All Canadian stock markets combined have thousands of stocks (collectively), and if you add the potential U.S. securities to the mix, which are even more numerous, the number becomes too unwieldy to keep track of for a single investor, even with all the new tools.

There are a few ways you can keep track of your most favourite securities and budding prospects; foremost among them would be a watchlist. But a few investors take a different approach. They invest a very small sum of money in the stocks they want to keep tabs on, making them part of their portfolio and allowing them to keep a closer eye on changes and patterns compared to a watchlist.

But that’s not the only reason people invest smaller sums in stocks. Indeed, many people are in the habit of investing their savings right away (no matter how small) to give them as much time […]

Uranium sale expected to boost Wyoming production

DOUGLAS — In a move that may mean a huge upswing in uranium mining in Converse County and Wyoming, Uranium Energy Corporation (UEC) has entered into an agreement with Russia’s Uranium One Investments Inc., a subsidiary of Uranium One, to acquire all issued and outstanding shares of Uranium One Americas, Inc. (U1A) for a total purchase price of $112 million in cash and the replacement of $19 million in reclamation bonding.

Uranium One is the world’s fourth largest uranium producer and part of Russia’s State Atomic Energy Corporation, Rosatom.

The deal will add approximately 100,000 acres in Wyoming’s prolific uranium producing Powder River and Great Divide Basins consisting of dozens of under-explored, mineralized brownfield projects, backed by detailed databases of historic uranium exploration and development programs, thus greatly enhancing the potential for resource expansion, according to a press release from UEC Nov. 9.

The company said U1A’s assets are primarily situated in […]

Thinking Of Investing In Uranium Energy Corp. (AMEX: UEC) Stock? Here’s What You Need To Know

Uranium Energy Corp. (AMEX:UEC) shares, rose in value on Friday, November 26, with the stock price down by -7.41% to the previous day’s close as strong demand from buyers drove the stock to $4.00.

Actively observing the price movement in the recent trading, the stock is buoying the session at $4.32, falling within a range of $4.19 and $4.52. The value of beta (5-year monthly) is 2.43. Referring to stock’s 52-week performance, its high was $5.79, and the low was $1.03. On the whole, UEC has fluctuated by 7.46% over the past month.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert […]

Uranium Energy Corp. (AMEX: UEC) Shares Have Been Up About 145.45% Year-To-Date Since The Beginning Of 2021

During the last session, Uranium Energy Corp. (AMEX:UEC)’s traded shares were 4.59 million, with the beta value of the company hitting 2.30. At the end of the trading day, the stock’s price was $4.32, reflecting an intraday loss of -1.14% or -$0.05. The 52-week high for the UEC share is $5.79, that puts it down -34.03 from that peak though still a striking 77.08% gain since the share price plummeted to a 52-week low of $0.99. The company’s market capitalization is $1.28B, and the average trade volume was 8.52 million shares over the past three months.

Uranium Energy Corp. (UEC) received a consensus recommendation of a Buy from analysts. That translates to a mean rating of 1.50. UEC has a Sell rating from 0 analyst(s) out of 5 analysts who have looked at this stock. 0 analyst(s) recommend to Hold the stock while 0 suggest Overweight, and 5 recommend a […]

Click here to view original web page at marketingsentinel.com

Consolidated Uranium Announces Closing of C$20.0 Million Bought Deal Private Placement

TORONTO, Nov. 22, 2021 (GLOBE NEWSWIRE) — Consolidated Uranium Inc. (“ CUR ” or the “ Company ”) (TSXV: CUR) (OTCQB: CURUF) is pleased to announce the closing of its previously announced “bought deal” private placement (the “ Offering ”) for gross proceeds of C$20,000,750 from the sale of 7,547,453 units of the Company (the “ Units ”) at a price of C$2.65 per Unit (the “ Unit Price ”), which includes the full exercise of the over-allotment option. Due to significant demand, the Offering was upsized from its original gross proceeds of C$15.0 million. Red Cloud Securities Inc. acted as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters that included Haywood Securities Inc. and PI Financial Corp. (collectively, the “ Underwriters ”).

