The spot uranium market traded in a wide range in March due to off-again, on-again speculation regarding a potential US ban on Russian uranium exports.

-Uranium not originally included in US sanctions

-Two bills now in Congress to do just that

-Spot and term prices rise, as does the estimated cost of productionIt was a tumultuous month of March in uranium markets. When sanctions were first imposed on Russian exports it was assumed uranium would be included, sending the spot price surging up to US$60.00/lb. When uranium wasn’t included, the price fell back to US$48.50/lb.But bills proposing the banning of Russian uranium exports to the US have since been put forward in both the Senate and the House, sending the spot price back up again.U3O8 closed the month at US$58.20/lb on industry consultant TradeTech’s spot price indicator, which was last Thursday, up from US$49.00/lb at end-February.On Friday, TradeTech’s […]

Enriched Uranium Market Size, Growth And Forecast | Leading Players – Sinosteel, CNNC, Sinohydro, Jinduicheng Molybdenum, JiangXi Copper Corporation, Cameco, Orano, BHP Billiton, Kazatomprom, APM3

New Jersey, United States – The research study on the Enriched Uranium Market offers you detailed and accurate analyzes to strengthen your position in the market. It provides the latest updates and powerful insights into the Enriched Uranium industry to help you improve your business tactics and ensure strong revenue growth for years to come. It sheds light on current and future market scenarios and helps you understand the competitive dynamics of the Enriched Uranium market. The market segmentation analysis offered in the research study demonstrates how different product segments, applications, and regions are performing in the Enriched Uranium market.

The report includes verified and revalidated market figures such as CAGR, gross margin, revenue, price, production growth rate, volume, value, market share, and Y-o-Y growth . We have used the latest primary and secondary research techniques to compile this comprehensive Enriched Uranium market report. As part of the regional analysis, […]

Purepoint Uranium : Athabasca Basin Exploration Update – April 2022

MONTHLY ATHABASCA BASIN EXPLORATION UPDATE April 2022 Geopolical Risk and Uranium Mining: A Quick Overview Source: INN The conflict in Ukraine shines a light on both the pivotal role of geopolics in uranium supply and the importance of geopolical stability. Conflict in Eastern Europe has had a sig- nificant impact on uranium prices, pung up to 16.5 percent of global supply at risk. This is not the first me geopolical tensions have impacted the uranium market, either. Given that uranium is a crucial fuel source for nuclear energy, investors, mining agencies and energy companies alike must factor geopolical risk into their decision making. Operang at a global scale has always been somewhat challenging. Global mining companies must typically navigate mulple processes and policies around exploraon, discovery and producon. They must also understand the geopolical climate of each region in which they operate and the likelihood of that climate disrupng […]

Click here to view original web page at www.marketscreener.com

Skyharbour’s Partner Company Medaro Mining Completes Airborne Geophysical Survey at Yurchison Uranium Property, Saskatchewan

Skyharbour Resources Ltd Vancouver, BC, April 04, 2022 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd.’s (TSX-V: SYH ) (OTCQB: SYHBF ) (Frankfurt: SC1P ) (the “Company”) partner company Medaro Mining (“Medaro”) is pleased to announce that it has completed an airborne geophysical survey at its Yurchison Uranium Property in Athabasca Basin, Northern Saskatchewan.

Location Map of Yurchison Project:

https://www.skyharbourltd.com/_resources/maps/Sky_Yurchison_20211209.jpgMedaro contracted Geodata Solutions GDS Inc. of Laval, Quebec to complete a high-resolution helicopter-borne magnetic survey on mining claim MC00011054 of the Yurchison Property. A total of 1,424 line kilometres of survey was completed at 50 metres line spacing using an AS 350 BA + helicopter (see Table 1 below for details). The mining claim MC00011054 is located in the middle of the Yurchison Property.

