uranium exploration and mining.

Uranium Energy ( UEC ): The acquisition of Uranium One offers access to Irigaray, a large uranium processing facility that has become a central hub for satellite uranium mining projects in Wyoming. Uranium stocks have been flaming hot since Russia invaded Ukraine in late February. Rising fossil fuel costs have prompted several countries, including the U.S., to look at nuclear energy more closely.Recent metrics suggest “At the end of 2021, there were 93 operating reactors with a combined generation capacity of about 95,492 MW.” Nuclear plants […]

Denison Reports Financial and Operational Results for Q1 2022, including $47.8 million gain on Physical Uranium Holdings

TORONTO, May 4, 2022 /PRNewswire/ – Denison Mines Corp. (‘Denison’ or the ‘Company’) (TSX: DML) (NYSE: DNN ) today filed its Condensed Consolidated Financial Statements and Management’s Discussion & Analysis (‘MD&A’) for the quarter ended March 31, 2022. Both documents will be available on the Company’s website at www.denisonmines.com or on SEDAR (at www.sedar.com ) and EDGAR (at www.sec.gov/edgar.shtml ). The highlights provided below are derived from these documents and should be read in conjunction with them. The Company’s results reflect earnings attributable to Denison shareholders of $0.05 per share for the quarter ended March 31, 2022 – including mark-to-market gains of $47.8 million on the Company’s investment in 2.5 million pounds U 3 O 8 of physical uranium holdings. All amounts in this release are in Canadian dollars unless otherwise stated. View PDF

David Cates, President and CEO of Denison commented, "Our results from the first quarter of […]

Sprott to bring its uranium mining ETF to Europe

ETF STRATEGY NEWS! ETF Strategy is delighted to announce the launch of ETF Strategy Hub ( hub.etfstrategy.com ), an on-demand repository of webcasts, videos, podcasts and white papers. Debuting with Special Series on Technology & Innovation in China and the Digital Economy.

Toronto-based Sprott Asset Management is preparing to launch an ETF in Europe providing exposure to companies in the uranium mining industry. Nuclear power has been touted as an important bridging fuel while new renewable capacity is being built. The Sprott Uranium Miners UCITS ETF will list on London Stock Exchange in US dollars ( URNM LN ) and pound sterling ( URNP LN ) later in May.

It will come with an expense ratio of 0.85%.

The fund is being brought to market in partnership with white-label ETF issuer HANetf who will be responsible for marketing and distribution responsibilities.The ETF will replicate the strategy behind Sprott’s US-listed Sprott Uranium Miners […]

Toro models transformational changes to WA uranium play

Drilling operations at Toro Energy’s Lake Maitland uranium deposit in WA. Credit: File A pit re-optimisation, the inclusion of vanadium credits and a change of plant location has turbo-charged Toro Energy’s plan for its WA based Lake Maitland uranium project, leading to a potential 48 per cent hike in uranium production over the life of mine to 23.5 million pounds from 15.8 million pounds and potential vanadium oxide production of 12.2 million pounds.

The company has modelled up the option of a stand-alone uranium mine at Lake Maitland instead of simply including it as part of a broader plan to mine multiple deposits as part of its Wiluna uranium project.

The new model will see the processing plant built alongside the Lake Maitland deposit instead of next to the company’s Centipede deposit around 80km to the northwest.

The resultant cost savings in transport and some processing tweaks when added to a new […]

Toro models transformational changes to WA uranium play

A pit re-optimisation, the inclusion of vanadium credits and a change of plant location has turbo-charged Toro Energy’s plan for its WA based Lake Maitland uranium project, leading to a potential 48 per cent hike in uranium production over the life of mine to 23.5 million pounds from 15.8 million pounds and potential vanadium oxide production of 12.2 million pounds. Drilling operations at Toro Energy’s Lake Maitland uranium deposit in WA. Credit: File A pit re-optimisation, the inclusion of vanadium credits and a change of plant location has turbo-charged Toro Energy ’s plan for its WA based Lake Maitland uranium project, leading to a potential 48 per cent hike in uranium production over the life of mine to 23.5 million pounds from 15.8 million pounds and potential vanadium oxide production of 12.2 million pounds.