Philip Williams, President and CEO commented, “we are very pleased to have completed another over-subscribed and strongly institutionally subscribed private placement. I […]

Click here to view original web page at www.juniorminingnetwork.com

Belmont Signs Binding Term Sheet for its Crackingstone Uranium Property

XS Resources Pty Ltd.To Acquire Up To 80% Interest in Crackingstone

Vancouver, B.C. Canada – TheNewswire – November 25, 2021 – Belmont Resources Inc. (“Belmont”), (or the “Company”), (TSXV:BEA) (FSE:L3L2) is pleased to announce that it has entered into a binding term sheet agreement (the “Agreement”) with respect to its Crackingstone Uranium Project (“Crackingstone”) in the Athabasca Basin of Northern Saskatchewan, Canada with XS Resources Pty Ltd. (“XSR”).

XS Resources is an Australian private resource exploration company currently applying for listing on the Australian Securities Exchange (“ASX”)

Under the terms of the agreement, XSR will make cash payments totaling $100,000 to Belmont upon the receipt of ASX approval under the Listing Rules, spend $2,500,000 in exploration expenditures over a two-year earn-in period and issue to Belmont, shares equivalent to a value of $250,000 (based on the issue price of ListCo Shares pursuant to ListCo’s IPO prospectus) to earn up to an 80% […]

Uranium Royalty Corp. (NASDAQ:UROY) trade information

During the last session, Uranium Royalty Corp. (NASDAQ:UROY)’s traded shares were 0.45 million. At the end of the trading day, the stock’s price was $4.79, reflecting an intraday gain of 0.42% or $0.02. The 52-week high for the UROY share is $5.95, that puts it down -24.22 from that peak though still a striking 82.67% gain since the share price plummeted to a 52-week low of $0.83. The company’s market capitalization is $375.19M, and the average trade volume was 1.18 million shares over the past three months.

Uranium Royalty Corp. (UROY) registered a 0.42% upside in the last session and has traded in the red over the past 5 sessions. The stock spiked 0.42% in intraday trading to $4.79 this Wednesday, 11/24/21, hitting a weekly high. The stock’s 5-day price performance is -8.06%, and it has moved by -12.75% in 30 days. Based on these gigs, the overall price performance […]

Click here to view original web page at marketingsentinel.com

Purepoint Uranium Outlines Upcoming Exploration Plans

Toronto, Ontario–(Newsfile Corp. – November 23, 2021) – Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) (" Purepoint " or the " Company ") today released its exploration schedule for the coming year, focusing on its large portfolio of 100% owned uranium projects strategically located across Canada’s Athabasca Basin; host to the world’s highest grade uranium resources.

"We intend to take full advantage of the renewed financial support afforded to us by the ongoing recovery of uranium prices," said Chris Frostad, Purepoint’s President and CEO. "We are now in a position to follow up on the significant discoveries already established across our portfolio of 100% owned projects."