Table 1: Flight Path Specification: https://www.skyharbourltd.com/_resources/images/nr-20220404-Flight-path-specification.jpg A Helicopter Versatile Time Domain ElectroMagnetic (VTEM) geophysics survey was flown by Geotech Ltd. on behalf of JNR […]

Click here to view original web page at nz.finance.yahoo.com

Manufacturing news briefs – stories you might have missed

Frucor Suntory to build $400m factory

Beverage manufacturer Frucor Suntory is to build a $400 million facility in Swanbank, Queensland with support from the Queensland government. Premier Annastacia Palaszczuk said: “The value of attracting this investment to Queensland will have significant benefits for our economic recovery and most importantly, it will create new jobs for Queenslanders. This project…(will) create 160 long-term roles when it starts operating in mid-2024.” Queensland won the project ‘ahead of offers from other states and other countries’. However the state did not state the subsidy offered to attract the company.

Defence grants schemes revised and relaunched

Defence industry minister Melissa Price has announced the renaming of the defence Capability Improvement Grant Program which will become the Defence Readiness Grant Program as part of a shake up and extension of defence industry grants. The Global Competitive Grant Program will restart as well as a revised and […]

Click here to view original web page at www.aumanufacturing.com.au

FIRST URANIUM RESOURCES LTD. ANNOUNCES FURTHER INCREASE TO THE PRIVATE PLACEMENT FINANCING TO $10M

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Vancouver, British Columbia, March 29, 2022 (GLOBE NEWSWIRE) — First Uranium Resources Ltd. (the “ Company ” or “ First Uranium ”) (CSE: URNM) (OTCPK:KMMIF) (FSE:5KA0) is pleased to announce it has further increased the size of the brokered private placement announced on March 9, 2022 and upsized on March 24, 2022 and March 25, 2022 to an aggregate total of $10,000,000 due to significant institutional demand.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), or applicable state securities laws, and may not be offered or sold to persons in the United States absent registration or an exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall […]

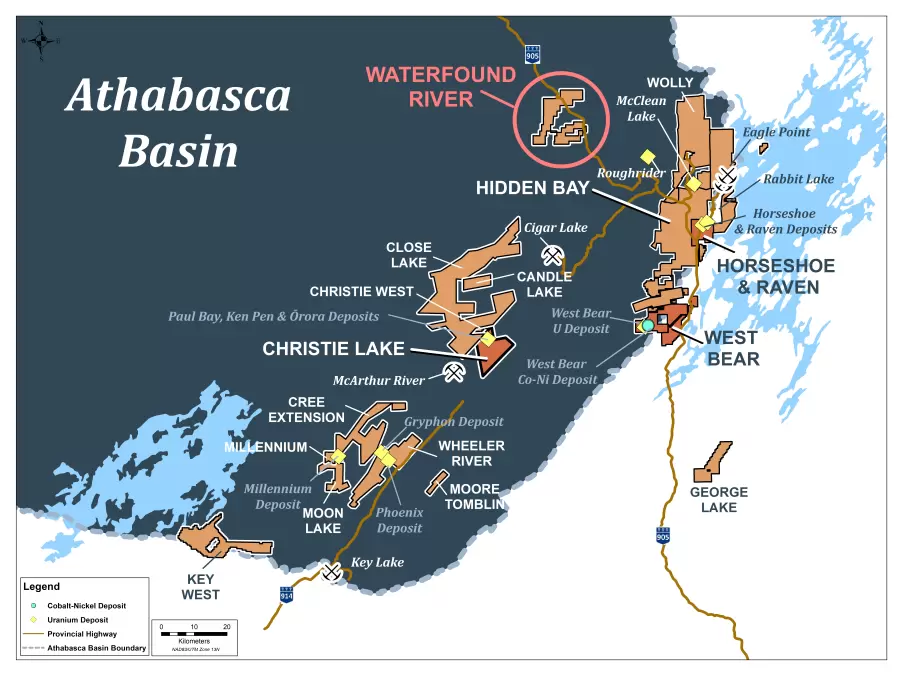

UEX Corporation: High-Grade Uranium Intersected on JCU’s Waterfound River Project

Mineralization Discovered 700 m along strike of the Alligator Zone

Saskatoon, Saskatchewan – TheNewswire – March 29, 2022 – UEX Corporation (TSX:UEX) (OTC:UEXCF) (“UEX” or the “Company”) is pleased to announce that its 50% owned company JCU (Canada) Exploration Company, Limited “(JCU”) has been informed by the operator of the Waterfound River Joint Venture (see Figure 1) that three holes have encountered high-grade uranium mineralization approximately 700 m west and along strike of the Alligator Zone.