The company has modelled up the option of a stand-alone uranium mine at Lake Maitland instead […]

Click here to view original web page at www.businessnews.com.au

Skyharbour’s Partner Company Basin Uranium Corp. Completes First Drill Hole at Mann Lake Uranium Project, Saskatchewan

Article content

Vancouver, BC, April 28, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. ’s ( TSX-V: SYH ) ( OTCQB:

SYHBF ) (Frankfurt:

SC1P ) (the “Company”) partner company, Basin Uranium Corp. (“Basin Uranium”) is pleased to announce it has completed the first diamond drill hole at the Mann Lake uranium project in Saskatchewan’s prolific Athabasca Basin. The Mann Lake project is located 25 km southwest of the McArthur River Mine, the largest high-grade uranium deposit in the world, and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit. Article contentMann Lake Uranium Project https://www.skyharbourltd.com/_resources/maps/SKY_MannLake_20211129.jpg Highlights : First diamond drill hole was completed to a depth of 731 metres Second diamond drill hole underway at a current depth of approx. 185 metres (target depth of 700 metres) Core logging and composite lithogeochemical sampling remains ongoing with samples being prepared for shipment […]

U3O8 : MD & A 2021 Q4

MANAGEMENT’S DISCUSSION AND ANALYSIS

U3O8 CORP.

Prepared by:

U3O8 Corp.36 Toronto Street, Suite 1050Toronto, OntarioM5C 2C5 www.u3o8corp.com U3O8 CORP.Management’s Discussion & AnalysisPeriod Ended December 31, 2021IntroductionThis Management’s Discussion and Analysis ("MD&A") is dated May 2, 2022, unless otherwise indicated, and should be read in conjunction with the audited consolidated financial statements of U3O8 Corp. ("U3O8 Corp.", "the Company") for the year ended December 31, 2021 and the related notes. This MD&A was written to comply with National Instrument 51-102 – Continuous Disclosure Obligations. Results are reported in Canadian Dollars, unless otherwise noted. The results presented for the year ended December 31, 2021, are not necessarily indicative of the results that may be expected for any future period.The audited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") for the year ended December 31, 2021. Information about U3O8 Corp., its minerals resources and technical reports prepared in accordance […]

Click here to view original web page at www.marketscreener.com

FIRST URANIUM SIGNS DEFINITIVE AGREEMENT WITH SOUTHWIND

Article content

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATESVancouver, British Columbia, April 26, 2022 (GLOBE NEWSWIRE) — First Uranium Resources Ltd. (the “ Company ” or “ First Uranium ”) (CSE: URNM) is pleased to announce that further to its news release of March 9, 2022, it has entered into a definitive agreement providing it with an option to acquire (the “ Option ”) all of the shares of Southwind Corporation (“ Sout hwind ”), a Delaware corporation (the “ Option Agreement ”). Southwind’s principal asset is a land package in Arkansas comprising a phosphate and rare earth metals project. The Option Agreement becomes effective following the satisfaction of certain conditions precedent including, but not limited to the completion of a reorganization of the shareholdings of Southwind. Article content

Pursuant to the terms of the Option Agreement, the Company […]

Uranium Energy Corp. (AMEX: UEC) Falls -0.71% In Recent Session, What Are The Points You Absolutely Need To Consider?

Uranium Energy Corp. (AMEX:UEC) price closed lower on Monday, May 02, dropping -0.71% below its previous close.

A look at the daily price movement shows that the last close reads $4.25, with intraday deals fluctuated between $4.03 and $4.24. The company’s 5Y monthly beta was ticking 2.06. Taking into account the 52-week price action we note that the stock hit a 52-week high of $6.60 and 52-week low of $1.89. The stock subtracted -8.06% on its value in the past month.

Uranium Energy Corp., which has a market valuation of $1.25 billion, is expected to release its quarterly earnings report Dec 14, 2021. Analysts tracking UEC have forecast the quarterly EPS to shrink by 0 per share this quarter, while the same analysts predict the annual EPS to hit $0 for the year 2022 and up to -$0.03 for 2023.

Revisions to the company’s EPS highlights a short term direction of a […]