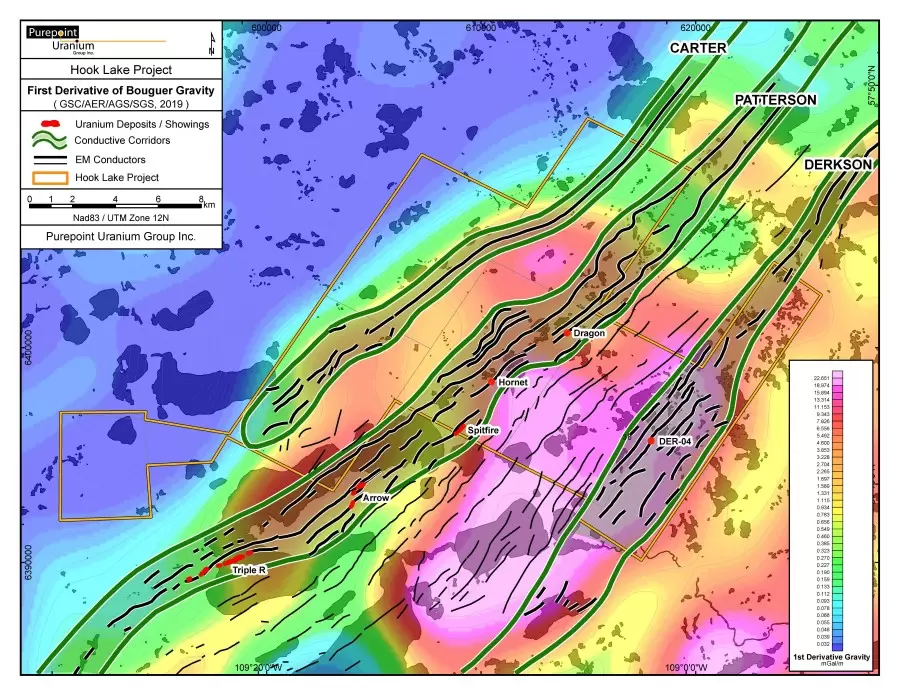

Highlights: In 2022, the Hook Lake JV is turning its attention to the Carter Corridor; 25km band of graphitic conductors running parallel to the Patterson trend, where initial drilling has shown significant opportunity for discovery,

Airborne geophysical work to help focus […]

Click here to view original web page at www.juniorminingnetwork.com

Valor backers pump $5.4m in for Canadian uranium hunt

Valor Resources Executive Chairman George Bauk. Credit: File Valor Resources has extracted a handy $5.4m from the market to throw at its Canadian uranium projects as it ramps up exploration activities amid strengthening uranium prices. The Perth-based explorer is knee deep in a flurry of exploration activities as the uranium price is spurred on by increased global demand for yellow cake.

The company recently completed a placement through the issue of 319 million new shares priced at 1.71 cents. Curiously, the price represents a seven per cent premium to Valor’s closing market price of 1.6 cents on the 22nd November 2021 and a four per cent discount to the 15-day volume weighted average price.

Valor is juggling seven projects in the uranium-rich Athabasca Basin of northern Saskatchewan, Canada that boasts some of the world’s highest-grade uranium deposits including Cameco’s Cigar Lake deposit which has a reported uranium oxide grade going a […]

Uranium sale expected to boost Wyoming production

DOUGLAS — In a move that may mean a huge upswing in uranium mining in Converse County and Wyoming, Uranium Energy Corporation (UEC) has entered into an agreement with Russia’s Uranium One Investments Inc., a subsidiary of Uranium One, to acquire all issued and outstanding shares of Uranium One Americas, Inc. (U1A) for a total purchase price of $112 million in cash and the replacement of $19 million in reclamation bonding.

Uranium One is the world’s fourth largest uranium producer and part of Russia’s State Atomic Energy Corporation, Rosatom.

The deal will add approximately 100,000 acres in Wyoming’s prolific uranium producing Powder River and Great Divide Basins consisting of dozens of under-explored, mineralized brownfield projects, backed by detailed databases of historic uranium exploration and development programs, thus greatly enhancing the potential for resource expansion, according to a press release from UEC Nov. 9.

The company said U1A’s assets are primarily situated in […]

Uranium sale expected to boost Wyoming production

DOUGLAS — In a move that may mean a huge upswing in uranium mining in Converse County and Wyoming, Uranium Energy Corporation (UEC) has entered into an agreement with Russia’s Uranium One Investments Inc., a subsidiary of Uranium One, to acquire all issued and outstanding shares of Uranium One Americas, Inc. (U1A) for a total purchase price of $112 million in cash and the replacement of $19 million in reclamation bonding.

Uranium One is the world’s fourth largest uranium producer and part of Russia’s State Atomic Energy Corporation, Rosatom.

The deal will add approximately 100,000 acres in Wyoming’s prolific uranium producing Powder River and Great Divide Basins consisting of dozens of under-explored, mineralized brownfield projects, backed by detailed databases of historic uranium exploration and development programs, thus greatly enhancing the potential for resource expansion, according to a press release from UEC Nov. 9.

The company said U1A’s assets are primarily situated in […]

Cauldron Energy talks up uranium potential after defining new targets at Yanrey

Cauldron Energy Ltd (ASX:CXU) believes its Yanrey Uranium Project contains significant undiscovered uranium resources, following positive results from a new passive seismic survey.

The results highlighted multiple new in-situ recovery (ISR) uranium targets at the Flagstaff prospect over areas of unusual basement complexity.