The Alligator Zone is located within the La Rocque Corridor, host of IsoEnergy’s Hurricane Zone and Cameco’s La Rocque Deposit which are located approximately 16 km and 10 km northeast of the Alligator Zone respectively (see Figure 2).

Project operator Orano Canada Inc. (“Orano”) reported to the joint venture partners that hole WF-68 encountered unconformity-style uranium mineralization over three intervals that averaged 0.92% eU3O8 over 1.6 m (calculated from 0.78% eU) from 460.3 m to […]

Click here to view original web page at www.juniorminingnetwork.com

Russia reportedly mulling uranium export ban

Russia supplies around 16% of the US’s uranium for nuclear power plants. Commodities are being weaponised in Russia’s war with Ukraine after Russia demanded Europe pay for gas in rubles and has restricted fertiliser exports to the West. Next up is uranium.

State news agency TASS has reported that Russia is considering banning the export of uranium, the fuel for nuclear power stations, citing Deputy Prime Minister Alexander Novak, in retaliation for the US ban on Russian oil imports.

Along with Kazakhstan and Uzbekistan, Russia is a major producer of uranium and the US is one of its biggest customers.

Russian President Vladimir Putin put the cat amongst the pigeons last week by demanding that Europe – which gets 40% of its gas from Russia – settle its Russian gas contracts in rubles .Biden announced an embargo on imports of Russian oil to the US on March 8, adding that he understood […]

Australian uranium companies announce merger plans

Australian uranium companies Deep Yellow and Vimy Resources have agreed to a merger by a Scheme of Arrangement, under which Deep Yellow will acquire 100% of Vimy’s shares. The merger will bring together the two companies’ complementary asset bases including the Mulga Rock uranium project in Western Australia and the Tumas project in Namibia. Mulga Rock (Image: Vimy)

According to the two companies, the merger will create a new global uranium player with "significant scale" and with cash resources of AUD106 million (about USD80 million). Its combined uranium resource inventory – some 389 million pounds U3O8 (14,963 tU) – will be one of the biggest in the world and will include two "advanced, world class assets in Tier-1 uranium mining jurisdictions".

Under the scheme, Deep Yellow will acquire 100% of the Vimy shares on issue, while Vimy shareholders will receive 0.294 Deep Yellow shares for every Vimy share held. Deep Yellow […]

Click here to view original web page at world-nuclear-news.org

Uranium Royalty Acquires Additional Royalty on the Lance Uranium Project in Wyoming, USA

VANCOUVER, BC, April 1, 2022 /CNW/ – Uranium Royalty Corp. (NASDAQ: UROY) (TSXV: URC) (" URC " or the " Company ") is pleased to announce that it has acquired an additional 1% gross revenue royalty interest on the Lance In-Situ Recovery ("ISR") Uranium Mine in Wyoming, USA operated by Strata Energy Inc. ("Strata"), a wholly owned subsidiary of Peninsula Minerals Limited ("Peninsula").

Highlights Near-term production potential: The Lance ISR Uranium Mine is a fully licensed mine, with Peninsula currently undertaking an updated feasibility study in preparation for a full re-start of ISR production. Mine production was idled in 2019 as the operator initiated a transition to a low-Ph mining method, but the project has been producing uranium in limited amounts during the test mining phase.

Additional exposure to U.S. uranium production: Provides URC with additional exposure to potential U.S. derived uranium production.

The royalty is a 1% gross […]

Click here to view original web page at www.juniorminingnetwork.com

Uranium Royalty Corp. Acquires Additional Royalty on the Lance Uranium Project in Wyoming, USA

This news release constitutes a "designated news release" for the purposes of the Company’s prospectus supplement dated August 18, 2021, to its short form base shelf prospectus dated June 16, 2021.

VANCOUVER, BC, April 1, 2022 /PRNewswire/ – Uranium Royalty Corp. (NASDAQ: UROY ) (TSXV: URC) (" URC " or the " Company ") is pleased to announce that it has acquired an additional 1% gross revenue royalty interest on the Lance In-Situ Recovery ("ISR") Uranium Mine in Wyoming, USA operated by Strata Energy Inc. ("Strata"), a wholly owned subsidiary of Peninsula Minerals Limited ("Peninsula").

Highlights Near-term production potential: The Lance ISR Uranium Mine is a fully licensed mine, with Peninsula currently undertaking an updated feasibility study in preparation for a full re-start of ISR production. Mine production was idled in 2019 as the operator initiated a transition to a low-Ph mining method, but the project has been producing […]

Russia reportedly mulling uranium export ban

Russia supplies around 16% of the US’s uranium for nuclear power plants. Commodities are being weaponised in Russia’s war with Ukraine after Russia demanded Europe pay for gas in rubles and has restricted fertiliser exports to the West. Next up is uranium.

State news agency TASS has reported that Russia is considering banning the export of uranium, the fuel for nuclear power stations, citing Deputy Prime Minister Alexander Novak, in retaliation for the US ban on Russian oil imports.

Along with Kazakhstan and Uzbekistan, Russia is a major producer of uranium and the US is one of its biggest customers.

Russian President Vladimir Putin put the cat amongst the pigeons last week by demanding that Europe – which gets 40% of its gas from Russia – settle its Russian gas contracts in rubles .Biden announced an embargo on imports of Russian oil to the US on March 8, adding that he understood […]

High-Grade Uranium Intersected on JCU’s Waterfound River Project

Mineralization Discovered 700 m along strike of the Alligator Zone UEX Corporation is pleased to announce that its 50% owned company JCU Exploration Company, Limited “ has been informed by the operator of the Waterfound River Joint Venture that three holes have encountered high-grade uranium mineralization approximately 700 m west and along strike of the Alligator Zone The Alligator Zone is located within the La …

(TheNewswire)

Mineralization Discovered 700 m along strike of the Alligator Zone

UEX Corporation (TSX:UEX) (OTC: UEXCF) ("UEX" or the "Company") is pleased to announce that its 50% owned company JCU (Canada) Exploration Company, Limited "(JCU") has been informed by the operator of the Waterfound River Joint Venture (see Figure 1) that three holes have encountered high-grade uranium mineralization approximately 700 m west and along strike of the Alligator ZoneThe Alligator Zone is located within the La Rocque Corridor, host of IsoEnergy’s Hurricane Zone and Cameco’s La […]

Uranium Energy Corp.: A Promising Investment On The Cusp Of Success

Written by Summary

Uranium Energy Corp. is a uranium mining and exploration company with financial backing from top institutional investors.

The company is among the first uranium producers in the United States to sign a large-scale contract with the federal government.

Facing a surge in demand and ample industry prospects, United Energy Corp is positioning itself as a market leader by diversifying its subsidiaries, operations, and products portfolio. RHJ/iStock via Getty Images Uranium Energy Corp. (NYSE: UEC ) is the largest American uranium exploration, mining, and processing company. UEC, headquartered in Texas, commenced developing uranium properties in the 1970s. Since then, the company has garnered an expansive portfolio of mining operations in the United States, Canada, and Paraguay. The long-term strategy of UEC is to become a regional producer of uranium without being dependent on hostile foreign governments. This strategy requires time and cash to reach fruition, both of […]

Australian uranium companies announce merger plans

Australian uranium companies Deep Yellow and Vimy Resources have agreed to a merger by a Scheme of Arrangement, under which Deep Yellow will acquire 100% of Vimy’s shares. The merger will bring together the two companies’ complementary asset bases including the Mulga Rock uranium project in Western Australia and the Tumas project in Namibia. Mulga Rock (Image: Vimy)

According to the two companies, the merger will create a new global uranium player with "significant scale" and with cash resources of AUD106 million (about USD80 million). Its combined uranium resource inventory – some 389 million pounds U3O8 (14,963 tU) – will be one of the biggest in the world and will include two "advanced, world class assets in Tier-1 uranium mining jurisdictions".