The company says the structural information gleaned from the survey will assist in further developing the systems-style exploration model at the project. Unlocking uranium potential

Cauldron chairman Simon Youds said the findings could help unlock the uranium potential of the Yanrey project.“Our ultimate objective is to explore for uranium mineralisation amenable to extraction by ISR,” he said.“Economic deposits of sandstone-hosted, palaeochannel-style uranium can be mined using ISR in the lowest cost quartile of uranium mined globally.“This characteristic makes these deposits extremely attractive for mining at any uranium price and necessarily must form the basis of any uranium resource portfolio.“The recent passive seismic results justify the confidence we have […]

Click here to view original web page at www.proactiveinvestors.com.au

Bannerman Energy Looks Overvalued Based On Fundamentals

Summary

The company owns the Etango-8 uranium project in Namibia and its current market valuation implies that uranium prices will stay at around $70/lb over the 15-year mine life.

I view this as highly unlikely as we’ve seen such uranium prices only for a period of five months during the uranium bubble of 2007.

Etango-8 is worthless at today’s spot uranium prices as the cash flow breakeven price stands at $52/lb. kasezo/iStock via Getty Images Investment thesis Earlier this week, I wrote an article on Cameco (NYSE: CCJ ) in which I said that the whole uranium sector seems to be detached from fundamentals. Today, I’m taking a look at a Namibia-focused uranium mining company that in my view proves this point pretty well. Bannerman Resources ( OTCQB:BNNLF ) owns 95% of the Etango-8 uranium project, which has a cash flow breakeven price that is above the current uranium […]

Sprott Physical Uranium Trust Announces Filing of Second Amended and Restated Base Shelf Prospectus and Updated “At-The-Market” Equity Program

TORONTO, Nov. 23, 2021 (GLOBE NEWSWIRE) — Sprott Asset Management LP (“Sprott Asset Management”), on behalf of the Sprott Physical Uranium Trust (TSX: U.UN) (TSX: U.U) (the “Trust” or “SPUT”), a closed-ended trust created to invest and hold substantially all of its assets in physical uranium, today announced that the Trust has filed and obtained a receipt from securities regulatory authorities in each of the provinces and territories of Canada for its second amended and restated short form base shelf prospectus (the “Second Amended and Restated Shelf Prospectus”) amending and restating its amended and restated short form base shelf prospectus dated September 9, 2021. The Second Amended and Restated Shelf Prospectus allows the Trust to issue up to US$3.5 billion of units of the Trust (“Units”) in Canada during the 25-month period that commenced on August 10, 2021.

The Trust has also updated its at-the-market equity program (the “ATM Program”) […]

Click here to view original web page at www.globenewswire.com

Don’t Miss Out on this Buy-In Window for Uranium Royalty Corp. (UROY)

For the readers interested in the stock health of Uranium Royalty Corp. (UROY). It is currently valued at $4.77. When the transactions were called off in the previous session, Stock hit the highs of $4.98, after setting-off with the price of $4.55. Company’s stock value dipped to $4.5419 during the trading on the day. When the trading was stopped its value was $4.44.Recently in News on November 9, 2021, Uranium Royalty Corp Provides Langer Heinrich Asset Update. Uranium Royalty Corp. (NASDAQ: UROY) (TSXV: URC) (“URC” or the “Company”) is pleased to provide the following update on the Langer Heinrich Mine, on which Uranium Royalty Corp. holds a production royalty of A$0.12 per kilogram of U3O8 produced from the Langer Heinrich Mine and sold by Paladin Energy Limited (ASX:PDN, OTCQX:PALAF) (“Paladin”) and Paladin Energy Metals Ltd:. You can read further details here

Uranium Royalty Corp. had a pretty favorable run […]

Purepoint Uranium Outlines Upcoming Exploration Plans

Share on Facebook

Tweet on Twitter

Toronto, Ontario–(Newsfile Corp. – November 23, 2021) – Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) (‘ Purepoint ‘ or the ‘ Company ‘) today released its exploration schedule for the coming year, focusing on its large portfolio of 100% owned uranium projects strategically located across Canada’s Athabasca Basin; host to the world’s highest grade uranium resources.