Under the scheme, Deep Yellow will acquire 100% of the Vimy shares on issue, while Vimy shareholders will receive 0.294 Deep Yellow shares for every Vimy share held. Deep Yellow […]

Click here to view original web page at www.world-nuclear-news.org

Uranium Mine Market Outlook 2022 Analysis By Leading Keyplayers | Kazatomprom, Orano, Cameco, Uranium One

New Jersey, USA,- Uranium Mine Market reports study a variety of parameters such as raw materials, costs, and technology, and consumer preferences. It also provides important market credentials such as history, various extensions and trends, trade overview, regional markets, trade and market competitors.Uranium Mine Market Report Based on market share analysis of major manufacturers The Uranium Mine Market Report covers business-specific capital, revenue, and price analysis, along with other sections such as expansion plans, support areas, products offered by major manufacturers, alliances, and acquisitions. Home office delivery.

The full profile of the company is mentioned. It also includes capacity, production, price, revenue, cost, gross profit, gross profit, sales volume, sales revenue, consumption, growth rate, import, export, supply, future strategy and the technology development they are creating. Report. Uranium Mine market historical and forecast data from 2022 to 2030.

Get | Download Sample Copy with TOC, Graphs & List of Figures@ […]

Click here to view original web page at www.businessmerseyside.co.uk

Uranium industry is the latest to hop on the bandwagon taking advantage of tragedy in Ukraine

This Thursday, March 31, at 10 a.m., the Senate Energy and Natural Resources Committee will hold a hearing examining the country’s supply of critical minerals. The hearing should be an opportunity for Congress to determine how we can safely and sustainably secure minerals needed to power American’s transition to a clean energy economy. At top of mind should be reform of our antiquated mining law, which is more than 150 years-old.

So, you might be surprised to see that one of the invited witnesses comes from the Uranium Producers of America —a trade organization for the uranium industry. As trade representatives are apt to do, we fully expect them to use this hearing and the ongoing crisis in Ukraine to plead for more taxpayer-funded subsidies, so they can ramp up production quickly and cheaply.

This may sound like an opportunistic ploy to use a brutal war as a profit-making scheme. Make […]

Commodities Are Ripping Higher – Here’s My Top Way To Cash In

mohamed_hassan / Pixabay Commodities are on fire.

The price of oil has soared 43% since the start of the year.

Palladium – a metal most often used in catalytic converters – has increased 28% over the same period, while wheat has spiked 39%…

George Soros’s Early CareerGeorge Soros is one of the most (in)famous figures in the world of finance. Known as ‘the man who broke the Bank of England’, thanks to his $10 billion bet against the British pound in 1992, Soros is one of the most successful hedge fund managers ever. While at the helm of the Quantum Fund Read More Get The Full Ray Dalio Series in PDFGet the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues Q4 2021 hedge fund letters, conferences and more These are major moves. But I see commodity prices […]

New $658m uranium major emerges as Deep Yellow ties the knot with Vimy Resources

Deep Yellow Vimy Resources uranium merger ASX DYL VMY Knocked back in November, merged in March — advanced uranium plays Deep Yellow (ASX: DYL) and Vimy Resources (ASX: VMY) have at last found common ground in a merger of their Australian and Namibia projects in a deal that creates a $658 million operation.

Deep Yellow is to acquire 100% of Vimy under a scheme of arrangement.

Vimy shareholders will receive 0.294 Deep Yellow stock for every 1 Vimy share, with Vimy shareholders representing 47% of the new Deep Yellow.

The new entity will own two advanced projects expected to begin the development pipeline voyage later this year or in 2023.At Mulga Rock in Western Australia Vimy has completed a definitive feasibility study and the merged group will look to produce a revised DFS that increases the value of the project by undertaking additional work.The existing Deep Yellow team will lead the studies […]

More for You

This Thursday, March 31, at 10 a.m., the Senate Energy and Natural Resources Committee will hold a hearing examining the country’s supply of critical minerals. The hearing should be an opportunity for Congress to determine how we can safely and sustainably secure minerals needed to power American’s transition to a clean energy economy. At top of mind should be reform of our antiquated mining law, which is more than 150 years-old.

So, you might be surprised to see that one of the invited witnesses comes from the Uranium Producers of America -a trade organization for the uranium industry. As trade representatives are apt to do, we fully expect them to use this hearing and the ongoing crisis in Ukraine to plead for more taxpayer-funded subsidies, so they can ramp up production quickly and cheaply.

This may sound like an opportunistic ploy to use a brutal war as a profit-making scheme. Make […]

Global Uranium Production Could More Than Double by 2040, According to Kinvestor Research Report

The Kinvestor Report on the global uranium industry covers its history and uses, analysis of current market data, and an outlook for the future of uranium.

VANCOUVER, BC, CANADA, March 30, 2022 / EINPresswire.com / — The latest Kinvestor Report on the global uranium industry covers the history and uses of uranium, analysis of current market data, and an outlook for the future of uranium exploration and production. The report also looks at factors of supply and demand and outlines major players in the industry.

Download the free Kinvestor Research report here for a full analysis of the global uranium industry.

BackgroundUsed as a nuclear energy source for over 60 years, uranium is a naturally-occuring heavy metal that can be found in rocks and seawater. As of 2020, nuclear power and other sources of renewable energy made up one third of the global electricity mix.The uranium market can be segmented into […]

Uranium Energy Corp. (AMEX: UEC) Stock: Investors Need To Know This

The trading price of Uranium Energy Corp. (AMEX:UEC) closed lower on Tuesday, March 29, closing at $4.54, -4.02% lower than its previous close.

Traders who pay close attention to intraday price movement should know that it fluctuated between $4.32 and $4.76. In examining the 52-week price action we see that the stock hit a 52-week high of $5.79 and a 52-week low of $1.89. Over the past month, the stock has gained 13.78% in value.

Uranium Energy Corp., whose market valuation is $1.34 billion at the time of this writing, is expected to release its quarterly earnings report Dec 14, 2021. Investors’ optimism about the company’s current quarter earnings report is understandable. Analysts have predicted the quarterly earnings per share to grow by $0 per share this quarter, however they have predicted annual earnings per share of $0 for 2022 and -$0.03 for 2023. It means analysts are expecting annual earnings […]

Boiling and ready to burst as Uranium Royalty Corp. (UROY) last month performance was -6.07%

At the end of the latest market close, Uranium Royalty Corp. (UROY) was valued at $4.13. In that particular session, Stock kicked-off at the price of $4.13 while reaching the peak value of $4.16 and lowest value recorded on the day was $3.85. The stock current value is $3.87.Recently in News on March 28, 2022, Uranium Royalty Corp. Expands Physical Uranium Holdings. Uranium Royalty Corp. (NASDAQ: UROY) (TSXV: URC) (“URC” or the “Company”) announces that it has made additional uranium concentrate purchase commitments totaling 200,000 lbs U3O8 at an average cost of US$58.40 per pound. Deliveries will be made in April/May 2022 to URC’s storage account with Cameco Corporation in Ontario, Canada. The purchase will be funded with cash on hand and available credit. You can read further details here

Uranium Royalty Corp. had a pretty favorable run when it comes to the market performance. The 1-year high price […]

Lawmakers see alternatives to Russian energy in their districts

With gas prices high and the world looking for alternatives to Russian oil and gas because of its invasion of Ukraine, some lawmakers are finding solutions in their own districts.

Russia’s incursion and the linked disruption of energy markets highlighted a long-running debate in Washington over the vulnerability of the U.S. and many of its allies to potential adversaries that feed the industrial world’s appetite for energy from oil and gas.

Republicans and fossil-fuel advocates have responded with calls to increase domestic oil and gas production by rolling back Biden administration policies that aim to wean the economy off of energy sources that contribute to climate change.

Democrats and environmentalists mark the invasion as a violent warning that it is time to shed the world’s reliance on fossil fuels not only because of climate change but because of the wealth and leverage it provides to oil- and gas-rich countries that don’t share […]

FIRST URANIUM RESOURCES LTD. ANNOUNCES FURTHER INCREASE TO THE PRIVATE PLACEMENT FINANCING TO $10M

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Vancouver, British Columbia, March 29, 2022 (GLOBE NEWSWIRE) — First Uranium Resources Ltd. (the “ Company ” or “ First Uranium ”) (CSE: URNM) (OTCPK:KMMIF) (FSE:5KA0) is pleased to announce it has further increased the size of the brokered private placement announced on March 9, 2022 and upsized on March 24, 2022 and March 25, 2022 to an aggregate total of $10,000,000 due to significant institutional demand.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), or applicable state securities laws, and may not be offered or sold to persons in the United States absent registration or an exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall […]

Click here to view original web page at www.globenewswire.com