‘We intend to take full advantage of the renewed financial support afforded to us by the ongoing recovery of uranium prices,’ said Chris Frostad, Purepoint’s President and CEO. ‘We are now in a position to follow up on the significant discoveries already established across our portfolio of 100% owned projects.’ Highlights: In 2022, the Hook Lake JV is turning its attention to the Carter Corridor; 25km band of graphitic conductors running parallel to the Patterson trend, where initial drilling has shown significant opportunity for discovery, […]

Okapi kicks off Utah uranium exploration play

Uranium-Vanadium mineralisation within the adits at the base of the Rattlesnake Pit. Credit: File ASX-listed Okapi Resources has boots on the ground at its high-grade Rattler uranium project in Utah, USA with the Perth-based company’s first-pass exploration checklist at Rattler to include a detailed review of historical workings, geological mapping and rock chip sampling. Okapi anticipates wrapping up field work by the end of the year ahead of a drill campaign that is earmarked for early in the new year.

The Rattler uranium project encompasses the prized historical Rattlesnake uranium mine that churned out some 285,000 tonnes of ore at 2,800 parts per million triuranium octoxide, or “U3O8” and 10,000ppm vanadium pentoxide for 1.6 million pounds of U3O8 and 4.5 million pounds of vanadium pentoxide between 1948 and 1954.

The Rattlesnake deposit is a prime exploration target for Okapi given it presents the only outcropping deposit in the immediate area. The […]

Kazakhstan-based physical uranium fund begins operations

Kazakh national nuclear company Kazatomprom has signed a framework agreement with Genchi Global to invest in the newly established ANU Energy OEIC Limited physical uranium fund, meaning the fund can begin operations. Meanwhile, Kazatomprom has exercised an option to buy back uranium previously sold to Yellow Cake plc. The signing cermony was attended by Kazatomprom CEO Mazhit Sharipov, seen here on the right, and Ali Ashraf, director of Genchi Global Limited (Image: Kazatomprom) Kazatomprom is to be a key supplier to ANU, set up last month by Kazatomprom (48.5%), National Investment Corporation of the National Bank of Kazakhstan JSC (48.5%) and Genchi Global Limited (3%) to store physical uranium as a long-term investment. It is registered on the Astana International Financial Centre.

The fund’s initial acquisition will be carried out using joint investments of USD50 million from its founders. The newly signed framework agreement sets out the terms and mechanisms […]

Click here to view original web page at www.world-nuclear-news.org

Bullish signals give uranium producers hope for market turnaround

A mothballed uranium mine sits in the middle of the Utah desert Oct. 27, 2017, outside Ticaboo, Utah. North American uranium producers have responded to the spike in uranium spot prices with cautious optimism, hoping longer-term contracts from nuclear power utilities follow. Source: George Frey/Getty Images News via Getty News Uranium producers say nuclear utilities have begun exploring long-term contracts now that a Canadian uranium fund has slurped up much of the excess supply in the spot market.

Yellowcake prices have been low for over a decade since the Fukushima Daiichi reactor accident in Japan made nuclear power a pariah, a situation that boosted existing nuclear plants which could rely on the low-priced spot market to meet their needs. This summer, however, Toronto-based hedge fund Sprott Asset Management LP, a subsidiary of Sprott Inc., took the uranium market by storm, buying up millions of pounds of excess supply of […]

Why Denison Mines, Energy Fuels, and Uranium Energy Stocks Soared More Than 10%

What happened

Uranium stocks are back in action. Stocks across the industry soared on Tuesday on the back of two big developments that have the potential to send uranium prices soaring. Here’s how much the top-performing uranium stocks had rallied at their highest points by around 10:05 a.m. ET, Nov. 23: So what

If you look at the dizzying rally in uranium prices between July and September, you could easily single out the Sprott Physical Uranium Trust ( OTC:SRUU.F ) exchange-traded fund (ETF) as the one behind the run-up.

The thing is, global demand for uranium was painfully low until the Sprott Physical Uranium Trust Fund launched in July. The Fund started buying up physical uranium from the spot market to meet demand for its units from investors betting on the physical uranium ETF. By Nov. 22, the Fund had amassed almost 40 million pounds of uranium versus only 18.3 […]

Board of Trustees of Exchange Traded Concepts Trust Approves Plan of Reorganization Relating to the North Shore Global Uranium Mining ETF

NEW YORK, Nov. 23, 2021 /PRNewswire/ — At a meeting held on November 22, 2021, the Board of Trustees (the "Board") of Exchange Traded Concepts Trust ("ETCT") approved an Agreement and Plan of Reorganization (the "Plan of Reorganization") relating to the North Shore Global Uranium Mining ETF (the "North Shore Fund"), a series of ETCT. The Plan of Reorganization provides for the reorganization of the North Shore Fund into the Sprott Uranium Miners ETF (the "Sprott Fund"), a newly created series of Sprott Funds Trust ("SFT") (the "Reorganization"). The Board of Trustees of SFT approved the Plan of Reorganization on November 15, 2021. Sprott Asset Management LP ("Sprott") has also entered into a definitive agreement with North Shore Indices, Inc. to acquire a license to use the North Shore Global Uranium Mining Index, the performance of which the North Shore Fund seeks to track.

A notice of special meeting of […]

Cameco Stock: High Uranium Prices Are Starting To Bite

Summary

The company closed Q3 2021 with a loss of $72 million and each $5/lb increase in uranium prices is expected to increase its Q4 loss by $3 million.

Cameco is stuck in no man’s land as uranium prices don’t seem high enough for the company to restart the idled McArthur River mine.

Even if McArthur River is restarted immediately, investors are currently paying over $22/lb for reserves. If uranium prices reach $100/lb and stay there, Cameco’s average realized price will vary between $58/lb and $65/lb in the next four years. caracterdesign/E+ via Getty Images Investment thesis Back in September, I wrote an article on how Sprott Physical Uranium Trust ( OTCPK:SRUUF ) is likely pushing up uranium prices through large purchases on the spot market. However, those high prices are having a negative effect on the financials of Cameco (NYSE: CCJ ). The company closed Q3 with a […]

5 Top Weekly TSX Performers: Uranium Stocks Dominate

Last week’s top-gaining stocks on the TSX were Energy Fuels, Golden Star Resources, Mega Uranium, Verde Agritech and Laramide Resources.

The S&P/TSX Composite Index (INDEXTSI: OSPTX ) was trending upward last Friday (November 5), trading at 21,442.42 by midday. It closed the five day period at 21,455.82.

The index hit a record high on the last day of trading, supported by strength in financial stocks.

On Friday, gold and silver edged up following dovish comments from the US Federal Reserve, which will wait for more job growth before raising interest rates.Last week’s five TSX-listed mining stocks that saw the biggest gains are as follows:Here’s a look at those companies and the factors that moved their share prices last week. 1. Energy Fuels Energy Fuels is a leading US-based uranium-mining company, supplying U3O8 to major nuclear utilities. Energy Fuels also produces vanadium from certain of its projects, as market conditions warrant, […]

These Numbers Prove Just How Vibrant The Uranium Energy Corp. (AMEX: UEC) Stock Has Been

The trading price of Uranium Energy Corp. (AMEX:UEC) closed lower on Monday, November 22, closing at $4.10, -4.43% lower than its previous close.

Traders who pay close attention to intraday price movement should know that it fluctuated between $4.08 and $4.44. In examining the 52-week price action we see that the stock hit a 52-week high of $5.79 and a 52-week low of $0.94. Over the past month, the stock has gained 4.59% in value.

3 Tiny Stocks Primed to Explode The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for big returns. Click […]

Uranium Energy Corp. [UEC] stock Initiated by Canaccord Genuity analyst, price target now $1.50

Uranium Energy Corp. [AMEX: UEC] stock went on a downward path that fall over -12.45% on Friday, amounting to a one-week price decrease of less than -21.57%. The company report on November 9, 2021 that Uranium Energy Corp Creates America’s Largest Uranium Mining Company with the Acquisition of Uranium One Americas.

Uranium Energy Corp. (NYSE American: UEC) (the “Company” or “UEC”) is pleased to announce the Company has entered into a definitive share purchase agreement with Uranium One Investments Inc., a subsidiary of Uranium One Inc. (“Uranium One”), to acquire all the issued and outstanding shares of Uranium One Americas, Inc. (“U1A”) for a total purchase price comprised of $112 million in cash and the replacement (with corresponding payments to the seller) of $19 million in reclamation bonding (the “Acquisition”). Uranium One is the world’s fourth largest uranium producer and part of Russia’s State Atomic Energy Corporation, Rosatom.

3 Tiny […]